- Whale movements of $154.3M and $11.45M suggest accumulation, supported by bullish on-chain signals.

- Technical indicators remain mixed, with slight bullish momentum.

As an experienced analyst with over two decades in the financial markets under my belt, I have seen countless instances of whale activity driving market momentum. The recent flurry of large MATIC transactions on Binance and OKEx is certainly noteworthy. While it’s impossible to predict the future with absolute certainty, these moves by the whales can often signal impending shifts in the market.

Lately, the behavior of whales (large investors) around Polygon (MATIC) has garnered considerable interest, with many heads turning following substantial trades on prominent platforms like Binance and OKEx.

On Binance, there were two substantial transactions of 200 million Matic tokens each, equating to around $154.3 million in value. Meanwhile, OKEx saw a transfer of 30 million Matic tokens worth roughly $11.45 million.

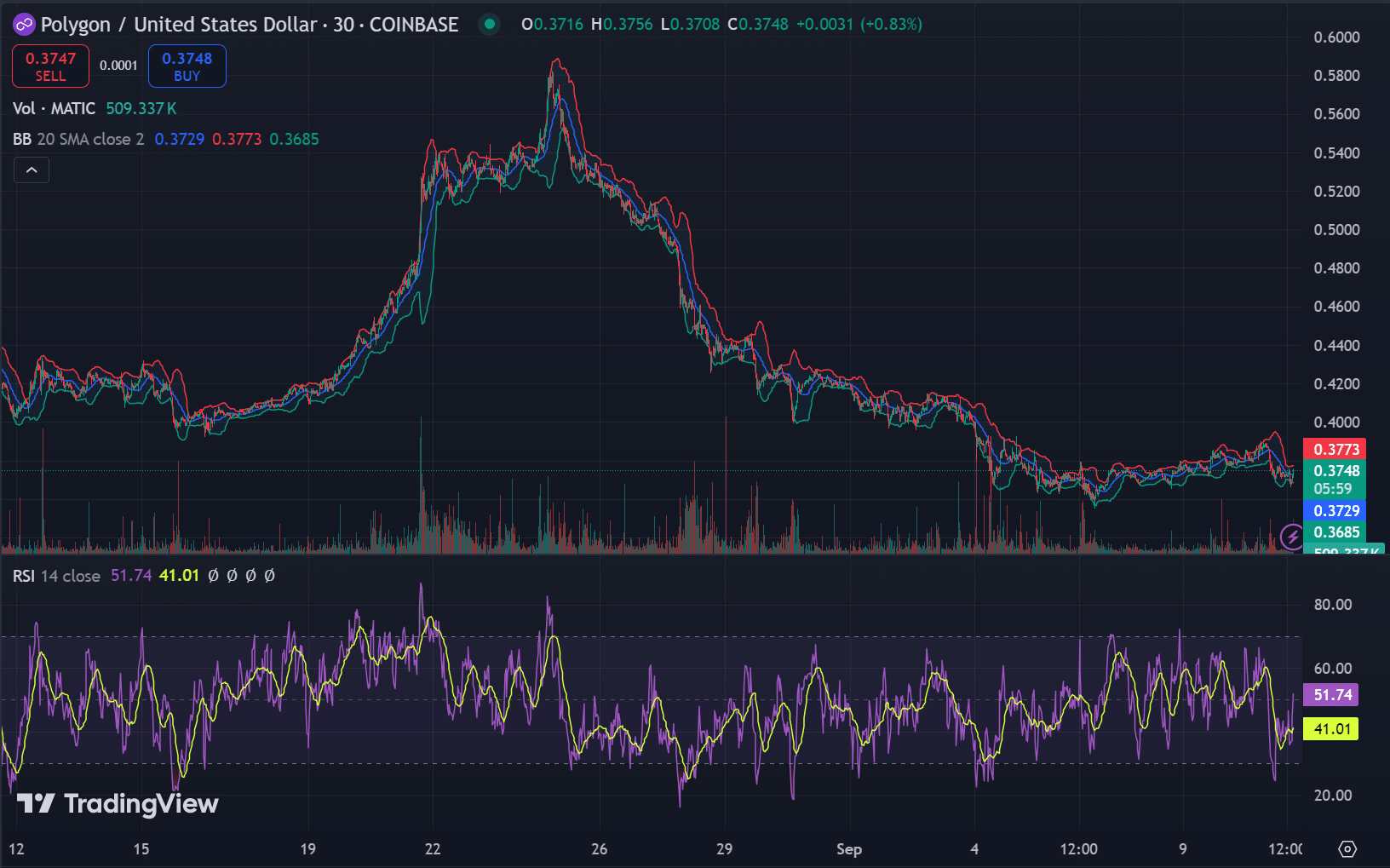

At the point of publishing, MATIC was priced at approximately $0.3754, showing a drop of about 0.90% in the last 24 hours.

When whales transfer substantial amounts of funds, it frequently signals potential changes in the market. Such movements might suggest either accumulation or disposal, which could significantly influence the direction of MATIC‘s price trend.

Nevertheless, the key point is: Could the observed whale behavior serve as a potential trading chance for investors?

What does technical analysis say?

In simple terms, the Relative Strength Index (RSI) reading of 51.74 suggests a balanced state for Matic. This implies that Matic isn’t excessively bought or sold, suggesting it may be consolidating its position, potentially preparing for a move in either an upward or downward direction.

The Bollinger Bands suggest that the current price is near the lower boundary, potentially signaling an overbought situation, usually a signal for a forthcoming price increase.

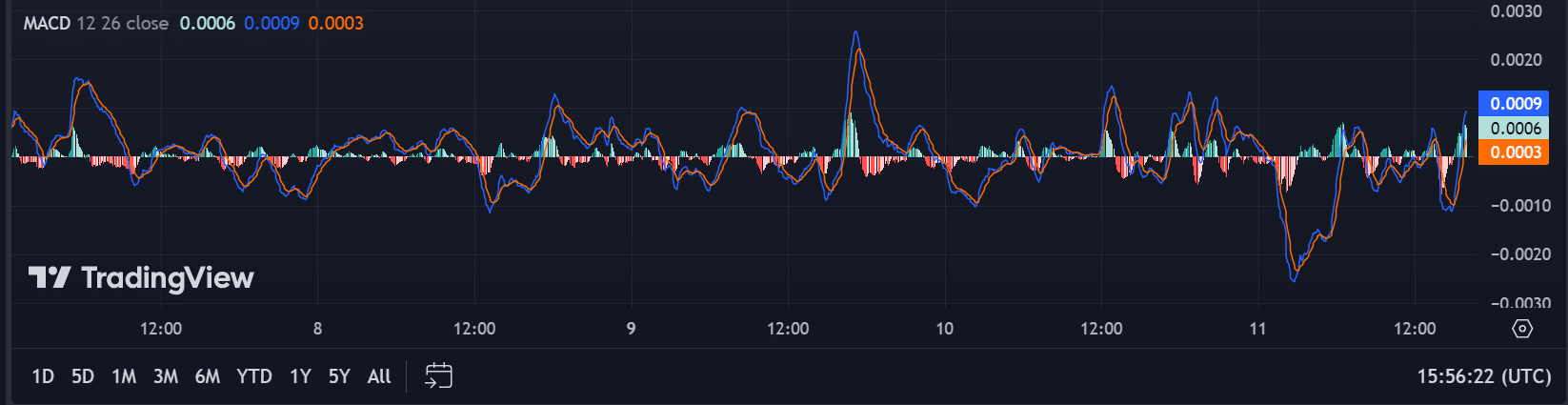

The MACD indicator also offers a glimpse into the market’s current momentum. The MACD line (0.0006) has crossed slightly above the signal line (0.0003), showing a modest bullish divergence.

Yet, a histogram value of 0.0003 suggests that momentum remains relatively low, and further evidence is necessary to decisively conclude this as a trend reversal with certainty.

As an analyst, I’m observing that the histogram value at 0.0003 suggests a relatively subdued momentum. While it’s intriguing, I feel it’s crucial to gather more robust evidence before conclusively labeling this as a trend reversal.

Are on-chain metrics bullish?

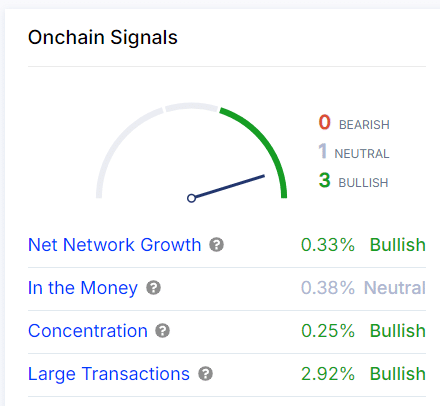

Based on the current on-chain analysis, there’s an indication of a bullish market trend. Specifically, we see a 0.33% increase in network growth, a decrease in large holder concentration to 0.25%, and an uptick in large transactions by 2.92%.

These statistics indicate a rise in whale involvement, implying that significant investors could potentially be buying up MATIC tokens in preparation for a potential price surge in the near future.

Buying opportunity or caution?

Based on the behavior of whales and blockchain data, there seems to be an optimistic forecast for MATIC. However, the technical analysis is showing some ambiguity.

In simpler terms, the RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) are showing signs of a pause or stability in the market trend, but with only slight hints of a potential bullish momentum. This could mean that traders might prefer to hold off on taking big steps until they see more definite confirmation of a strong market movement.

However, for long-term investors, the current whale activity and bullish on-chain signals could indicate a favorable time to accumulate MATIC.

As always, it is crucial to employ robust risk management strategies when considering new positions in volatile markets like cryptocurrency.

Read More

2024-09-12 10:48