Microsoft’s share price took a battering over the past couple of weeks, what’s going on?

Someone sent me an article created by AI yesterday claiming Xbox’s lack of presence at The Game Awards caused a huge drop in its stock price. While it was an interesting thought, the claim wasn’t actually true.

Microsoft’s stock price has dipped about 7% in the last month, but overall it’s still up 5% for the year and has more than doubled in value over the past five years. CEO Satya Nadella has been credited with boosting Microsoft’s stock performance, but recently the stock has been acting a bit strangely.

Investors aren’t concerned about Xbox missing The Game Awards, despite a significant drop in Microsoft’s market value – over $170 billion, which is likely more than the value of Xbox itself. The recent decline in Microsoft’s stock price is primarily due to investor concerns surrounding artificial intelligence, both in how it directly affects Microsoft and the broader AI landscape.

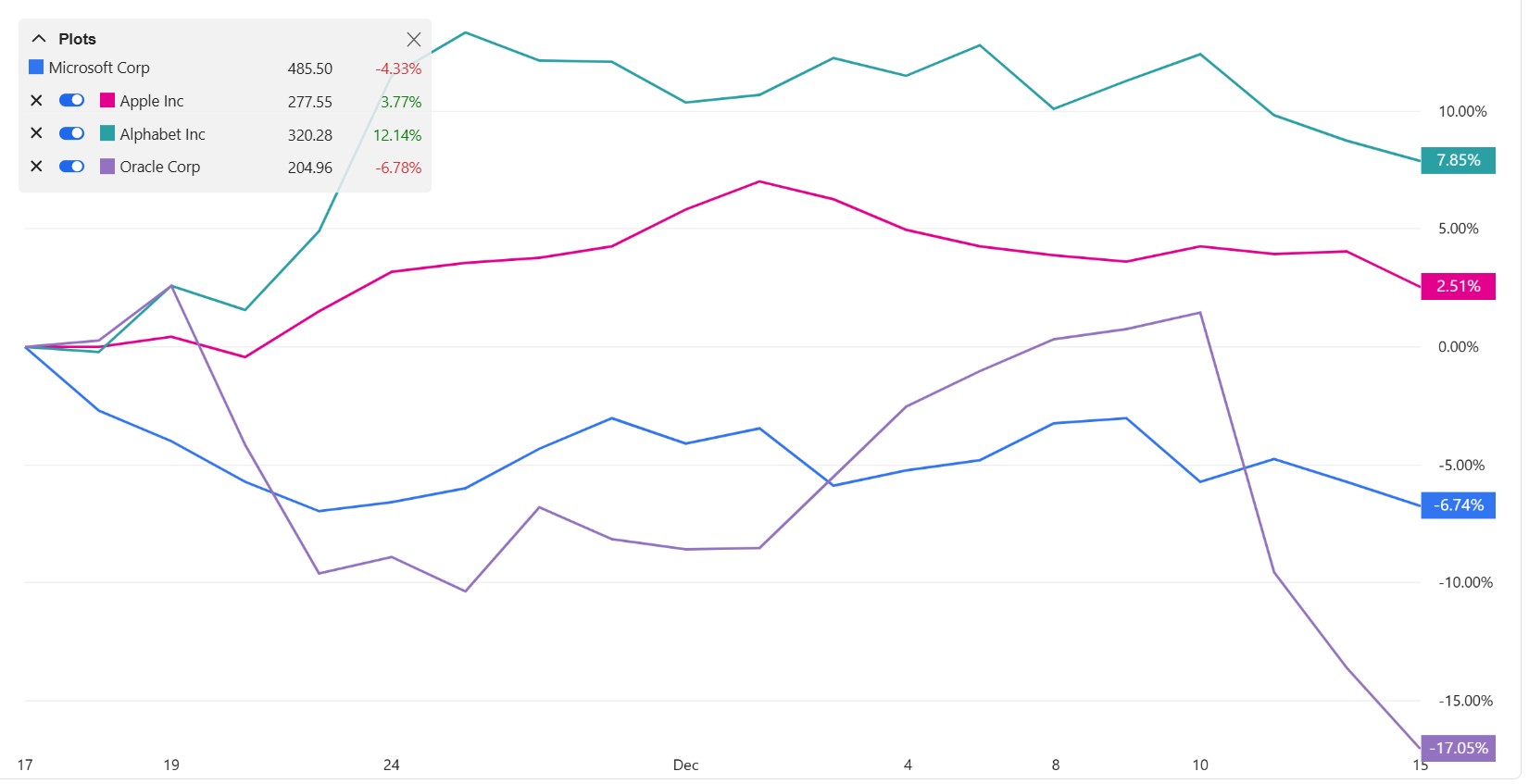

Google is up, Microsoft is down

Microsoft’s stock has been falling due to a mix of issues, all stemming from its role in the rapidly evolving field of artificial intelligence.

Artificial intelligence is currently a major force in the stock market. Companies like NVIDIA, Meta, and Oracle are leading the way, and Microsoft, through its partnership with OpenAI, has become a close second in overall market value, trailing only NVIDIA. NVIDIA’s technology is essential for everything from cloud computing to running AI programs, and companies like Microsoft and Amazon are selling NVIDIA’s hardware to help other businesses develop their own AI capabilities.

Microsoft isn’t leading the way with new AI technology; it’s mostly using AI models created by OpenAI. Recently, investors have become worried that the rush to develop AI products won’t actually be profitable. We’ve seen this worry play out in the stock market with companies like Oracle and Broadcom, both of which experienced significant drops after disappointing financial reports. Broadcom’s stock fell 11% because of concerns about a claimed $73 billion in future orders that haven’t materialized. Broadcom, Oracle, OpenAI, and others have been announcing future purchase commitments, but are struggling to actually provide the computing power they’ve promised due to various challenges.

AI companies, especially those using NVIDIA technology, are creating a massive and growing need for computing power. Microsoft CEO Satya Nadella recently noted that his company has graphics processing units (GPUs) ready to use, but lacks the electrical power to actually run them. The U.S. power grid is struggling to keep up with the demands of these large data centers, leading investors to worry that the growth of server infrastructure may slow down in the near future.

Tech giants such as Microsoft and Google are working hard to improve efficiency and overcome current limitations. OpenAI has also made its models more efficient, as computing power isn’t increasing quickly enough to keep up with demand. However, investors are worried that AI businesses may not ultimately be profitable.

Both Broadcom and Oracle recently worried investors by signaling they’ll need to spend a lot more money to upgrade their technology. This increased spending is driven by the growing demand for computing power from companies developing artificial intelligence, like OpenAI and Anthropic. Oracle, which has been heavily investing in AI, announced that its revenue and profits were lower than expected. They also warned that their spending will be about $15 billion higher than previously forecast by 2026, and currently, their AI investments aren’t yet generating profits, leading to negative cash flow. As a result, investors reacted by selling off Oracle stock, causing its value to drop around 11%.

As a researcher following the tech industry, I’m observing that while Microsoft’s diverse range of businesses offers some protection against sudden market shifts, it’s not immune. What’s particularly interesting right now is that investors are starting to closely examine spending on AI infrastructure. They’re concerned that valuations are becoming unrealistic and aren’t supported by actual performance.

Google’s Gemini Pro models are consistently outperforming OpenAI’s, which is giving Google a significant advantage, especially for Microsoft. Google’s control over its own technology – including the servers that power its AI – also helps it reduce costs. Recent reports suggest Microsoft is lowering its expectations for AI product sales, as both consumers and businesses appear hesitant to invest.

Several other issues are also contributing to the situation. U.S. state attorneys general recently warned Microsoft and other AI companies to address problems with their technology, like making up false information and excessively flattering users. This came after several cases where AI systems provided harmful suggestions to people who were struggling. While regulations are meant to protect individuals, there’s often concern that they could negatively impact a company’s profits.

AI stocks might be coming back to Earth, but the tech is here to stay

Microsoft Copilot has received a lot of criticism, and rightfully so. Its features in apps like Notepad, Paint, and Photos feel unfinished and poorly implemented. Microsoft seems unsure how to effectively integrate AI into Windows 11, even as they plan to make AI a central part of the next version of Windows (Windows 12), which many users find frustrating.

Microsoft’s Copilot is proving most successful with large organizations. Specifically, building AI tools that meet strict industry regulations for businesses like law firms and banks appears to be a strong strategy. These companies benefit from Copilot’s centralized, IT-managed features, especially those already using Microsoft Azure. GitHub Copilot has also gained traction, providing programmers with a user-friendly option similar to Anthropic’s Claude.

Recently, many investors believe Google is becoming the leading contender in the development and application of this technology. While Google started slowly, its initial AI attempts actually harmed its search engine reputation and were plagued by inaccurate and bizarre results. However, with the release of Google Gemini Pro and its Nano Banana image generation tools a couple of years later, Google now surpasses OpenAI, quickly erasing Microsoft’s previous lead in just one month.

As of today, Google’s market value has surpassed Microsoft’s, moving Google into third place while Microsoft falls to fourth. Interestingly, Apple has improved its standing by abandoning its own AI development and instead using Google’s technology to power its Siri assistant and other AI features. This shift has effectively pushed Microsoft’s AI solutions off of mobile devices, possibly permanently.

I’ve noticed Microsoft in a familiar position – needing to lean heavily on Windows and businesses to get its AI products out there, since they don’t have a phone operating system of their own. While Windows is still a big player in the computing world, there’s a lot of negative sentiment surrounding Windows 11 these days. What’s really interesting is how many organizations, even governments, are choosing open-source options like Linux instead of Microsoft’s products. It seems Apple and Google have completely shut Microsoft out of the mobile market, and that earlier decision to stop developing Windows Phone is definitely coming back to haunt them.

A small drop of around 5% isn’t a huge surprise, but it, like Time Magazine recently overlooking Microsoft, suggests the AI landscape is shifting. Microsoft led the AI discussion for the last two years, but Google now appears ready to become the leader again.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Best Controller Settings for ARC Raiders

- The Best Members of the Flash Family

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Battlefield 6 Season 2 Update Is Live, Here Are the Full Patch Notes

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- Dan Da Dan Chapter 226 Release Date & Where to Read

2025-12-15 19:40