-

MATIC whales have accumulated more tokens in the last month.

However, the token’s price has continued to fall.

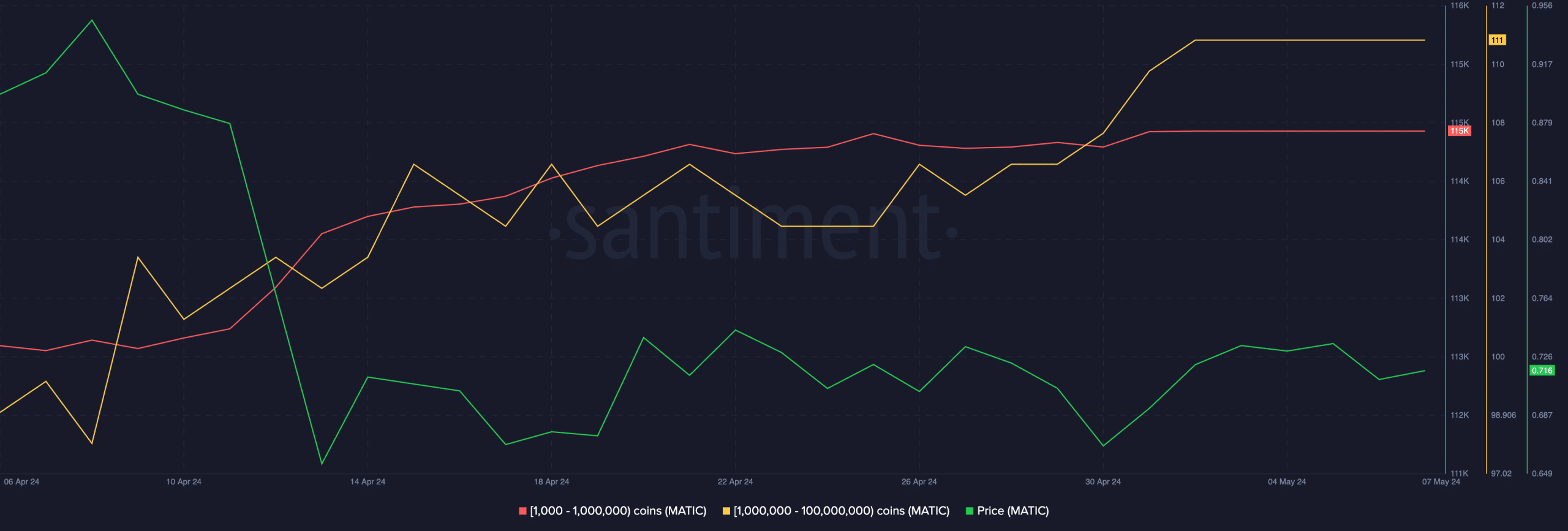

As an experienced financial analyst, I find it intriguing that despite the increase in MATIC whales’ accumulation in the last month, the token’s price has continued to decline. According to Santiment’s data, there has been a 2% rise in the number of smaller whales (1,000-1,000,000 tokens) and a 5% increase in bigger whales (1,000,000-100,000,000 tokens). However, this accumulation has not translated into price gains for MATIC.

The number of large investors, or “whales,” holding Polygon [MATIC] has increased over the past month, even as the price of the Layer-2 (L2) token dropped by more than 10%. According to data from Santiment.

As a researcher examining data from an on-chain provider, I’ve observed a noteworthy development: there’s been a 2% rise in the count of MATIC token holders possessing between 1,000 and 1,000,000 tokens over the past month.

As of this writing, this cohort of MATIC holders was 115,000.

Similar to those larger whale entities holding between one million and one hundred million MATIC tokens, there has been a growth in their token hoarding during the specified timeframe. A rise of 5% has been noted in their number.

As of this writing, they held 21% of MATIC’s circulating supply of 9.8 billion tokens.

MATIC is due for further decline

As a crypto investor, I’ve noticed an increase in whale transactions in the MATIC market over the past month. However, this activity hasn’t translated into any significant price gains for me. In fact, the value of my MATIC holdings has dropped by approximately 21% during this period, according to CoinMarketcap’s data.

At press time, the altcoin exchanged hands at $0.72.

The price drop of MATIC over the past month aligns with the broader downturn observed in the cryptocurrency market during that timeframe.

As a researcher studying the cryptocurrency market, I’ve noticed that there’s been a significant decrease in trading activity over the past month, resulting in a 11% reduction in the total market capitalization, based on data from CoinGecko.

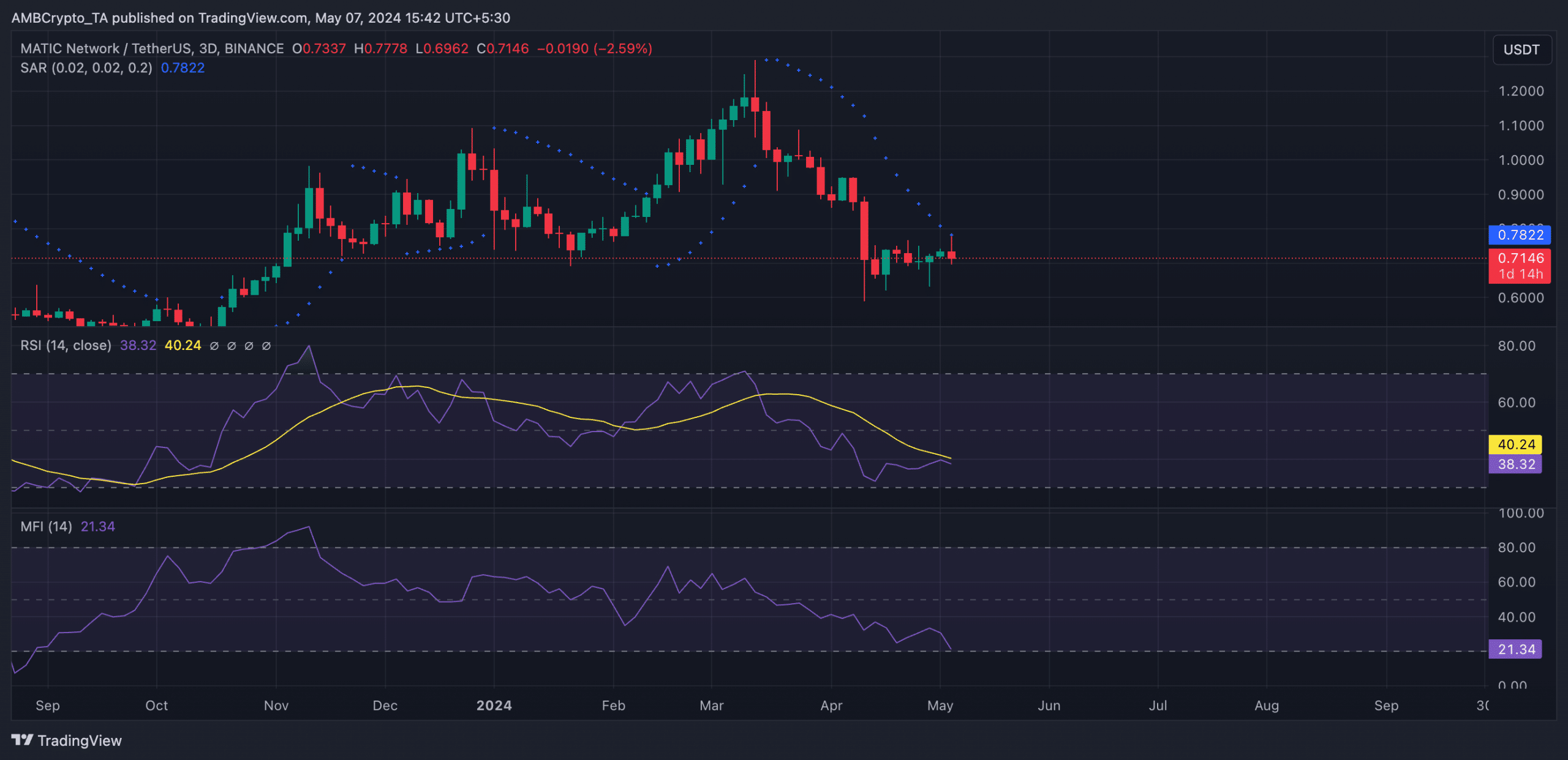

Based on an analysis of a three-day chart by AMBCrypto, there has been a noticeable decrease in the demand for MATIC from token market participants.

As a crypto investor, I closely monitored the momentum indicators, but unfortunately, they were all falling short of their respective midpoints when I last checked.

The RSI value for MATIC stood at 38.41, in contrast to its Money Flow Index (MFI) which read as 21.34.

Based on these readings, the altcoin’s indicators signaled that it was overbought by bears, who exerted substantial selling pressure on its price.

Read Polygon’s [MATIC] Price Prediction 2024-2025

As a researcher studying the MATIC cryptocurrency market, I’ve observed that the asset’s price has been exhibiting bearish behavior. At present, the price hovers below the Parabolic SAR (Stop and Reverse) indicator. This technical tool assists in determining trend directions and potential reversal points.

When an asset’s price is marked with upward-pointing dotted lines, it suggests a downward trend in the market. This means that the asset’s value has been decreasing and could potentially drop further.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-05-08 07:03