- Saylor could announce the buying of $3 billion BTC after the latest hint.

- Will the announcement boost BTC to hit the elusive $100K level?

As a seasoned researcher with years of experience tracking the crypto market, I find myself intrigued by the latest developments surrounding MicroStrategy and Bitcoin. Michael Saylor’s hint at a potential $3 billion BTC purchase has certainly stirred excitement among investors, raising questions about whether this move will finally propel Bitcoin to the elusive $100K level.

Michael Saylor, one of the co-founders of MicroStrategy, suggests that Bitcoin (BTC) could potentially be a significant recipient from the funds raised through their recent bond sale.

In his 24th November X post, Saylor indicated that the firm needs to buy more BTC.

“We need more green dots on SaylorTracker.com.”

![]()

Previously, when he published a comparable post, he followed it up with a 51.78K BTC offer. This led to speculation that a similar event might occur, potentially amounting to a $3 billion purchase using the funds from the recent bond sale (approximately 30K BTC).

Will it push BTC to $100K?

Currently, the company owns approximately 331,200 Bitcoins, valued at more than $32 billion. Earlier, the company disclosed an ambitious plan to procure Bitcoin to the tune of $42 billion using a 21/21 approach.

In simpler terms, $21 billion of the total amount will be obtained through debt instruments such as convertible notes, while the rest will come from selling shares. The pace of implementing this plan seems to have gained speed recently, based on recent developments.

Through serving as a Bitcoin intermediary, the company’s stock, MSTR, has experienced remarkable growth, benefiting significantly from the unpredictable nature of cryptocurrencies and its substantial Bitcoin holdings.

Based on insights from data analytics firm Amberdata, Mastercard’s anticipated volatility (future predictions) continues to be high. This could indicate that the company may issue additional debt and stocks to invest further in Bitcoin. Such a move might provoke a temporary increase for both Mastercard and Bitcoin.

Part of the Amberdata report read,

As an analyst, I find myself intrigued by the current market dynamics, which lead me to ponder if there’s still room for Microsoft Corporation (MSTR) to deliver an extraordinary performance. Given the potential surge in Bitcoin (BTC) beyond $100k, causing a FOMO-driven price increase to $120-$140k, I cannot rule out the possibility that MSTR could potentially reach $1,500 by the end of the year. However, it’s essential to approach such predictions with caution and maintain a balanced perspective.

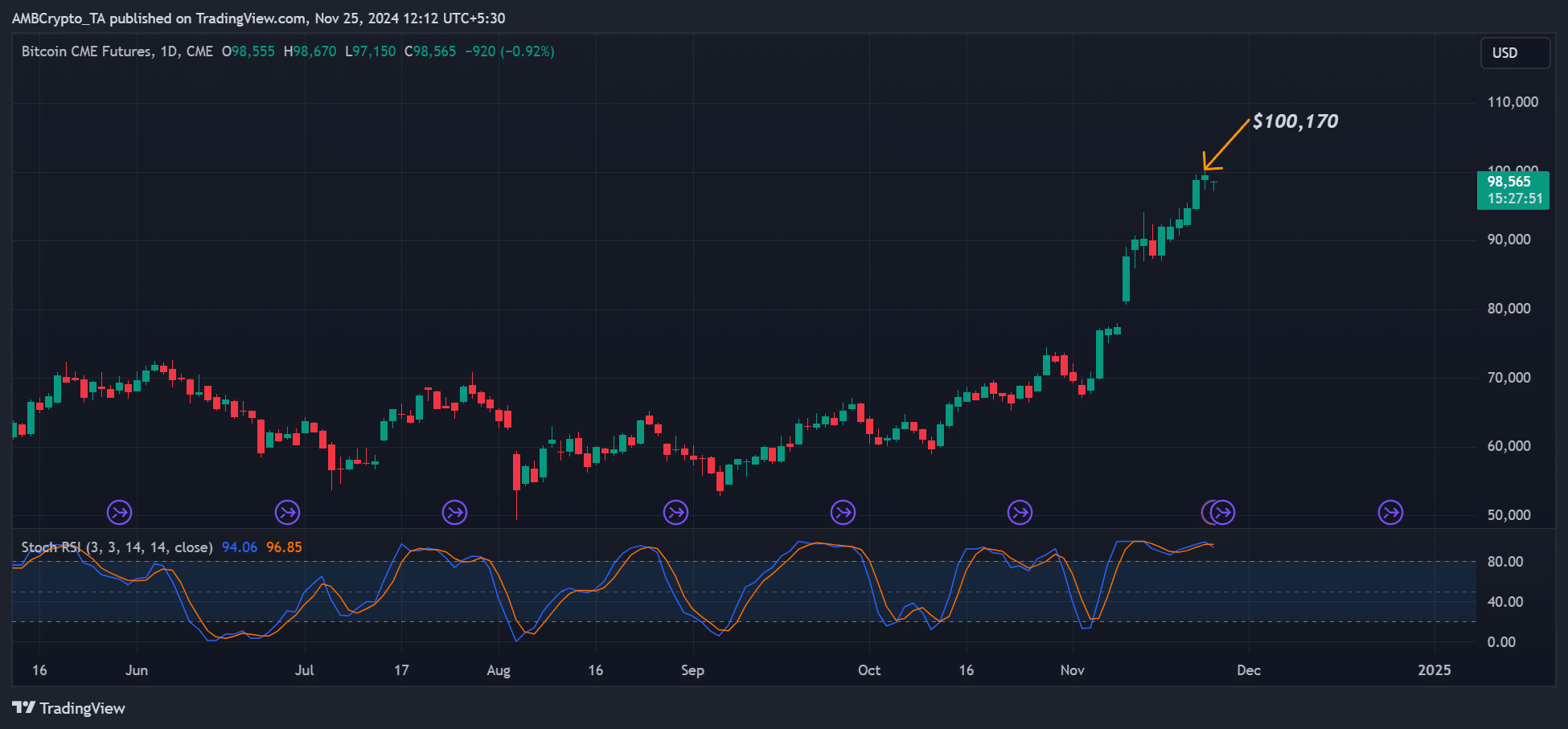

Currently, Bitcoin is worth approximately $98,300 following a 9% surge over the past week. Yet, the hoped-for $100,000 mark failed to materialize in the open market during the weekend.

It’s worth noting that the record high for CME Bitcoin Futures was reached at $100,170, suggesting the possibility that the actual Bitcoin market might soon surpass the $100K mark. However, it’s unclear if Michael Saylor’s announcement of Bitcoin purchases will speed up this target.

Contrarily, MSTR was worth $421 at the time of publication, having increased by 6% prior to the US market’s opening on November 25th. Analysts predicted a surge in early buying for the stock, given its potential inclusion in the Nasdaq 100 before December 2024.

Read More

2024-11-25 16:10