-

At the time of writing, DOT was trading within a four-hour consolidation phase and at a major support line, signaling a bullish outlook

Accumulation and distribution (AD) ratio traded within a pattern that will determine its rally

As a seasoned researcher with years of experience analyzing cryptocurrency markets, I find myself cautiously optimistic about Polkadot (DOT). At present, DOT is exhibiting signs of consolidation within a symmetrical triangle pattern, which could potentially lead to a bullish breakout. The Accumulation and Distribution (AD) ratio, an indicator that reflects buying and selling pressure, has been on the rise, indicating ongoing accumulation by investors.

Polkadot (DOT) has been slow-moving since the start of this month, staying within a period of sideways movement on the graphs. This was also reflected in its minimal price fluctuations – A rise of 0.97% for the entire month, and an increase of 1.57% over the past 24 hours.

As a researcher, I find that while these trends persist, the trajectory of DOT hinges on a significant departure from the established patterns that have emerged.

Is a major rally imminent for DOT?

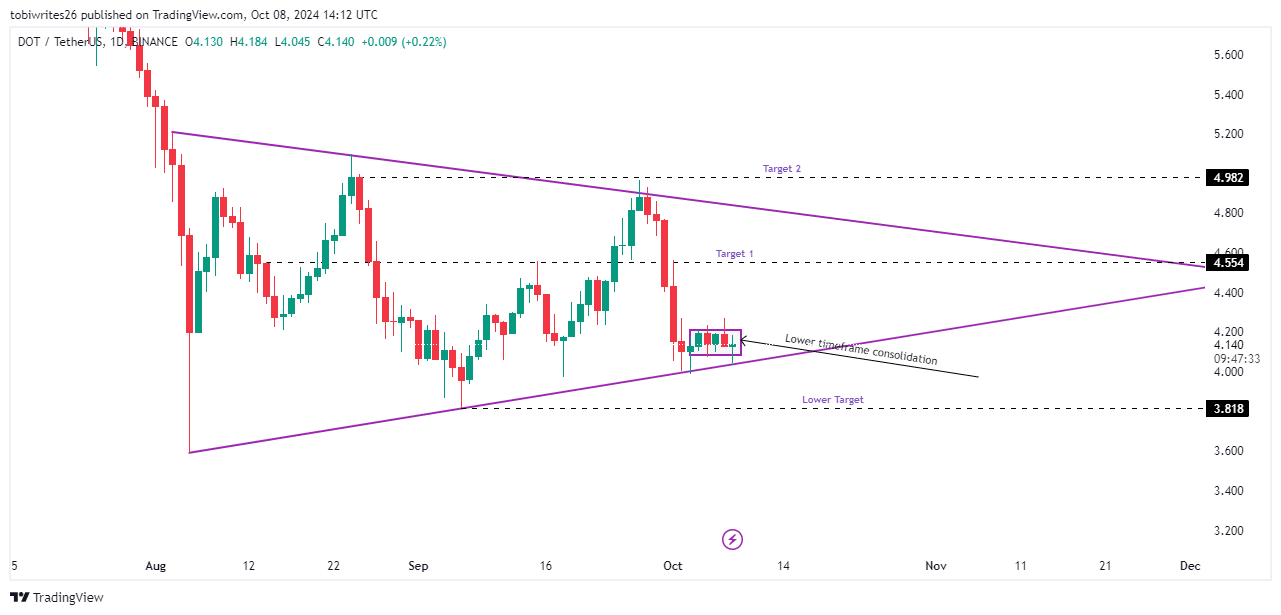

Currently, DOT is being exchanged within a symmetrical triangle structure. The price fluctuations are confined to a specific band. Although past instances have shown upward trends from similar positions, since October 2nd, DOT has held steady near the triangle’s lower support instead.

As I delve deeper into my analysis, it appears that DOT could potentially burst out of its current consolidation phase, driving it towards two possible price points – the first at around $4.554 and a subsequent level at approximately $4.982. However, if we don’t see a breakout, there’s a possibility that DOT may retrace back to its September low of $3.818.

The general feeling about the market was quite optimistic, implying that Polkadot (DOT) might continue to increase in the coming sessions. Further analysis by AMBCrypto also strengthened the possibility of a prolonged growth for DOT.

Buying activity is confirmed, yet DOT’s rally remains conditional

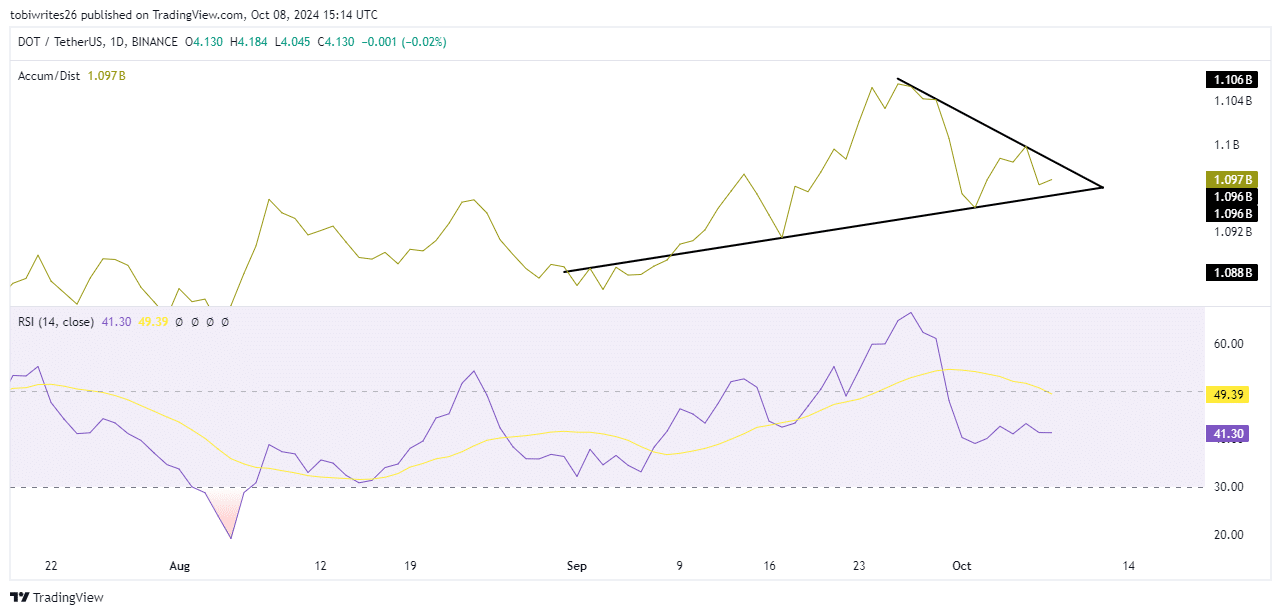

The upward trend of the Accumulation and Distribution (AD) technical indicator suggests continued buying activity, or accumulation. This trend aligns with the consolidation stage previously noted on the graph.

To trigger a bullish surge, the Accumulation Distribution (AD) line needs to surpass the upper boundary of the triangular formation that DOT is contained in. Once this happens, it could indicate increased buying interest, possibly leading to an upward push in DOT’s price.

Additionally, it’s worth noting that the Relative Strength Index (RSI) is on an uptrend, signifying a quicker pace in price fluctuations. This suggests that the price of DOT may persist in its rising pattern, potentially exceeding the upper limits of the consolidation range.

Interest in DOT shifts towards bulls

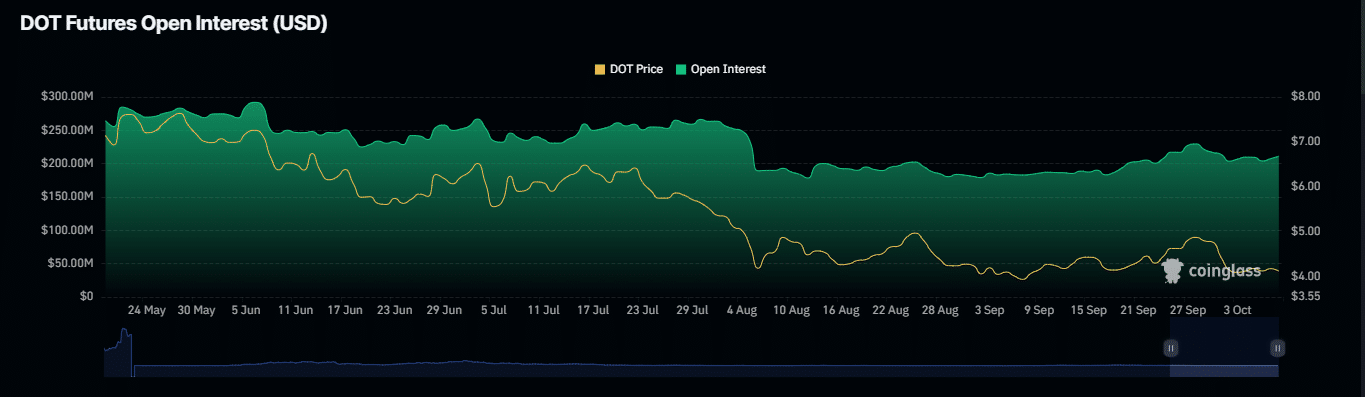

The curiosity towards DOT has been gradually increasing, as shown on Coinglass’s charts, with the intrigue hitting a monthly minimum on October 6th.

This rise could be seen as evidence of growing optimistic trading behavior in the market, further supporting the current positive outlook.

Currently, Open Interest is experiencing a minor decrease of about 1.03%. Its value stands at approximately $209.93 million. If this downward trend reverses, it could potentially hit new record highs and move into positive territory.

Under these circumstances, it’s likely that DOT will persist in its upward trend, possibly even surpassing the set price goals.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Flight Lands Safely After Dodging Departing Plane at Same Runway

- Elden Ring Nightreign Recluse guide and abilities explained

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

2024-10-09 12:07