- 9% spike propels MEW to record highs.

- Liquidation risks loom as MEW tests $0.0130 resistance zone

As a seasoned crypto investor who’s weathered multiple market cycles, I can confidently say that MEW’s current trajectory is nothing short of impressive. With my hard-earned savings riding on this cat in a dog’s world, I can’t help but feel a surge of optimism as I watch it soar to record highs.

Boasting a market value exceeding $1 billion, MEW (Cat among the dogs) has garnered attention as a leading player in the cryptocurrency sector. A noteworthy increase of 9% over the past day propelled its token price to $0.01218, igniting curiosity among investors.

Can MEW’s bullish trajectory carry it beyond $0.012 and toward the $0.02 psychological level?

Cat in a dogs world technical analysis

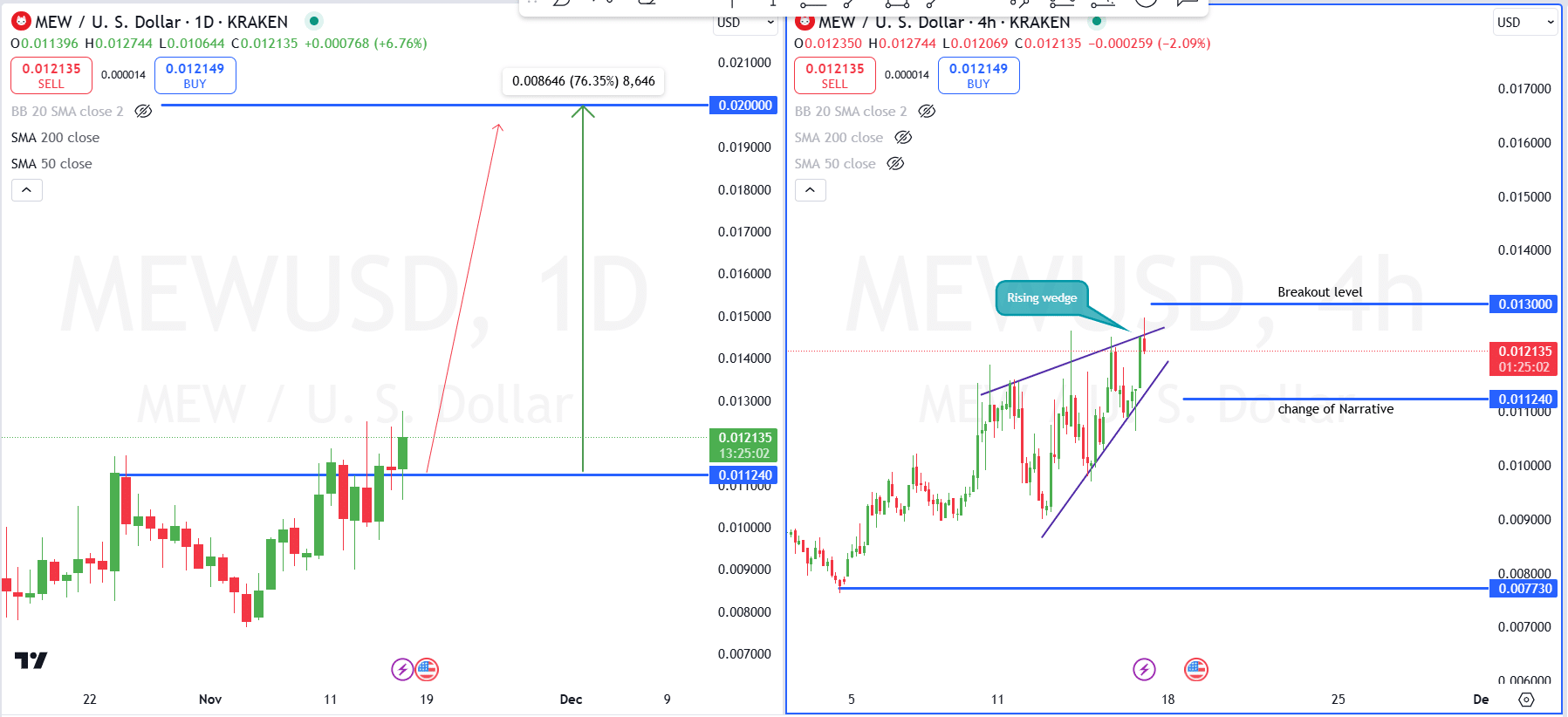

On a daily basis, MEW demonstrates robust bullish energy, consistently trading above the significant support of $0.011240. This recent upward trend is bringing the price near the crucial resistance at $0.013, potentially leading it towards the psychological target of $0.02.

Should the current momentum continue, MEW might experience a 76.35% increase, which could mark a significant turning point leading to potential further advancements.

On a 4-hour timeframe, MEW appears to form a rising wedge shape, a configuration typically associated with potential bearish reversals. Currently, the price is approaching a significant resistance level at around $0.013, where it could face strong opposition in its upward movement.

If we don’t manage to surpass this stage, there might be a retreat towards the $0.011240 support area. Yet, if we forcefully break free from the wedge formation, it would suggest the bullish momentum persists, disregarding the pessimistic outlook.

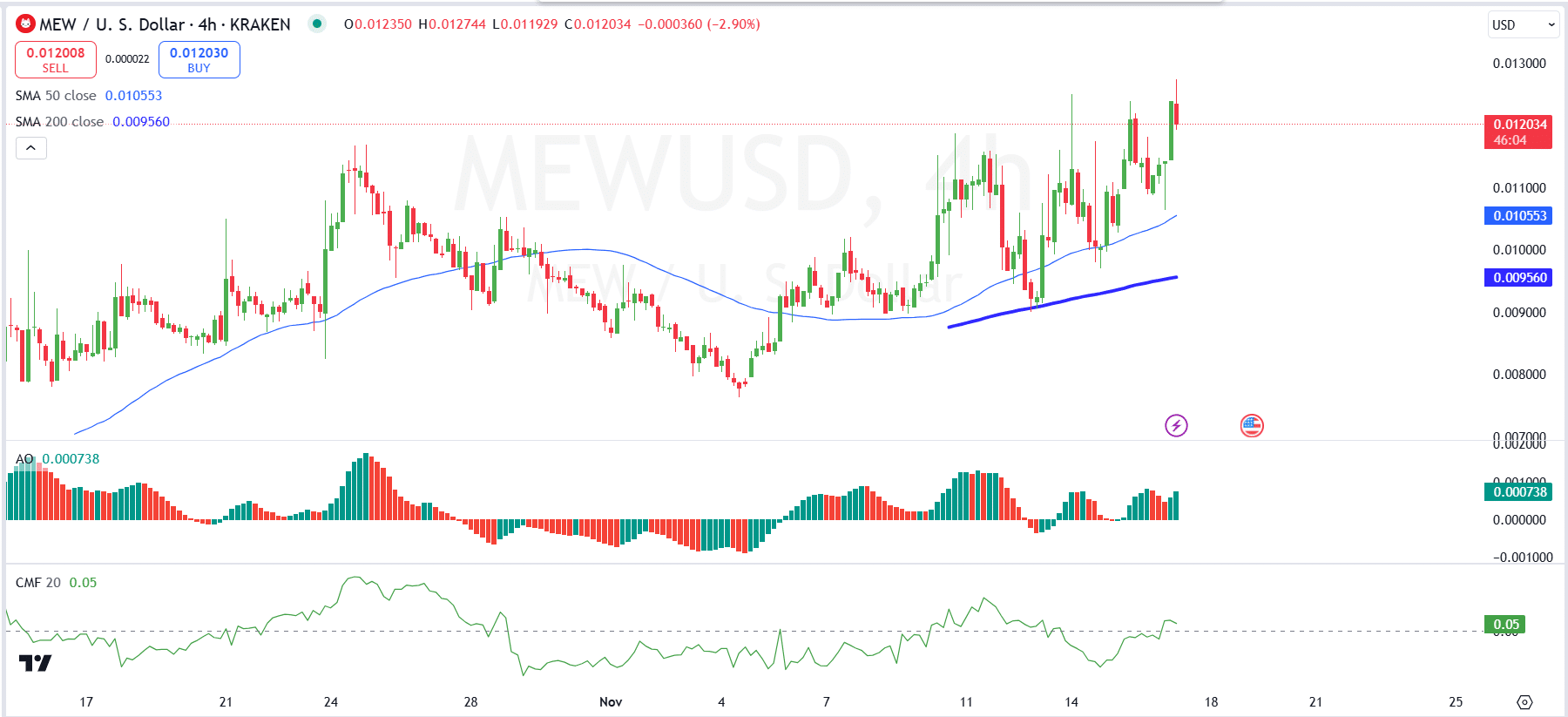

As a crypto investor, I’m seeing some encouraging trends. The current price is significantly above both the 50-day Simple Moving Average (SMA) and the 200-day SMA, which suggests a robust bullish momentum in the market. Interestingly, the 50-day SMA seems to be serving as a reliable short-term support, providing a cushion against any potential short-term downturns.

As an analyst, I’m observing a strengthening bullish momentum based on the Awesome Oscillator (AO). Specifically, the AO is displaying green bars above the zero line, which typically indicates accumulating buying pressure. The growing size of these green bars implies that this buying pressure is intensifying and accelerating, signaling a potential increase in market bullishness.

Right now, the Chaikin Money Flow (CMF) reads 0.05, suggesting a robust influx of funds into the asset. This positive CMF indicates that buying actions are dominating over selling ones.

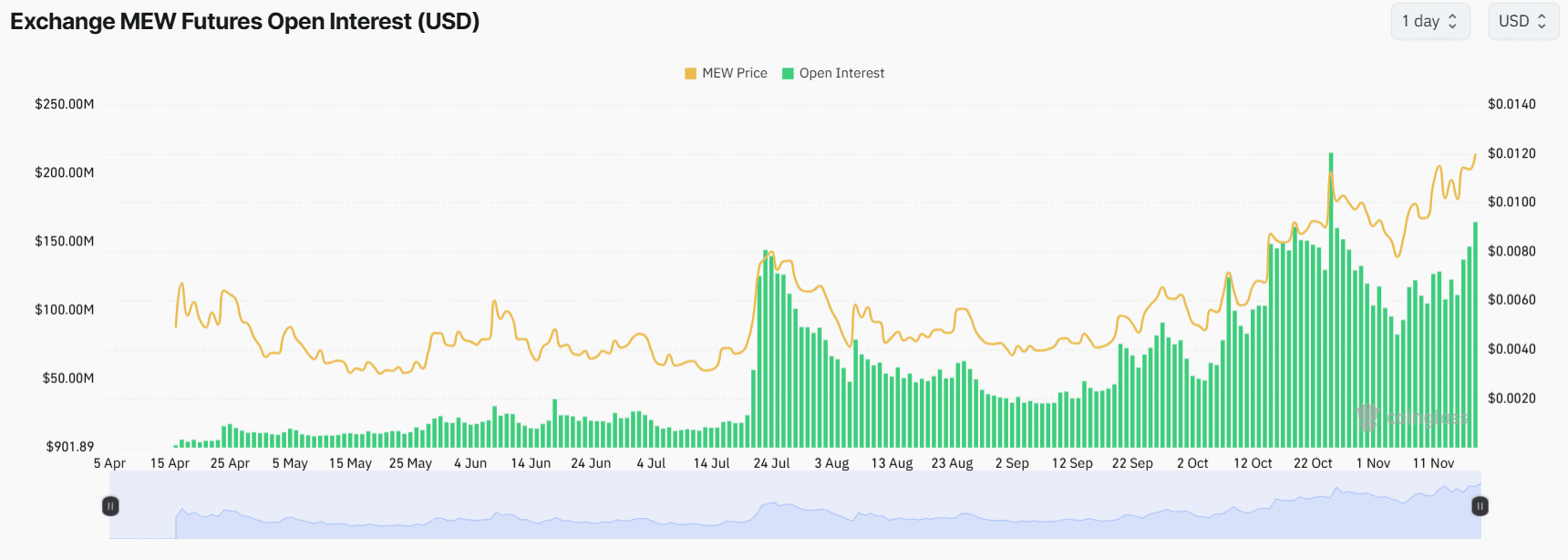

MEW open interest doubles in two weeks

Starting on November 5th, open interest has significantly risen from around $82 million to its present level of $164 million, indicating a noteworthy surge of more than 100%.

The significant surge in open interest suggests a rise in trading activities among investors and an increased allocation of funds towards MEW futures, implying a growing level of speculative attention. In the months of July and October, increases in open interest coincided with price surges, demonstrating robust trader participation during bullish market trends.

After those stretches, there was a decline in both price and trading volume, possibly because traders were taking profits or losing interest due to decreased speculation. The simultaneous increase in both price and trading volume since early November suggests that the market’s trust has been restored.

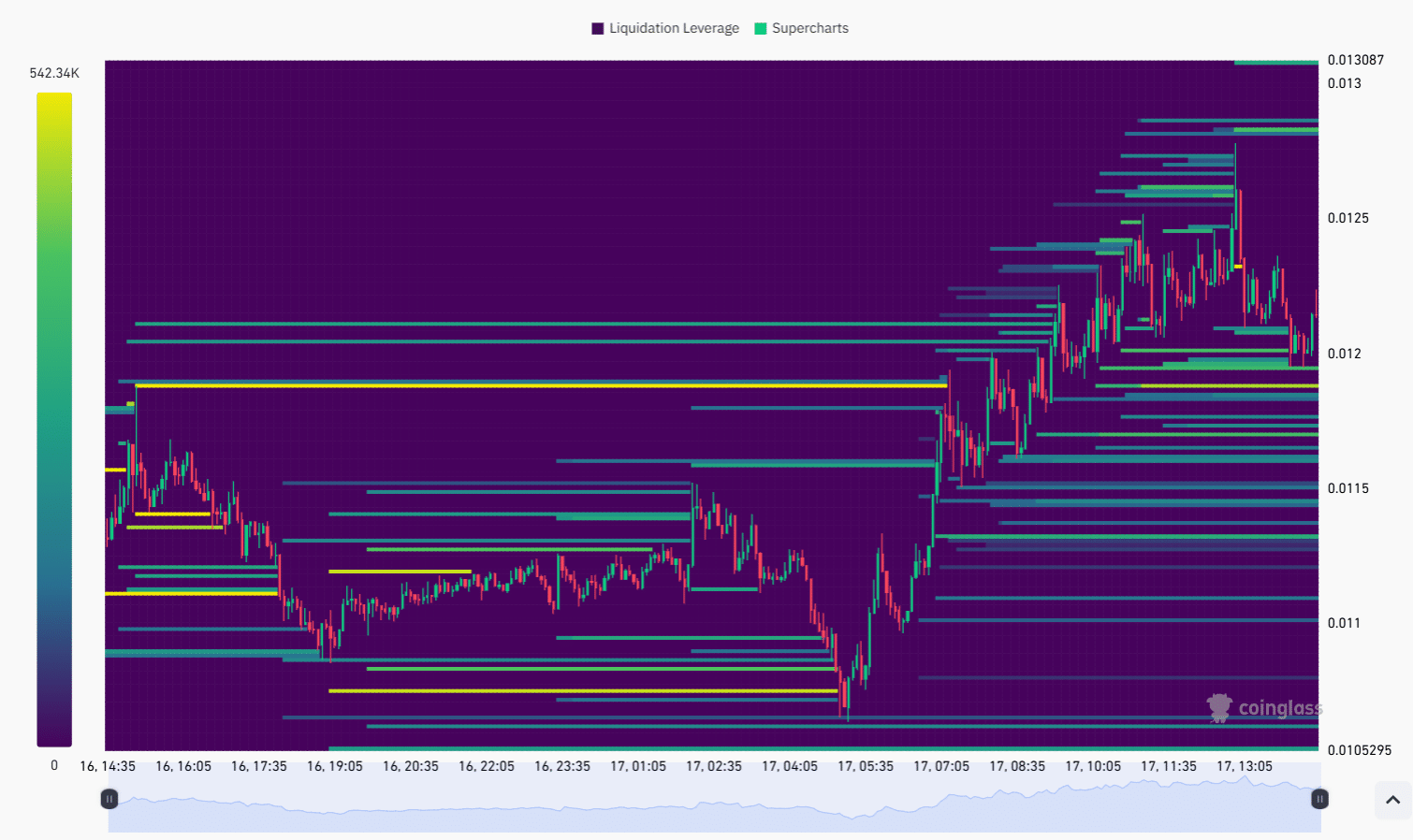

MEW liquidation levels spike near $0.0130

The graph shows substantial selling actions (represented by yellow bars) occurring between $0.0120 and $0.0130, suggesting a concentration of long positions with leverage in these potential resistance levels.

The high rate of liquidations implies that traders who have taken long, or bullish, positions may be at risk of losing their investments if the current uptrend weakens, potentially leading to a market reversal.

As we approach these areas, the intensity of bullish feelings (reflected by the rising green and blue bars) becomes more pronounced, which could potentially lead to a rapid chain reaction of sell-offs if there’s a market correction.

Realistic or not, here’s MEW’s market cap in BTC’s terms

The recovery from $0.0110, where earlier liquidations occurred, shows the market absorbed selling pressure and regained bullish momentum.

Yet, the accumulation of highly leveraged positions close to resistance underscores the significance of surpassing $0.0130 for the continuation of the upward trend.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-11-18 12:08