- MEW has surged by 47.06% over the past months

- Analyst and market fundamentals indicate a correction as market sentiment turns bearish

As a seasoned analyst with over two decades of market experience under my belt, I must admit that the current trajectory of Cat in a Dogs World (MEW) has piqued my interest. While I’ve seen bull runs like this before, it’s always the subsequent corrections that shape the long-term narrative.

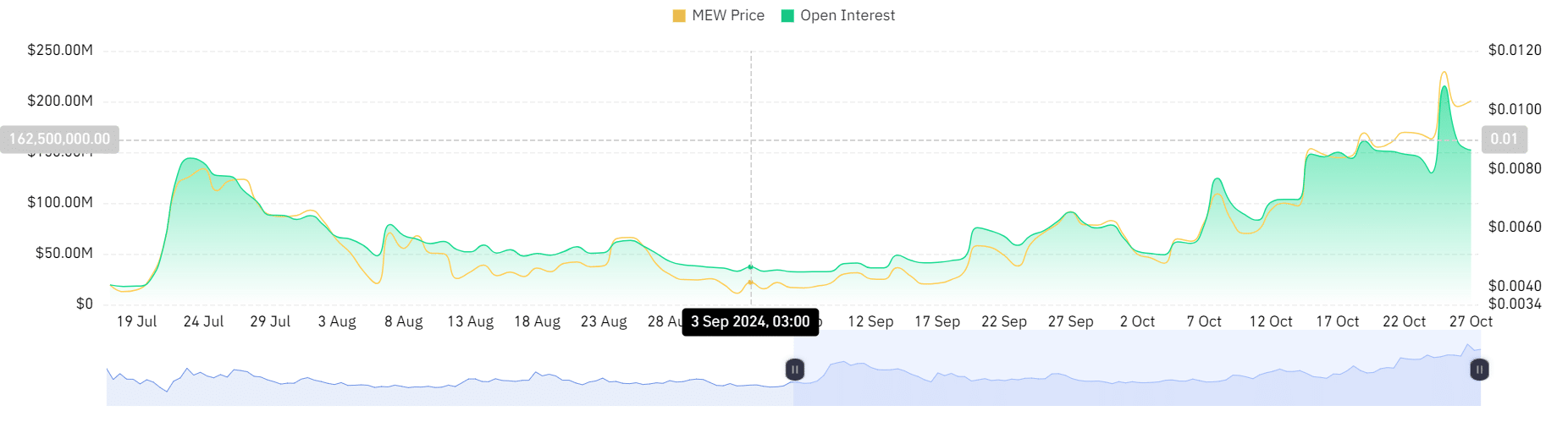

For about a month now, the cryptocurrency known as Cat among Dogs (MEW) has shown significant growth trends. After reaching its lowest point this month at $0.0046, MEW has been steadily climbing upwards.

Currently, MEW is being traded at a price of $0.01. Over the last month, this represents a significant rise of 47.06%. Moreover, the bullish trend seems poised for further growth, with a potential increase of 16.74% projected on weekly charts.

In this present market landscape, I find myself contemplating the potential path of my memecoin investments. Some fellow investors seem hopeful about the current momentum, while others express skepticism, viewing it as a temporary phase that may soon conclude.

One of these analysts who sees a potential pullback was Man of Bitcoin, who suggested a correction citing wave 4 of the Elliot wave.

Market sentiment

In his analysis, Man of Bitcoin posited that MEW was working on wave C of 3 on the upside.

As wave 3 reaches its highest point, it’s typically followed by a corrective wave 4, which suggests that the memecoin might see a drop in its price trends.

A dip beneath the upward trajectory (trendline) suggests a change in market opinion, signifying the conclusion of Wave 3 and the onset of Wave 4. During this phase, the memecoin is expected to experience a retreat.

Using this comparison, it seems that the memecoin could soon experience a downward correction, despite its ongoing uptrend.

What MEW’s chart says

Without a doubt, the analysis presented earlier serves as a warning signal, suggesting that the memecoin might dip. Nevertheless, it’s crucial to cross-check other market signals and see what insights they offer.

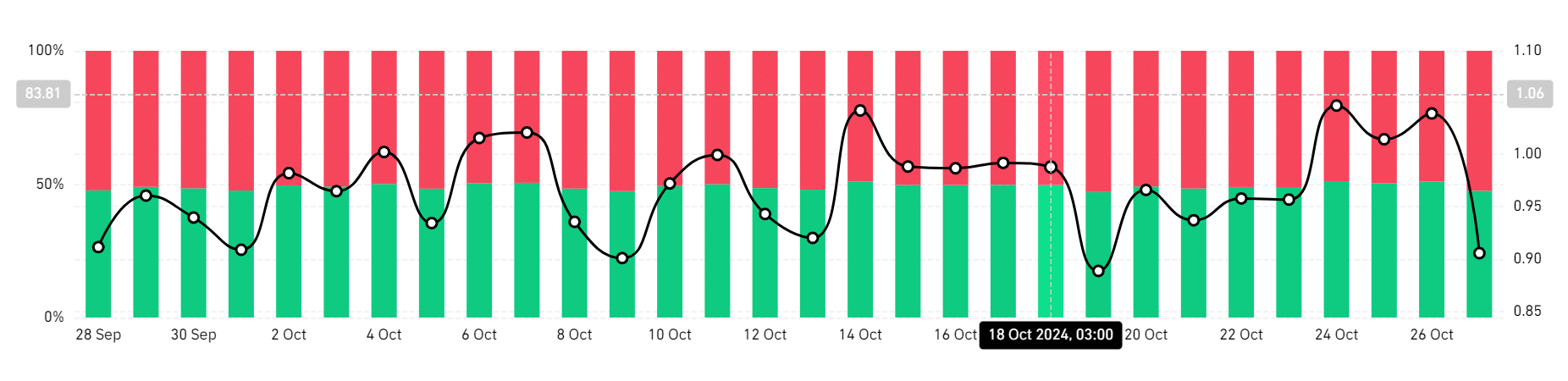

Initially, it was evident from MEW’s long-short ratio that a larger proportion of trades were short positions compared to long ones. Specifically, short positions accounted for approximately 52.7%, while long positions represented 47.2%. This implies that the majority of traders held a bearish outlook and were wagering on prices decreasing in the market.

Furthermore, MEW’s open interest decreased by about 29.30% during the last two days, going from $215 million to $152 million. This decrease implies that investors are closing their positions without creating new ones, which may indicate a diminished confidence in the memecoin’s future trajectory.

According to MEW’s Directional Movement Index, the present trend is weakening, with bears potentially taking over the market as the ADX spiked to 54.8 and the +DI dipped to 37, suggesting a shift in power dynamics.

Realistic or not, here’s MEW’s market cap in BTC’s terms

Essentially, despite MEW continuing to rise, there was a noticeable change in public opinion about the memecoin. Given this shift, it appears that the uptrend for this memecoin was nearing its end, suggesting a market adjustment or downturn might be forthcoming.

If the value of the meme coin decreases, it should find a stabilizing point at approximately $0.0087. In order to continue rising, the meme coin needs to stay above its Simple Moving Average (SMA), which is currently around $0.0095.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Quick Guide: Finding Garlic in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- BLUR PREDICTION. BLUR cryptocurrency

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- How to Get to Frostcrag Spire in Oblivion Remastered

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Shundos in Pokemon Go Explained (And Why Players Want Them)

2024-10-28 02:16