- Memecoins that topped the gainers chart last week may be due for a correction.

- Meanwhile, low-cap assets could experience short-term gains.

As a seasoned researcher with years of experience navigating the dynamic landscape of cryptocurrencies, I can confidently say that this week’s market trends are reminiscent of a rollercoaster ride. The memecoin surge last week was nothing short of exhilarating, with high-cap memecoins leading the charge. However, as we all know, what goes up must come down.

The second week of October kicked off with Bitcoin [BTC] breaking resistance to test the critical $64K level. This marks a strong rebound after last week’s dip, where BTC briefly touched $58K.

During this period, popular meme coins experienced substantial growth spikes, with a few even seeing over 100% increases in value as investments shifted away from Bitcoin.

On the other hand, numerous meme-based cryptocurrencies have dropped below their past highs, which could indicate that a distribution period is underway, as investor attention once again shifts towards Bitcoin.

In light of Bitcoin’s resurgence and many high-value meme coins experiencing a downturn, AMBCrypto notices a pattern that hints at the possible end of the memecoin fad rather than the beginning of a prolonged “super cycle.” If this trend continues, a broader market cool-off could be just around the corner.

Top memecoins are lagging behind

The graph shows us that for the last seven days, there has been a trend where nearly 60% of all cryptocurrencies were memecoins, and each of these saw a rise of more than 30% within one week.

As a crypto investor, I’ve noticed a significant change in the landscape: While traditionally, low-cap altcoins surge when Bitcoin hits rock bottom, there seems to be a new trend emerging. Instead of seeking out these lower-value altcoins, traders are now drawn towards high-cap memecoins. These offer high-risk, high-reward opportunities that might just pay off in the long run.

Essentially, the recent downturn in BTC has led investors to move their money towards larger digital tokens as a form of safety. But when traders start cashing out their gains, there’s a possibility that those funds could shift into smaller, less valued meme-coins, mirroring the surge of altcoins following every peak in Bitcoin’s value.

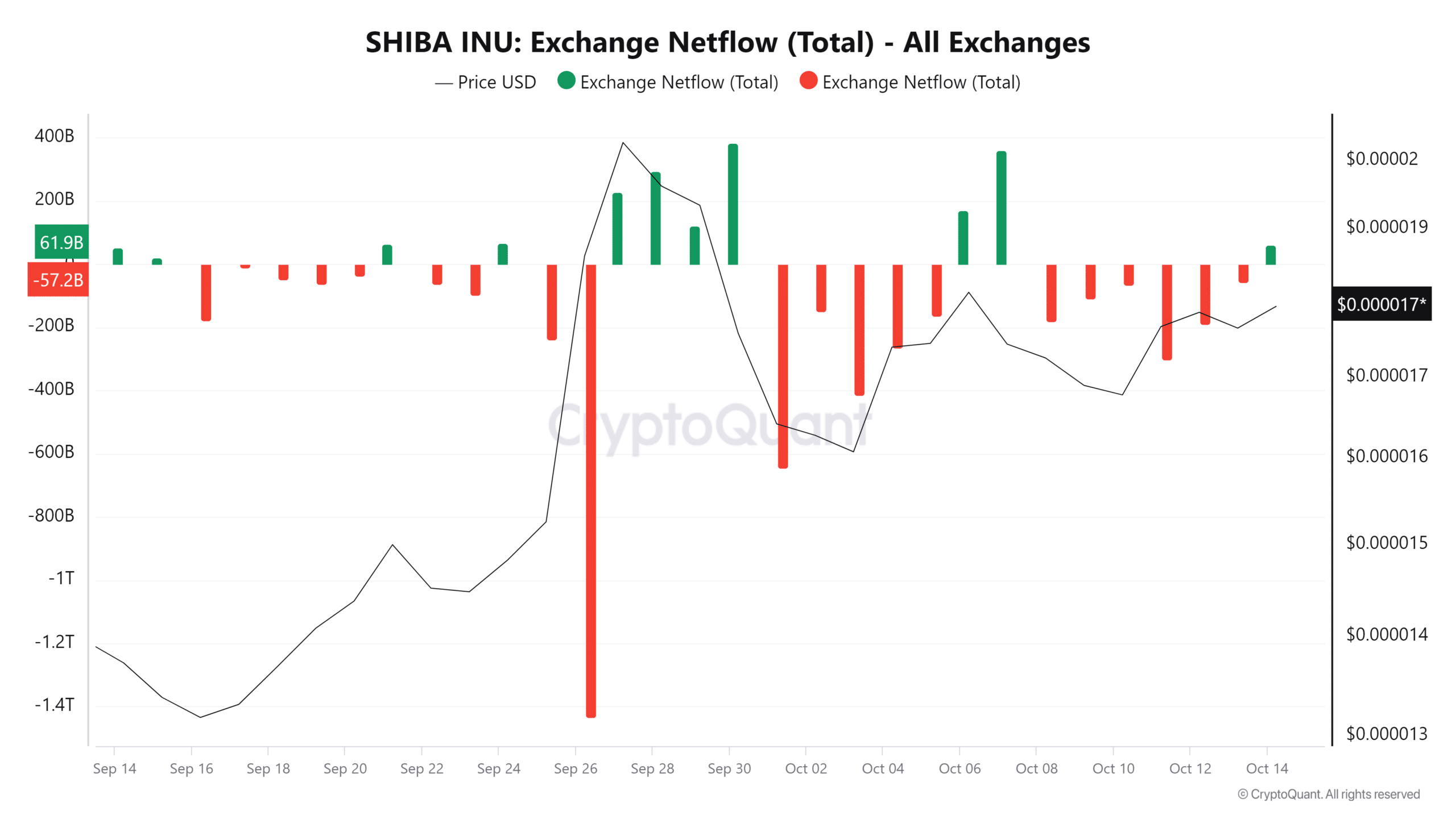

Source : CryptoQuant

Shiba Inu (SHIB), the second-biggest meme token and boasting a market value over $10 billion, has repeatedly surpassed Bitcoin in terms of daily returns, recording more substantial increases during every green period on its daily price graph.

This rise in value could be due to a trading approach used by investors when Bitcoin experiences a dip, where they switch their attention towards purchasing popular meme tokens with high market capitalization, such as Shiba Inu (SHIB). Interestingly, the last week has shown a net withdrawal of 58 billion SHIB from all exchanges.

Nevertheless, as Bitcoin surpasses a significant resistance point, this development has sparked increased enthusiasm among traders, causing them to sell off their Bitcoin holdings en masse. This mass selling action has led to an influx of Shiba Inu (SHIB) tokens amounting to 62 billion.

To put it simply, several popular meme coins might experience a downturn soon, given that Bitcoin is preparing for another significant surge. This means the next major boom in meme coins could start when Bitcoin hits a peak around $66K, indicating exhaustion.

Low-cap tokens might see a short-term surge

Usually, a rise in Bitcoin’s price tends to stimulate investor’s risk tolerance, leading them to consider venturing into more speculative investments, such as memecoins with smaller market caps.

Even though these investments can be more unpredictable, they’re often considered enticing due to the potential for swift and significant profits. Consequently, there might be a temporary increase in interest as investors flock towards them.

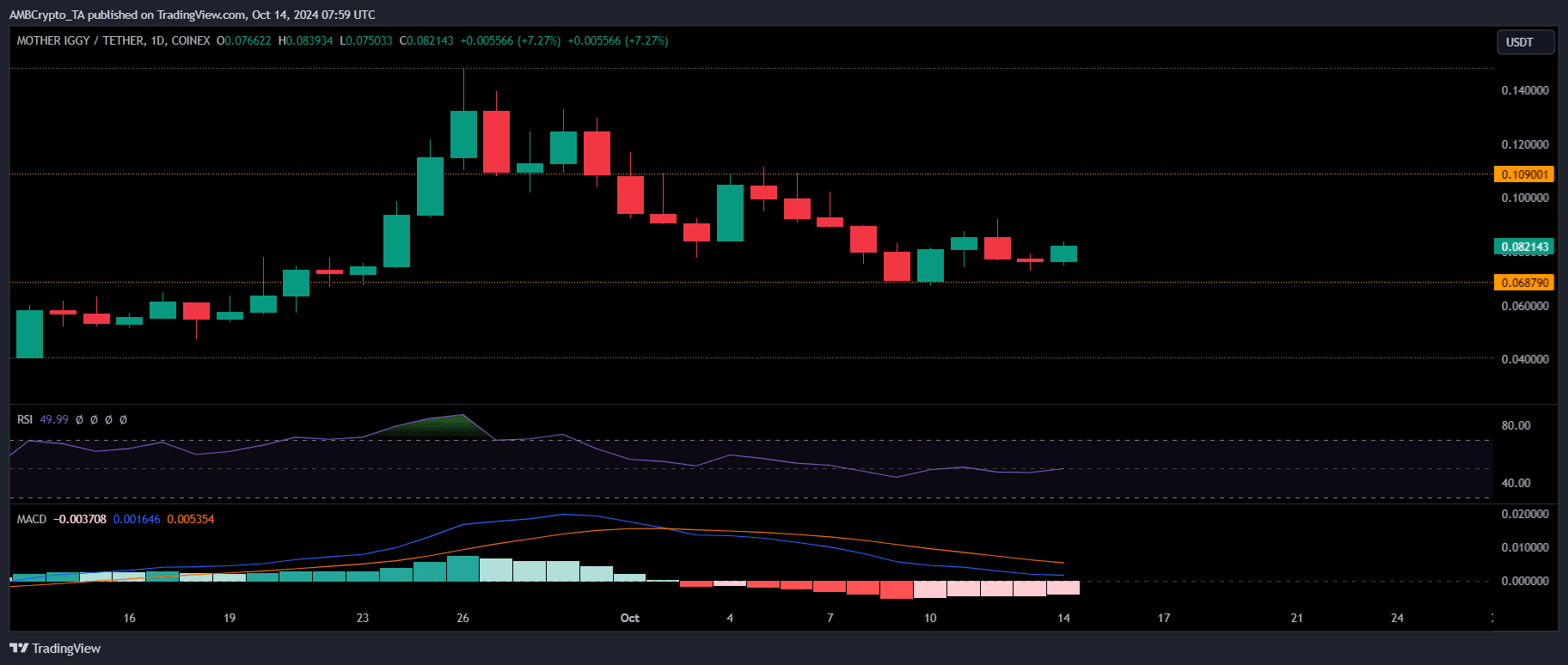

Source : TradingView

A notable instance is MOTHER Iggy [MOTHER], a well-known Solana-backed memecoin worth approximately $85 million in the market. Over the past day, the token has gained momentum, spiking by more than 5%, currently trading at $0.83. This recent rise indicates a substantial comeback from last week’s 10% drop.

Realistic or not, here’s SHIB’s market cap in BTC’s terms

Previously, as Bitcoin hit $62K at the start of a weekly cycle, MOTHER approached its upper limit of $1. Should this pattern persist, there’s a possibility that MOTHER might be about to experience an upturn in its price trend.

In summary, it appears that significant cryptocurrencies known as meme coins are experiencing a slowdown, whereas lesser-known tokens with lower market values are increasing rapidly. This pattern is reminiscent of the trend that follows after Bitcoin reaches its peak, when investors tend to move their capital into smaller coins while larger players rebalance their portfolios by dispersing their holdings.

Read More

2024-10-14 15:04