- MKR has surged by 45.46% over the past month.

- Maker’s large transactions have surged by 130.43% in 24 hours as the market showed a strong recovery.

As a seasoned crypto investor with a knack for spotting trends and understanding market dynamics, I find myself quite intrigued by Maker’s recent performance. After experiencing a significant dip to $1107, it’s heartening to see MKR stage a remarkable comeback, currently trading at $1867. The 45.46% monthly surge and the 14.12% weekly gain are encouraging signs of a market on the mend.

After reaching a bottom price of $1107, Maker (MKR) has consistently risen, peaking at a high of $2073.

After hitting a peak, the cryptocurrency Maker experienced a downturn, dropping as low as $1634. But it appears that this period of market adjustment has ended, and the upward trend may be resuming. At the current moment, Maker is being traded at $1867, representing a 3.67% rise in value compared to the previous day.

Over the past week, the altcoin has seen a surge of 14.12%, and over the last month, it has climbed an impressive 45.46%. However, despite this recent increase, MKR still lags significantly behind its record high, sitting roughly 70.47% below the peak price of $6339.

The prevailing market offers optimism, as Maker has made a considerable recovery across the charts.

What MKR’s charts say

Notably, following a steep drop where sellers gained control, buyers have regained momentum with a powerful resurgence.

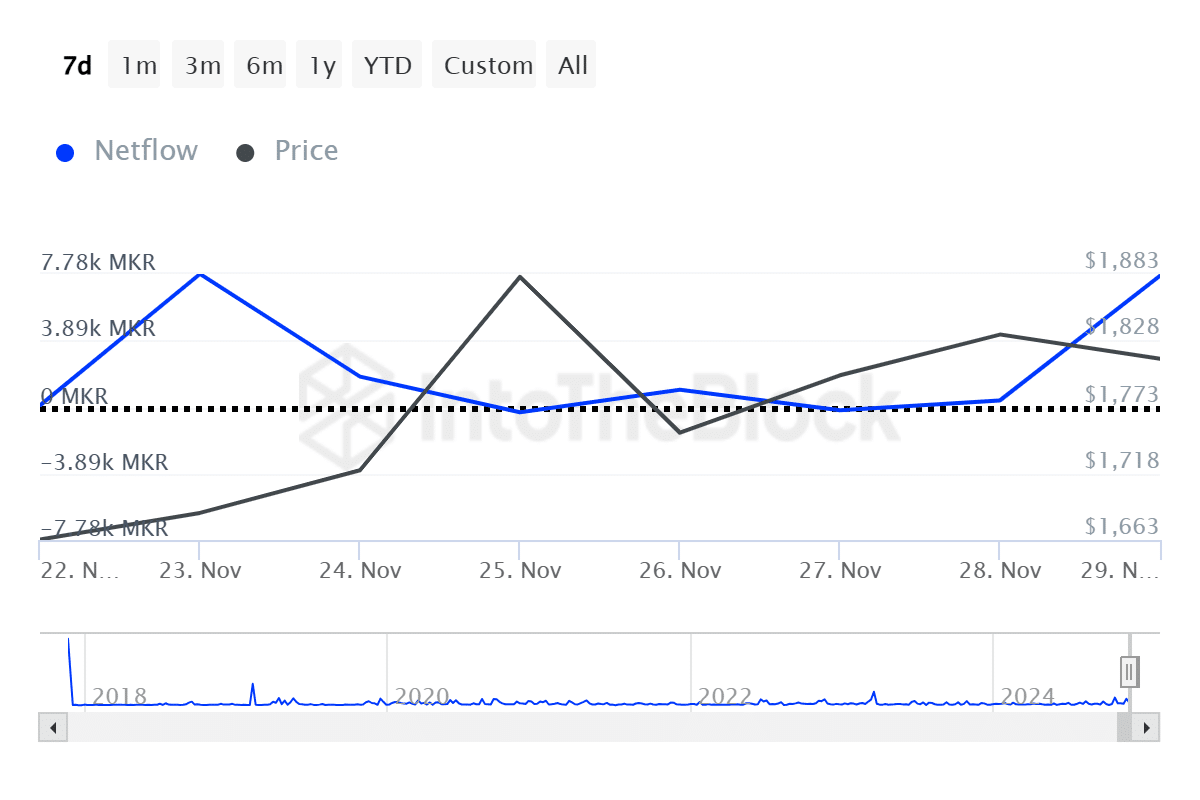

Over the last two days, the net outflow of Maker’s major investors has significantly increased, moving from a negative position to 7,680 units. This indicates that there is currently more money flowing in (purchases) than out (sales) among large holders. Therefore, they appear to be buying more assets than they are selling off.

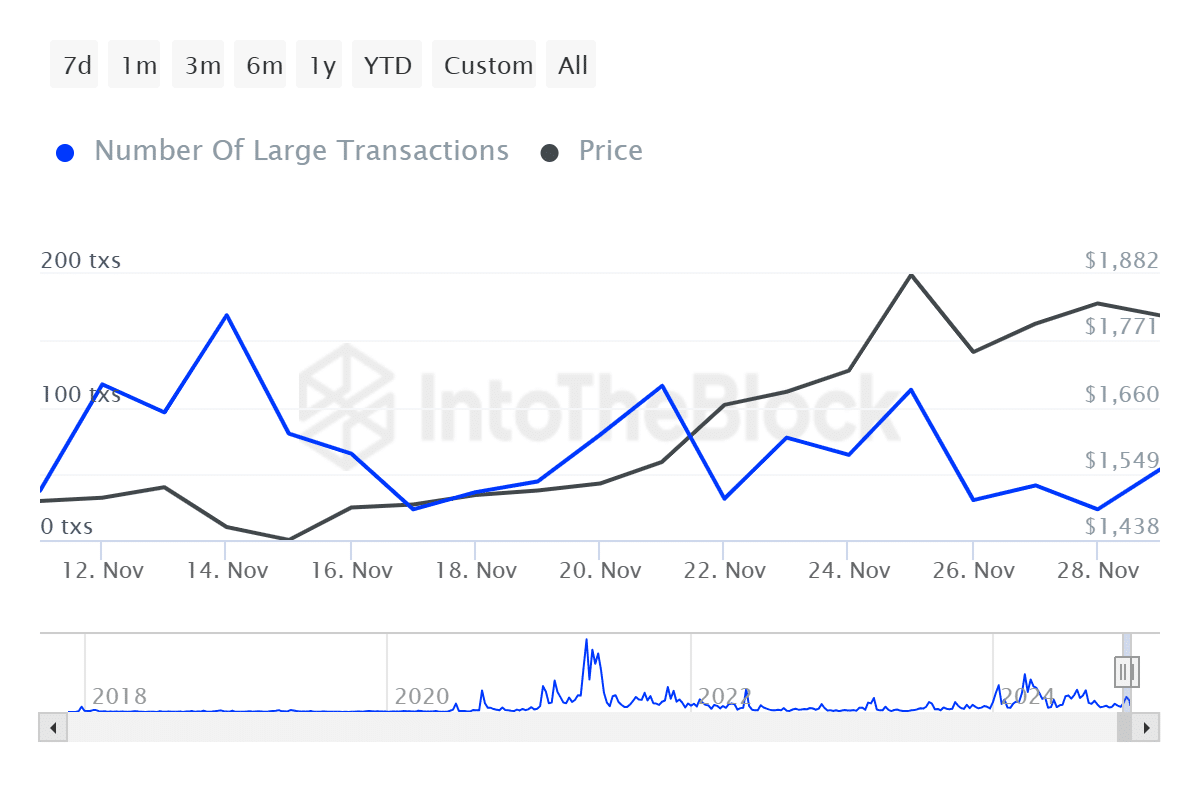

The rise in activities from significant account owners is also supported by an uptick in big transactions observed in the previous 24 hours.

Transactions involving significant amounts of money have increased by a staggering 130.43% over the past day. This suggests that ‘whales’ (large investors) are particularly active right now. Given what we’ve seen, it appears that most of these large transactions are incoming funds.

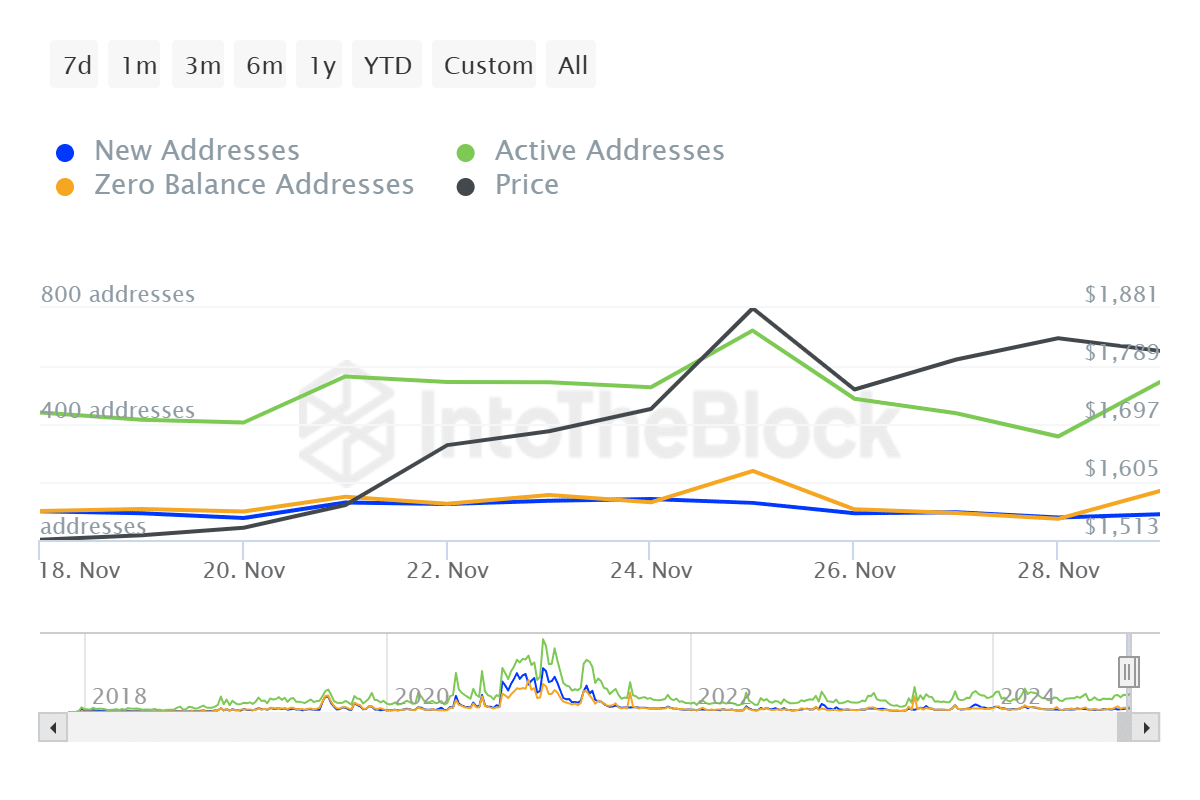

Beyond just major participants, engagement with Maker has expanded throughout the market. Consequently, the number of daily active addresses has jumped by 58.07% within the last 24 hours, climbing from 503 to 803. This rise in active addresses is significant for the growth of the MKR price because it indicates growing demand, curiosity, and acceptance.

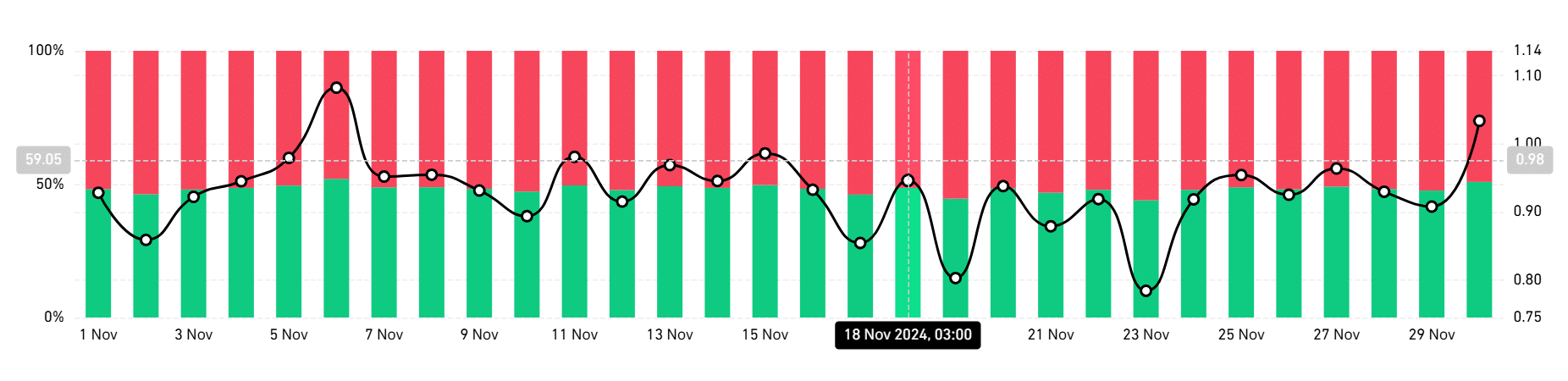

Ultimately, as more money flows in, data from Coinglass suggests that most investors are opting for long-term investments. This trend is reflected in the long/short ratio, which currently stands at approximately 50.83%, implying a majority of 50.83% prefer long positions on daily charts.

This implies these traders entering the market are betting on prices to surge further.

What next for Maker?

Essentially, the attitude of investors towards Maker seems to be changing positively, leaning towards optimism. This change in investor sentiment, given the current market circumstances, might lead to further increases in MKR’s price graph.

Read Maker’s [MKR] Price Prediction 2024–2025

Under specific circumstances, MKR may surpass the $2000 barrier, a point where it’s been repeatedly turned down, and make an initial attempt at reaching the $2200 resistance level, which hasn’t been challenged since August.

However, if a trend reversal occurs, MKR will find support around $1680.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

2024-12-01 00:07