-

DOGE, WIF, and PEPE saw price declines in the last 24 hours.

This resulted in significant long liquidations in their futures markets.

As a crypto investor with some experience under my belt, I’ve seen my fair share of market volatility and liquidations. The recent declines in DOGE, WIF, and PEPE have left me concerned, especially given the significant long liquidations that occurred in their futures markets.

The popular cryptocurrencies Dogecoin [DOGE], Pepe [PEPE], and dogwifhat [WIF] experienced an increase in long position liquidations after the market took a downturn on April 30th, according to data from Coinglass.

As a crypto investor, I understand that liquidations are an unwelcome but sometimes necessary event in the derivatives market. When my position on a particular asset becomes too large or risky, and I’m unable to add more collateral to cover the potential losses, the exchange forcibly closes my position to protect itself from excessive risk. This can result in significant losses, so it’s important to keep an eye on market volatility and maintain adequate collateral to avoid liquidations.

When the worth of an asset unexpectedly plummets, lengthy sell-offs ensue. Consequently, traders with outstanding bets on a price surge are compelled to close their positions.

According to CoinMarketCap’s report, the prices of Dogecoin (DOGE), PepeCoin (PEPE), and Shiba Inu (WIF) have experienced decreases of 9%, 14%, and 10% respectively over the past 24 hours.

As a researcher examining the data, I discovered that a total of $12.48 million worth of DOGE underwent liquidation during the specified timeframe. Among this figure, long liquidations accounted for approximately $12 million.

PEPE’s long positions represented more than $4 million of the $6 million total value in closed positions. In contrast, WIF underwent a total liquidation of $2.06 million, which included long liquidations amounting to $1.8 million.

The meme assets are at risk of further price declines

As a researcher observing the cryptocurrency market, I’ve noticed that DOGE‘s price has dropped significantly over the past 24 hours, resulting in numerous long positions being closed forcefully. This trend has sparked an increase in the number of short trades being initiated by traders in anticipation of further price declines.

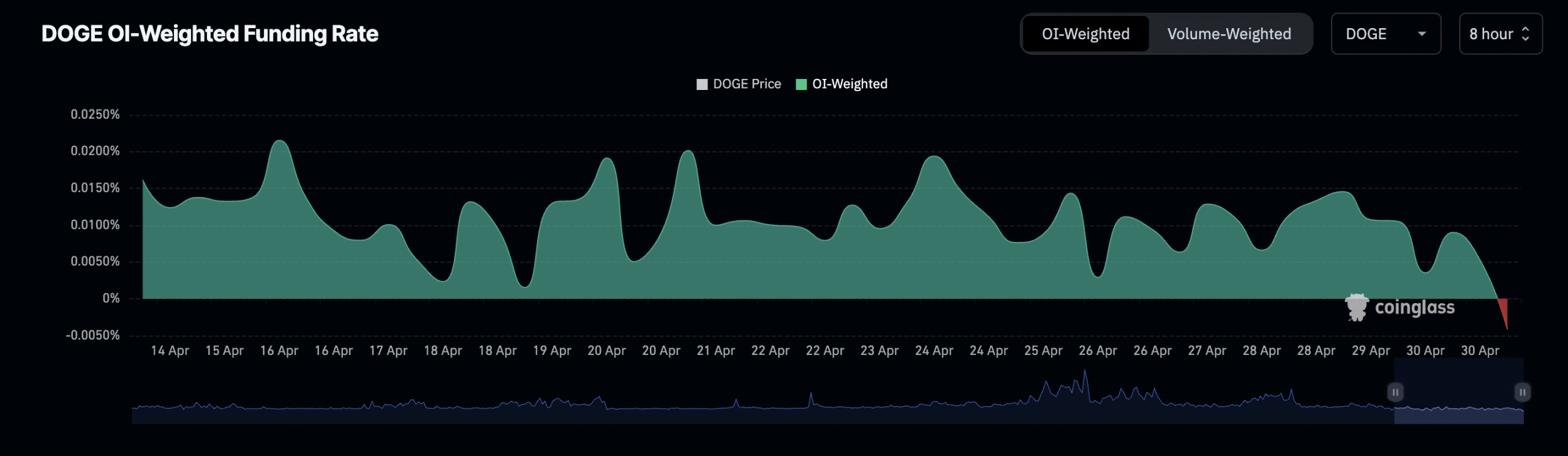

Coinglass reports that the coin’s funding rate has turned negative for the first time this year.

In simpler terms, funding rates are fees paid periodically in perpetual futures contracts to keep the contract’s price aligned with the current market price.

When an asset’s funding rate is positive, it means that the price of the contract for that asset is greater than its current market price or spot price. Consequently, individuals holding long positions in this asset are required to compensate those with short positions by making a payment. This fee system encourages a balance between buyers and sellers in the market.

When the Funding Rate is negative, it indicates that the contract price for the asset is below the current market price. Consequently, short traders are required to compensate long position holders with a fee.

As a researcher studying the Dogecoin (DOGE) market, I’ve discovered an intriguing finding regarding its funding rate. The negative value signaling this metric implies that more traders in the derivatives market hold bearish bets on DOGE than bullish ones. In simpler terms, more traders are wagering that DOGE’s price will decrease rather than increase, leading to a net outflow of funds from the long (buy) positions to the short (sell) positions.

The open interest in WIF‘s Futures contracts has reached a low point not seen in several months, amounting to $249 million as of now. This represents a significant decrease of approximately 60% from the figure reported on April 1st.

As an analyst, I’ve noticed a decrease in the Futures Open Interest for the meme coin, indicating that a substantial number of traders have closed their positions without establishing new ones.

Read Shiba Inu’s [SHIB] Price Prediction 2024-2025

I’ve noticed an intriguing development regarding PEPE‘s market dynamics. While its price has been on a downward trajectory over the past ten days, its Futures Open Interest has shown a significant surge, increasing by approximately 79%. According to Coinglass, this trend is noteworthy and could potentially indicate shifts in investor sentiment or market expectations for PEPE.

Despite a funding rate indicating that more individuals have wagered for a decrease in the value of the frog-themed meme asset, it’s important to note.

Read More

2024-05-01 14:16