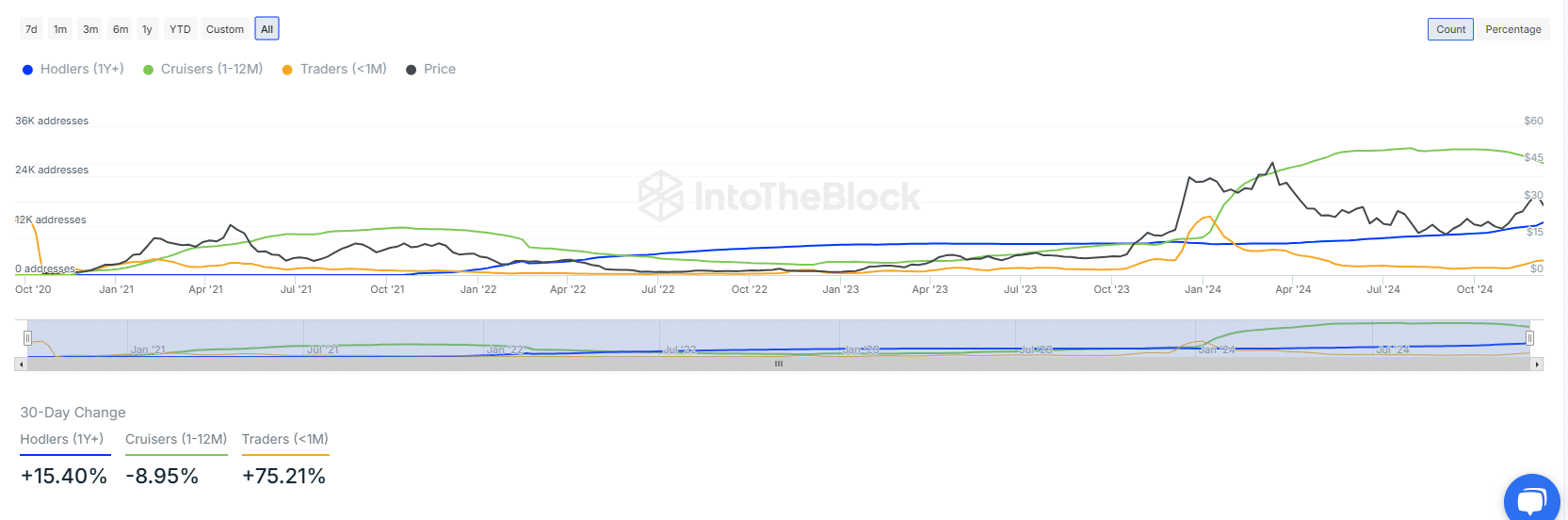

- The number of short-term traders increased by 75%, signaling growing market speculation on INJ.

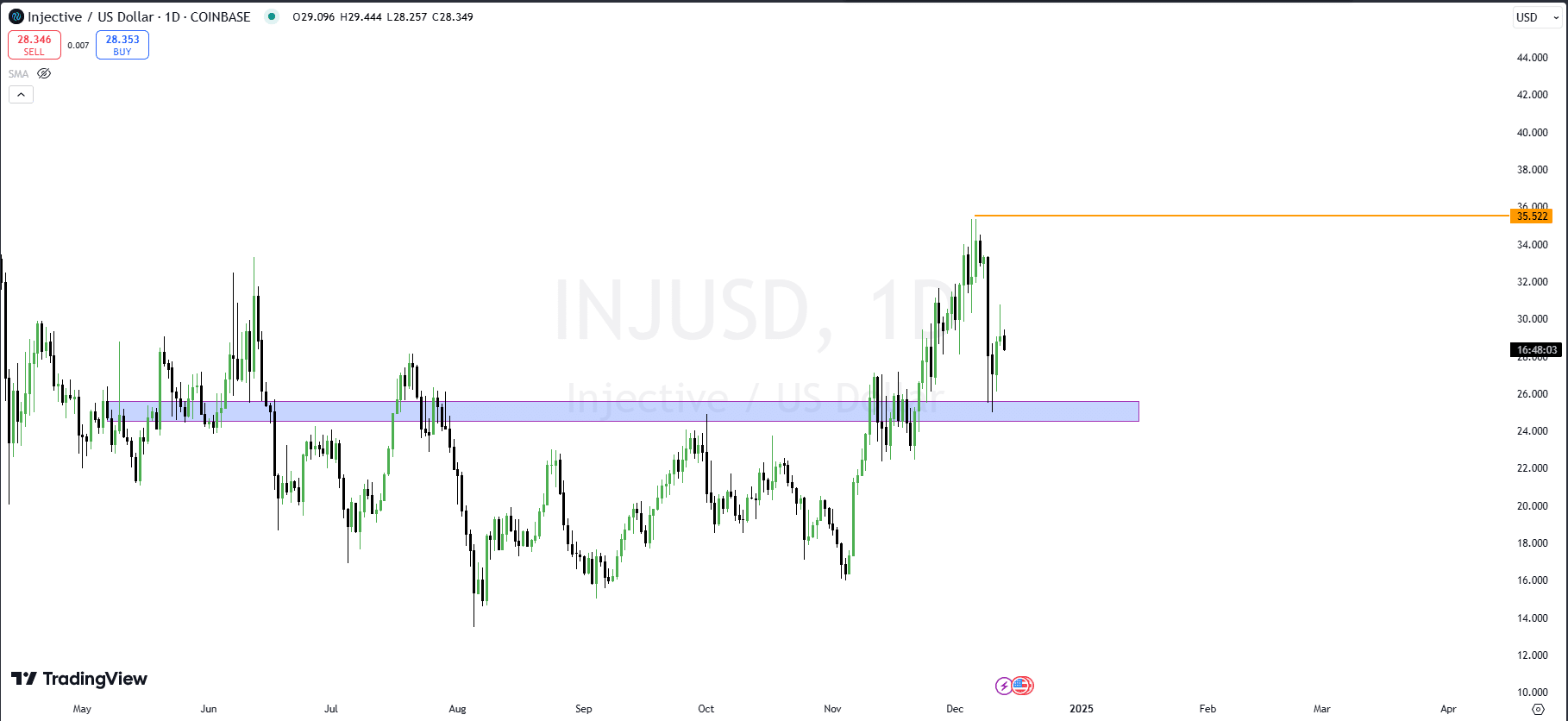

- INJ bounced off $25 support, eyeing a rally to $35.

As an analyst with over two decades of experience in the crypto market, I’ve seen my fair share of bull markets and bear markets. Looking at Injective [INJ], I see a promising asset that’s showing signs of recovery after a brief dip. Despite the 4.68% pullback in the last 24 hours, the overall sentiment remains positive.

The injective asset appears to be making a strong comeback, hinting that around $30 could become a potential floor. Although it experienced a minor dip of 4.68% within the past day, the overall outlook on the market continues to be optimistic.

During this timeframe, the value of the token varied from $28.32 to $30.66, suggesting a degree of instability, yet a general belief in the worth of the asset remains steady.

Despite currently trading well under its previous peak of $52.75, achieved eight months past, INJ remains a promising investment opportunity.

1) The trading volume stays robust, totaling approximately $184.35 million worth of transactions within the past day. The endorsement from institutions like BlackRock lends credibility to INJ’s potential, despite the fact that widespread acceptance is still a hurdle.

These factors offer a deflationary impact

179th week’s burning event saw the elimination of more than 11,309 INJ tokens, showcasing a commitment to decreasing the total amount of circulating INJ tokens.

Launching Inj_iAGENT has streamlined and improved the burn process significantly. The idea that half of the total INJ supply might be burned has sparked interest due to speculation about its impact on the market, making it more scarce or “deflationary.

As a crypto investor, I’m excited about the deflationary strategy being implemented for INJ. This approach is designed to make the token more scarce, which could boost its value gradually. By reducing the amount of INJ in circulation, Injective becomes more attractive to potential investors like myself. The consistent success of these burn events will play a crucial role in maintaining a strong demand and upward trend for INJ’s price over time.

Technical analysis points to…

According to an analysis by AMBCrypto, Injective (INJ) is showing signs of consolidation within a specific price range, with significant support found between $25 and $30. If INJ falls below this zone, it might indicate further price drops, with the next potential support at approximately $23.

Instead, focus on the significant resistance point around $30.00. If the price manages to surpass this, it might propel further towards the crucial $35 resistance level.

35 dollars serves as a significant barrier, and if prices manage to rise above it, it might spark an upward trend, or in simpler terms, a surge of buying activity.

As for the market signals, the Stochastic Relative Strength Index (RSI) hints at an impending bullish trend, as it subtly crosses midway. However, the Chaikin Money Flow (CMF) remains unbiased, suggesting a lack of significant buying demand.

According to the Alligator indicator, the market is showing signs of uncertainty, as prices are stabilizing close to the moving averages around $29.03 and $29.31.

How did short-term sentiment shift bullish?

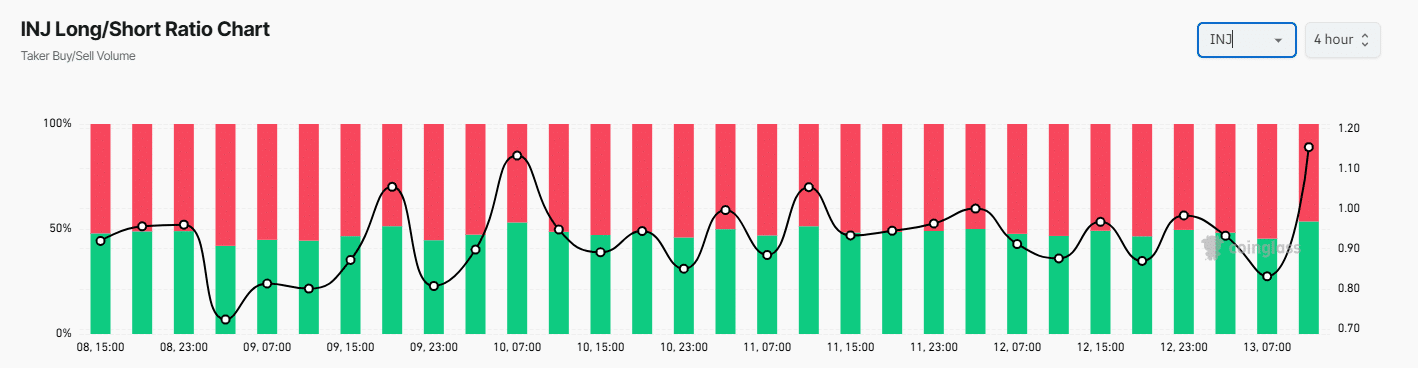

For the near future, there’s been a noticeable trend in the INJ market leaning toward optimistic outlooks. On December 13th, long positions significantly increased, causing the Long/Short Ratio to exceed 1.10, indicating more bullish than bearish positions.

As more traders take on long positions, it suggests a surge of optimism. However, the volatile ratio suggests times when the market is uncertain or hesitant. Yet, even with these ups and downs, the growing number of long positions demonstrates that traders are becoming increasingly confident once again.

In the past few days, the Long/Short Ratio has oscillated between approximately 0.7 and 1.2, with a substantial increase happening on December 13th. This suggests that investors are becoming increasingly optimistic about the market, as they adjust their strategies based on recent price movements.

Holders’ behavior reflects long-term optimism

Over the past month, I’ve noticed a significant uptick in the number of long-term holders, particularly those who have been holding INJ for over a year. This increase stands at approximately 15.40%. This data from IntoTheBlock suggests that there is strong, long-term confidence in INJ, which is an encouraging sign for us crypto investors.

Read Injective’s [INJ] Price Prediction 2024–2025

Conversely, short-term traders have experienced a significant rise of 75.21%, suggesting an uptick in speculative behavior and market instability.

Regardless of the temporary influence of short-term traders, those who hold INJ long-term maintain their stance, demonstrating a strong belief in its future success.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- PGA Tour 2K25 – Everything You Need to Know

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- `SNL’s Most Iconic SoCal Gang Reunites`

2024-12-13 17:44