-

Historical data using the MVRV ratio indicated a possible 31% hike for MATIC in the mid-term

Old tokens have refrained from moving – A sign that another correction might be unlikely

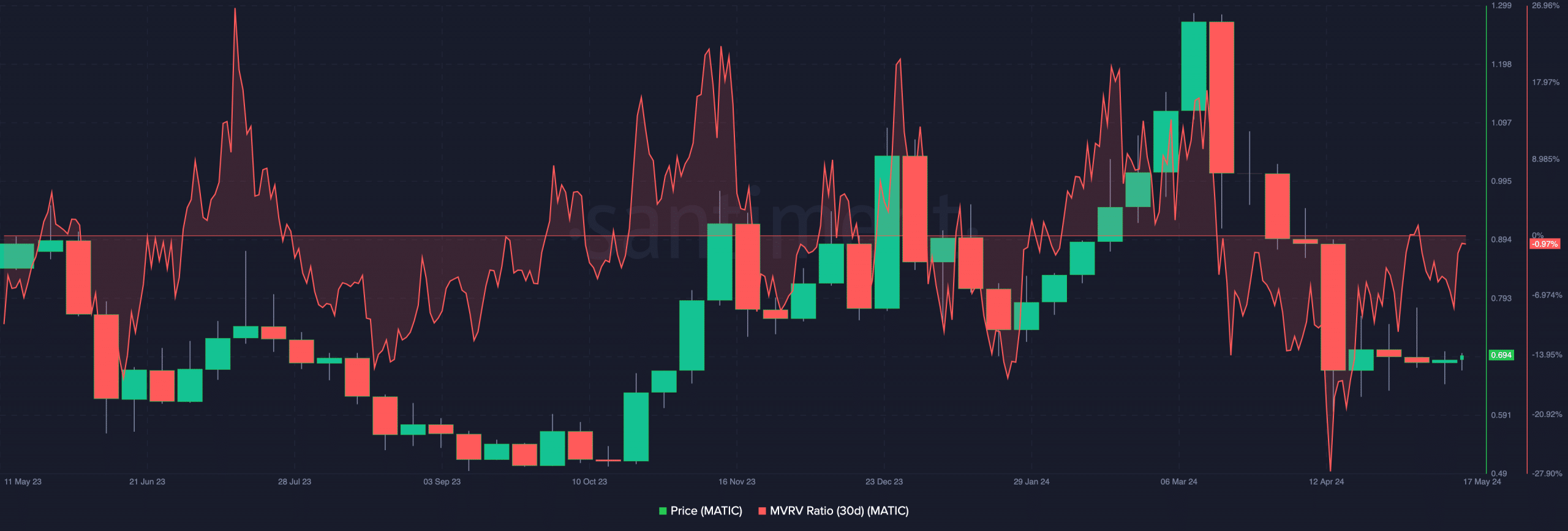

As a researcher with extensive experience in analyzing cryptocurrency market trends and on-chain metrics, I find the current state of MATIC intriguing. Based on the historical data using the MVRV ratio, there is a potential 31% hike for MATIC in the mid-term. This metric indicates that many investors are holding their positions at prices lower than their cost basis, making them less likely to sell and more inclined to accumulate.

As a researcher studying the MATIC token’s on-chain metrics, I’ve noticed some encouraging signs that could indicate a potential reversal of its losses from the past few months. Currently, the token is priced at $0.69 according to the latest charts, representing a 26.38% decline over the last 90 days.

As a crypto investor, I closely monitor various metrics to gauge the value of my assets. One such important indicator is the Market Value to Realized Value (MVRV) ratio. By calculating the difference between an asset’s current market price and the total realized profits or losses from previous transactions, this ratio helps me determine if an asset is currently undervalued or overvalued based on past investor profitability in the market.

Based on current market conditions, the MVRV ratio (Moving Average Realized Value to Market Price Ratio) for MATIC over the past 30 days stood at a level of -0.97%. In the past, it has been observed that the price of MATIC tends to rebound when this metric falls within the range of -8% and -16%.

After the lows, come the highs

As a researcher observing the market, I’ve noticed that some investors continue to hold onto assets despite their current prices being lower than their initial cost basis. Instead of accepting losses, these participants choose to buy more during market declines. Often, this strategy leads to a higher overall value in the long run.

On the 14th of May, the MVRV ratio for MATIC stood at a negative 8.22%. Despite this, the price of MATIC managed to rise from this price range, causing the MVRV ratio to significantly increase.

Back in February, MATIC‘s price reached a peak of $1.20 following a similar event. But let me clarify that the crypto market isn’t always predictable and history doesn’t always repeat itself. Nevertheless, we’ve seen trends leaning towards this direction in the past.

As a researcher studying the price trends of MATIC, I’ve noticed that a positive ratio could indicate a potential increase in its value. With $1 being a significant level of resistance for MATIC in the past, reaching this target might be a likely outcome if this ratio holds true.

The fate of MATIC‘s price hinges on the actions of its current holders. Should some choose to sell at the anticipated price point, a price correction could ensue for MATIC on the charts.

If the current demand continues at this rate, it may lead to a further increase in price, potentially reaching $1.30. Yet, it’s important to consider other factors before drawing such a definitive conclusion.

MATIC diamond hands are not quitting

One metric AMBCrypto examined was the level of dormant tokens in circulation. A significant increase in dormant tokens suggests that previously inactive tokens are now being traded. This could potentially lead to an influx of selling activity for the token.

An apparently low reading of the metric suggested that long-term investors have been holding onto their MATIC positions rather than selling it off. This trend held true for MATIC as well.

As a researcher studying the cryptocurrency market, I have observed that the price of MATIC has been relatively stable lately. While it’s impossible to predict the future with certainty, my analysis suggests that this trend may continue. The price might not experience significant declines but instead consolidate for an extended period. Eventually, a breakout could occur, leading to potential gains.

During this period, the proportion of on-chain transactions resulting in profits versus losses dropped to 0.42. Such readings suggest that a majority of token transactions concluded with losses, as opposed to gains.

Read Polygon [MATIC] Price Prediction 2024-2025

Based on current signs, the profit-generating on-chain volume for MATIC could potentially increase if the forecast holds true. But, if there’s a shift from the bullish outlook, then transactions resulting in losses may persist.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-05-17 19:04