- Michael Saylor predicts Ethereum will be classified as a crypto-asset security

- Charles Hoskinson was quick to respond to the Bitcoin maxi’s comments

As an experienced analyst in the cryptocurrency space, I believe that both Michael Saylor’s and Charles Hoskinson’s perspectives are valid, but their comments should be taken with a grain of salt. The regulatory landscape for digital assets is constantly evolving, and predictions about how specific tokens will be classified are just speculation at this point.

The US government is moving forward with cryptocurrency market regulation, focusing initially on exchanges like Kraken, Coinbase, and Uniswap. It now appears that Ethereum [ETH] is the next target of this regulatory action. Opinions are varied regarding this development.

As a financial analyst, I would express it this way: I acknowledge that there is ongoing debate regarding the Securities and Exchange Commission’s (SEC) characterization of Ethereum (ETH) as a security. However, from my perspective, I align with MicroStrategy’s executive chairman, Michael Saylor, who holds the belief that ETH falls under this classification.

Michael Saylor’s argument

As a crypto investor, I’ve been following the classification debate surrounding Ether, the leading altcoin. And according to Michael Saylor, the esteemed executive who graced the MicroStrategy World 2024 conference, his take is that Ether should be categorized as a crypto-asset security instead of a commodity.

“By the end of May, it will become apparent that Ethereum won’t gain approval. At that point, it will be understood by all that Ethereum is classified as a crypto asset security rather than a commodity.”

He went on to say,

Following that, you’ll notice that Ethereum, BNB, Solana, Ripple, Cardano, and other crypto assets below them have not been registered as securities.

In simpler terms, according to Saylor’s perspective, those mentioned cryptocurrencies will never gain acceptance as legitimate crypto-assets in Exchange-Traded Funds (ETFs) on the Wall Street market or among traditional institutional investors.

Charles Hoskinson steps in

As a crypto investor, I’ve observed that not everyone agreed with Michael Saylor’s recent comments. In response, Charles Hoskinson, the co-founder of Cardano, expressed his criticism on X, formerly known as Twitter.

If Michael’s sole justification for Bitcoin is that governments approve of it while despising all other cryptocurrencies, he is taking a position contrary to the historical trend.

As a dedicated crypto investor, I’ve come across this perspective many times: Bitcoin maximalists often argue that other cryptocurrencies may be considered illegal or fraudulent by authorities. This criticism also adds fuel to an ongoing debate within our community – the question of legitimacy for alternative digital assets beyond Bitcoin.

Hoskinson has previously advocated for altcoins. In fact, just last month, Forbes identified several cryptocurrencies as “crypto zombies.” Among them were Cardano (ADA), Ripple (XRP), and Bitcoin Cash (BCH).

Responding to the aforementioned criticism Hoskinson said,

As a crypto analyst, I’d rephrase that statement as follows: “Amongst us at Tezos, Algorand, Bitcoincashorg, Ripple XRP, and StellarOrg, Forbes has labeled us ‘Crypto Zombies.’ However, I beg to differ. Rather than being mindless creatures, we are the ones who possess the intellectual depth and understanding required to navigate the complexities of the cryptocurrency landscape.”

As a neutral analyst, I’d like to clarify the recent controversy surrounding Cardano (ADA) instigated by Ben Armstrong, also recognized as BitBoy Crypto. He declared with conviction that “ADA is DEAD for REAL.” In response, Hoskinson took it upon himself to address these concerns directly.

“Ben, I’m sorry but once you board the Ada train towards cryptocurrenies, our conversation on this topic comes to an end. Wishing you success and prosperity in your future endeavors.”

Investors’ interests remain unaffected

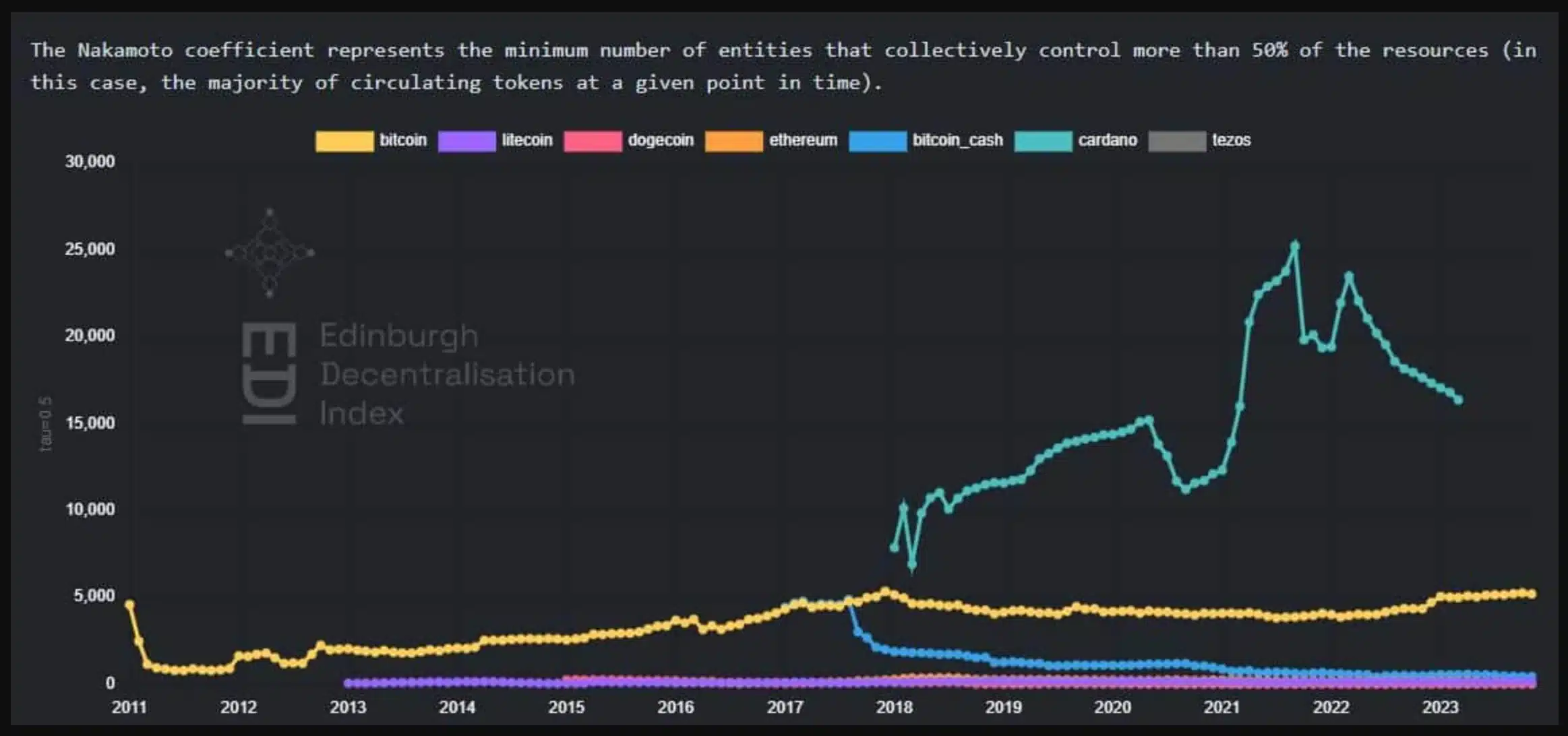

As a crypto investor, I’d interpret those remarks to mean that making predictions about the market is essentially taking an educated guess. However, it’s essential to keep in mind that these speculations are not set in stone. Intriguing new data has emerged, suggesting that Cardano boasts a more significant degree of decentralization than other altcoins. Specifically, this is indicated by its higher Nakamoto coefficient.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

- Superman Rumor Teases “Major Casting Surprise” (Is It Tom Cruise or Chris Pratt?)

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2024-05-04 13:11