- XRP’s price is testing key resistance at $0.529, a critical level that could pave the way for a bullish breakout if surpassed.

- Rising Open Interest for XRP indicates heightened market engagement, signaling a potential increase in price volatility.

As a seasoned crypto investor who has witnessed the ebb and flow of the market for years, I can’t help but feel that XRP is standing at a critical juncture right now. The resistance at $0.529 looms large, but it’s not uncharted territory for Ripple. Having been through several bullish breakouts in my time, I remain hopeful that this could be another opportunity to cash in on the upside.

Keeping a close eye on Ripple XRP’s current value near $0.51, analysts are assessing if the asset will manage to surpass significant resistance points within the upcoming seven days.

As a researcher, examining the Open Interest (OI) metric together with other technical pointers, I find myself intrigued by the blend of influences seemingly in action.

Ripple’s key resistance levels and potential breakout

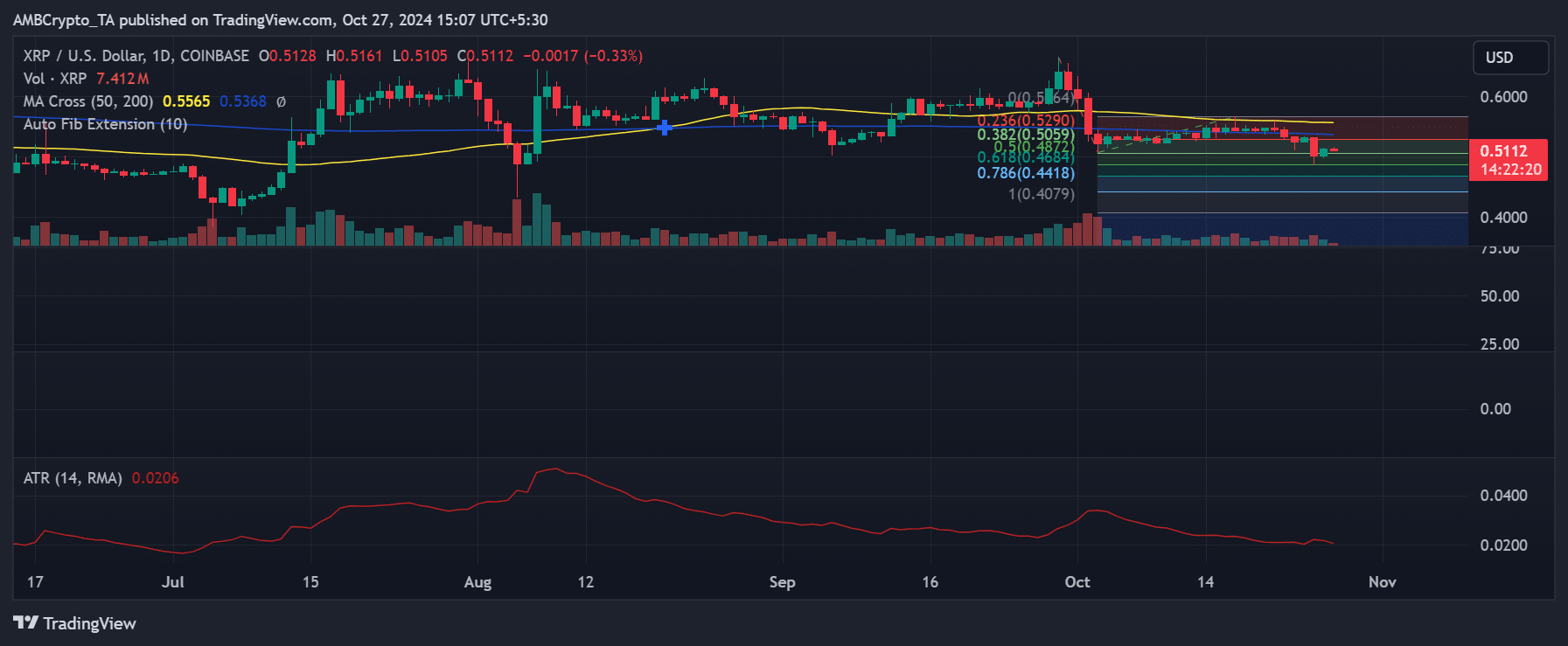

A recent analysis of Ripple’s daily chart reveals several important price zones. The Auto Fibonacci Extension tool places resistance at $0.529, a level XRP has tested previously but failed to sustain above.

At this point, we should pay close attention as it represents approximately 23.6% Fibonacci retracement of XRP’s previous peak levels, which makes it a significant spot to monitor.

Should XRP manage to gather enough strength to surpass its current level, a significant challenge awaits at approximately $0.564, which corresponds to the 50-day Moving Average (MA) and serves as a former support level that has now become resistance.

A breakthrough here could open the door for more gains, possibly propelling XRP into a bullish trend.

On the other hand, a potential drawback is that XRP’s value might drop if it doesn’t manage to create enough buying interest. Two key support levels to keep an eye on are the Fibonacci retracement levels at around $0.505 (38.2%) and $0.482 (50%). If XRP falls below these areas, it could suggest a resurgence of bearish feelings, possibly leading to further consolidation for a longer period.

Rising Open Interest indicates growing market engagement

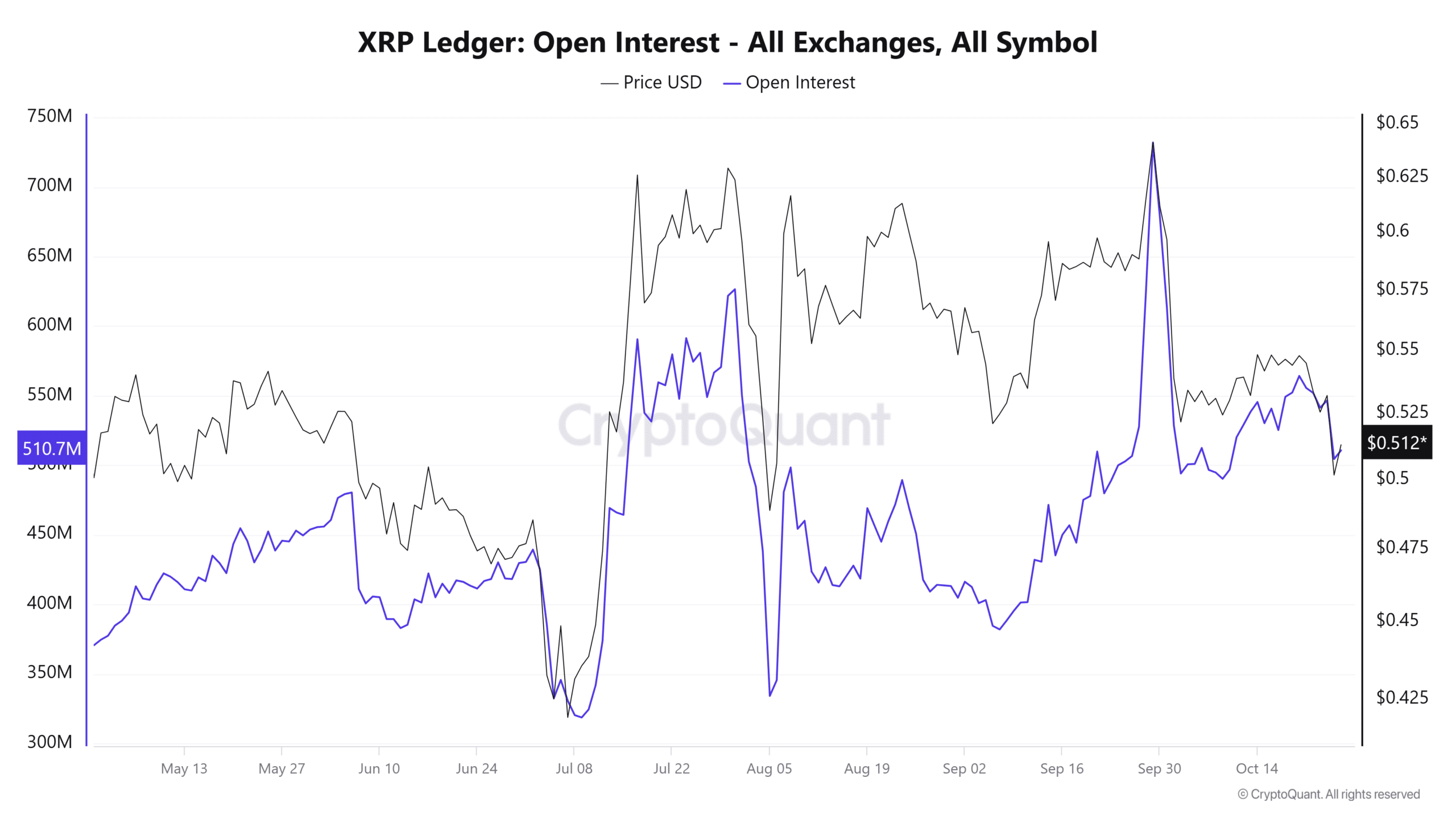

Examining the Open Interest (OI) figure for Ripple across all trading platforms indicates a persistent upward trend. This minor rise hints at increased involvement from both bullish and bearish investors.

According to the latest figures, Open Interest (OI) is currently at approximately 510.7 million. Historically, this level of OI has often preceded substantial price fluctuations. An increase in Open Interest typically indicates that more capital is entering the market, as traders are taking new positions in expectation of a significant price shift.

Historically, when the Open Interest (OI) of XRP reaches high levels, its price typically becomes more volatile. This trend often signals an upcoming breakout or breakdown in the market.

If OI keeps rising in the near future, it could hint at a larger price shift ahead. This heightened market action might lead to a strong breakthrough over resistance (bullish) or trigger a reversal (bearish), depending on whether selling force is stronger than buying demand.

Will Ripple’s ATR and RSI indicators signal a trend shift?

In terms of volatility, Ripple’s Average True Range (ATR) indicates a generally calm market condition. However, this stability could be setting up for a potential build-up, which is often followed by substantial price fluctuations.

On a daily basis, the Average True Range (ATR) has remained consistent, suggesting a narrowing trading band that might soon break open, leading to a clearer direction in the market trends.

Furthermore, the Asset’s Relative Strength Index (RSI) hovers slightly below the 50 mark, suggesting that it’s not currently in a state of being overbought or oversold.

If the Relative Strength Index (RSI) moves upwards towards 60 or more, it suggests growing buying strength, possibly strengthening a bullish breakout. On the other hand, if the RSI falls below 40, it might suggest escalating selling pressure, which could lead to a possible test of lower resistance levels.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-27 19:04