-

Marathon Digital bought an extra $100 million as part of a new HODL approach.

MARA plans to hold all its mined BTC and buy more from open markets

As a seasoned researcher with a strong background in the Bitcoin and cryptocurrency space, I see Marathon Digital’s recent move to add $100 million worth of BTC as part of its new HODL strategy as a significant development. Having closely followed the industry for years, I have witnessed the ups and downs of Bitcoin mining and the strategies adopted by various players in the market.

Marathon Digital, a well-known Bitcoin miner, made headlines recently by announcing the acquisition of $100 million in Bitcoin (BTC) as part of a new financial approach. According to Mara Digital’s CEO, Fred Thiel, this significant purchase was made over the past month to bolster their treasury strategy.

Today, Marathon is thrilled to reveal that as part of our continued commitment to making Bitcoin a cornerstone of our strategic treasury reserves, we are taking the next step and becoming unwavering holders. In other words, we’re fully embracing the “HODL” philosophy.

The company announced that under its new HODL strategy, it will retain all newly mined Bitcoin and purchase additional amounts from market exchanges. This action from a major Bitcoin miner serves as an optimistic signal regarding the digital currency’s worthiness as a long-term investment.

Marathon Digital’s move: Is BTC miner crisis over?

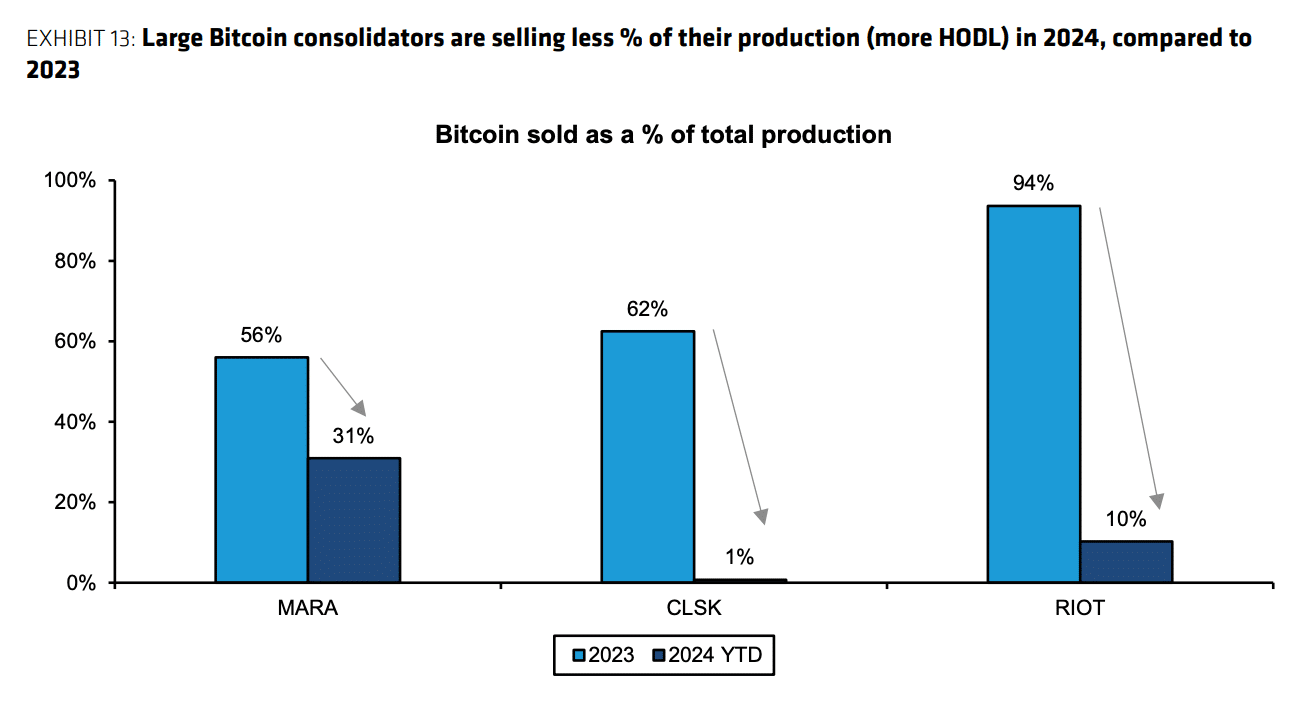

A Bernstein analysis highlighted the buying frenzy and “HODL” strategy of Mara Digital, revealing that the proportion of Bitcoin sold from their production decreased from 56% in 2023 to just 31% in 2024.

The HODL trend has also been seen across other BTC miners, like Riot platforms and CleanSpark.

Indeed, the CEO and Chair of MARA, Fred Thiel, is advocating for others to adopt their “HODL and store Bitcoins as a tactical reserve in treasuries.”

“Bitcoin holds great potential as the premier reserve asset globally, and we advocate for sovereign wealth funds to consider including it in their portfolios. Our recommendation extends to governments and corporations alike: consider investing in Bitcoin as part of your reserve assets.”

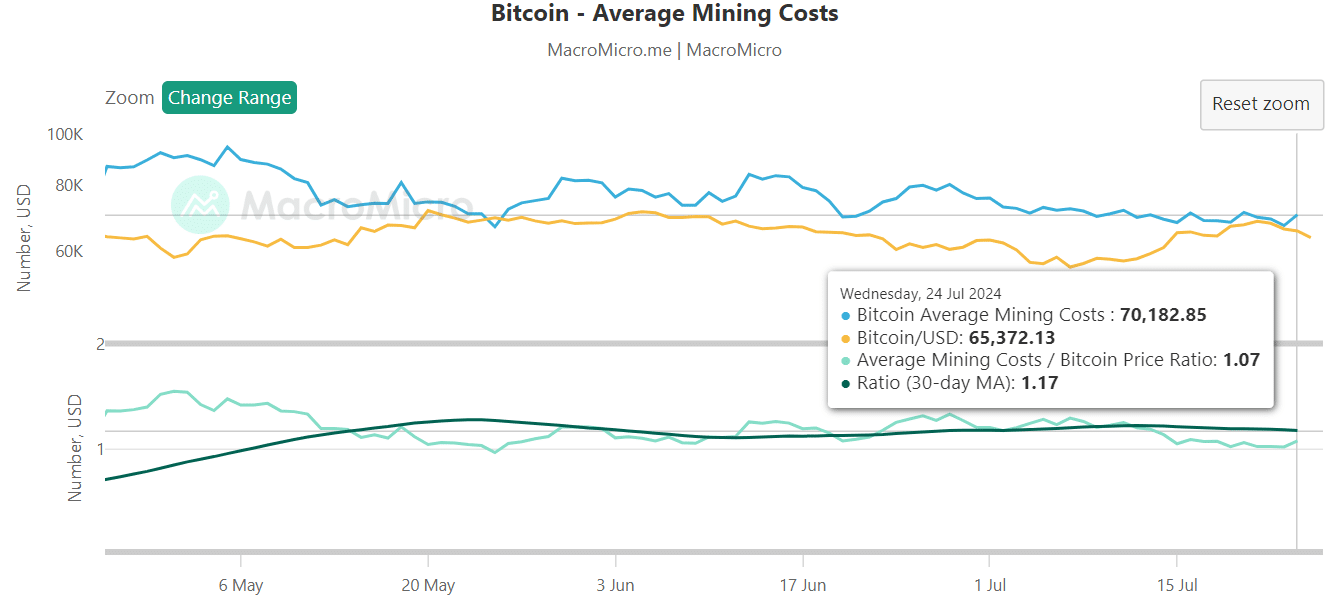

Although some large publicly-traded Bitcoin miners may be holding onto their assets, the typical mining costs continue to surpass Bitcoin’s current value. At this moment in time, the average mining expense is around $70,000, while the Bitcoin price hovers at approximately $65,000.

Small-scale private businesses continue to face challenges in achieving profitability from Bitcoin mining.

According to Bitcoin analyst Willy Woo’s perspective, the miner crisis may soon come to an end, leading to a significant surge in Bitcoin’s price and the related mining stocks, such as MARA.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-07-26 00:39