-

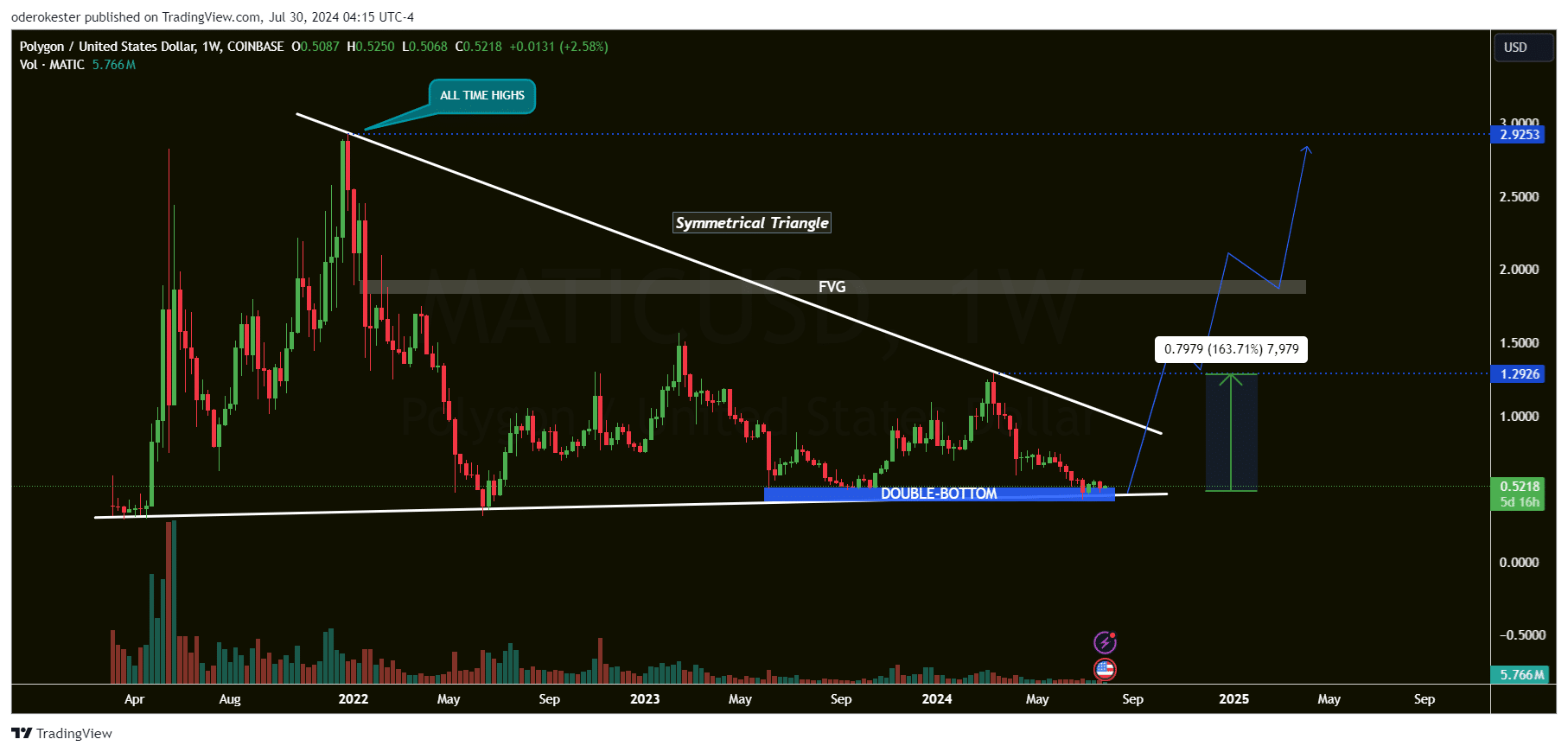

A double-bottom formation suggested that MATIC could rally 163%, targeting resistance at $1.29.

Whale transactions spiked in mid-June and July, signaling major moves by large MATIC holders.

As a seasoned analyst with over two decades of market experience under my belt, I find myself intrigued by the current state of affairs surrounding MATIC. The double-bottom formation and the recent surge in whale activity have certainly piqued my interest.

💥 EUR/USD Faces Historic Test Amid Trump Tariff Turmoil!

Market chaos looms — top analysts release an urgent forecast you must see!

View Urgent ForecastOver the last seven days, the price of Polygon‘s [MATIC] coin dropped by 3.82%, aligning with the ongoing process of migrating MATIC to the POL platform. This migration is a significant step in Polygon’s 2.0 plan, designed to boost the usefulness of its native token.

It’s been verified that the update, switching from MATIC to POL, is planned for September 4th.

In 2025, it’s anticipated that the latest POL token will take on a crucial function within the upcoming Polygon Staking Center. This includes its involvement in the creation of blocks and generating zero-knowledge proofs.

Currently, Polygon’s total market capitalization stands at approximately $4.7 billion. At the moment of this writing, MATIC was trading at around $0.5176. Over the past 24 hours, a trading volume of about $231 million has been recorded for MATIC, representing a minor 0.83% decrease in its price compared to the previous day.

The continuous fluctuation in MATIC‘s price is attracting interest towards the possible technical shapes emerging on its graph.

Potential bullish reversal

In simpler terms, Polygon’s liquidity increased significantly from its previous low of $0.4922 on September 11th, causing a squeeze for early buyers. This price surge eventually stopped at $0.5270 where it found support again.

This movement indicated a potential double-bottom formation, suggesting a possible trade up to the next resistance at $1.2926, representing a 163.71% rally.

Moreover, the Securities and Exchange Commission’s (SEC) adjustment in its legal action against Binance.US, now categorizing MATIC and various other tokens as non-securities, offers a more optimistic perspective regarding the token’s future prospects.

Technical indicators and market trends

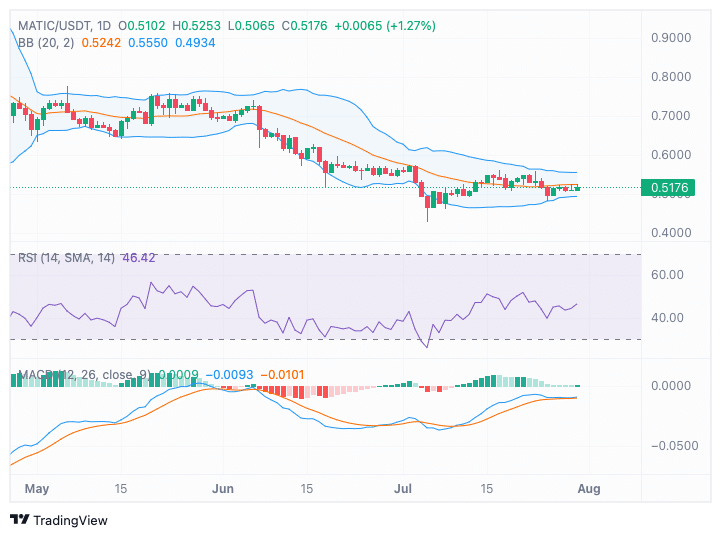

At the current moment, technical signals suggest an impending bullish turnaround. Specifically, the Bollinger Bands are becoming tighter, signaling decreased market volatility that could lead to a substantial price shift in the near future.

Furthermore, the cost is somewhat higher than the midpoint, indicating a slight inclination towards the bulls within a larger pattern of sideways trading.

Currently, the Relative Strength Index (RSI) stands at 46.42 which is lower than the neutral 50 benchmark. This suggests that the market isn’t showing signs of being either overbought or oversold at this point.

In simpler terms, this middle RSI value indicated that the market was showing hesitation, as it didn’t have significant push or pull in either bullish (upward) or bearish (downward) direction, suggesting a period of cautious observation.

In simpler terms, the Relative Strength Index (RSI) pattern seemed stable, supporting the idea that the market is going through a period of holding steady or accumulating before a significant move.

The MACD line briefly moved above the signal line, indicating a potential increase in bullish sentiment, but both lines are near the zero point, suggesting a relatively weak or neutral market condition.

In simpler terms, this blend might signal an initial bullish change, but its slow progress suggests any price increase would likely occur gradually rather than quickly.

Whale moves

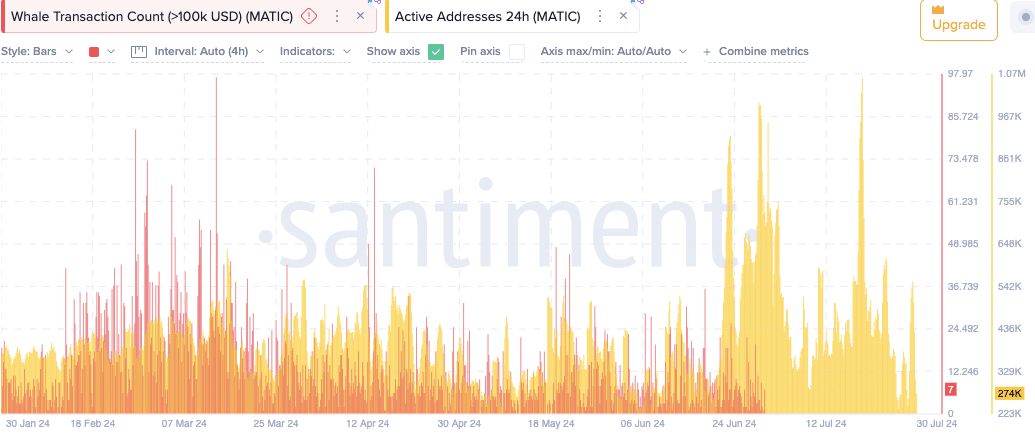

The analysis of market activity reveals a series of peaks in big investor transactions, notably in mid-June and late July, suggesting that these major shareholders were actively trading a substantial amount.

As a crypto investor, I’ve noticed an impressive surge in the number of active wallets, reaching over a million by late July. This significant uptick underscores increasing user interaction and network dynamics.

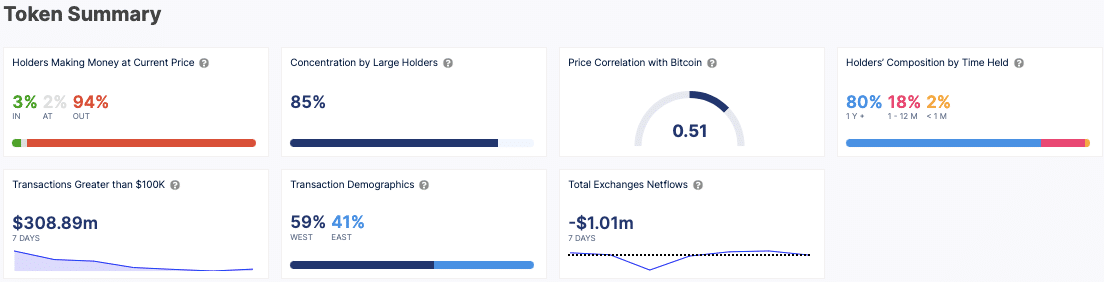

At the current moment, as per IntoTheBlock’s analysis, I find that an overwhelming 94% of MATIC holders are underwater, meaning their purchase price is higher than the current market value. This distribution is quite concentrated, with a substantial 85% held by larger entities. Furthermore, there seems to be a moderate correlation between MATIC’s price and Bitcoin‘s [BTC], with a correlation coefficient of 0.51.

In the last week, transactions amounted to a grand total of $308.89 million. However, this figure does not tell the full story, as there was a net withdrawal of approximately $1.01 million from exchanges. This suggests that more funds were taken out than put in.

Read Polygon’s [MATIC] Price Prediction 2024-2025

The overall market trend was primarily optimistic, as trading signals exhibited a favorable imbalance in bid-ask volume and intelligent pricing. However, an on-chain indicator called “In the Money” displayed a modest bearish tendency, standing at -3.82% .

Finally, these mixed signals highlight cautious optimism surrounding MATIC’s potential breakout.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-07-31 06:16