- Oh, how the mighty memecoins have fallen! Over 50% in mere months, left gasping for breath as the hype evaporates into thin air, like a puff of smoke from a long-forgotten party.

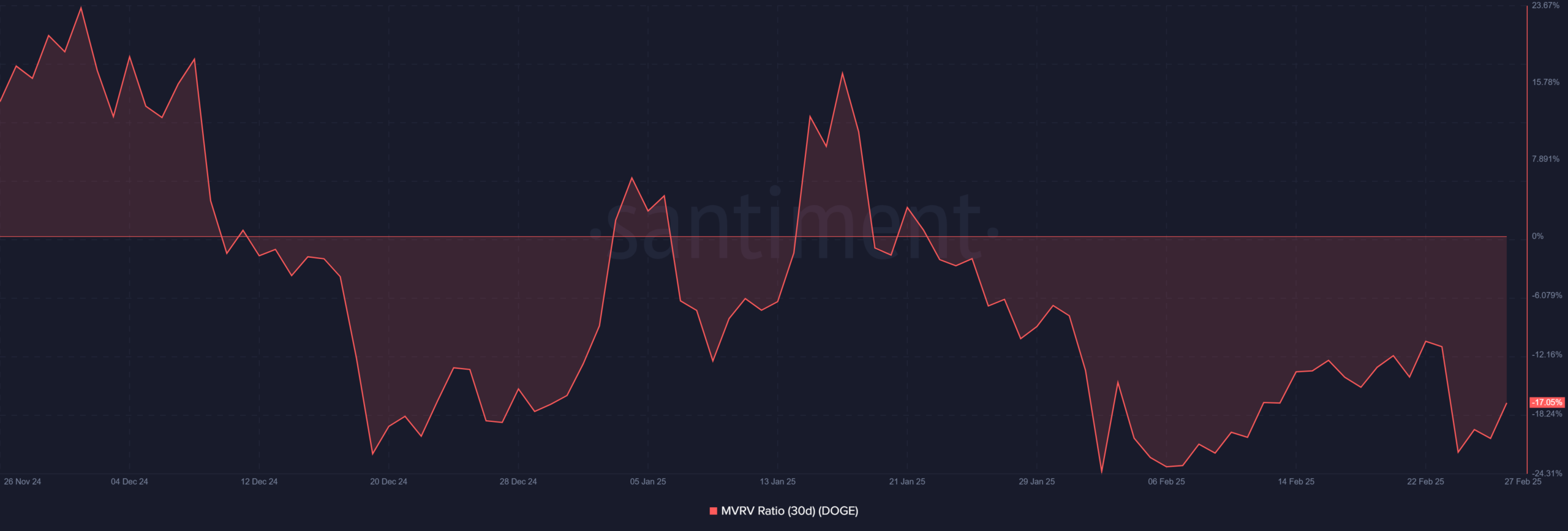

- Our dear MVRV ratios have turned negative, trapping the unfortunate DOGE holders in a relentless cycle of regret, much like one might feel after a bad haircut.

The cryptocurrency market has found itself in the throes of a gripping correction, with memecoins taking the brunt of the calamity—a scene reminiscent of a Shakespearean tragedy, but with more dogs and frogs involved.

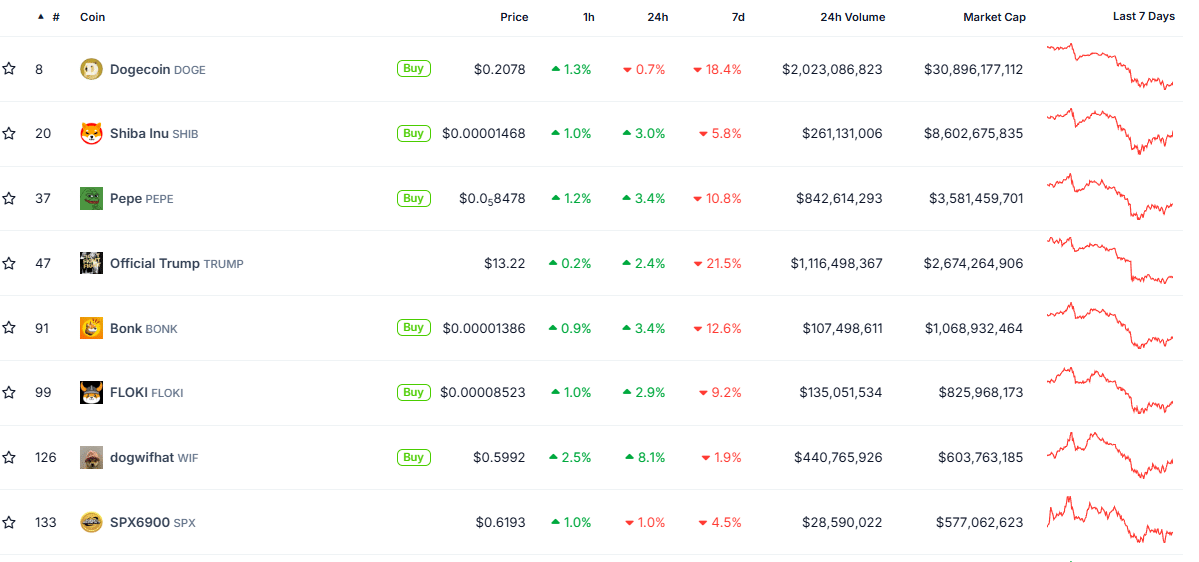

As noted by the wise sages at Delphi Digital, memecoins have plummeted an average of a staggering 51.74% between the 31st of December and the 24th of February—a feat that would leave even the most hardened investor in a state of disbelief.

For context, Bitcoin, that stalwart of the cryptosphere, has remained relatively unscathed, like a valiant knight compared to the hapless foot soldiers.

As the speculation bubble deflates, assets such as Dogecoin [DOGE] and Shiba Inu [SHIB] suffer staggering losses, posing existential dilemmas about the sustainability of the entire memecoin sector—a question that rings louder than a church bell on a Sunday morning.

The Great Memecoin Massacre: Over 50% Decline

The most unfortunate casualties of this market massacre encompass PEPE, DOGE, Melania Meme [MELANIA], and SHIB. In a mere three weeks, the memecoin capital has dwindled from $116 billion to a meager $67.7 billion—like watching your wallet empty itself in real-time.

PEPE, that once-mighty frog, has seen a harrowing loss of about 80% from its peak—a tragedy fueled by whale activity, as a colossal sell-off resulted in 1.1 trillion tokens cast into the abyss.

This fire sale has scorched billions from the memecoin market, once buoyed by the froth of social media hype and speculative trading, now left in the cold, shivering like a forgotten puppy.

Recent data from CoinGecko reveals that the overall memecoin market cap stands at $64.1 billion, reflecting a 1.1% drop in the last 24 hours, indicating a persistent bearish cloud hovering ominously above.

A separate report from Glassnode declares with grim finality that the broader cryptocurrency market has entered a contraction phase, as Bitcoin faltered and failed to break past the lofty heights of $105,000 in January 2025.

Memecoins, which were once crowned kings of the forest with dazzling 90% monthly gains, have now crumbled, suffering an average loss of 37.4% in February alone. Quite the fall from grace, akin to an emperor stripped nude!

Market sentiment, it appears, has soured, as futures market data suggests a significant reduction in memecoin perpetual futures open interest, decreasing by a staggering 52.1%.

Moreover, Funding Rates have ventured into negative territory, signifying investor sentiment so bearish that even a grizzly bear might feel optimistic in comparison.

Probe into the Abyss: An On-Chain Breakdown

Among the more tragic tales, DOGE has witnessed its price tumble a sharp 13% within the span of a week. A closer examination reveals disturbing signs for its beleaguered holders, akin to discovering a hole in one’s favorite pocket.

The 30-day Market Value to Realized Value (MVRV) Ratio, which gauges the average profit or loss for the unlucky recent buyers, has basked in negativity throughout February. It turned negative in mid-December and has firmly remained below zero, with no reprieve on the horizon.

During that fateful December, the MVRV ratio stood gallantly at +23.44%. However, in a dramatic turn, by the 2nd of February, it plummeted to -24.07%, a staggering drop of 47.51 percentage points in just 60 days. Ah, the cruel hand of fate!

Historically, lingering negative MVRV ratios have foretold of despondent market sentiment and weak buying will—an ominous sign that DOGE may remain in this quagmire for the near future.

This aligns with a notable decline in Dogecoin’s network activity, as whale transactions have dwindled to multi-month lows, raising fears of its resilience much like a flower wilting in the harsh sunlight. Should DOGE fail to reclaim critical support levels, it could face even darker days ahead.

IntoTheBlock’s analytical prowess also reveals a similarly grim forecast for Shiba Inu (SHIB)—a tale that mirrors the one of its canine counterpart. The ominous red bubbles show up between $0.000015 and $0.000056, an indication that many investors acquired SHIB at much higher prices. With SHIB currently languishing at $0.000015, even a modest price drop could ensnare more holders in the grip of loss.

Bitcoin: The Lighthouse Amidst the Stormy Sea

Despite the chaotic tides that beset the overall crypto market, Bitcoin has managed to maintain a semblance of stability, standing firm among its high-risk altcoin companions. Reports linger of Bitcoin’s leverage reaching critical levels, stirring whispers of potential volatility lurking in the shadows.

As of now, BTC is trading beneath $86,950, with technical indicators flickering warnings like sirens on the brink of an impending disaster.

While Bitcoin still wrestles with its own set of risks, institutional demand propelled by ETFs has provided a crutch, unlike the precarious speculative altcoins, which seem to float sans a life vest.

Is More Pain on the Horizon?

Current indicators imply that memecoins are enveloped in a phase of substantial drawdown—like a silent movie devoid of laughter, where immediate recovery seems like a distant dream. Social media enthusiasm has waned, akin to a party that lost its energy, resulting in dwindling retail participation and a general decline in speculative fervor.

Bearish futures market sentiment and negative funding rates suggest further bouts of despair might be in store. Investors may pivot their capital towards BTC as a safer harbor, inevitably nudging Bitcoin’s dominance upward.

Although memecoins have historically rebounded during bull cycles, doubts linger about their long-term viability as they wallow in the current corrective haze. Without fresh narratives to ignite renewed speculative flames, the sector may continue its struggle into the uncertain months ahead.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Superman Rumor Teases “Major Casting Surprise” (Is It Tom Cruise or Chris Pratt?)

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

2025-02-27 20:18