-

MATIC’s Open Interest jumped by over 15% in the last 24 hours, indicating growing interest from investors.

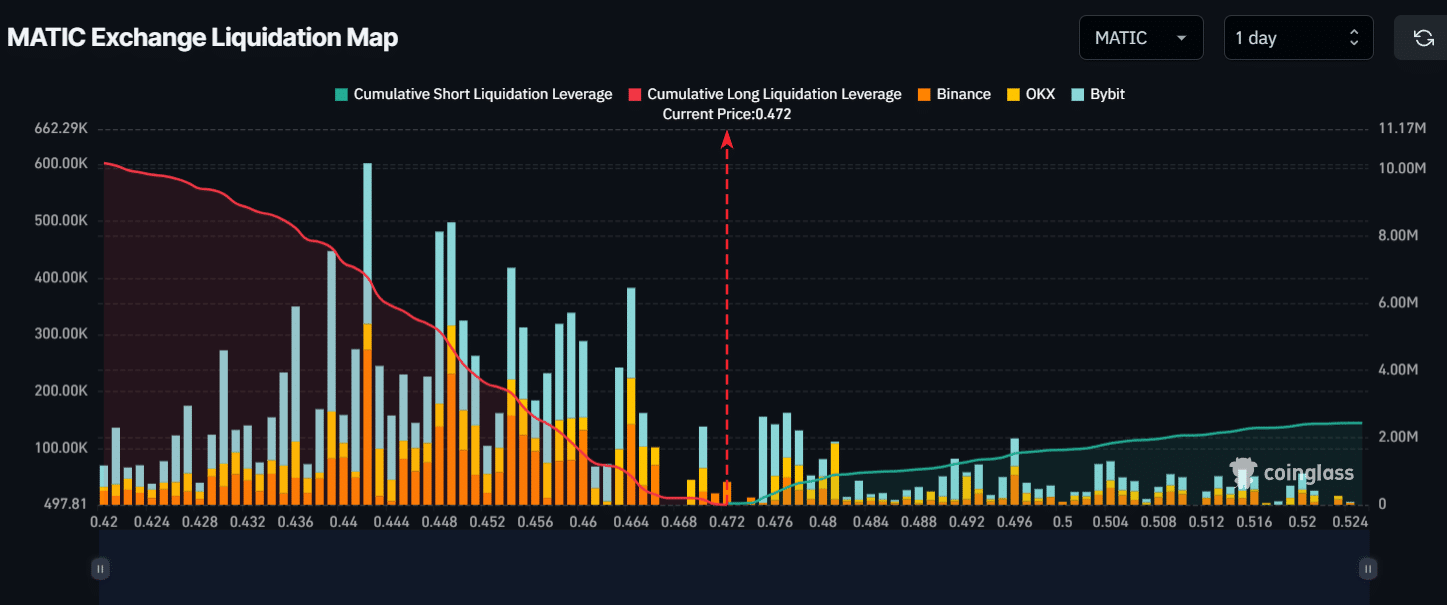

If MATIC’s price falls to $0.442, nearly $6.77 million worth of long positions will be liquidated.

As a seasoned crypto investor with over a decade of experience navigating market highs and lows, I must admit that the recent bullish breakout of MATIC has piqued my interest. The historical price momentum and the significant increase in open interest are strong indicators of growing investor interest. However, I’ve learned the hard way not to underestimate the power of whales in this market.

As a crypto investor, I’m finding the current market climate rather gloomy, given the massive Bitcoin [BTC] exchange at Mt. Gox and the record-breaking gold price peak we’ve recently witnessed.

During the ongoing market slump, on August 21st, Polygon (MATIC) saw a powerful surge beyond its consolidation area and the falling trendline, indicating a potential positive shift.

Major breakout in MATIC

For approximately 14 days, MATIC had been moving consistently within a narrow price band, according to its past price trends.

Starting from March 2024, it has been experiencing a steady decline and has created a falling trendline against which it repeatedly encounters resistance.

Following its latest surge beyond the trendline, there’s a strong likelihood that MATIC could experience an increase of around 20% or more, potentially reaching the $0.575 mark or possibly going even higher, depending on current market conditions.

Bullish sentiment

With the recent breakout, MATIC looks bullish.

As reported by the analysis firm CoinGlass, there’s been a significant surge (over 15%) in Matic’s Open Interest within the past 24 hours. This increase suggests that more investors and traders are showing increased interest in MATIC, likely due to its recent breakout.

Over the specified timeframe, there’s a noticeable increase in long-position leverage among traders compared to short-position leverage. This trend implies that investors are placing heavier bets on the market rising (bullish sentiment) rather than falling (bearish sentiment).

Over the past seven days, there’s been a steady increase in the number of daily active Ethereum (MATIC) addresses, as reported by on-chain analytics company IntoTheBlock.

The escalating number of daily active addresses might be a significant contributor to the recent surge. Furthermore, the rate at which this cryptocurrency is being adopted is increasing in tandem with its price.

MATIC’s price performance

Currently, as we speak, many cryptocurrencies are finding it tough to build up speed, but Matic stands out, trading around $0.4725, and showing a significant increase of more than 7.5% over the past day.

During that timeframe, the trading volume saw a rise of 31%, suggesting more traders are getting involved.

Currently, the key support and resistance levels identified by Coinglass are approximately $0.442 (on the downside) and $0.496 (on the upside). At these price points, a significant number of traders have high leverage positions.

If the market feeling continues and MATIC‘s price increases to approximately $0.496, it is projected that around $1.52 million in short positions will be closed out.

In a flipside scenario, should the sentiment shift and the price drops to $0.442, approximately $6.77 million in long positions might get closed out.

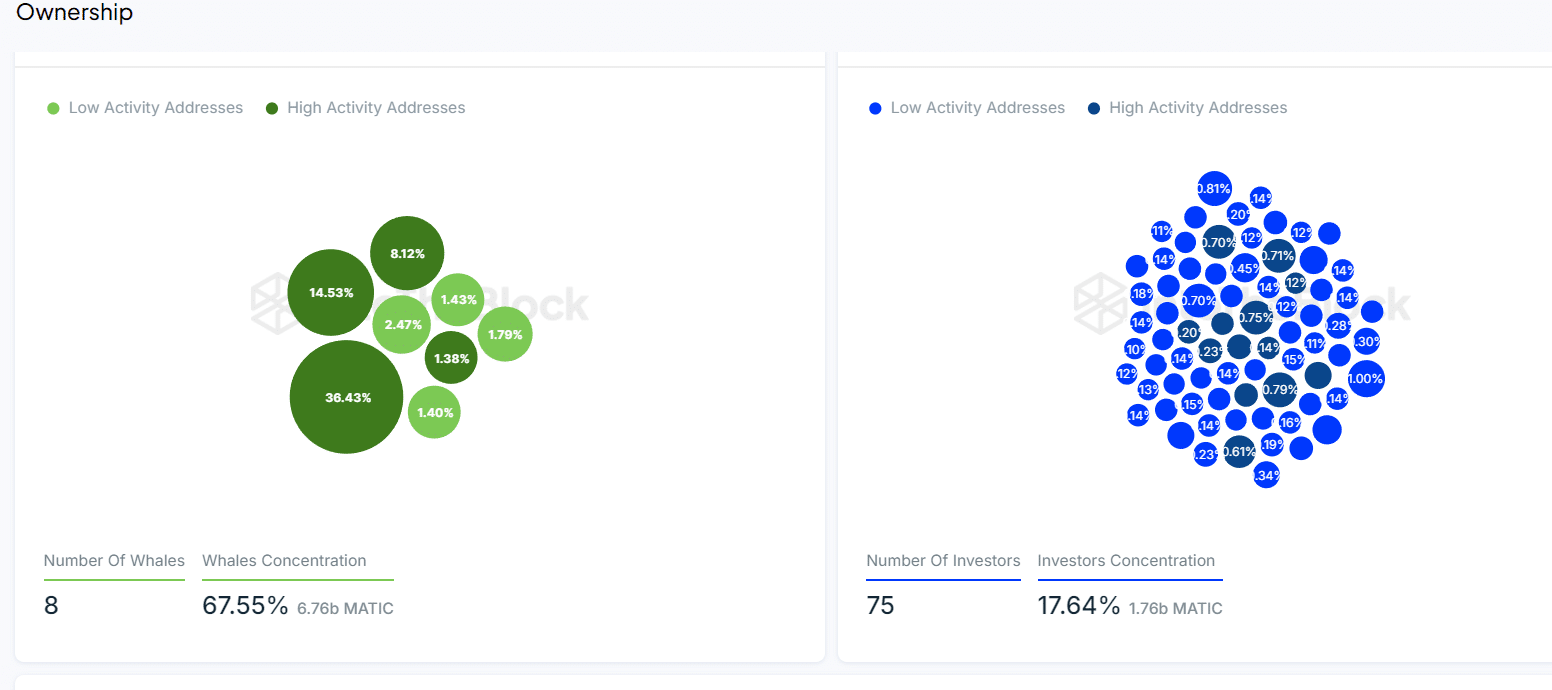

Whale concentrations in MATIC are significantly high, making price manipulation more likely.

Read Polygon’s [MATIC] Price Prediction 2024-25

Approximately 8 whales own about 67.55% of the entire supply, and around 75 sharks possess over 17.64%, whereas just 14.8% remains with ordinary investors or retail holders.

This data suggests that price manipulation in MATIC is relatively easy.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Michelle Trachtenberg’s Mysterious Death: The Unanswered Questions

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

2024-08-22 07:04