-

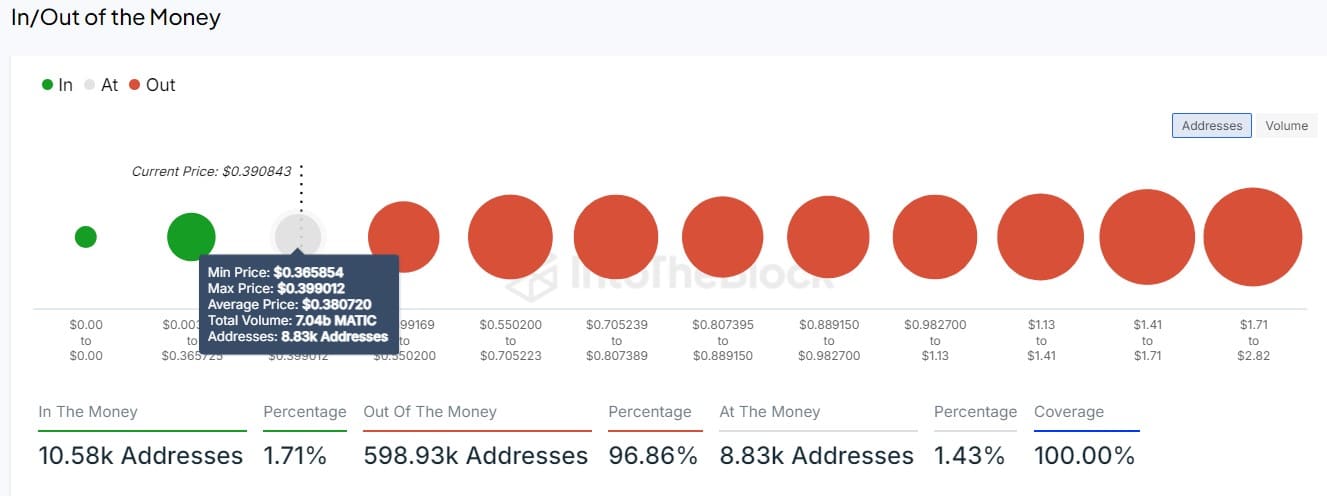

MATIC holders in profit currently stands at 2%, marking a concerning low for investors.

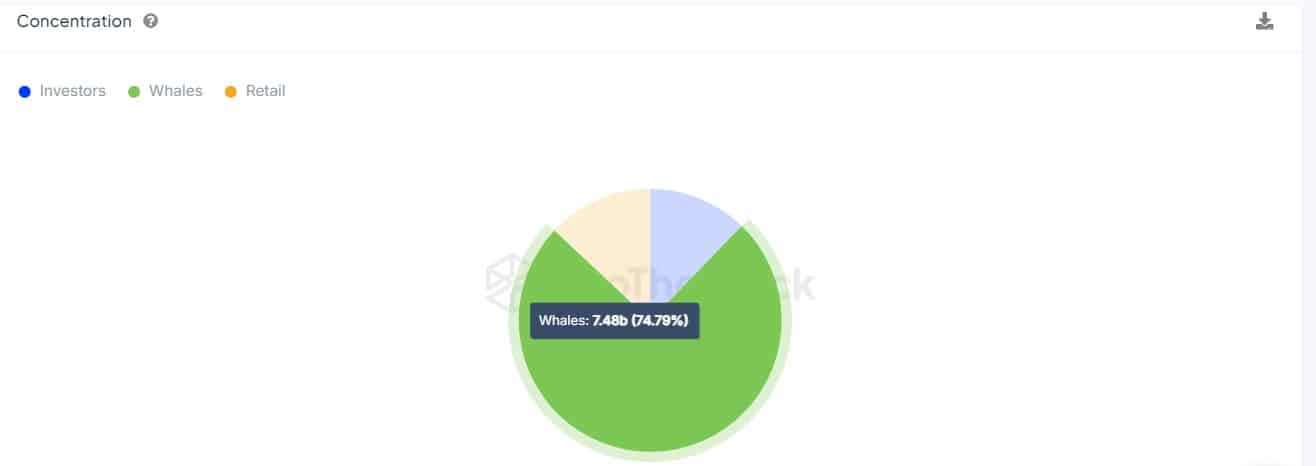

Whales control 74.79% of MATIC total supply.

As a seasoned researcher with years of experience observing cryptocurrency markets, I find myself looking at Polygon (MATIC) with a mix of concern and intrigue. The current state of affairs – 2% of holders profiting while whales control an alarmingly high 74.79% of the total supply – paints a picture that is both fascinating and daunting.

The cryptocurrency Polygon (MATIC) has seen a significant drop in profitability as just 2% of its owners are currently making a profit, according to data from IntoTheBlock. This is the lowest percentage ever recorded, suggesting that most investors are holding onto their investments at a loss until market conditions become more stable.

As a crypto investor, I find myself in a challenging position with MATIC currently fluctuating between $0.36 and $0.40. This price range seems to have left many of us stuck, as it’s holding onto approximately 7 billion tokens across around 8,830 different addresses. This situation underscores the tug-of-war that most holders are experiencing right now.

Whale dominance in play

As a researcher, I’ve noticed that the concentration of tokens in the hands of whales significantly influences the ebb and flow of the MATIC market. Interestingly, an analysis of the Polygon ownership structure reveals that about 74.79% of the total supply is held by major market players, suggesting a relatively concentrated distribution.

Typically, when a few whales (large investors) own a significant amount of a particular asset, it can lead to dramatic price fluctuations that are hard to anticipate for individual or small-time investors due to their control over the market.

The whale’s control implies potential market fluctuations over the short term, since their substantial holdings have the power to significantly impact the market with only a few transactions.

For retail traders, this high concentration will raise red flags over liquidity and potential wild price swings.

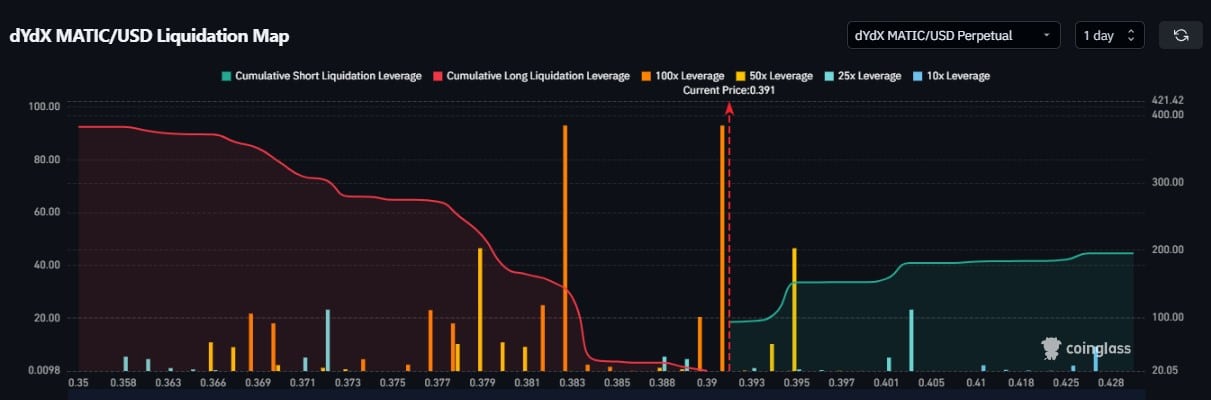

The AMBCrypto analysis, based on Coinglass liquidation map data, shows a surge in liquidations for MATIC within the range of approximately $0.37 to $0.40.

This suggests that the prices may range in this region for sometime before a significant movement.

What next for MATIC holders?

Even though just 2% of owners are currently making a profit and a few large investors dominate the market, the forecast for MATIC remains difficult to navigate.

If prices keep oscillating within the $0.36 to $0.40 bracket, it might lead to significant fluctuations in price due to the high number of whales involved.

For retail investors, it might be challenging to sail smoothly amidst the stormy market conditions since their assets are under immense stress from the market’s turbulence.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-19 13:43