-

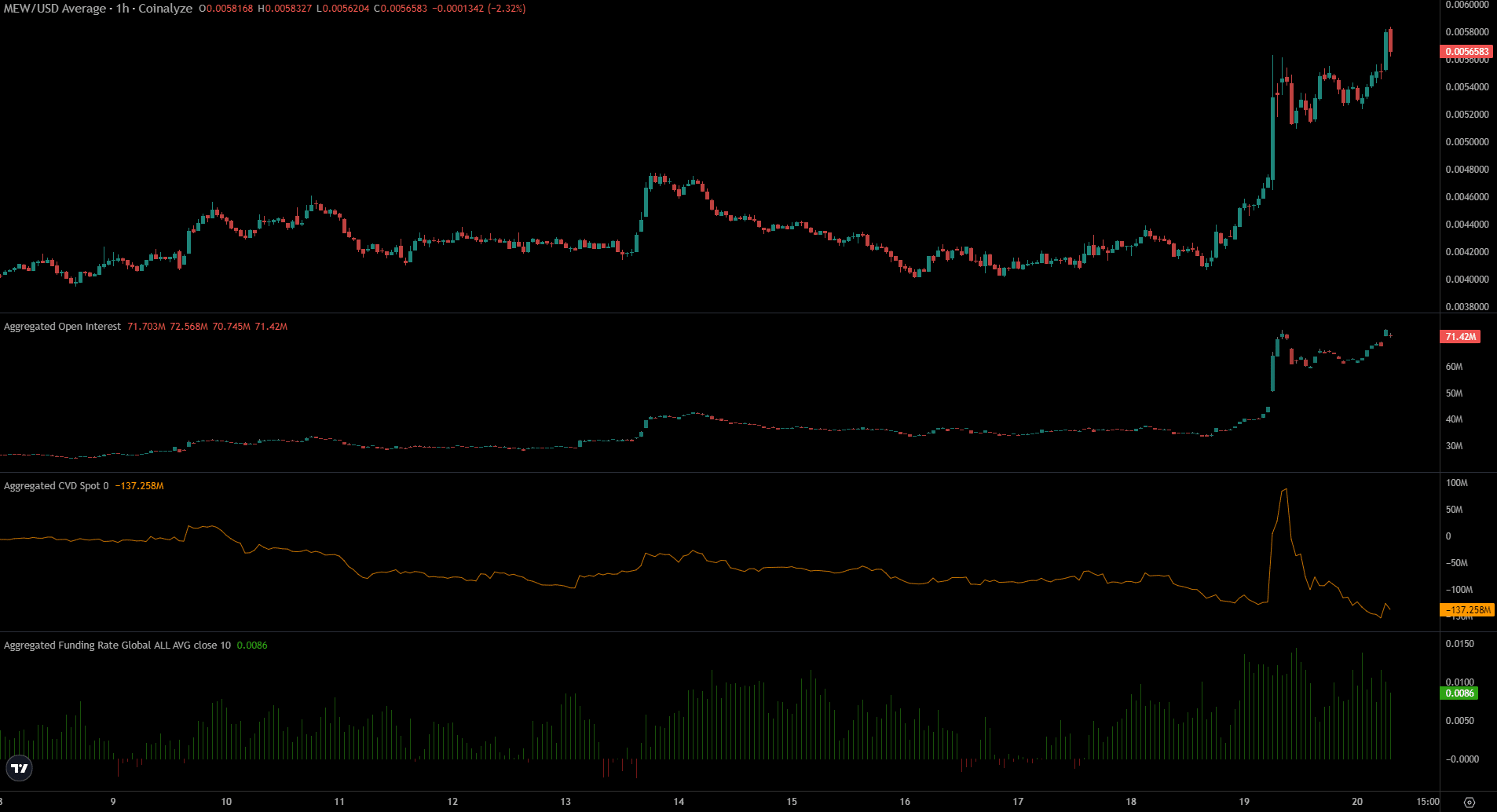

MEW gained bullish momentum and trading volume suggested conviction.

The spot CVD gave a negative signal, but sentiment was still bullish.

As a seasoned crypto investor with a knack for spotting trends and understanding market dynamics, I find myself intrigued by MEW‘s recent performance. The memecoin has shown impressive gains of 34% since September 18th, and the lower timeframe momentum is undeniably bullish. However, the two key resistance levels at $0.006 and $0.00633 present a formidable challenge that MEW bulls have been grappling with since August.

In a canine-centric environment, the feline-themed cryptocurrency [MEW] experienced a surge of 34% since September 18th. The lower trading interval indicated a rising bullish trend for this memecoin. However, it currently confronts two significant resistance levels.

As an analyst, I’ve observed that for quite some time now, the resistance levels around $0.006 and $0.00633 have served as barriers for the MEW coin bulls, a struggle they’ve been facing since August.

A retest of the resistance zone is at hand

Over the past six weeks, I’ve noticed that the range between $0.004 and $0.00434 has served as a reliable base of support. Notably, two upward surges originated from this point, which I attribute to the bullish activity of MEW investors.

One was rejected at the $0.006 resistance level, while the other is in progress.

On September 19th, there was a significant increase in trading activity, far exceeding the levels seen during the rally on August 23rd. This strong surge in trading suggests that the bullish momentum was considerably greater during this period.

As a result, we’re expecting greater achievements, however, it’s important to note that this isn’t definitive. To shift the trend positively, a closing price above $0.00633 is essential.

The Relative Strength Index (RSI) reached 78, indicating strong upward momentum, while On-Balance Volume (OBV) significantly increased due to heightened purchasing activity. In summary, these factors suggest a high likelihood of further price increases.

The rapid drop in spot CVD was a surprise for MEW coin

Over the last two days, the Open Interest has significantly increased from $34 million to $73.9 million, indicating a robust bullish sentiment among traders.

A favorable Funding Rate indicated that speculators were keen on taking a long position to reap some profits, since MEW coin experienced rapid price increases.

Realistic or not, here’s MEW’s market cap in BTC’s terms

The spot CVD made large gains on the 19th of September, but these were erased a few hours later.

The increase in selling activity on the spot market suggested that some traders were cashing out their profits. This trend was concerning for MEW holders because it implied that the sellers did not expect MEW to surpass the resistance level at $0.006.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-09-20 16:07