- Whale bought 416 million MEW for 10K SOL, sells for 16.27K SOL.

- Will profit-taking slow down MEW momentum?

As a crypto investor with over five years of experience in this wild west of digital finance, I’ve witnessed my fair share of whale dances and market jumps. The recent sale of 416.8 million MEW tokens by a whale for a tidy profit of $1.52 million has left me pondering the fate of Cat in a Dogs World [MEW].

Following the whale’s departure, the [MEW] token’s performance in Cat’s dog world exhibited a moderate level of fluctuation. The token was traded between a 24-hour low of $0.009228 and a high of $0.009704, indicating a cautious approach by the market.

Currently, MEW has dropped by 25.4% from its peak of $0.01288, which it reached on the 17th of November, a mere 12 days ago. The intriguing point is whether this recent sell-off indicates that the highs for MEW coin have been established due to profit-taking?

As a crypto investor, I recently discovered that a significant player (referred to as a ‘whale’) dumped approximately 416.8 million MEW tokens for around 16,270 SOL, which equates to roughly $3.94 million. Interestingly, the whale initially bought these tokens for 10,000 SOL ($2.42 million), meaning they pocketed an additional 6,270 SOL or approximately $1.52 million in profit.

The tokens were initially bought on the 15th of July, spending 10,000 SOL through a Dollar-Cost Averaging (DCA) approach with US dollars.

In simpler terms, when a large amount of MEW’s tokens were suddenly introduced into the market, it caused a brief drop in price due to selling. This action led to heightened volatility and more trades taking place, demonstrating that big transactions by whales can have a substantial impact on token prices and market stability.

What do the Charts say?

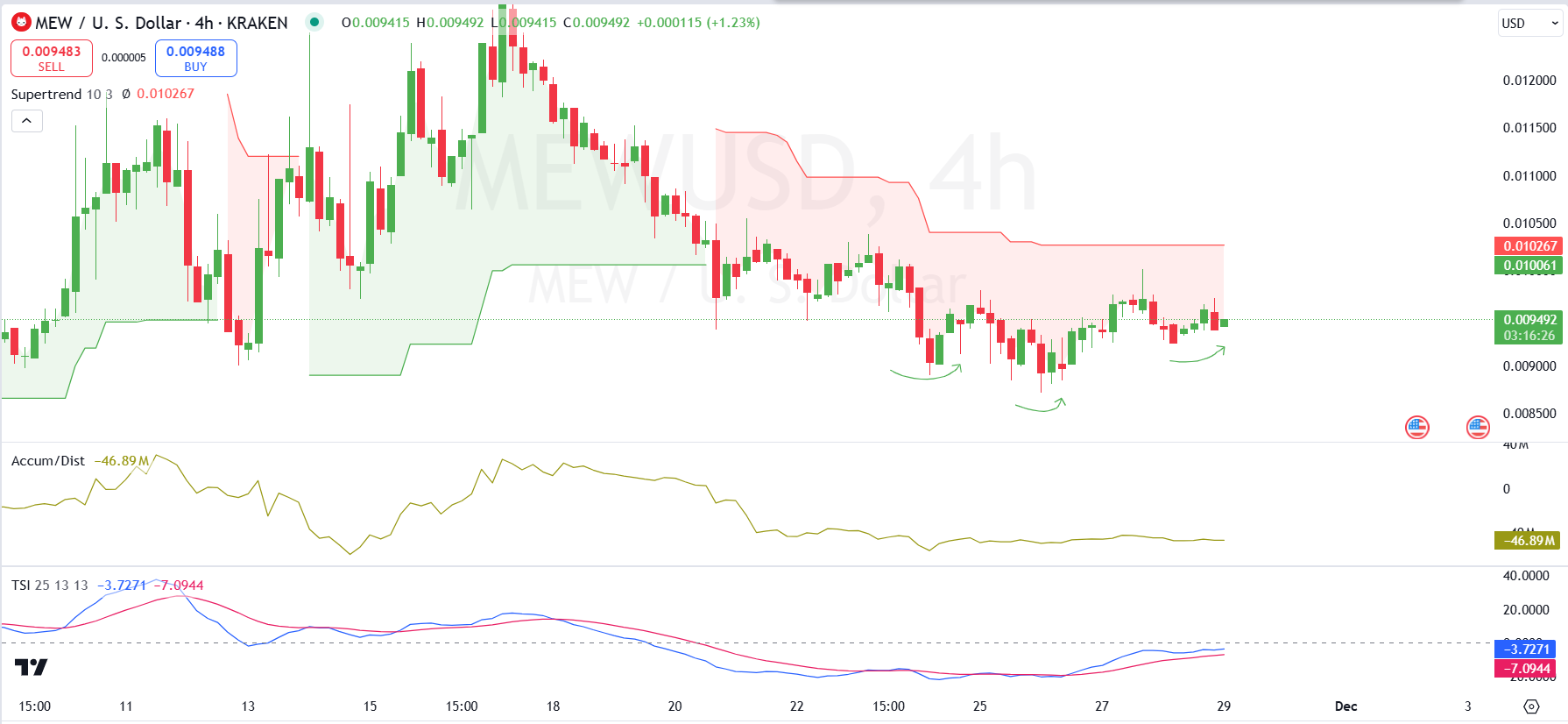

Examining the 4-hour MEW/USD chart by AMBCrypto, we observe that the price trend is currently stabilizing after experiencing fluctuations in the market.

At the moment, the price is roughly fluctuating near $0.0095, indicating an effort to rebound from its lowest point on Tuesday at $0.0088.

In simpler terms, when the price stays below the $0.0102 level (indicated by the red line), the Supertrend indicator signals a downward trend. But, a series of lower highs and higher lows recently indicates an increase in bullish energy.

The Accumulation/Distribution indicator is signaling a decrease in demand, represented by a value of approximately -46.89 million, suggesting persistent selling activity continues.

MEW / USD source: Tradingview

Even though the current market conditions may be challenging, the repeated bounces at approximately $0.009 suggest that I, as a crypto investor, am not alone in holding this price point as significant. It seems that other investors, too, are standing firm to defend this crucial area.

If the price successfully holds above $0.009, it could build a foundation for a bullish reversal.

If MyEtherWallet (MEW) manages to surpass the $0.01 mark, there’s a possibility that its trend could shift from bearish to bullish, potentially leading to further upward movements reaching around $0.012.

The True Strength Indicator, at present showing bearish signals, is getting close to a possible crossover. If this occurs, it will suggest an increase in bullish energy.

MEW price struggles as liquidity and interest fall

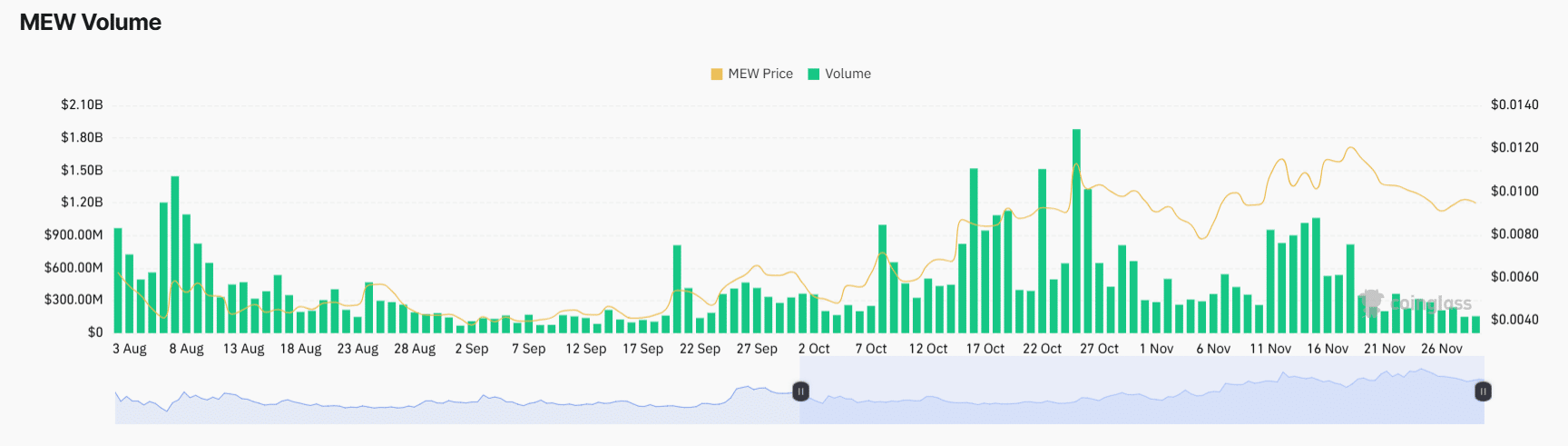

During periods of price increases, like those seen in early August and late October, the trading volume on MEW significantly surged, peaking at approximately $1.8 billion and $1.5 billion respectively.

During these busy spells, the prices tended to rise, indicating a significant level of demand for purchasing.

Over the past few weeks, specifically since mid-November, I’ve noticed a substantial decrease in trading volume, consistently falling below the $500 million mark. This decline corresponds with a drop in the price from its peak of approximately $0.013 to its current range around $0.009.

The decline in volume shows reduced market participation and lower liquidity.

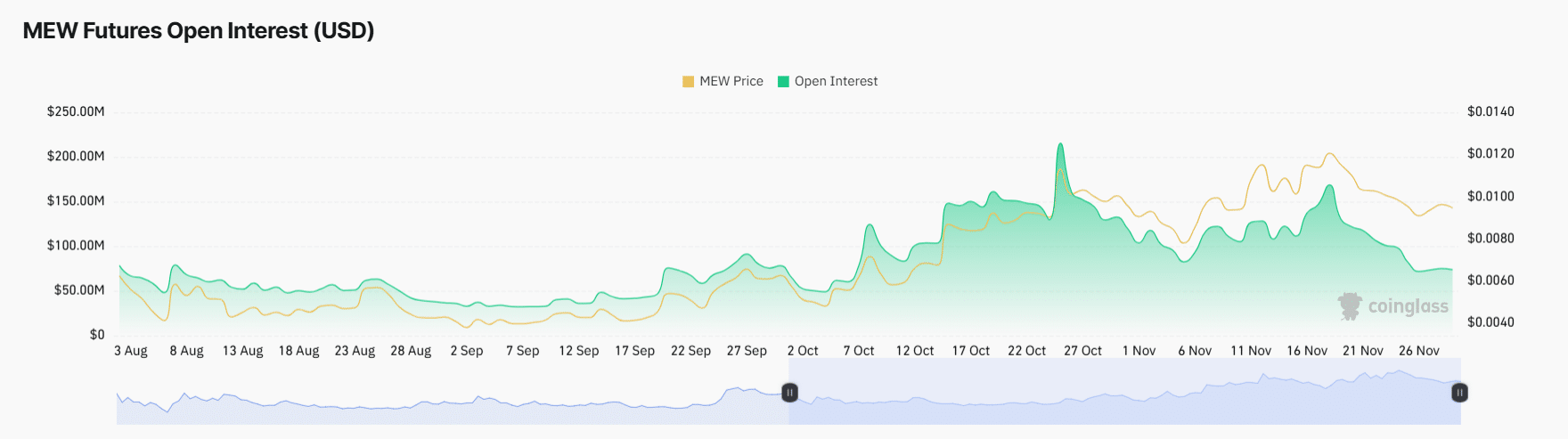

The level of participation in MEW Futures contracts closely followed market trends, reaching a high of around $230 million during the surge in late October.

The increase in Open Interest (OI) suggests a high level of speculative activity, as traders are actively entering trades during the market uptrend.

However, OI has since declined alongside the price, falling below $50 million by late November.

Realistic or not, here’s MEW’s market cap in BTC’s terms

Based on my years of trading experience, I’ve learned that a decrease in new positions being opened and an increase in traders closing existing contracts is often a sign of decreased confidence in sustained upward momentum. In my personal journey as a trader, I’ve witnessed this pattern several times before, usually following periods of market volatility or uncertainty. It reminds me of the importance of staying adaptable and cautious when making trading decisions.

The overall data shows a change towards pessimism in the market. This pattern implies that for MEW to resume its positive trajectory, there needs to be a substantial boost in both trading volume and investor enthusiasm.

Read More

2024-11-30 06:16