- Altcoin recently broke out of a descending channel, indicating the start of a potential upswing

- Large-volume traders are yet to enter the market, leaving retail investors to drive the price action

As a seasoned crypto investor with over five years of experience in this ever-evolving market, I’ve learned to navigate the rollercoaster ride that is cryptocurrency trading. After analyzing the recent price action and on-chain data for FTM, I believe we might be witnessing the beginning of a significant rally.

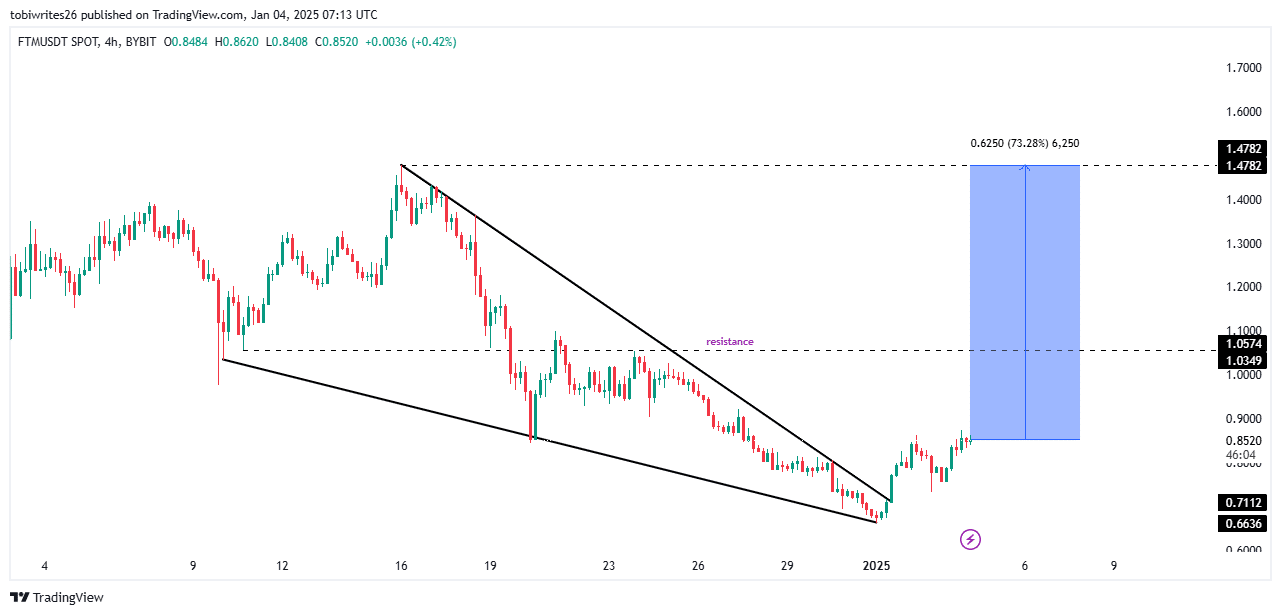

Having observed numerous market cycles, I can recognize the signs of a potential breakout—such as the one we’re seeing with FTM right now. The asset’s sharp recovery from a 30% monthly loss and its recent breakout from a descending channel have piqued my interest.

However, it’s essential to remain cautious, as there are still some hurdles ahead. The resistance level on the 4-hour chart could potentially lead to a slight pullback or delay in further gains. But if FTM can sustain its upward drive from its current price of $0.85, I’m optimistic that it could rally to $1.47—a potential 73% increase.

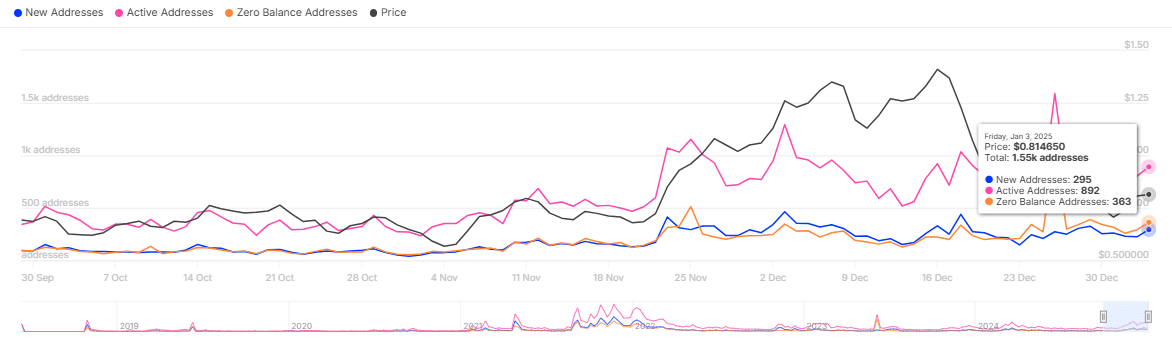

One interesting trend I noticed is the increased activity among retail investors, as evidenced by the surge in Active Addresses. This growing interest from smaller traders suggests a strong bullish sentiment, which could fuel further price gains if sustained. However, I’m curious to see whether large-volume traders will eventually join the party and drive the market higher.

If institutional “whale” investors begin to re-enter the market, FTM could experience a significant momentum surge, pushing the asset towards its full potential. In my opinion, the current chart setup and technical indicators suggest that we might be on the cusp of a full-fledged rally for FTM.

As always in crypto, it’s crucial to stay vigilant and adapt to market conditions. I’ll keep a close eye on FTM’s development and adjust my investment strategy accordingly. Who knows? We might just witness another exciting chapter in the world of cryptocurrencies!

By the way, remember: Never invest more than you’re willing to lose—even if it’s your favorite meme coin! 😉

Over the past day, the value of FTM increased by 11.68%, showing a significant rebound. This surge could help the asset make up for its 30.87% drop during the entire month.

Additional increases in prices might be driven by increased investment from large-scale institutional investors, often referred to as “whales,” and continued purchasing enthusiasm among individual traders.

FTM’s build-up to $1.47 in progress

Currently, as I’m typing this, FTM appears to have exited a descending triangle formation on the 4-hour chart. This is signified by a noticeable upward price trend following a long phase of tight trading within limited ranges.

Yet, the graph indicated a substantial barrier level, one that had halted advancements on two prior occasions – Strengthening the downward sloping triangle’s structure. This resistance might cause a brief reversal or postpone additional progress, contingent upon the robustness of the current bullish trend.

Should FTM continue its uptrend from its current price of $0.85 at the time of writing, it might surge towards $1.47. This represents a possible increase of approximately 73.28%.

As a seasoned cryptocurrency analyst with years of experience in the digital asset space, I recently examined several key on-chain indicators to determine if there is enough momentum to sustain this rally. My analysis focused on crucial variables that have proven to be reliable predictors of market trends. The results of my investigation will help me make informed decisions about investing and trading strategies moving forward.

Retail investors drive FTM’s rally as whales hold back

As a researcher, I’ve observed that recently, Financial Technology Market (FTM) has seen significant growth not only on a weekly but also daily trading basis. Interestingly, this surge seems to be largely attributed to retail investors, who, despite constituting a relatively smaller segment of the market, have played a substantial role in these gains.

It appears that this trend is bolstered by an increase of 17.86% in the number of active wallet addresses, suggesting a rise in trading activity among participants. These active addresses represent wallets engaged in any transaction, either sending or receiving, within a defined period.

An increase in active addresses, along with a spike in FTM’s value, indicated a significant upsurge in retail curiosity towards this cryptocurrency.

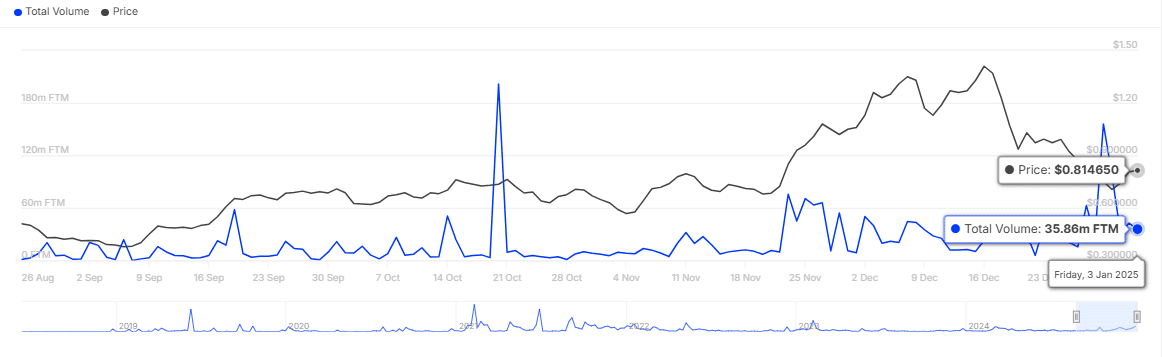

Instead, it appears that whale activity has decreased noticeably. Currently, the total value of major transactions amounts to 35.86 million FTM, equivalent to $29.22 million – This represents a substantial decrease in transaction volume. A reduction in transaction volume during an upward price trend often indicates low trading activity among large holders.

If substantial whale investors decide to return and increase their investments, it’s possible that Fantom (FTM) may experience a significant boost in momentum. With a growing number of large-scale transactions, this influx of institutional buying could exert significant pressure on the asset price, further reinforcing its upward trend.

FTM’s full rally on the horizon

As I’m typing this, it appears that FTM is about to embark on a significant upward trend. This is particularly notable given the signs pointing towards the development of a Golden Cross pattern, which typically indicates that an uptrend might be just around the corner.

In simpler terms, when the blue line (MACD) moves over the orange line (Signal) on the Moving Average Convergence Divergence (MACD) chart, it’s called a Golden Cross. This event often signals an increase in buying strength, potentially leading to a rise in the asset’s price.

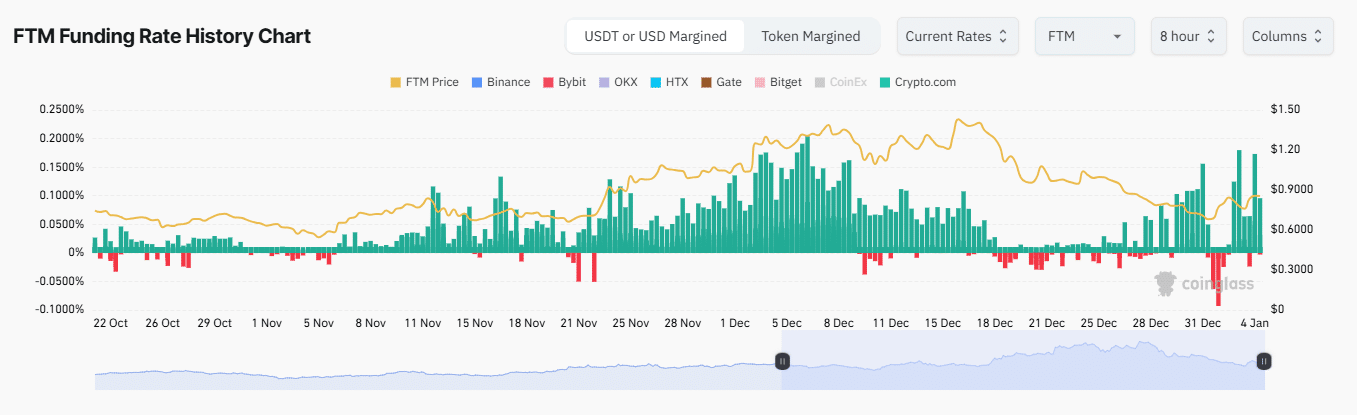

The potential rally is further bolstered by various indicators like the funding rate and the long-to-short ratio, suggesting a generally optimistic market outlook based on these figures.

In essence, the funding rate signifies who holds the upper hand in the market for a certain duration – either bulls or bears – by determining which party pays extra to preserve balance between the Spot and Futures markets prices. As it stands now, the bulls seem to be leading, as the funding rate has escalated to 0.0330%.

In a similar fashion, the number of long contracts exceeded the number of short contracts for FTM, with a ratio of 1.0317. This suggests a higher prevalence of buy positions over sell positions, which underscores the growing optimism and bullish trend in the market.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Here’s What the Dance Moms Cast Is Up to Now

2025-01-04 22:16