Well now, if you ever pegged your faith to a bunch of clever machines instead of honest folks, you ain’t far from the truth. The crypto world keeps its promises about security about as well as a Mississippi fog keeps a boat from finding the shore.

SwapNet Integration Exploit Triggers Security Incident at Matcha Meta

Word comes from Matcha Meta that a breach slipped through the door of its SwapNet tie-in. The mischief-makers hauled off roughly $16.8 million in assets after sniffing out a weakness in the platform’s smart contracts, a flaw as plain as a jaybird on a wire.

In plain talk, the attackers moved digital assets from an external aggregator linked to Matcha Meta’s interface, SwapNet.

After conferring with 0x’s protocol crew, we reckon the breach did not spring from 0x’s AllowanceHolder or Settler contracts.

Users who used One-Time Approval are safe, and those who turned off One-Time approvals may want to keep one eye open.

– Matcha Meta 🎆 (@matchametaxyz)

The folks at Matcha Meta say they spotted suspicious transfers from SwapNet’s router contract and told the SwapNet team to shut things down for a spell.

PeckShield pegs the loss at about $16.8 million. The tale says the thief swapped around $10.5 million in USDC on Base for roughly 3,655 ETH, then bridged the loot onward to Ethereum.

CertiK, not wanting to be outdone in the numbers game, put the loss nearer $13.3 million in USDC on Base. They blamed an “arbitrary call” vulnerability in the SwapNet contract that let funds that already had the green light slip away to the contract.

Matcha Meta hasn’t declared all hands lost. Their first word was that exposure was limited to folks who disabled One-Time Approvals and opted for direct allowances on specific aggregators. Accounts with One-Time Approval were said to be safe.

But after a sit-down with the 0x protocol crew, Matcha Meta cleared up that the mischief did not involve 0x’s AllowanceHolder or Settler contracts.

The company also warned that those who shun One-Time Approval and trust direct allowances must bear extra risk tied to each aggregator. To keep a future such misfortune from happening on its watch, Matcha Meta has pulled the plug on allowing direct allowances for aggregators.

Smart Contract Flaws and Cross-Chain Laundering Fuel Rising Crypto Hacks

As the crypto frontier keeps expanding, the danger line grows too. Chainalysis tells us crypto theft topped $3.41 billion in 2025, a touch higher than the year prior, mostly fed by cross‑chain sprees and half-witted approvals that let rogues waltz off with the money.

Study after study shows the laundering game slicks up using coin-swapping services-websites or telegram channels where thieves can whisk stolen funds around quicker than a mule can kick a bucket.

We’ve seen echoes of this trouble before. CoWSwap’s breach last year saw about $180,000 in DAI slip away through the GPv2Settlement contract.

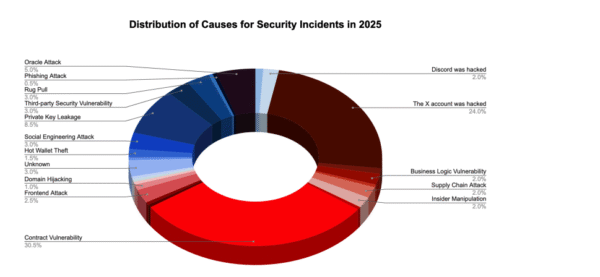

Smart contracts remain a chief culprit in losses; SlowMist puts contract-flaw exploits at just over 30% of crypto incidents in 2025.

Image Source: SlowMist

AI is said to be a newer engine behind the mischief-machines getting clever at sniffing out vulnerabilities and taking advantage of them.

A single $1.5 billion hack of Bybit accounted for about 44% of last year’s losses, while North Korea-linked groups traded in a record $2.02 billion in theft.

Since the year began, DeFi platforms have felt the pressure. Makina Finance lost about $4.13 million after hackers drained its DUSD/USDC pool on Curve. Not long after, Saga paused its SagaEVM chain when nearly $7 million was moved to Ethereum.

Image by Clint Patterson from Unsplash

Read More

- Best Controller Settings for ARC Raiders

- How to Get to Heaven from Belfast soundtrack: All songs featured

- 10 Most Memorable Batman Covers

- Best X-Men Movies (September 2025)

- Star Wars: Galactic Racer May Be 2026’s Best Substitute for WipEout on PS5

- Netflix’s Stranger Things Replacement Reveals First Trailer (It’s Scarier Than Anything in the Upside Down)

- Why Juliana Pasquarosa, Grant Ellis and More Bachelor Duos Have Split

- Bitcoin’s Mysterious Millionaire Overtakes Bill Gates: A Tale of Digital Riches 🤑💰

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- How to Froggy Grind in Tony Hawk Pro Skater 3+4 | Foundry Pro Goals Guide

2026-01-26 20:12