- PEPE recovered well, bouncing back from its crucial support and climbing above its key EMAs

- Derivates data suggested mixed sentiment, implying a cautiously optimistic approach

As a seasoned analyst with over two decades of market experience under my belt, I must admit that the recent performance of PEPE has been quite intriguing. The memecoin’s recovery from its crucial support and subsequent climb above its key EMAs is a testament to the resilience of this digital asset.

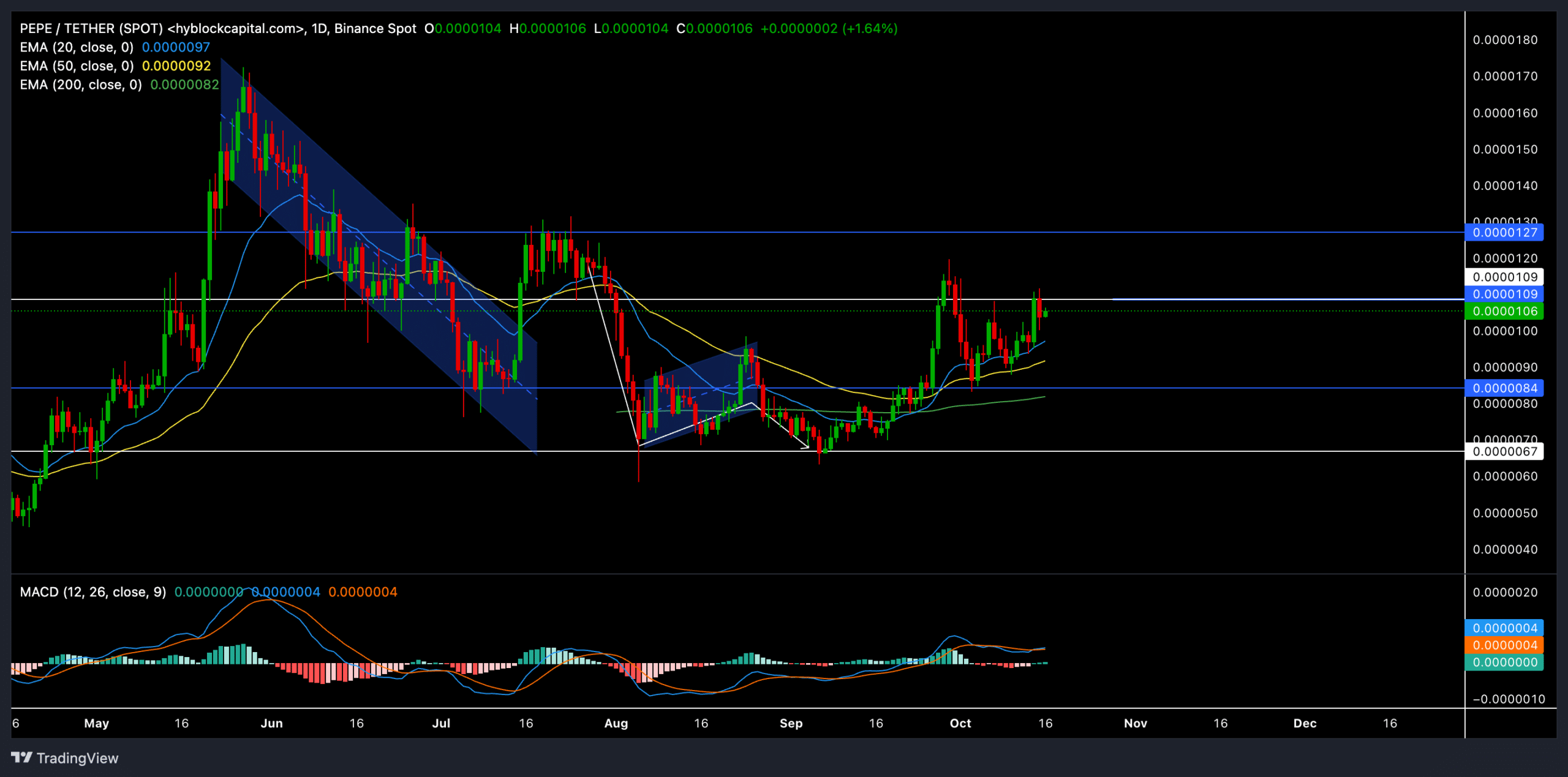

In the last month, PEPE has seen a significant surge following robust backing at approximately $0.0000067, which propelled a nearly 62% upward movement. At the moment of this writing, PEPE is being traded at $0.0000106, nearing the crucial resistance level set at $0.0000109.

After surpassing significant Exponential Moving Averages (EMAs), it’s worth wondering if the memecoin can maintain its rising trend.

Recent price action showed a strong bullish edge

After breaking away from a bearish trend (known as a bearish flag), PEPE experienced solid backing at approximately $0.0000067, paving the way for a powerful surge. The price surged past its 20-day, 50-day, and 200-day moving averages, indicating a robust bullish momentum.

The behavior of the memecoin’s price has been volatile near its current resistance, with buyers trying unsuccessfully so far to drive it above this point for a prolonged upward trend. If the price manages to close decisively above $0.0000109, it could pave the way for further buying interest targeting the $0.0000127 resistance in future trading periods.

In simpler terms, the MACD (Moving Average Convergence Divergence) has moved into a bullish zone, as the MACD line has crossed above the Signal line. This crossover suggests an increase in positive momentum, implying a higher possibility of continuous bullish trends, especially if the market can break through its current resistance level at this moment.

Key levels to watch

Support: The $0.0000084 level remains a critical support that helped the bulls regain footing. Any dip towards this level could present a potential buying opportunity.

As an analyst, I’m observing that the current immediate resistance is situated at $0.0000109. If we manage to surpass this barrier, it could potentially pave the way for a re-test of the $0.0000127 resistance in the upcoming sessions.

Derivatives data and sentiment

As a researcher analyzing the derivatives data, I noticed an increment of 0.13% in PEPE’s Open Interest, suggesting a modest increase in trader attention towards it. On the flip side, the trading volume plummeted by a substantial 35.05%, implying reduced market activity following its recent rally, which could be indicative of a cooling down period.

The long/short ratio on OKX was 2.42, underlining a predominantly bullish sentiment among traders on the platform. Interestingly, Binance PEPE/USDT also highlighted a balanced long/short ratio of 0.9516 over the last 24 hours – A sign of cautious optimism within the market.

It’s important to point out that the 12-hour liquidation data shows a higher number of liquidations for those who were short (selling), implying that they’re struggling to maintain their positions, particularly as the price continues to rise.

In summary, it’s advisable for traders to monitor Bitcoin‘s price fluctuations and evaluate the general market mood before deciding whether to take on a long or short trade.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2024-10-17 12:39