What to Know:

- Patrick McHenry believes there’s a real shot for crypto regulation to pass in the post-election session, which could finally make institutions stop squinting at crypto like it’s a magician’s trick and call it legitimate.

- Legal clarity will expose the tech gaps of fragmented blockchains, proving once and for all that interoperability isn’t a buzzword-it’s a survival skill for grown-up markets.

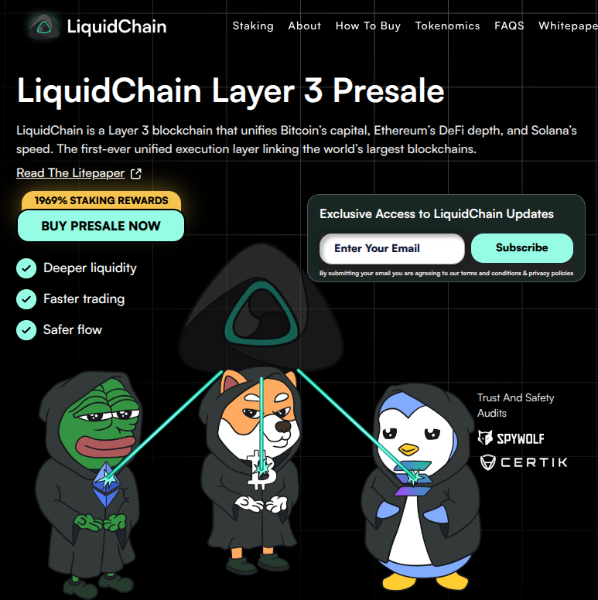

- LiquidChain promises to merge Bitcoin, Ethereum, and Solana liquidity into a single L3 execution layer, so you don’t have to participate in a high-stakes bridge dodgeball game anymore.

Retiring House Financial Services Committee Chair Patrick McHenry isn’t ghosting the scene. He’s signaling that the window for comprehensive crypto regulation isn’t closing-it’s cracking wide open, like a champagne bottle at a tech conference.

Speaking on CoinDesk Live at the Ondo Summit in NYC, McHenry suggested the post-election “lame duck” session is prime time to pass significant market-structure legislation or a stablecoin bill before the new Congress takes office in January. Basically, it’s senior year, and regulations are grading on a curve.

Why does this matter? The market has spent two years pricing in regulatory gridlock. A sudden shift to clarity becomes a total risk-reduction miracle for institutional capital-like finding a Costco sampler that actually makes sense.

The logic is simple: political will hardens during campaigns and then liquefies after. McHenry, leaving office with a legacy to cement, views the bipartisan support for the FIT21 Act as a template for year-end action-because nothing says “midlife crisis” like rushing to pass a bill before you retire.

If legislation passes, it legitimizes digital assets in the eyes of traditional finance, potentially unlocking trillions in sideline capital currently blocked by compliance forms and fear of jaywalking into the digital economy.

However, a legislative green light reveals a secondary bottleneck: technical infrastructure. While Washington debates jurisdiction, the blockchain ecosystem remains a fragmented archipelago of isolated liquidity. There’s no single railroad to move smoothly between Bitcoin, Ethereum, and Solana.

This gap, between regulatory readiness and infrastructure maturity, is drawing attention to interoperability solutions like LiquidChain ($LIQUID), which aims to fix the liquidity fragmentation problem before the institutional deluge arrives.

Regulatory Clarity Demands One Unified Execution Layer

If McHenry’s forecast is on point and regulatory clarity arrives by early 2026, the narrative will shift from “is it legal?” to “does it work at scale?” Right now, the answer for cross-chain operations is a hard no. The industry relies on cumbersome bridges and wrapped assets-clearly not the kind of reliability institutional desks tolerate.

That’s the gap LiquidChain ($LIQUID) targets. It presents itself not merely as another blockchain, but as a Layer 3 (L3) infrastructure designed to fuse the liquidity of major chains into a single execution environment.

Instead of forcing users through a maze to move value from Solana to Ethereum, LiquidChain offers a “Unified Liquidity Layer.” Think one-step execution where Bitcoin, Ethereum, and Solana assets can be used together, like a chaotic but harmonious family road trip.

For developers, the “Deploy-Once Architecture” creates real efficiency: they can build an application once on the LiquidChain L3 and instantly access the user bases of all connected chains.

The implication is huge. If regulatory hurdles fall, the next major valuation driver will be user experience (UX) and capital efficiency. Protocols that eliminate wrapped assets and trim transaction steps will likely capture the volume that regulations unlock.

LiquidChain’s approach to verifiable settlement without the typical bridge risks addresses the security concerns that have historically kept large asset managers cautious.

EXPLORE THE LIQUIDCHAIN UNIFIED LAYER

LiquidChain Presale Data Signals Appetite for Infrastructure Plays

While the broader market waits for the legislative gavel, smart money appears to be positioning itself in infrastructure plays that solve the ‘fragmentation trilemma.’ The ongoing LiquidChain presale offers a quantifiable glimpse into this sentiment shift.

The $LIQUID presale has raised over $533K, with the token currently priced at $0.0136.

The specific appeal of $LIQUID lies in its utility within the ecosystem; it functions not just as a governance token, but as fuel for cross-chain transactions and liquidity staking.

The economics here favor early positioning. At $0.0136, the entry point reflects a valuation before the protocol captures mainnet volume. By fusing the three largest liquidity pools-Bitcoin’s deep capital, Ethereum’s DeFi dominance, and Solana’s speed-LiquidChain is theoretically addressing a total addressable market (TAM) in the trillions. It’s not surprising we see it as one of the best crypto presales.

Plus, the project’s focus on “Liquidity Staking” aligns with the yield-seeking behavior expected from the incoming wave of compliant capital. Rather than passive holding, the protocol incentivizes providing cross-chain liquidity, creating a flywheel where deeper liquidity attracts more volume, which in turn generates higher staking yields.

As McHenry pushes for the regulatory ink to dry in Washington, the on-chain race is to build rails that can actually handle the traffic.

BUY YOUR $LIQUID FROM ITS OFFICIAL PRESALE PAGE

Read More

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Best Controller Settings for ARC Raiders

- Gold Rate Forecast

- How to Build a Waterfall in Enshrouded

- The Sci-Fi Thriller That Stephen King Called ‘Painful To Watch’ Just Joined Paramount+

- 1998 Fighting Game Secretly Re-Released After 27 Years With Rollback Netcode

- Witnessing the Unstable Heart of Quantum Systems

- Invincible VS Release Date, New Character Teased for The Game Awards

- 10 Best Shoujo Manga Writers

2026-02-10 15:22