-

Bitcoin maintained a balanced Put/Call Ratio ahead of the deadline

ETH traders face potential losses as its price was close to the maximum pain point

As an experienced options analyst, I closely monitor the Put/Call Ratio and maximum pain points in the cryptocurrency derivatives market. Based on the latest data from Deribit, Bitcoin and Ethereum options with a combined notional value of $2.13 billion will expire on May 17.

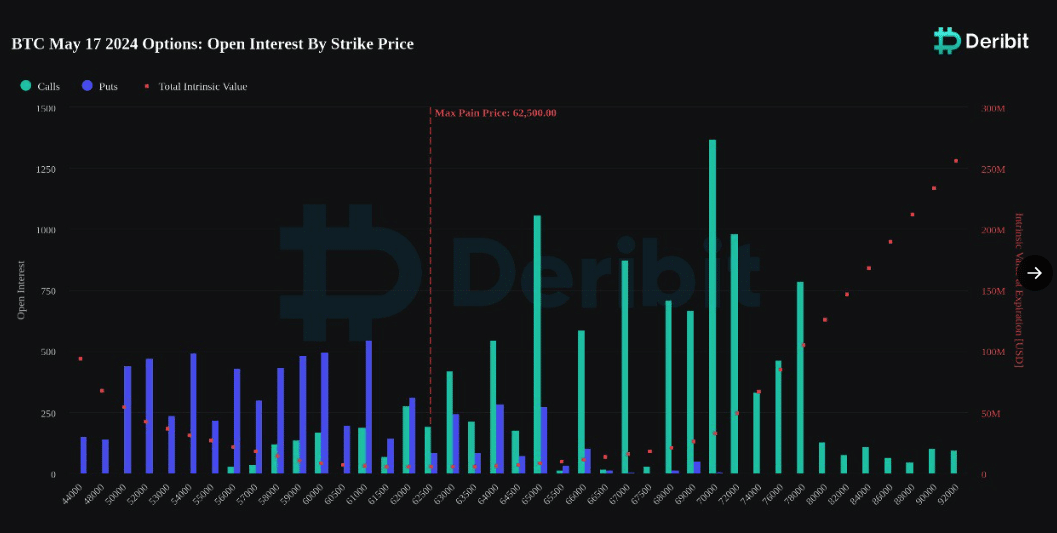

Based on information from Deribit, the prominent derivatives platform, approximately $1.18 billion worth of Bitcoin [BTC] option contracts are set to expire on May 17th.

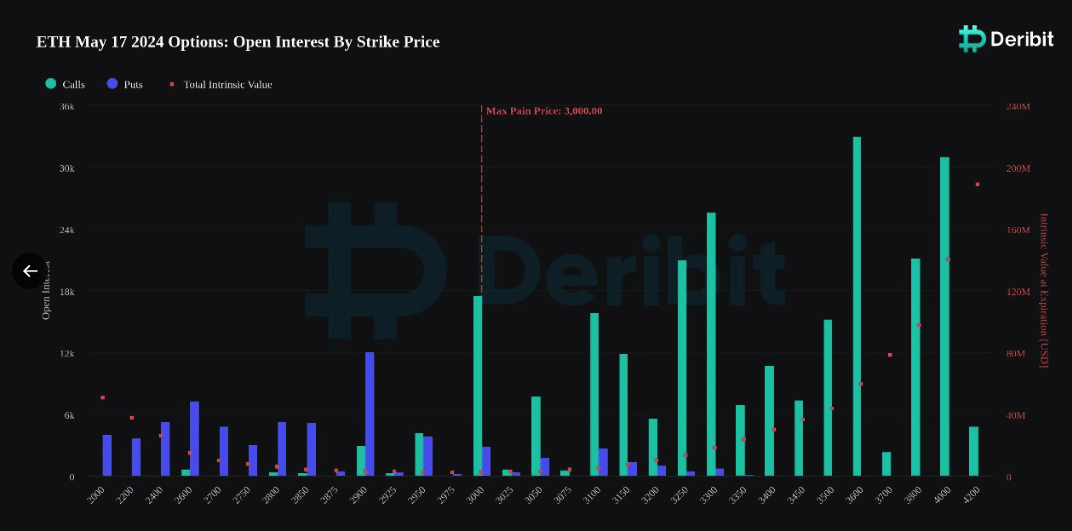

Additionally, contracts for Ethereum [ETH], worth approximately $950 million, were set to expire concurrently. The Put/Call Ratio for Bitcoin stood at 0.61, and its maximum pain point was priced at $62,500 as of the current report.

Where do both BTC and ETH stand?

When dealing with options trading, a put represents a contract held by a trader with the intention of selling it. The hope is that the value of the underlying asset will decrease, enabling profits from this position.

From a research perspective, if the Put/Call Ratio surpasses 0.70, it signifies that traders have been preferring to purchase put options over call options. This tendency implies a bearish outlook on the market, as put options allow for the sale of an underlying asset at a specified price in the future. Consequently, these traders anticipate a potential decrease in asset prices and are hedging against potential losses.

In simpler terms, when the reading is 0.50 or less, it reflects a bullish outlook in the market as there are more bullish (call) than bearish (put) positions taken for Bitcoin. The number of these positions was nearly equal, suggesting a market equilibrium between optimistic and pessimistic sentiments.

In simpler terms, for Ethereum (ETH), the Put/Call Ratio was 0.21, meaning that there were fewer put options (bets on price decreases) than call options (bets on price increases). This indicates a predominantly bullish sentiment among traders. However, if Ethereum reaches its maximum pain point of $3,000 or falls below it by the end of the day, many traders could potentially face significant financial losses.

If Bitcoin’s price reaches $62,500 or falls beneath it, there would be no significant difference in its impact at present. Currently, Bitcoin is priced at $66,443, suggesting that it may not inflict substantial damage either way.

As a researcher examining the cryptocurrency market, I’ve noticed that the value of Ethereum (ETH) was approaching a significant level: $3,018. This figure is relatively close to what could be considered a maximum point of distress for ETH traders. Consequently, they face a considerable risk of experiencing losses due to this proximity.

ETH’s weakness has not deterred future bets

As a crypto investor, I’ve come across some valuable insights from Greeks.live, a platform known for its options trading resources. They concurred with AMBCrypto’s perspective on Bitcoin using indicator X. Regarding Ethereum, they pointed out a different yet interesting analysis.

“The Bitcoin market currently exhibits a more even distribution between buyers and sellers. On the other hand, the Ethereum price shows weakness, contributing to a decline in market confidence and an increase in sell calls being made.”

According to Deribit’s data, traders are optimistic about Ethereum’s future recovery. Notably, there’s been a surge in wagers aiming for $3,600 during the last week of May through June, as reported by AMBCrypto.

One possible explanation for this forecast is the upcoming SEC verdict regarding multiple Ethereum ETF proposals. If the SEC approves any of these applications, it could lead to a surge in Ethereum’s value, providing profitable opportunities for traders.

Realistic or not, here’s ETH’s market cap in BTC terms

If we consider the opposite scenario, a delay or rejection could potentially push the price of the altcoin down even more. Consequently, traders may face substantial financial losses if this occurs.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-05-17 15:03