-

MATIC rallies 27%, but 90% of long-term holders are at a loss, signaling potential selling pressure soon.

Active MATIC traders see profits while TD Sequential warns of an imminent correction that could impact short-term gains.

As an experienced crypto investor who has seen market cycles come and go, I find myself cautiously optimistic about Polygon (MATIC) at this point. The 27% rally over the past week is undeniably impressive, but the warning signs from analysts such as Ali and the TD Sequential make me pause before jumping in headfirst.

In the last seven days, the value of Polygon [MATIC] has significantly increased by approximately 27.37%. Currently, MATIC is being traded at $0.5274, and in the past 24 hours, a trading volume of $730.3 million has been recorded for it.

Over the past day, we’ve seen a growth of about 11.70%. However, market experts are advising us to proceed with care, even though things seem to be moving upwards.

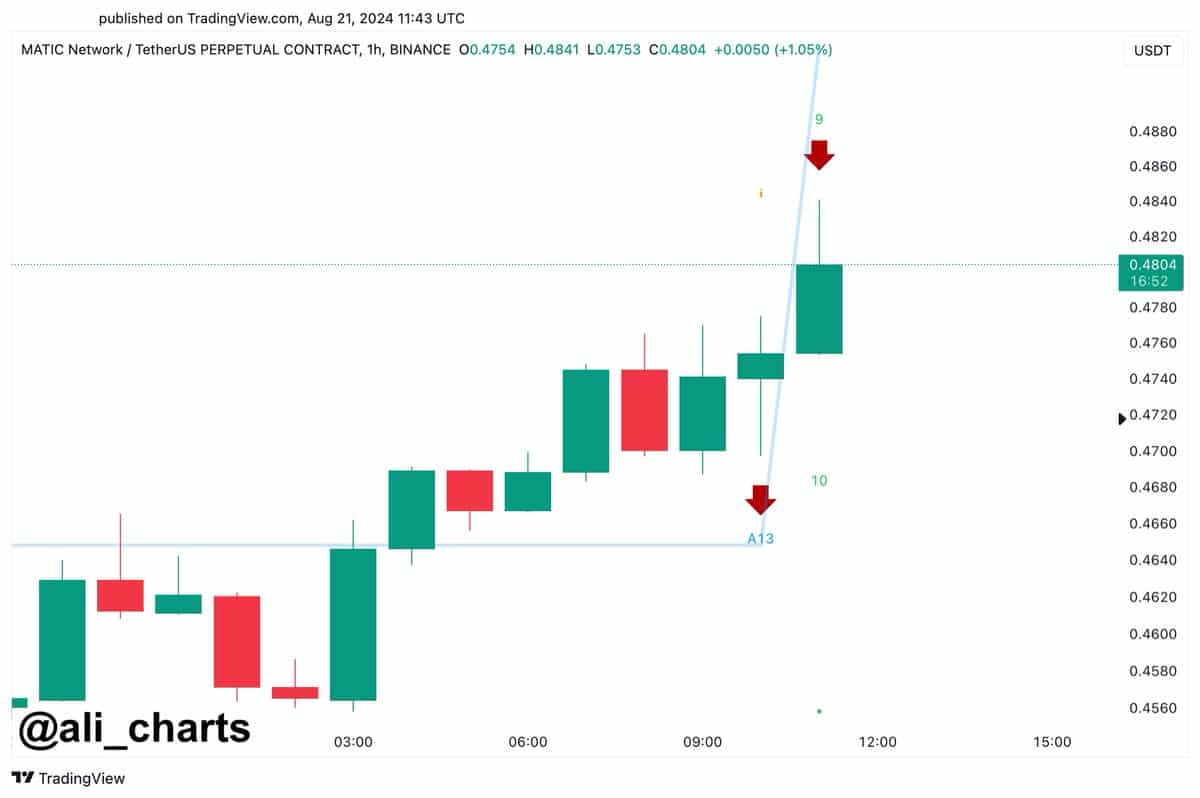

Ali, a market analyst, stated,

“In the last few days, Polygon (MATIC) has experienced a notable increase, however, it’s important to exercise caution. The TD Sequential indicator on its hourly chart suggests that there may be an upcoming correction for MATIC.”

As an analyst, I’m keeping a keen eye on these technical indicators, as they seem to hint at a potential correction following our recent market surge.

Long-term MATIC holders face losses

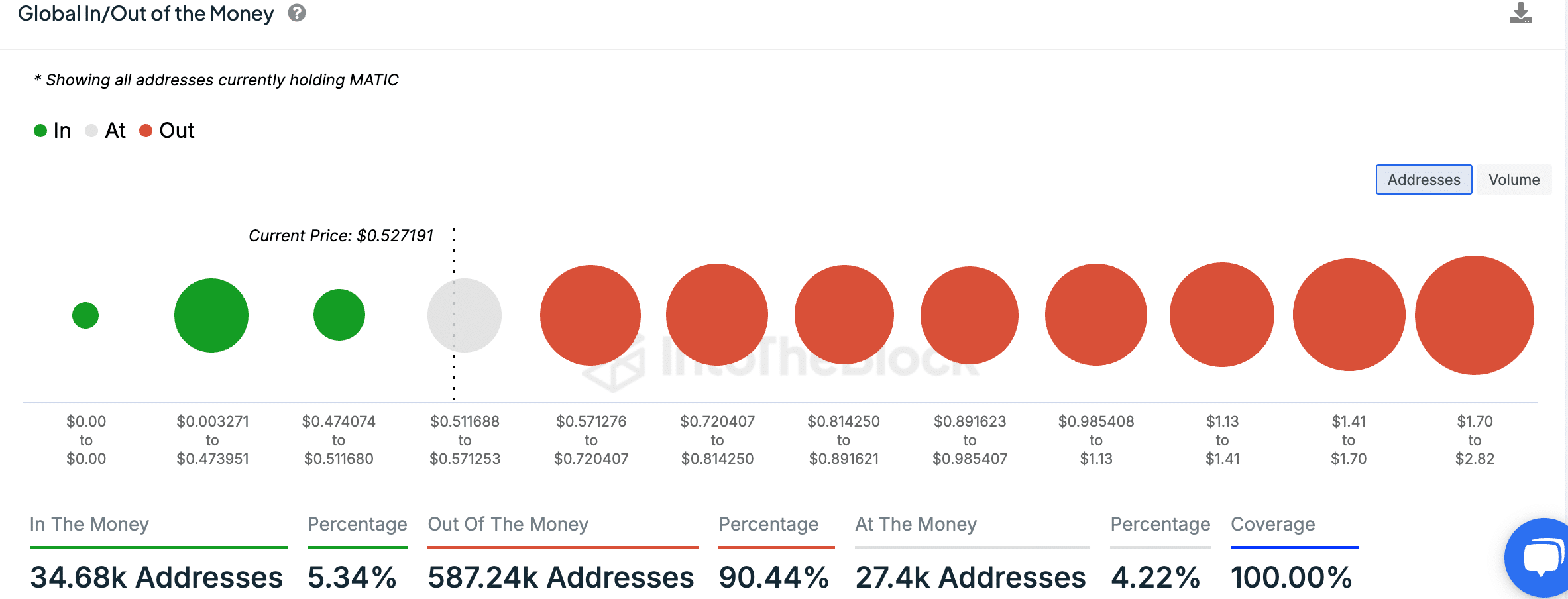

Based on information from IntoTheBlock, it appears that most long-term MATIC investors are experiencing losses at this time, as indicated by the Global In/Out of the Money graph.

Currently, about 90.44%, which equates to approximately 587,240 addresses, have a buy-in price greater than their current worth. These addresses are referred to as being “Out of the Money.”

Approximately 5.34% (or around 34,680) of MATIC address holders are currently seeing profits, while slightly over 4.22% are at the break-even point. This data implies that a majority of MATIC holders may be incurring losses at present, which could lead to increased selling pressure.

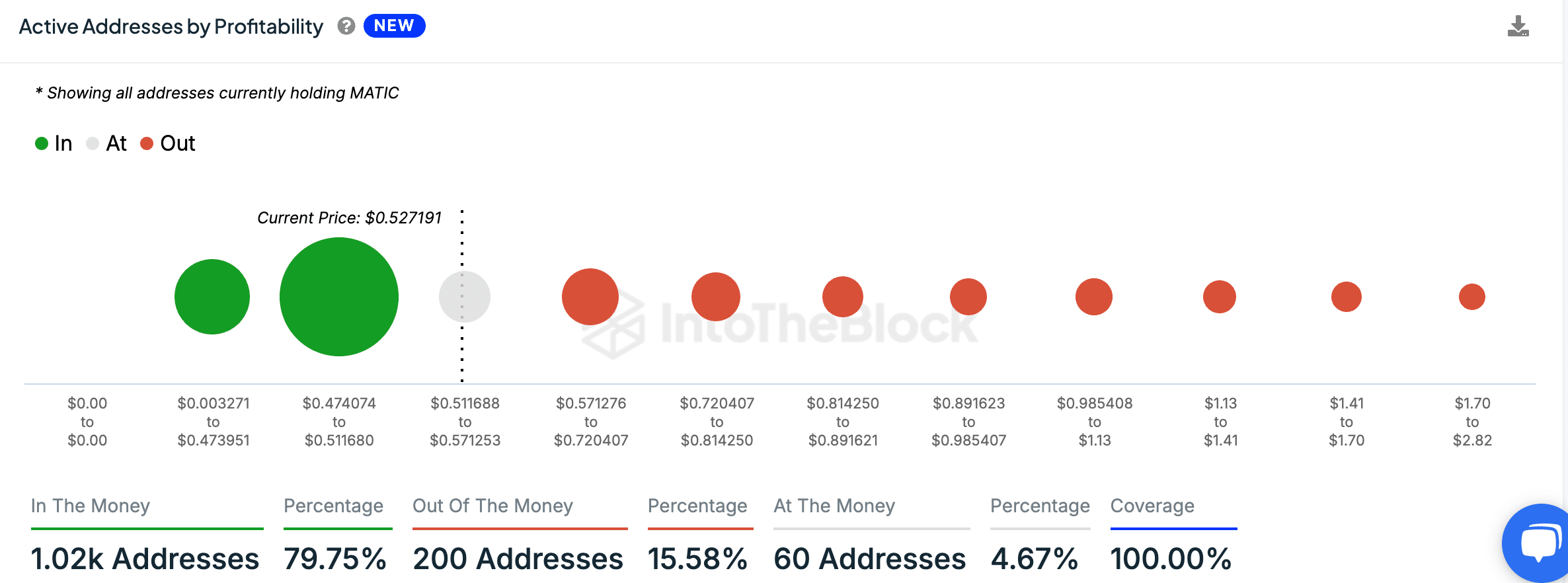

Conversely, most active Matic addresses exhibit a distinct pattern. In fact, about 79.75% or approximately 1,020 of these active addresses are currently in the green, meaning they initially purchased MATIC for less than its current value.

As someone who has been actively trading cryptocurrencies for a few years now, I have learned that the market can be unpredictable and volatile. Recently, I’ve noticed that while some active traders have benefited from the price increases, this contrasts with long-term holders who have remained steadfast in their investments. However, as I dig deeper into the data, I find that 15.58% of active addresses are “Out of the Money,” which means that some traders could be at risk if a correction occurs. With my own experience in mind, I always remind myself to exercise caution and not get too carried away by short-term gains, as the market can quickly turn and leave us with losses if we’re not careful. So, while it’s tempting to chase after the latest price surge, it’s important to remember that the market can be deceptive and that a correction could happen at any moment.

Upcoming migration from MATIC to POL

Starting on September 4, 2024, there’s a planned switch from MATIC to POL as the primary gas token on the Polygon Proof-of-Stake (PoS) network. From this date forward, POL will be responsible for fueling transactions and maintaining the network’s security through validator rewards.

As a long-time blockchain user and enthusiast, I am thrilled about the upcoming automation of the migration process through smart contracts. Having witnessed numerous challenges with manual migrations in the past, this solution seems like a game-changer for me. The ability to swap MATIC to POL on a 1:1 basis will undoubtedly streamline transactions and make it easier for users like myself to continue seamlessly interacting within the Polygon network. This move demonstrates the ongoing evolution of blockchain technology, and I am excited to see what other advancements are in store for us in this rapidly developing field.

Following the update, every transaction made within the Polygon Proof-of-Stake (PoS) network will be handled natively using POL. This bridge between Polygon and Ethereum will facilitate POL, thereby guaranteeing a smooth interaction between these two networks.

No action is required from MATIC holders as the migration is handled through the contract.

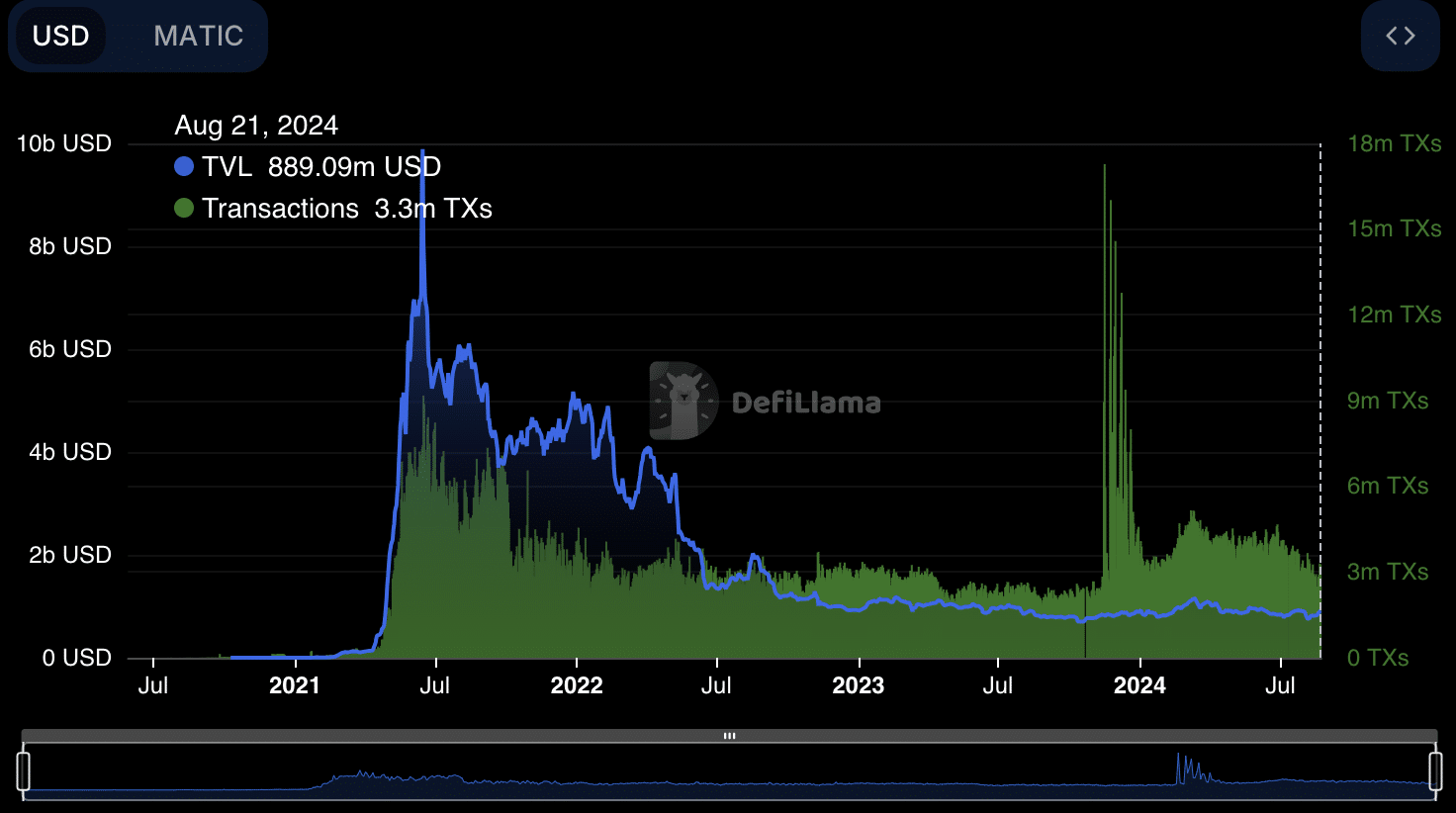

Over the past day, I’ve noticed a bustling trading scene on the Polygon network, with an impressive 3.27 million transactions taking place. This high volume of activity suggests a thriving community. Furthermore, it’s exciting to see that approximately 55,169 new addresses have joined the network during this period, indicating a surge in interest towards the platform.

Read Polygon’s [MATIC] Price Prediction 2024-25

Moreover, as reported by DefiLlama, the sum currently secured within the Polygon decentralized finance (DeFi) system amounts to a substantial $889.09 million. Over the last day, this ecosystem has experienced an inflow of approximately $1.67 million.

Although the network indicators look promising, there’s still apprehension among traders about the possibility of a price adjustment.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-08-23 03:04