- Saylor owns 17,732 Bitcoin, representing 10% of MicroStrategy’s total holdings.

- MicroStrategy’s stock surged 1,000% since adopting Bitcoin, but a recent dip of over 90% was noted.

As a seasoned crypto investor and follower of MicroStrategy’s moves since their initial Bitcoin acquisition, I find Michael Saylor’s recent disclosure of his personal BTC holdings both intriguing and reassuring. His unwavering support for Bitcoin, demonstrated by his continuous accumulation without selling a single token, is commendable.

Michael Saylor, the co-founder and head honcho at MicroStrategy, who is well-known for his steadfast backing of Bitcoin [BTC], recently shared that he’s personally committed a substantial amount to this digital currency.

Saylor’s Bitcoin holdings revealed

In a recent interview with Bloomberg, Saylor revealed that he owns 17,732 BTC and emphasized that he has not sold a single one of these digital assets.

“I’m consistently adding to my holdings. I strongly believe it makes an excellent financial asset for individuals, families, businesses, or even nations. I can hardly think of a better way to invest my funds.”

People paid close attention to this announcement as it marked the first occasion in four years where Saylor revealed specific information about his private Bitcoin assets.

Although Saylor didn’t reveal the exact number of Bitcoins he currently owns, he did acknowledge that he has not sold any of his bitcoins since first disclosing them.

MicroStrategy’s present Bitcoin holdings

Beyond his own investments, Saylor’s company, MicroStrategy, now stands as the top publicly-traded corporation with a Bitcoin stash. By the close of July, they had acquired approximately 226,500 Bitcoin tokens.

With the current market value, this extensive reserve is worth approximately $12.7 billion.

That being said, Saylor’s individual BTC holdings are notably significant, representing around 10% of MicroStrategy’s entire Bitcoin portfolio.

Remarking on the same, an X user- Yakuza said,

“Really not surprised. He’s been a true advocate for #bitcoin as long as I can remember.”

Saylor’s remark on Senator Lummis’s BTC bill

In alignment with Saylor’s recent interview on CNBC, he likened Senator Lummis’s Bitcoin reserve bill to a “historic” or “significant” moment for digital assets, using the analogy of the Louisiana Purchase.

By applying this term to Lummis’ Bitcoin reserve bill, Saylor suggests that it may significantly influence the acceptance of Bitcoin within the United States, possibly placing the country at the forefront of the cryptocurrency sector.

This underscores not only Saylor’s personal investment in Bitcoin but also his advocacy for both his company and the nation to embrace and appreciate its value.

Market trends

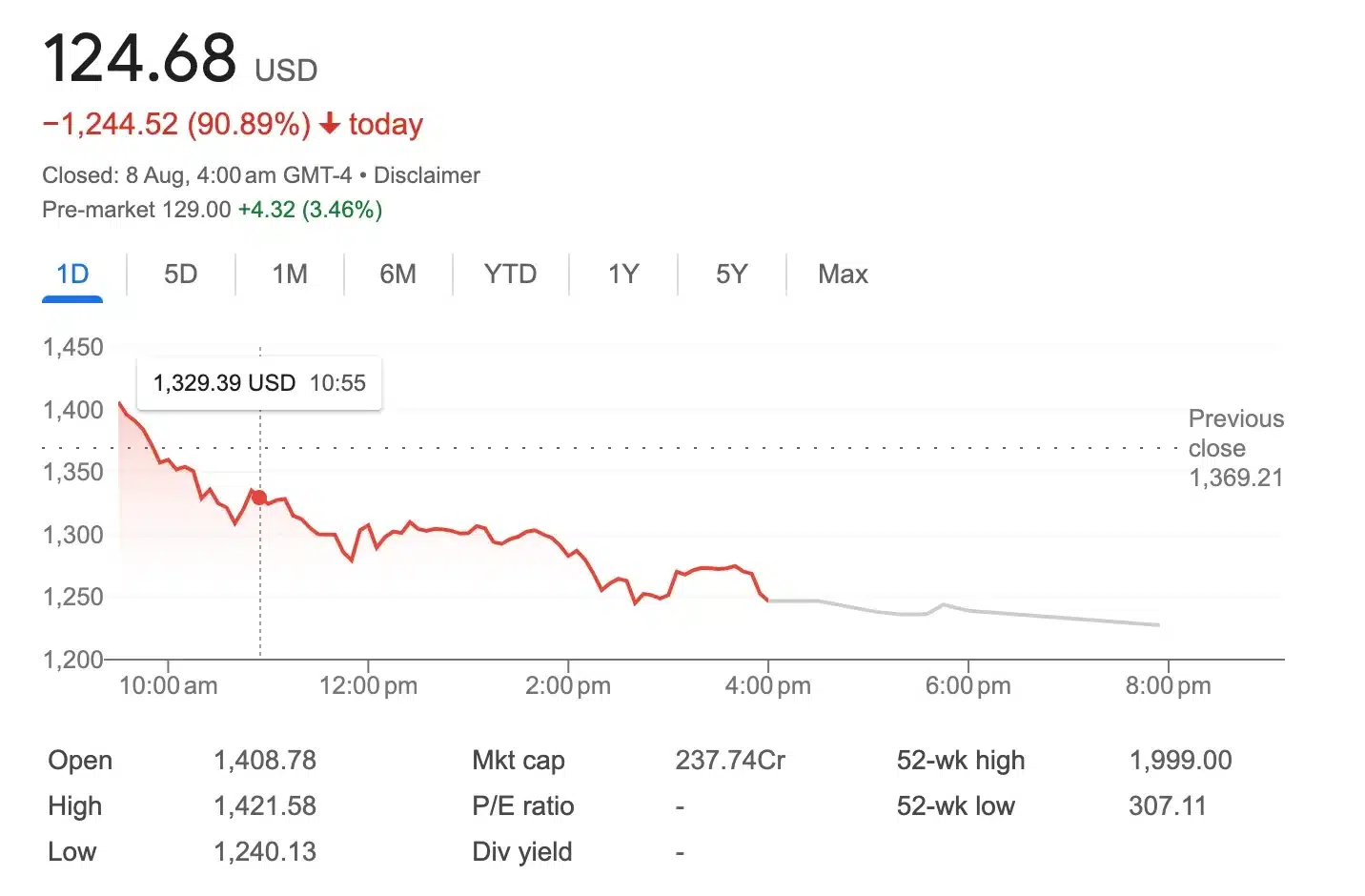

Just as anticipated, MicroStrategy’s shares have soared approximately 1,000% following the company’s decision to adopt a Bitcoin purchasing approach.

Over the same timeframe, BTC itself has seen a substantial increase of over 500%.

Nevertheless, while Michael Saylor’s daring Bitcoin investment and MicroStrategy’s impressive stock rise are noteworthy, the present market scenario presents a striking difference.

Following the recent update, MicroStrategy’s stock has dropped significantly more than 90%, whereas Bitcoin, currently valued at approximately $57,000, has seen a relatively small rise of about 0.53% in value.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- PGA Tour 2K25 – Everything You Need to Know

- MrBeast Slams Kotaku for Misquote, No Apology in Sight!

2024-08-08 16:07