- MEW hit a record high after its Bitstamp listing

- Threat of a pullback still looms large

As a seasoned crypto investor with battle-scarred fingers from countless market fluctuations, I must admit that the recent surge of MEW is nothing short of intriguing. After witnessing the rise and fall of memecoins like dogs and frogs, it’s refreshing to see the emergence of cats in a dogs world. The record high of $0.0117 is indeed impressive, but as we all know too well, the crypto market is a roller coaster ride without a safety harness.

Following the time of canines and amphibians, felines have taken their place in the meme coin market. spearheading this movement is MEW’s depiction of cats in a dog’s world, which reached its peak value [ATH] of $0.0117 on the charts.

The surge in value for this record high can be attributed to Bitstamp’s decision to list the token, offering two trading options: MEW/USD and MEW/EUR. After the announcement, the Solana [SOL]-based token experienced a significant increase of over ten percent.

Here, it’s worth noting that the decentralized on-chain perpetual swap platform, Drift Protocol, also added support for MEW Perpetual Futures.

On October 22nd, MEW Perpetual Futures were introduced for trading on Kwenta, a platform built on the layer-2 network of Synthetix, which operates on Base.

MEW tops market gainers

Recently, this digital asset established a new all-time high (ATH) in quick succession after MEW reached its prior peak. This significant increase was likely due to its recent listing on Upbit. Currently, at the time of reporting, the price stood at $0.0112, reflecting a 7.91% surge from the previous day, based on data provided by CoinMarketCap.

Moreover, the token claimed the top position among the day’s market’s rising stocks. Furthermore, its 24-hour trading activity increased by approximately 35.71%.

Due to the recent increase in prices, MarketCap of MEW also experienced a significant rise. It climbed up by 5.30%, amounting to approximately $955.51 million, which indicates strong belief in the promising future of this token tied to Solana.

Is the bullish rally under threat?

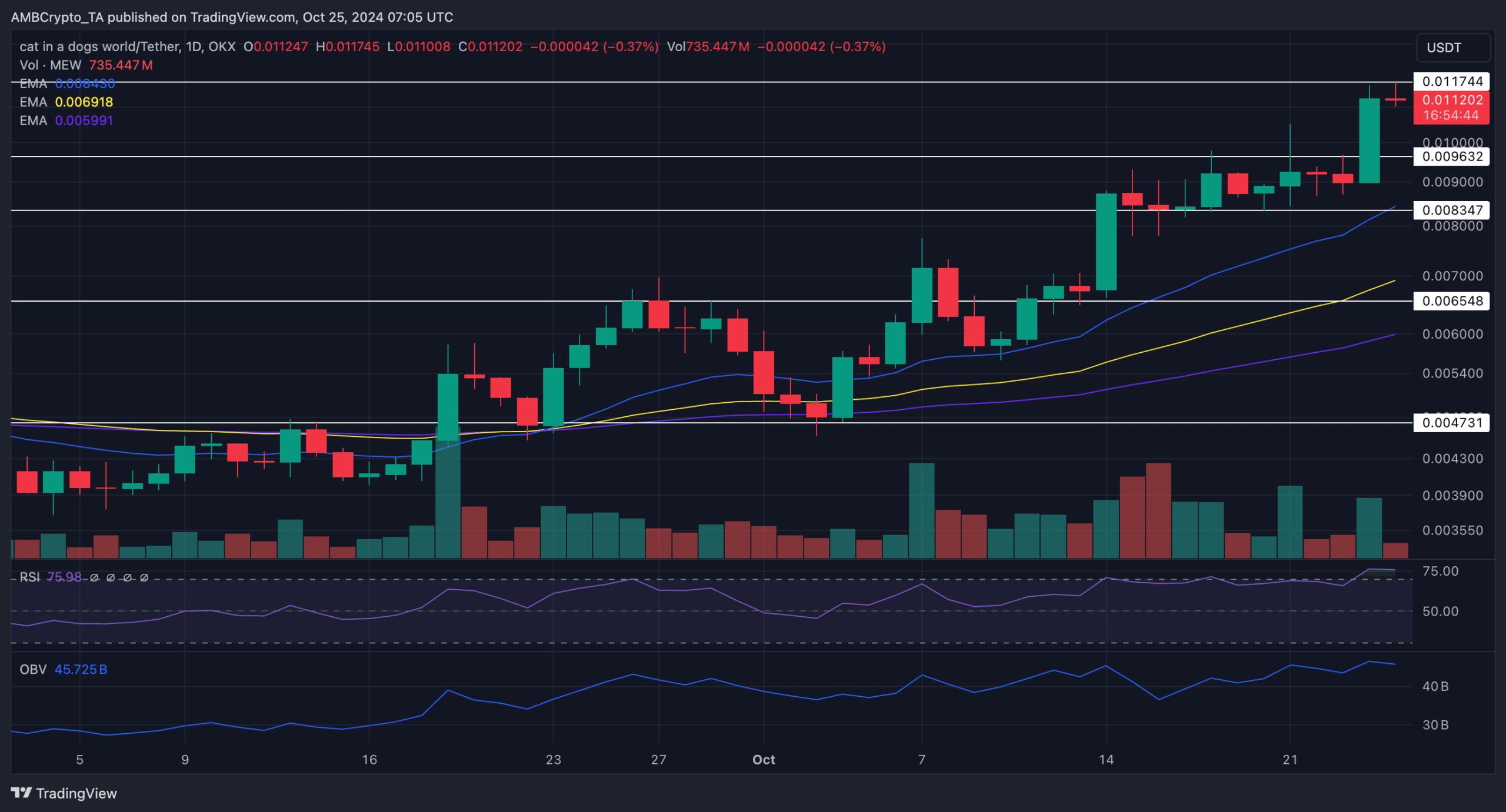

Although there’s a lot of positive sentiment right now, it’s important not to ignore the potential for market downturns. To better understand how the ongoing bullish trend may hold up in the present market climate, AMBCrypto examined the daily chart for insights.

At the moment, the Relative Strength Index (RSI) stands at 75.98, suggesting that the asset might be slightly overbought. This could potentially result in a correction. Furthermore, a decline in On-Balance Volume (OBV) to approximately 45.725 million implies a slight decrease in buying pressure.

If there’s a market downturn, it’s possible that MEW may find support near the $0.009 level. But if the selling activity picks up significantly, the price might dip back towards the 20 Exponential Moving Average (EMA) around $0.008.

If the price drops slightly, it might give an edge to the sellers. Conversely, if buyers manage to maintain their ground, the token may carry on ascending, possibly reaching unprecedented peak levels.

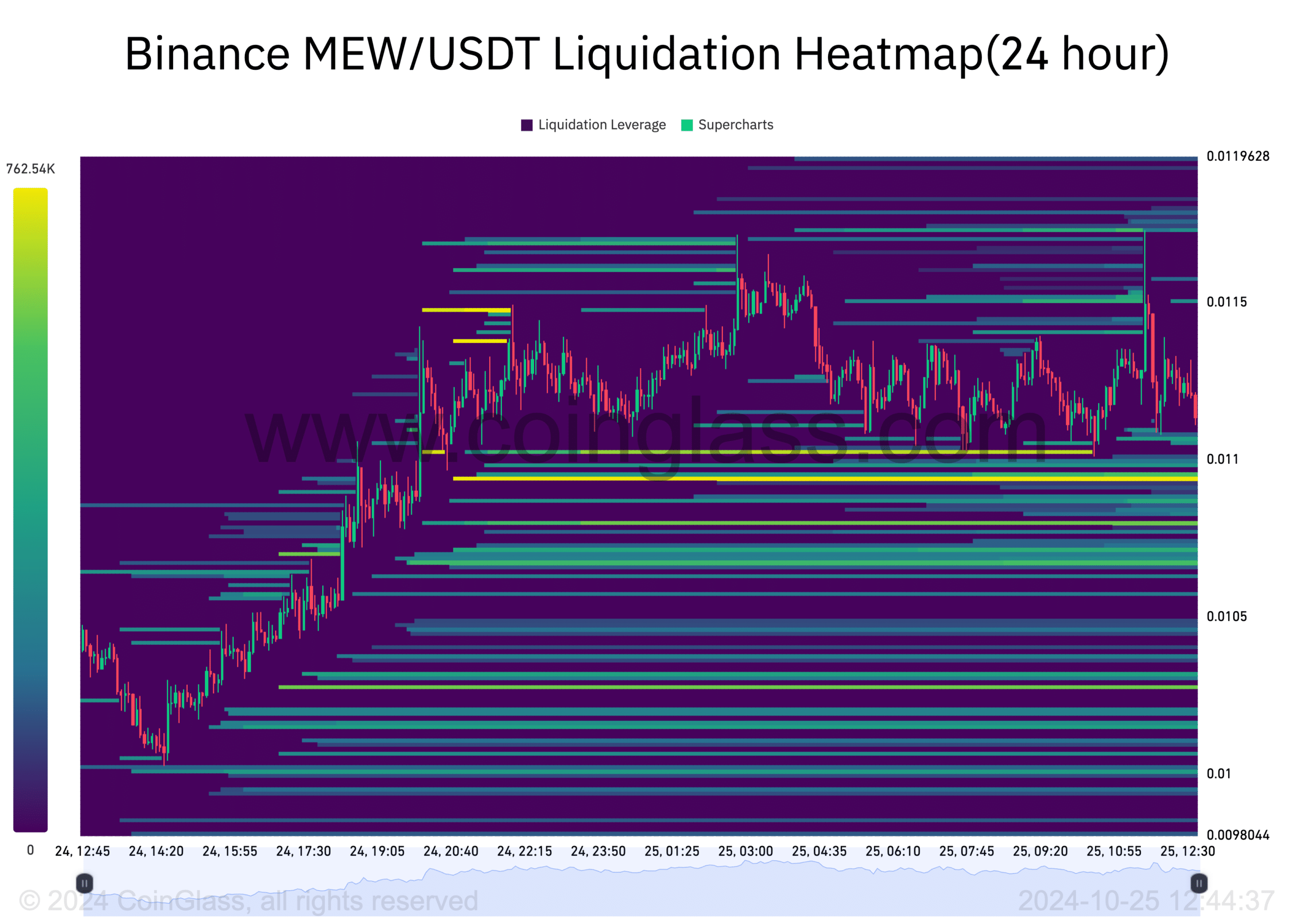

Liquidation heatmap analysis

However, before the bull rally continues, a short-term drop could be on the cards.

On the Coinglass liquidation map, AMBCrypto discovered a substantial concentration of liquidity around the price point of approximately $0.011. Additionally, they noted a more potent area of interest near $0.0109.

Realistic or not, here’s MEW’s market cap in BTC’s terms

These groups indicate that the price could momentarily drop to these points to attract liquidity, after which the upward trend is expected to continue, stimulating new purchases from these areas.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

2024-10-26 10:15