- ETH found critical support at key levels.

- Network growth showed more ETH addresses popping up.

As a seasoned researcher who’s seen my fair share of crypto bull runs and bear markets, I find myself optimistic about Ethereum‘s current trajectory. The critical support at $3,700 to $3,810, backed by 3 million addresses, is a testament to the growing investor confidence in ETH. Add to that the surge in new wallet creation reaching an 8-month high, and it’s clear that Ethereum’s network activity is expanding at a rapid pace.

The cost of Ethereum (ETH) is currently experiencing robust support in the range of $3,700 to $3,810, as approximately 3 million investors have amassed around 4.6 million ETH in this area. This significant accumulation indicates growing investor assurance and serves as a buffer against potential downward market forces.

As the demand for Ethereum increases relative to its supply, and significant Fibonacci indicators suggesting a possible price of $5,000, the argument for Ethereum’s price rise becomes increasingly convincing.

Support levels and accumulation zones

As I delve into the analysis of Ethereum’s price movement, an intriguing pattern emerges: a substantial demand zone seems to be established between $3,700 and $3,810. Based on IntoTheBlock’s data, roughly three million wallets have amassed about 4.6 million Ether within this price range, suggesting a strong appetite for the cryptocurrency at these levels.

Analysis showed that this level emerges as a critical support area, providing a cushion against potential bearish pressures. The strong accumulation here reflects investor confidence and hints at the possibility of sustained bullish momentum.

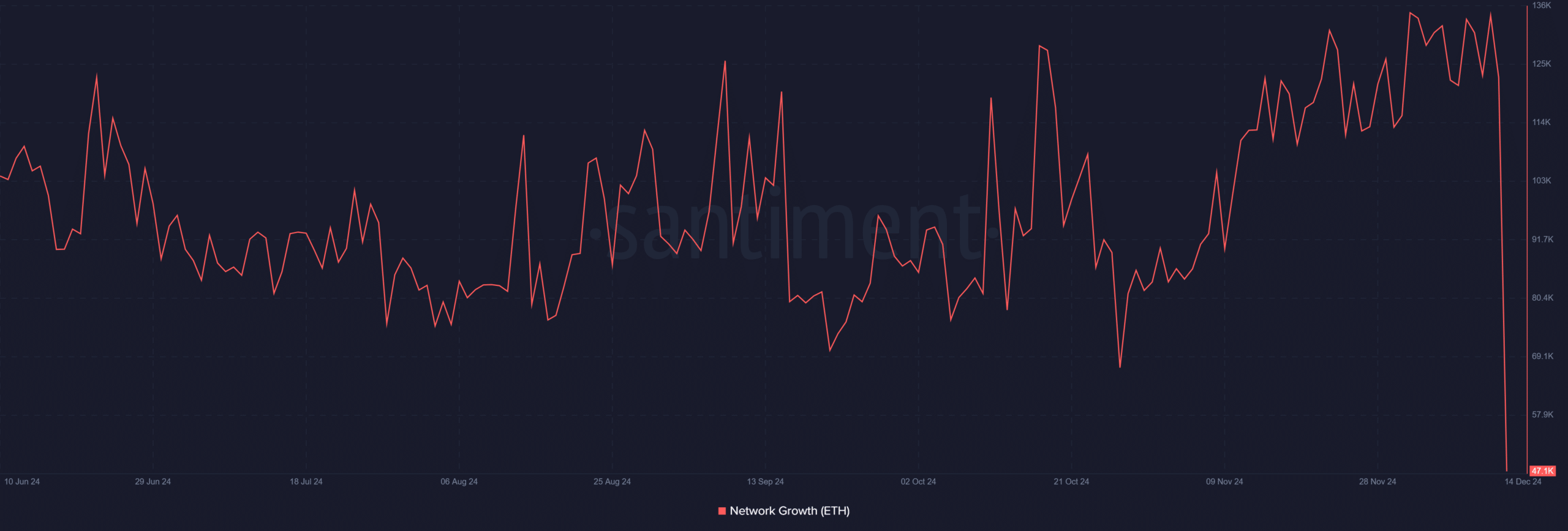

Ethereum network growth reaches new highs

Based on a study conducted by Santiment on Ethereum’s network expansion, there has been a substantial rise observed. This analysis indicated an average of approximately 130,200 new Ethereum wallets being created each day in the month of December.

This reaches a 8-month peak, showing increased enthusiasm for ETH since it draws notice from both individual and professional investors.

Additionally, the increase in new wallets implies that the number of transactions on the Ethereum network is growing, suggesting a larger user community with more active transactions.

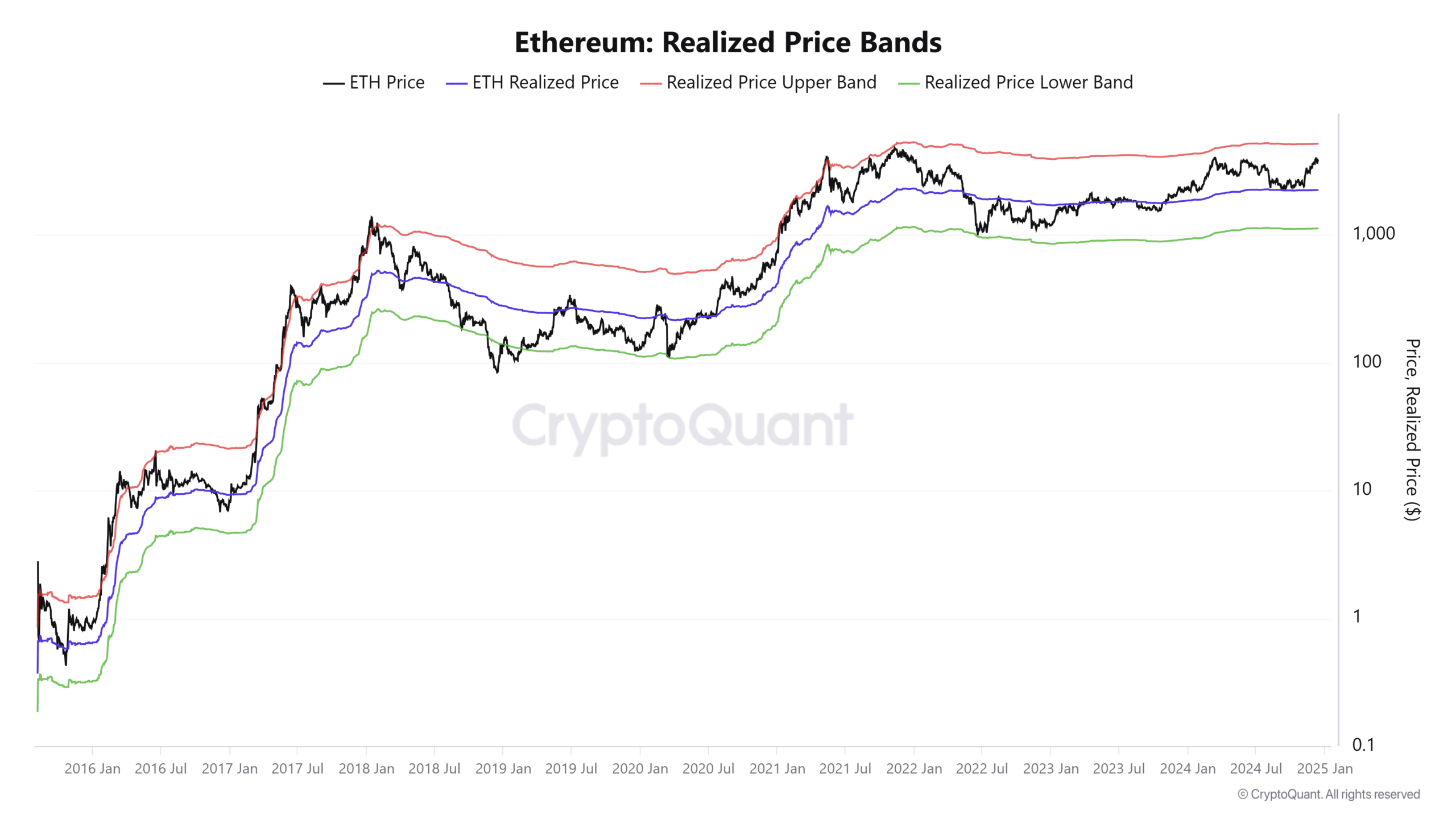

Realized price upper band signals bullish potential

In simpler terms, the current highest price point for Ethereum ($5,200) coincides with its record high during the 2021 bull market surge. This level serves as a significant mental hurdle and could potentially mark a goal or aim in the ongoing upward trend.

Moreover, the realized price of Ethereum being set at $2,300 signifies the typical purchase cost across the network, emphasizing the profitability for current owners.

As the current market price stays near $3,900, the difference between the actual price and the higher boundary suggests there’s potential for additional price increases.

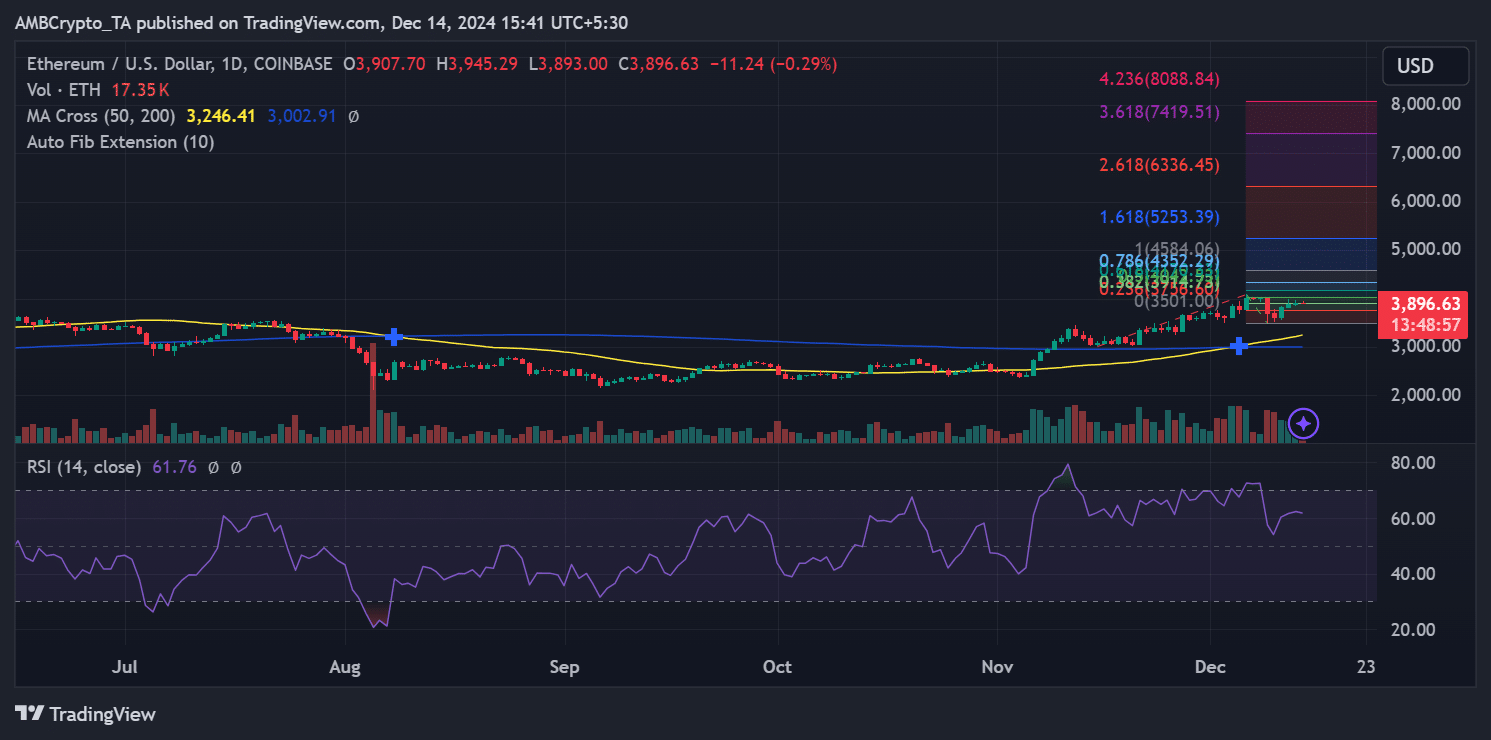

Ethereum Fibonacci extension levels signal…

Currently, Ethereum is being exchanged for approximately $3,896 per unit. Important technical markers offer clues about its possible future trajectory. By applying the Fibonacci extension tool, we can identify significant resistance points and potential targets for further growth.

As Ethereum approached the 1.618 Fibonacci extension point of roughly $5,253, this figure was near to its upper band for the realized price, which is around $5,200.

Overcoming this current barrier suggests robust upward price movement, possibly paving the way for an advance towards the 2.618 extension, which is approximately $6,336, and potentially even further.

For Ethereum, a key challenge or obstacle in its price movement can be found around the $4,278 mark. This level is notable because it aligns with the 0.786 Fibonacci retracement ratio.

Advancing through this stage might set the stage for continued progress, bringing Ethereum nearer to the significant $5,000 milestone. However, if things don’t go as planned, there’s a key support level around $3,700, which lines up with a crucial accumulation zone.

Supply dynamics and implications for $5K

As a crypto investor, I’ve noticed that Ethereum’s price movement is being positively influenced by strong demand-supply dynamics. The concentration of holdings in the $3,700 to $3,810 range, coupled with the swift growth in active addresses, indicates continuous interest from long-term investors and newcomers to the market. This trend suggests a sustained influx of both seasoned and fresh capital into Ethereum, which could potentially drive its price further upwards.

If Ethereum continues on its present course and overcomes significant resistance points, it might reach the $5,000 milestone more quickly than initially anticipated.

Read Ethereum (ETH) Price Prediction 2024-25

The pathway for Ethereum to reach $5,000 is bolstered by robust accumulation areas, unprecedented expansion of the network, and crucial Fibonacci extension points that correspond with past pricing trends.

The combination of these elements strongly suggests a convincing argument for the rise of ETH, potentially pushing it past the $5,000 mark as investor interest and technological momentum grow.

Read More

2024-12-14 22:16