- $1.2 billion liquidated as market downturn amplified memecoin sell-offs.

- DOGE showed resilience; BONK, SHIB lagged with weaker buy-side momentum.

As a seasoned researcher who has navigated through numerous market cycles, I can attest that this downturn is one for the books – a rollercoaster ride that even the most hardened traders might find challenging. The memecoin market, once a beacon of exuberance and speculative fervor, now stands as a stark reminder of the inherent risks in high-leverage trading.

The market is in turmoil, with a sharp sell-off sending shockwaves across all sectors.

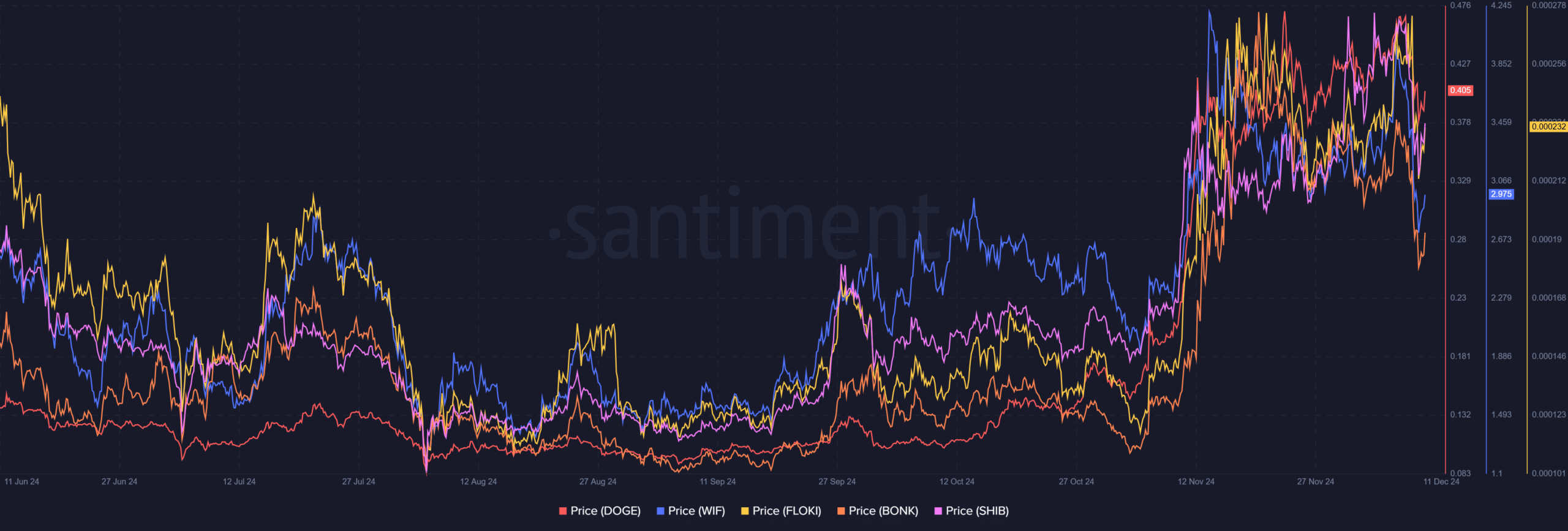

The influence is most evident in the market for meme coins, where high-risk assets such as Bonk (BONK), Floki (FLOKI), dogwifhat (WIF), Shiba Inu (SHIB), and Dogecoin (DOGE) have experienced significant double-digit declines.

Traders who use borrowed money to increase their investments (leveraged traders) are seeing an increasing number of forced sales (mounting liquidations), revealing the vulnerability of this risky sector as prices drop to record lows during the general market adjustment.

Memecoin fragility amid broader market turmoil

According to Santiment’s analysis, the volatility in popular meme coins increased significantly during the current market slump. Following impressive growth throughout the first half of the year, all five of these digital assets experienced a steep decline starting from November, which can be attributed to liquidity problems.

DOGE and WIF rebounded sharply, while BONK and SHIB lagged as well.

The divergence shows the fragility of speculative assets in volatile environments.

As a crypto investor, I’ve noticed that Floki’s price movements tend to mirror broader trends in the cryptocurrency market, making it potentially vulnerable to macroeconomic changes. On the other hand, Dogecoin seems to be bouncing back, demonstrating its resilience, especially considering its high liquidity.

The division among meme coins should serve as a cautionary tale for traders: collective actions can greatly increase losses when the overall market mood becomes negative.

Market-wide liquidations

In the last two days, a significant number of trading positions worth more than one billion two hundred million dollars have been closed due to a widespread selling off on various trading platforms, intensifying the market downturn.

The sharp unwinding occurred due to a mix of reasons: unexpected Bitcoin price plunges that broke crucial resistance points, made worse by excessive borrowing levels.

In simpler terms, lesser-known cryptocurrencies (altcoins) such as meme-based ones were significantly impacted, with a greater number of sell-offs (liquidation volumes) than more established assets like Ethereum (ETH) and Bitcoin (BTC).

In simpler terms, rapid price drops (liquidation spikes) can create a loop where price adjustments lead to margin call notifications for traders, compelling them to sell their assets. This selling action, in turn, adds more pressure on the already declining market prices.

In simple terms, this process of liquidating assets has been extremely harsh for areas of investment that are considered speculative. It’s made clear how vulnerable highly leveraged investments can be when market conditions turn unfavorable.

This level of instability emphasizes the significance of effective risk control, particularly in environments where public opinion may swiftly change due to major economic or policy triggers.

A high-stakes gamble

The recent memecoin fall reminds us of the extreme volatility inherent in this niche.

These resources, primarily influenced by social media fads and speculative dealings, often don’t have the practical applications or usage statistics that are typical among well-established digital currencies.

In periods of widespread market decline, memecoins tend to be more susceptible due to their weak support levels being easily eroded by low trading volume and the absence of significant institutional support.

High leverage amplifies these risks, as cascading liquidations further depress prices.

Trade in memecoins can lead to significant losses due to their volatility, as they offer the potential for massive profits during market surges but are also prone to steep drops during downturns, making them a risky investment with both high rewards and high risks.

Read More

2024-12-11 22:15