- Notable reduction in capital inflows into the cryptocurrency market has contributed to delay in altseason

- Tokens like BNB, AAVE are expected to maintain their bullish outlook despite the setback

As a seasoned researcher with years of experience navigating the ever-changing cryptocurrency market, I can’t help but see the current trends as a familiar dance between bull and bear. The notable reduction in capital inflows into the market has indeed contributed to delaying the much-anticipated altseason. However, it is essential not to underestimate the resilience of tokens like BNB and AAVE.

Recently, the total market value of cryptocurrencies has been decreasing, with a drop of about 2.06% to reach approximately $3.33 trillion. Yet, upon closer examination, it was found that this decrease is more substantial, with a fall of around 18.33% from its peak in November at $3.7 trillion, down to $3.28 trillion on December 24.

Over the past day, the market’s drop corresponds to an increase of 3.3% in trading activity, reaching a staggering $121.84 billion. This suggests that the selling force among traders is being driven by genuine market movement.

As a crypto investor, I’ve noticed that when the overall market trends downward, it significantly impacts altcoins. These tokens usually mirror the broader market’s movement. In fact, based on AMBCrypto’s analysis, the reduction in capital inflows has been instrumental in perpetuating this market slump.

Liquidity flows see a significant downturn

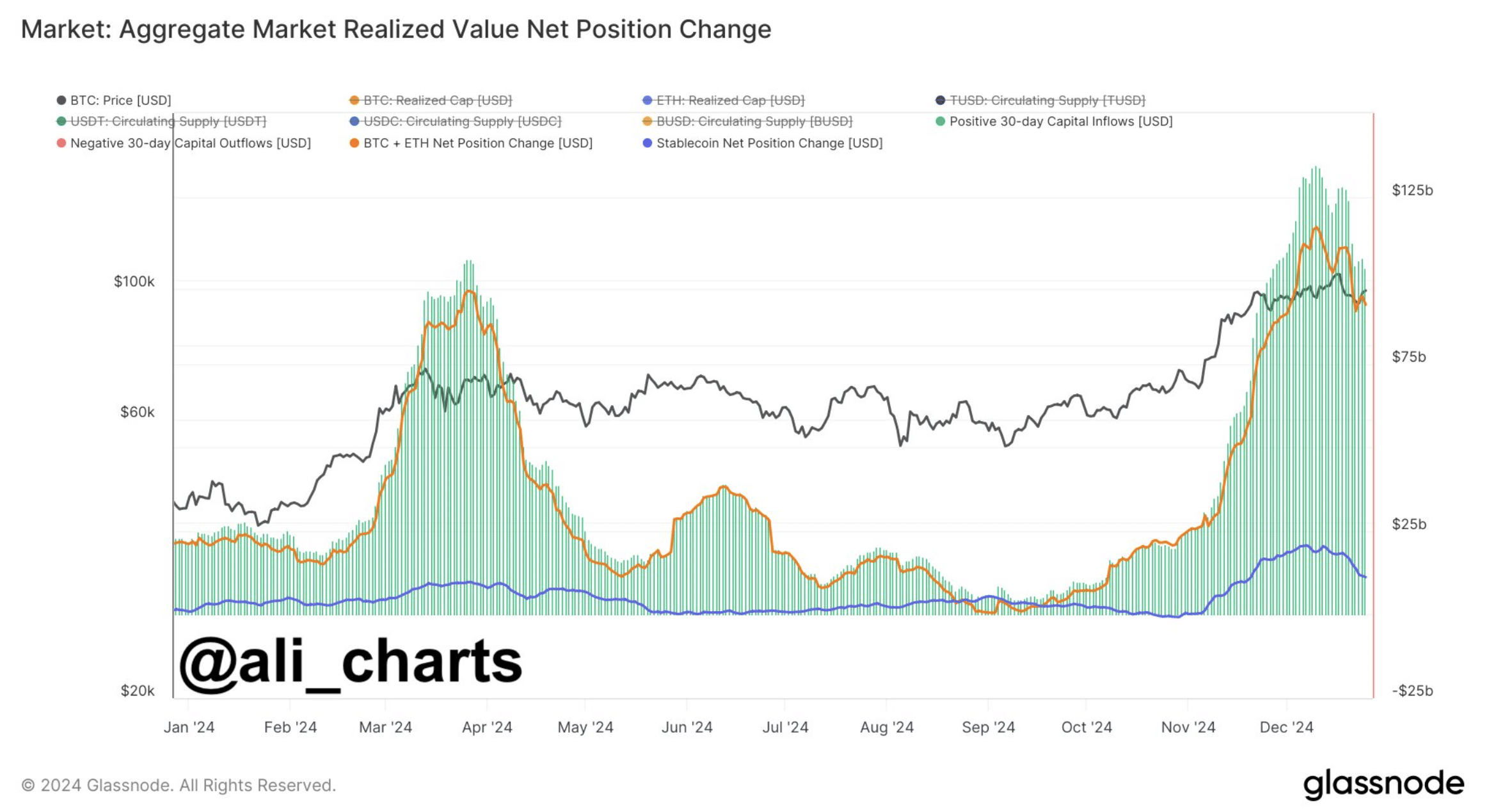

As a researcher, I’ve observed a significant decrease in investments flowing into the cryptocurrency market, as indicated by Glassnode’s findings. This could be a signal that there’s less active investment happening in this space at the moment.

The change in net position as indicated by the Aggregate Market Realized Value Net Position Change metric shows a decrease in capital inflows, valued in US dollars, from approximately $134 billion on December 10th, to currently around $100 billion.

Typically, when there’s a decline like this, it suggests that most cryptocurrencies aren’t attracting much optimism from investors. Instead, they seem more inclined to hold secure assets rather than buying unpredictable coins. This could strengthen the negative market outlook and make prolonged drops more probable.

As a researcher, I anticipate that certain digital assets might sustain their upward trajectory, even amidst a general decrease in investment inflows, and could possibly surpass the overall market performance.

BNB poised to set a new all-time high

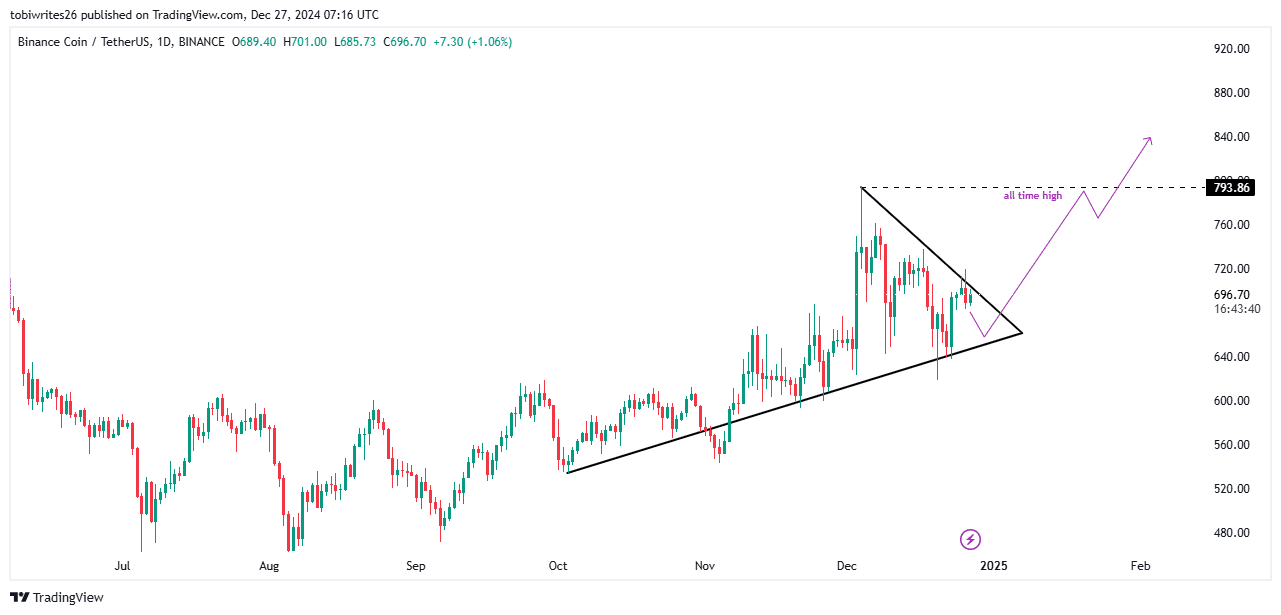

2024 saw BNB continue as a top performer among digital currencies, hitting new record highs on not one but two occasions throughout the year.

Starting from its high of $691.77 back in 2021, BNB exceeded this value in June 2024, reaching a new height of $721.80 on the graphs. However, it didn’t stop there. By December 2024, it broke yet another record, exchanging hands at $793.86.

Currently, when I’m writing this, BNB appears to be in an accumulation stage based on its chart trends. If it moves out of this stage, there’s a potential for another surge, with a good chance of reaching beyond its previous peak and aiming at prices exceeding $800.

AAVE remains structurally bullish

On the price graph, AAVE continues to hold its ground within the bullish sector. Following several months of market stabilization, the asset surged ahead in January, increasing by a significant 332.78% to reach $399.85 – a level not seen since 2021.

As an analyst, I’m excited to report that on December 17th, the Total Value Locked (TVL) of AAVE hit a record high, soaring to $23.19 billion. However, over the past few days, we’ve seen a slight pullback, with TVL now sitting at $20.63 billion. Despite this minor dip, it’s clear that AAVE is still fundamentally bullish, given the steady growth in activity on its protocol.

If Total Value Locked (TVL) remains stable or rises, it’s reasonable to expect that the price of AAVE will continue to climb. This is particularly significant because AAVE plays a crucial role in powering the platform’s functions.

A key requirement for altcoin season

For an altcoin rally to occur, it’s crucial that the influence of Bitcoin decreases compared to other cryptocurrencies in the market. When Bitcoin’s influence (or dominance) is high, this means it’s doing better than most alternative coins. On the flip side, a lower dominance indicates that the altcoins are performing more robustly.

Currently, as I’m typing this, CoinMarketCap shows a minor decrease of 0.18% in Bitcoin’s dominance, bringing it down to approximately 56.94%.

Since Bitcoin’s dominance continues to be rather substantial, it seems like the altcoin season might be postponed for now. This could continue until there’s a more pronounced decrease, possibly dropping it below the 50% threshold.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-12-28 04:08