-

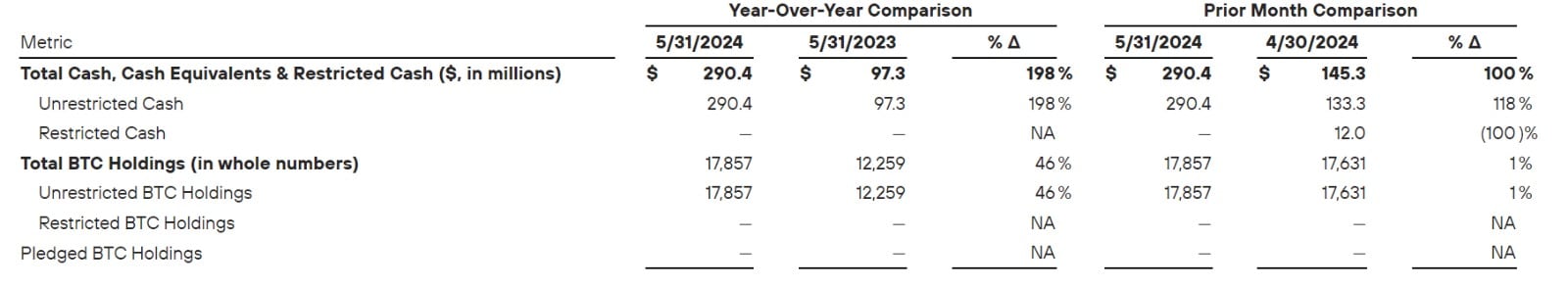

Mara purchased BTC worth $249 million.

Recent purchases of 4144 BTC brought Marathon’s total holding to 25000 BTC.

As an analyst with over two decades of experience in the financial markets, I find Marathon Digital’s strategic move to accumulate Bitcoin (BTC) through open market purchases quite intriguing. The company’s recent purchase of $249 million worth of BTC brings its total holding to 25,000 BTC, a significant increase that underscores its confidence in the long-term value of BTC.

The cryptocurrency market is persistently changing as it gains more acceptance and attracts institutional involvement. As governments and political figures pay closer attention to cryptocurrencies, miners find renewed motivation.

Over the course of the year, significant businesses specializing in cryptocurrency and Bitcoin [BTC] have been actively purchasing these assets, anticipating an increase in their future worth.

As an analyst, I’ve observed that the leading Bitcoin miner, Marathon, is proactively strengthening its Bitcoin reserves through strategic purchases in the open market.

Mara buys $249m worth of BTC

The mining form announced the purchase through its official page, reporting that,

“Through an oversubscribed sale of convertible senior notes, MARA raised $300 million. Using these funds, we acquired approximately 4,144 Bitcoins, which were worth around $249 million at the time. This purchase has increased our strategic Bitcoin reserves to more than 25,000 Bitcoins.”

The action carries weight, as the company aims to solidify its dominance as a prominent figure in Bitcoin mining operations.

Through this transaction, the company acquired 4,144 Bitcoins, with an average cost of around $59,000 per Bitcoin, thereby boosting their total Bitcoin holdings to approximately 25,000 units.

As a crypto investor, I found the senior note offering particularly appealing, generating a substantial net income of $292.5 million. This attractive investment comes with an annual interest rate of 2.125%, and it matures in September 2031.

These sales are essential as it affords the company financial flexibility in operations.

Mara’s HODL strategy

Undoubtedly, the purchase certifies Mara’s strategy for BTC accumulation.

According to earlier reports from AMBCrypto, Mara intends to employ a “HODL” approach, meaning they will mine cryptocurrency themselves and also buy more on the open market to boost their reserves.

Following our strategic plan, MARA recently acquired approximately $100 million in Bitcoin (BTC) during the past month. This move reflects their belief in BTC’s potential future value as they have chosen to hold onto these assets rather than sell them.

Based on the information provided by the company, their “HODL” strategy demonstrates their belief in Bitcoin’s (BTC) lasting worth in the long term. Consequently, BTC serves as an ideal treasure reserve asset that is expected to consistently appreciate, thereby benefiting both Marathon and its investors.

What it means for Marathon Digital and BTC

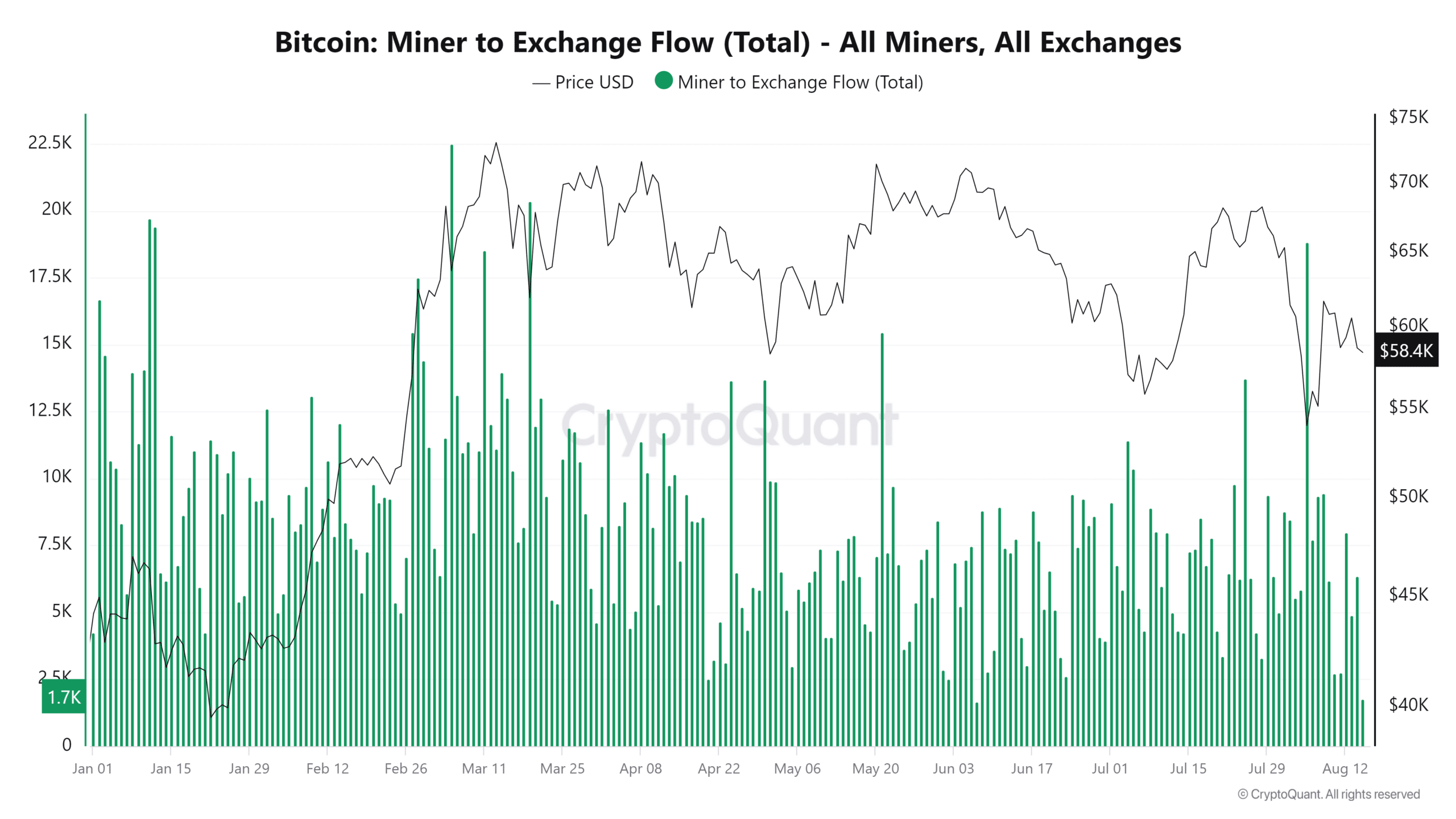

Since October 2023, MARA has offloaded a substantial quantity of Bitcoin (BTC). From June to July alone, they sold approximately 1400 BTC, with other miners following suit and also increasing their sales during the same period.

Equally, in May, the company sold 390 BTC.

In contrast to the sales figures, Marathon Digital managed to decrease its expenditures by a significant amount, from 56% in 2023 to just 31% in 2024. Yet, these sales seem to have had a detrimental impact on Marathon Digital’s operations.

Based on information from Google Finance, the company’s stocks have decreased by 33.97% this year so far. This drop is attributed to heightened volatility in Bitcoin and a decrease in their Bitcoin reserves.

Consequently, the ongoing Bitcoin acquisition serves to enhance the company’s worth.

As Bitcoin (BTC) is expected to grow in worth in the future, consistently purchasing it should enhance Mara’s share price, earnings, and overall profitability.

Similarly, an increase in acceptance by institutions can be advantageous for King Coin because it boosts demand, which in turn raises purchasing pressure.

Typically, when demand increases, so do prices. With more institutional investment, this demand is likely to surge even more, causing the value to rise significantly.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-08-15 13:50