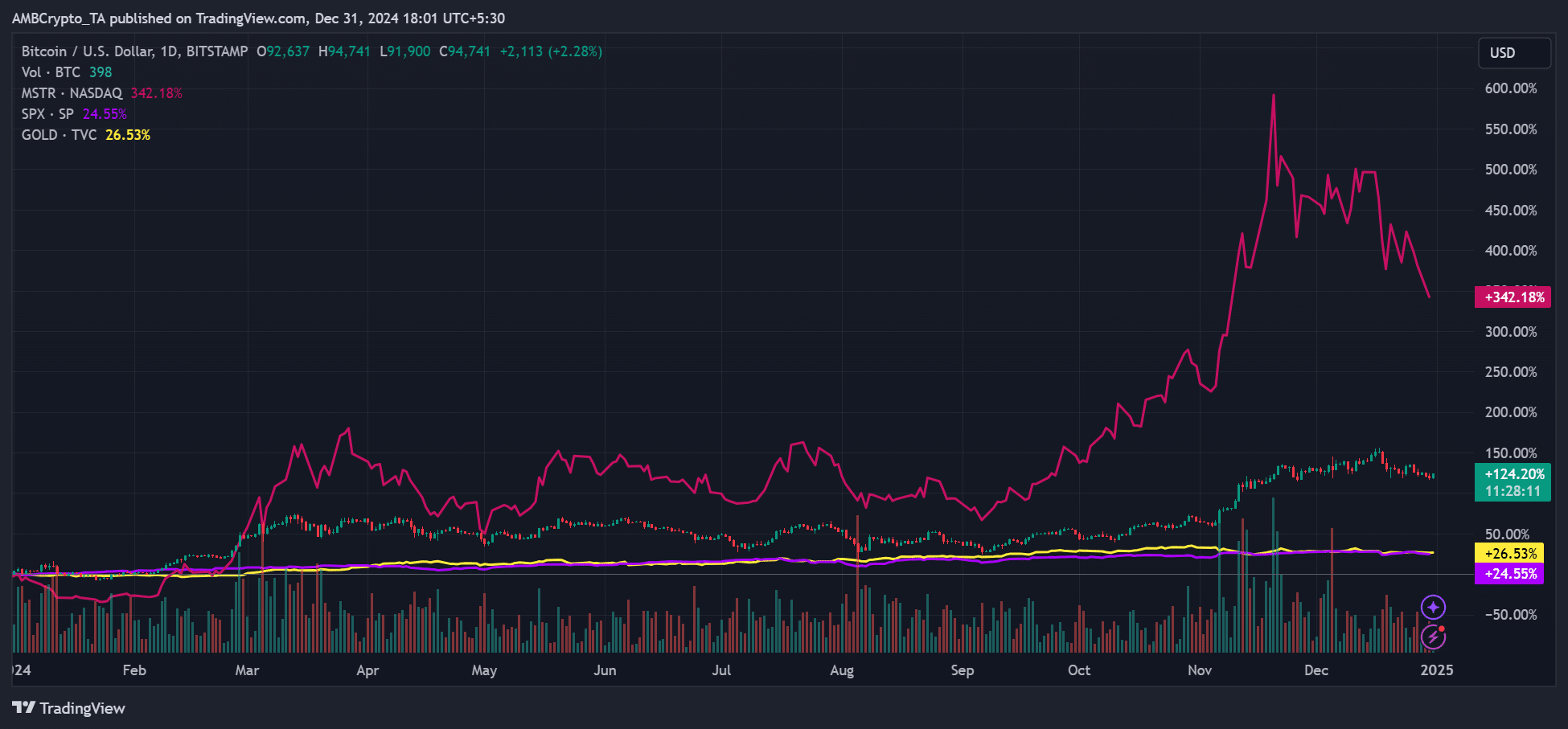

- MicroStrategy’s MSTR saw 342% yearly gains compared to BTC’s 122%.

- However, ongoing BTC weakening could drag MSTR lower in January.

As a seasoned financial analyst with over two decades of experience in the market, I have seen my fair share of bull runs and bear markets. The performance of MicroStrategy (MSTR) and Bitcoin (BTC) in 2024 has certainly been intriguing.

In my career, I’ve witnessed the rise and fall of various assets, from the dot-com bubble to the housing market crash, and now the digital asset revolution. The fact that MSTR saw a whopping 342% yearly gain compared to BTC’s 122% is nothing short of remarkable. It’s a testament to Michael Saylor’s bold strategy and the increasing institutional adoption of Bitcoin.

However, as with any investment, there are always risks involved. The ongoing weakening of BTC could potentially drag MSTR lower in January, as predicted by QCP Capital. I remember back in 2008 when Lehman Brothers filed for bankruptcy, causing a global financial crisis. It’s essential to be mindful of market trends and not get too carried away by short-term gains.

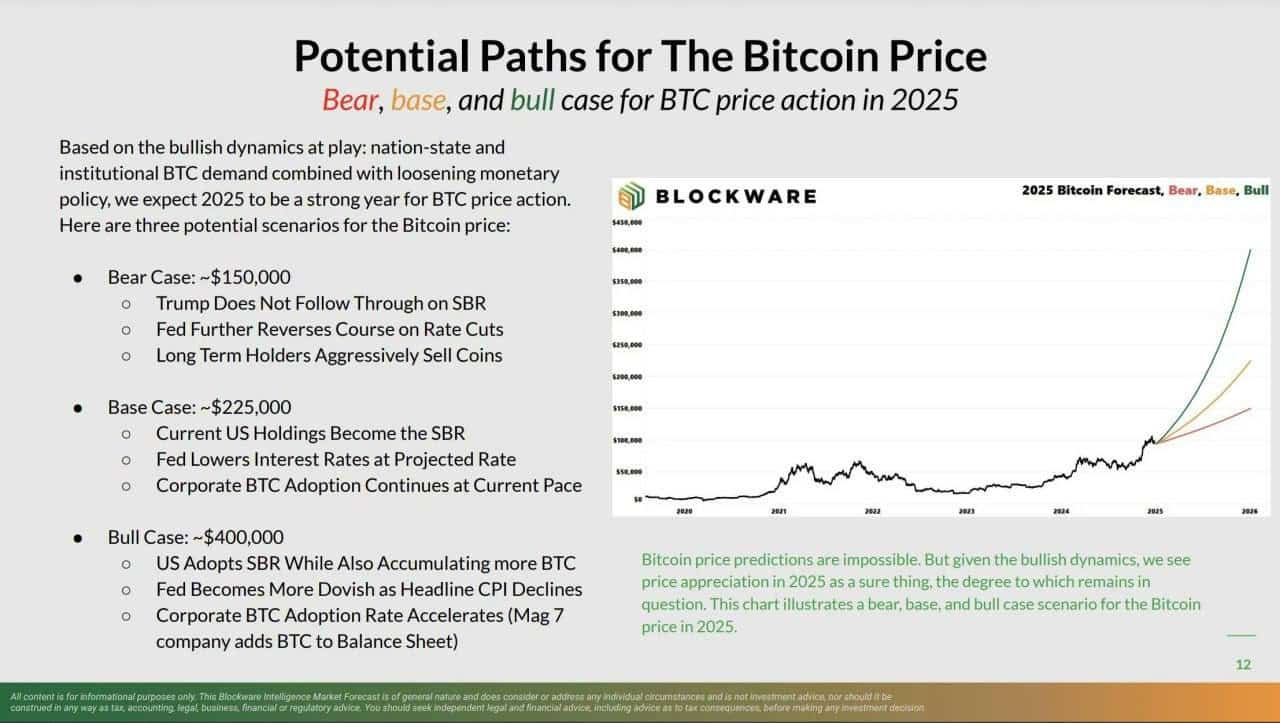

On the flip side, if we look at the projections made by Blockware, BTC could potentially hit $225K or even $400K in 2025, provided corporate treasury adoption accelerates and a US BTC strategic reserve is created. This would undoubtedly benefit MSTR shareholders as they are heavily invested in Bitcoin.

In my experience, it’s always wise to diversify one’s portfolio and not put all eggs in one basket. So, while I am bullish on the long-term prospects of both BTC and MSTR, I would advise caution in the short term given the potential market volatility.

Lastly, as a light-hearted note, let me share a joke that always cheers me up during these uncertain times: Why did Bitcoin cross the road? To get to the other blockchain! Jokes aside, stay informed and make wise investment decisions!

At the close of the year, MicroStrategy acquired an additional 2,138 Bitcoins, valued at approximately $209 million, thereby increasing their total Bitcoin holdings to a staggering 446,400 coins. This substantial investment is now worth over $41 billion.

Currently, the front-runner within Bitcoin’s corporate holdings owns approximately 2.12% of the entire Bitcoin supply, with the majority of these benefits being distributed to shareholders of MicroStrategy (MSTR).

On a YTD (year-to-date) basis, MSTR logged 342% gains, while BTC logged 122% over the same period.

2024 saw Mastershare (MSTR) investors achieve returns almost three times greater than their Bitcoin counterparts. Remarkably, both MSTR and Bitcoin surpassed gold and U.S. stocks (specifically the S&P 500), which posted annual gains of 26% and 24%, respectively.

So, what’s next for BTC and MicroStrategy in 2025?

The company intends to increase its stock offering, selling up to 10 billion shares of MSTR, in order to boost its Bitcoin purchases at a faster rate. Many experts predict that this move might significantly increase the value of Bitcoin.

If the pace of Bitcoin’s corporate treasury adoption quickens and a U.S. strategic Bitcoin reserve is established, Blockware forecasts that Bitcoin could reach anywhere between $225,000 to $400,000 by 2025.

However, according to the Blockware team, BTC could only reach $150K in a ‘bear case’ scenario.

In other words, QCP Capital forecasted that Bitcoin might stay relatively stable through January due to historical patterns. This could potentially limit MicroStrategy’s immediate profits until the market rebounds again.

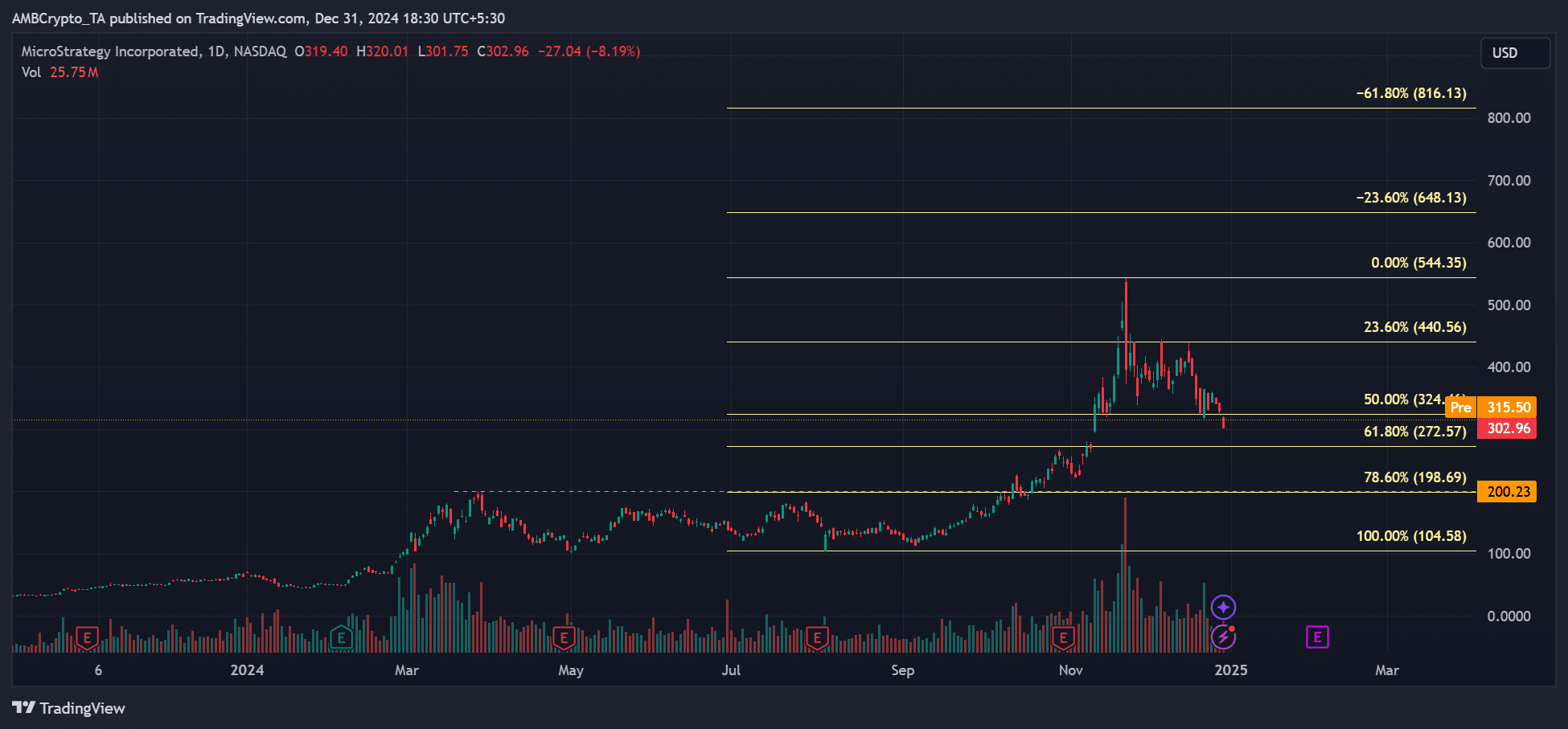

Currently, MSTR has dropped by 45% since it reached a high of $543, with its value holding steady around $300 as we speak. This drop coincides with Bitcoin’s significant decrease from $108,000 to $92,000.

Should there be any additional weakness, it might present attractive purchasing chances for MSTR, particularly if the market rebounds in January.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2025-01-01 08:08