-

MATIC showed bearish signs with a decrease in price and trading activity.

Despite network upgrades like Polygon 2.0, MATIC faced declines with a key support at $0.68.

As a seasoned crypto investor, I’ve seen my fair share of market corrections, and Polygon (MATIC) is no stranger to this volatility. Recently, MATIC has shown bearish signs with a decrease in price and trading activity, despite network upgrades like Polygon 2.0.

As an analyst, I’ve observed that the cryptocurrency market has experienced a slight correction, and Polygon (MATIC) has followed suit. The bullish pressure on MATIC seems to have waned based on recent price movements.

The price of MATIC has dropped by 1% in the last 24 hours, and there’s been a significant decrease in trading volume. This could indicate that the bear market may be making a comeback for this cryptocurrency.

MATIC turns bearish

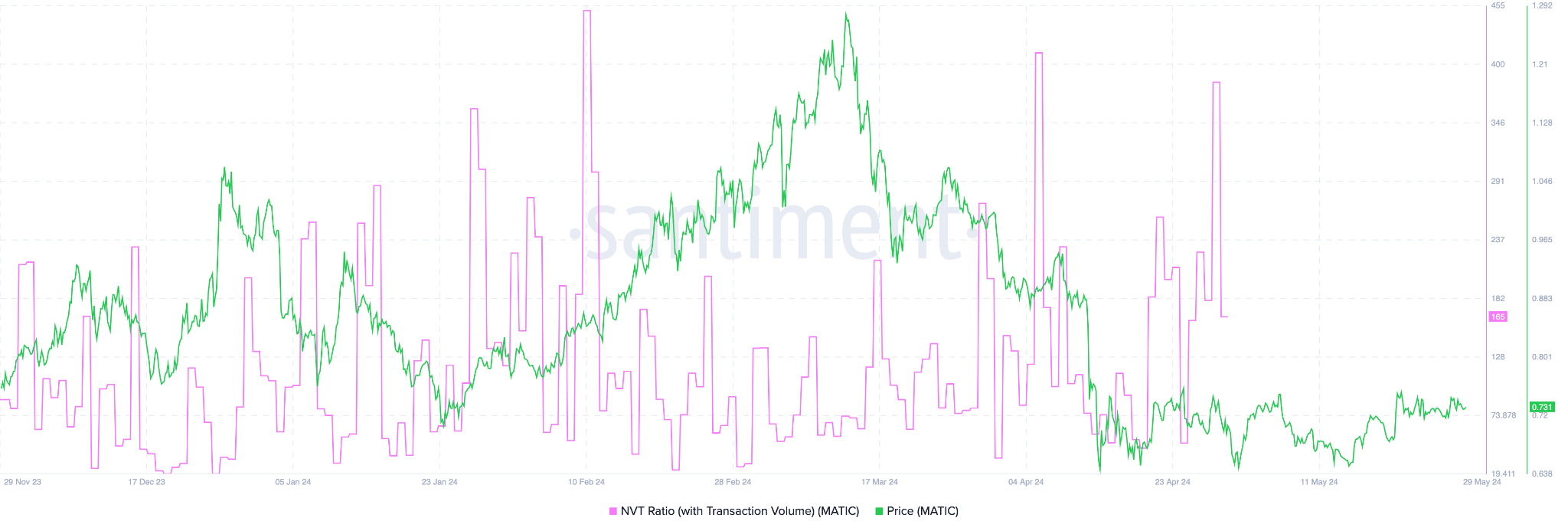

The price of MATIC and its NVT ratio have both taken a downturn, indicating a noticeable slowdown in its growth.

Normally, a decrease in a stock’s NVT (Net Asset Value to Total Market Value) ratio implies that the stock may be undervalued. However, when this downturn occurs alongside a drop in price, it’s also an indication that pessimism is spreading among traders, potentially signaling a bearish market trend.

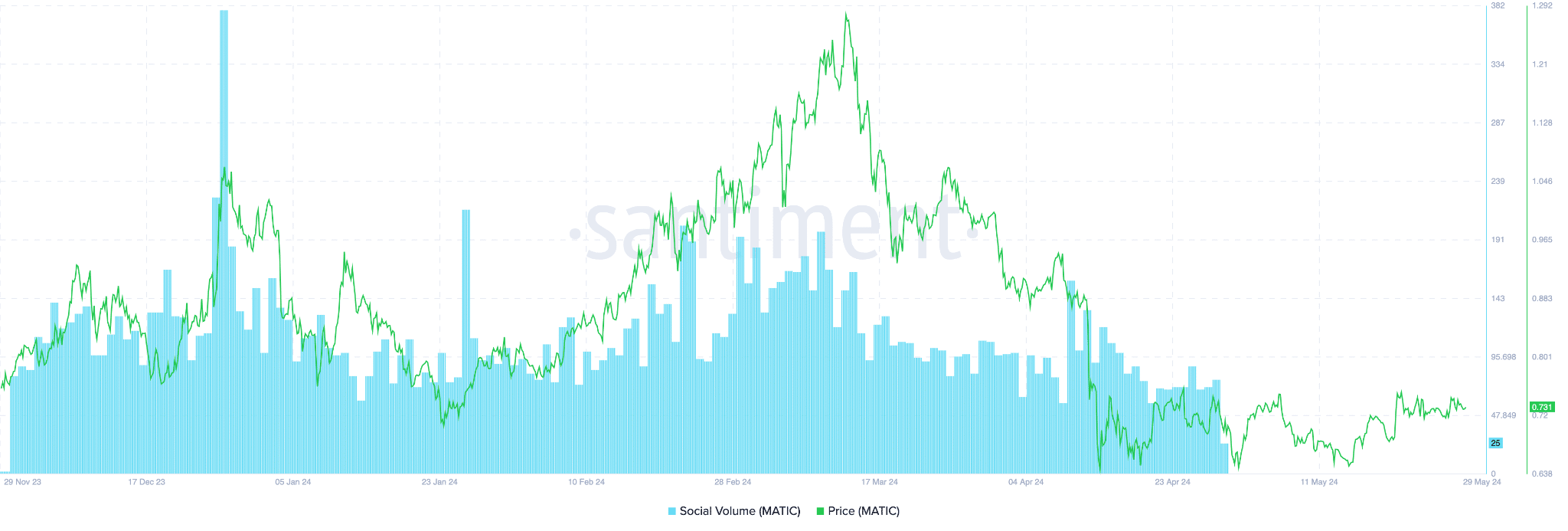

Regarding MATIC‘s social volume trend, it follows a pattern similar to its price movement. Both are declining sharply.

As an analyst, I’ve noticed an intriguing pattern in the data. Previously, there were significant surges in social media activity around early February and mid-April, coinciding with noticeable price peaks. However, in recent weeks, this heightened social volume has been absent, mirroring a more muted trend in pricing.

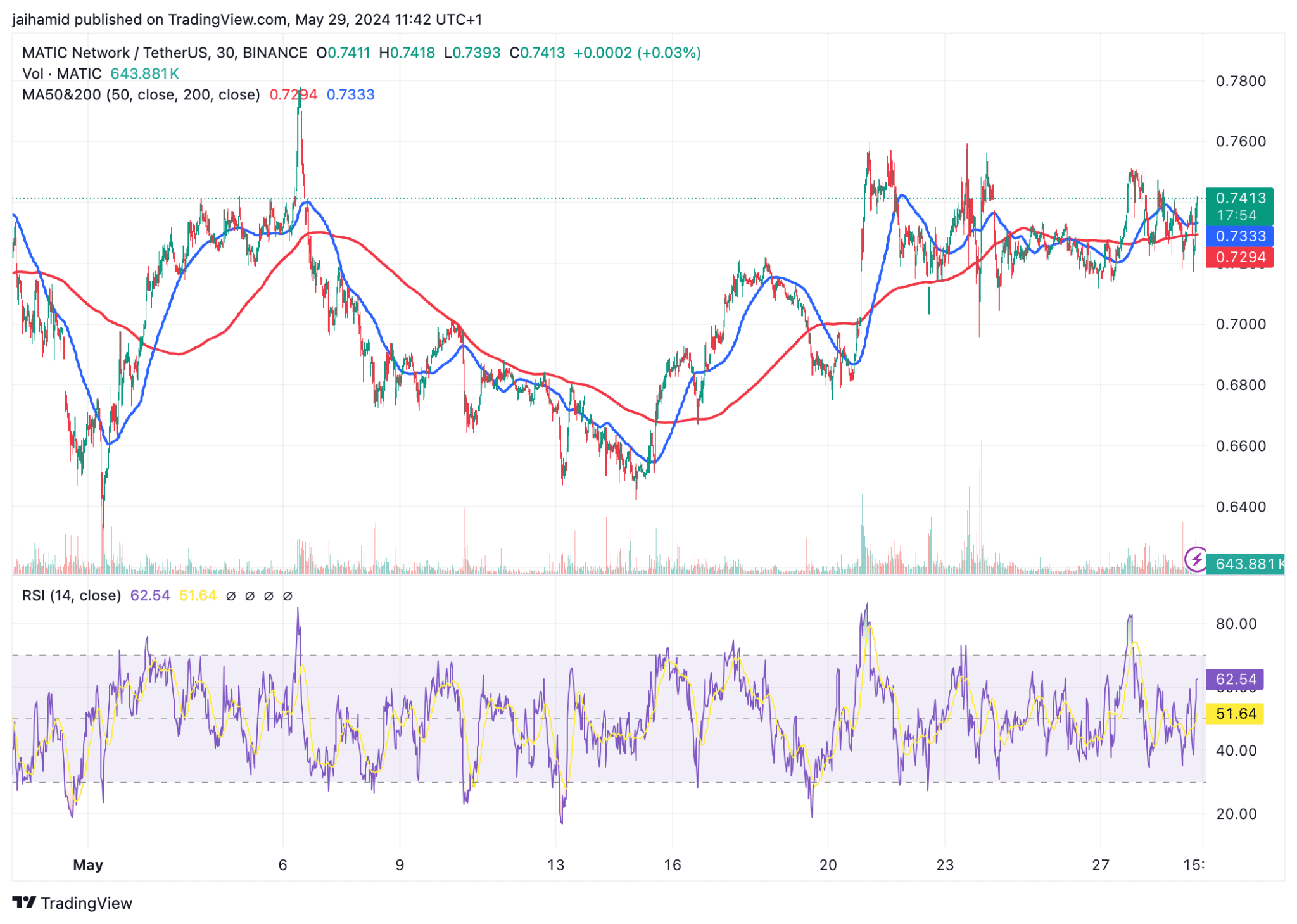

In recent trading activity, MATIC encountered resistance at the MA200 mark but was unable to maintain an upward trend, suggesting a bearish outlook for the asset.

With an RSI of 51.59 presently, there’s a sign of equal force from buyers and sellers, indicating no definitive trend.

If MATIC‘s price falls beneath $0.70, the subsequent significant support is anticipated around the $0.68 region, which was a prior minimum during the previous consolidation period in the month.

Conversely, the resistance level is firmly established by the MA200 at approximately $0.7333.

Reaching a definitive peak beyond this level might propel MATIC upwards, potentially reaching the next hurdles at approximately $0.74 and $0.78 – these being previous peaks prior to the price decline.

What’s been going on with Polygon?

Beyond price and trading volumes, it’s important to consider Polygon’s network activity.

More recently, the team announced the rollout of Polygon 2.0 along with a series of proposed upgrades called Polygon Improvement Proposals (PIPs). One significant change among these PIPs is the shift towards a new token named POL.

Read Polygon [MATIC] Price Prediction 2024-2025

This token would enable a one-to-one migration from MATIC with a new emission mechanism.

The effects of these enhancements on Polygon’s network usage and MATIC‘s market trends hinge greatly upon active community involvement and the fruitful execution of the suggested plans.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

2024-05-30 05:11