- MicroStrategy plans a $700 million convertible note offering amid Bitcoin market uncertainty.

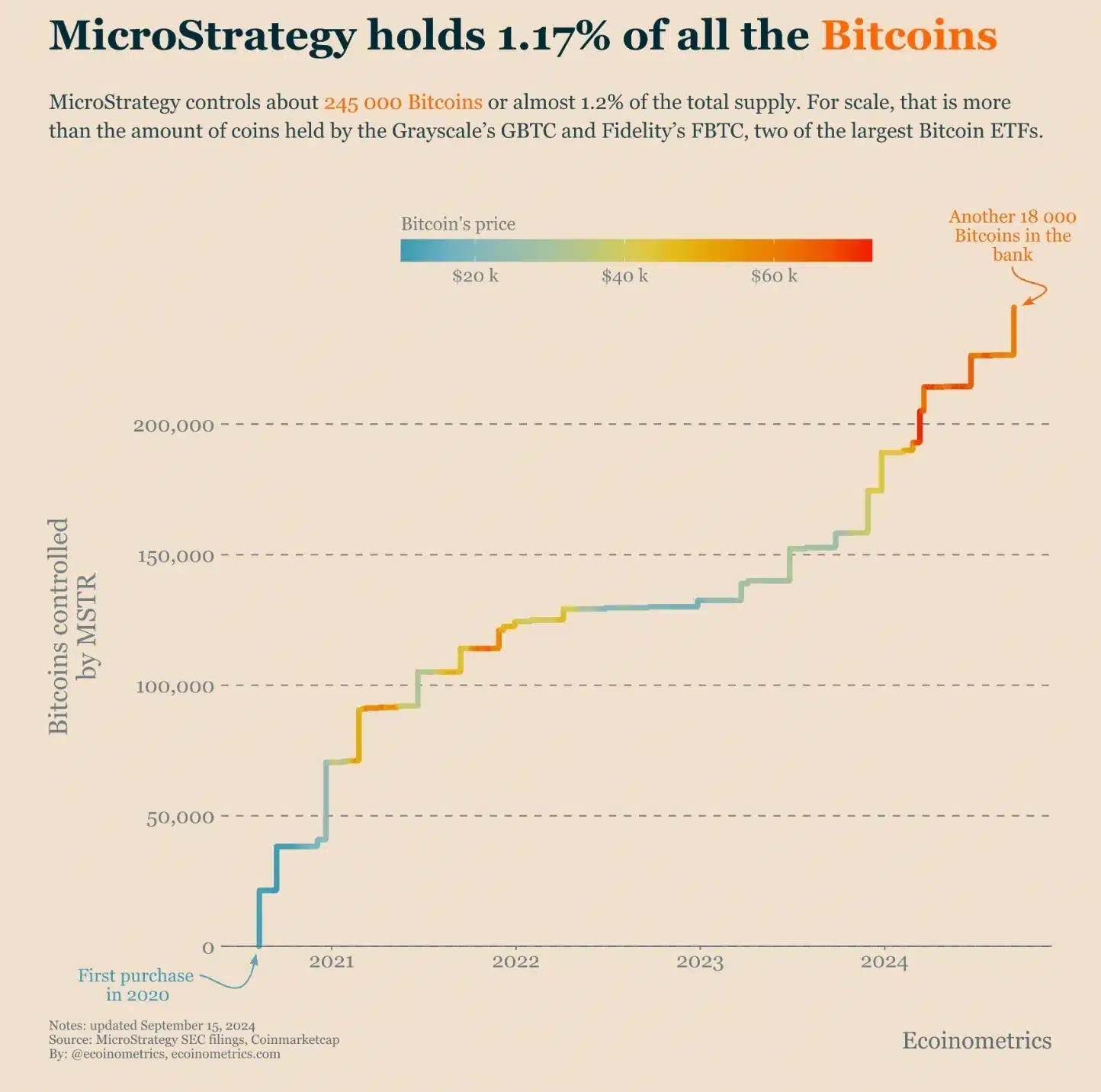

- MicroStrategy now holds 1.17% of the total Bitcoin supply, increasing its crypto dominance.

As a seasoned researcher with years of experience navigating the volatile world of cryptocurrencies and traditional markets alike, I find myself intrigued by MicroStrategy’s latest move to offer $700 million worth of convertible senior notes amid Bitcoin’s market uncertainty.

In simpler terms, the publicly traded company MicroStrategy, known for its work with Bitcoin (BTC), announced it intends to sell $700 million worth of notes that can be converted into shares by 2028. This is stated on the Nasdaq stock exchange.

This announcement comes at a time when BTC’s price is facing resistance around the $60,000 mark.

Despite this, the cryptocurrency showed positive movement, with its value rising by 1.02% in the past 24 hours to $59,173.

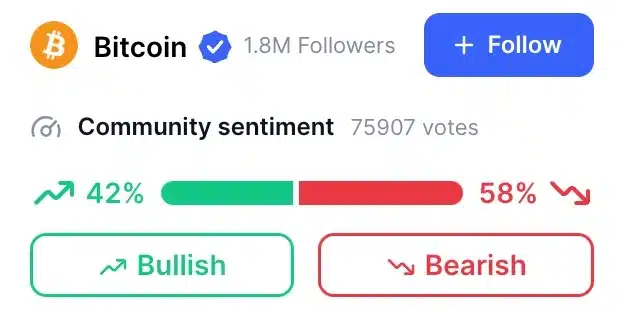

However, sentiment within the Bitcoin community remains divided.

As a researcher, I’ve discovered that, based on data from CoinMarketCap, approximately half of the investors (42%) are optimistic about Bitcoin (BTC), while the remaining majority (58%) express pessimism or bearishness. This split in outlook underscores the market’s current uncertainty surrounding BTC.

Microstrategy’s Bitcoin strategy

As per the announcement, these notes are set for a private sale exclusively to institutions that meet the eligibility criteria outlined in Rule 144A under the Securities Act of 1933.

As a researcher, I’d describe convertible senior notes as a type of financial instrument that can be transformed into company shares (equity) under specific circumstances. The term “senior” signifies that these notes are prioritized over other outstanding debts when it comes to liquidation or bankruptcy proceedings.

This private offering, targeted towards institutional investors who meet specific qualifications, enables the company to avoid stringent rules associated with public offerings. The aim is to procure funds using this debt instrument, providing an opportunity for investors to potentially transform their investment into the company’s shares if they choose.

Community reacts

Nevertheless, Bitcoin skeptic Peter Schiff seemed unperturbed by this turn of events, as shown in a recent post on platform X, where he emphasized that this does not change his stance.

“Oh no, here we go again. When Master (MSTR) is the last one buying, what happens then? At some point, there’s a limit to how much debt Master can take on to prevent the structure from crumbling.

In the midst of current advancements, Ecoinometrics has shared that MicroStrategy currently owns approximately 1.17% of all existing Bitcoin.

The business is consistently growing its Bitcoin savings, placing it among the top holders compared to many Bitcoin Exchange-Traded Funds (ETFs).

Other firms following Microstrategy’s path

In the footsteps of MicroStrategy’s daring Bitcoin approach, other companies are now adopting similar tactics.

Regardless of Bitcoin’s recent difficulties, Metaplanet – a publicly traded financial advisory firm headquartered in Japan – persists with its strategy of purchasing dips in the market.

The company recently acquired an additional 38.46 BTC for $2.1 million, bringing its total Bitcoin holdings to nearly 400 BTC, valued at approximately $23 million.

Over the past few months since Metaplanet began its Bitcoin investment approach in April, it’s reported that their stock value has skyrocketed by an impressive 480% as per MarketWatch data.

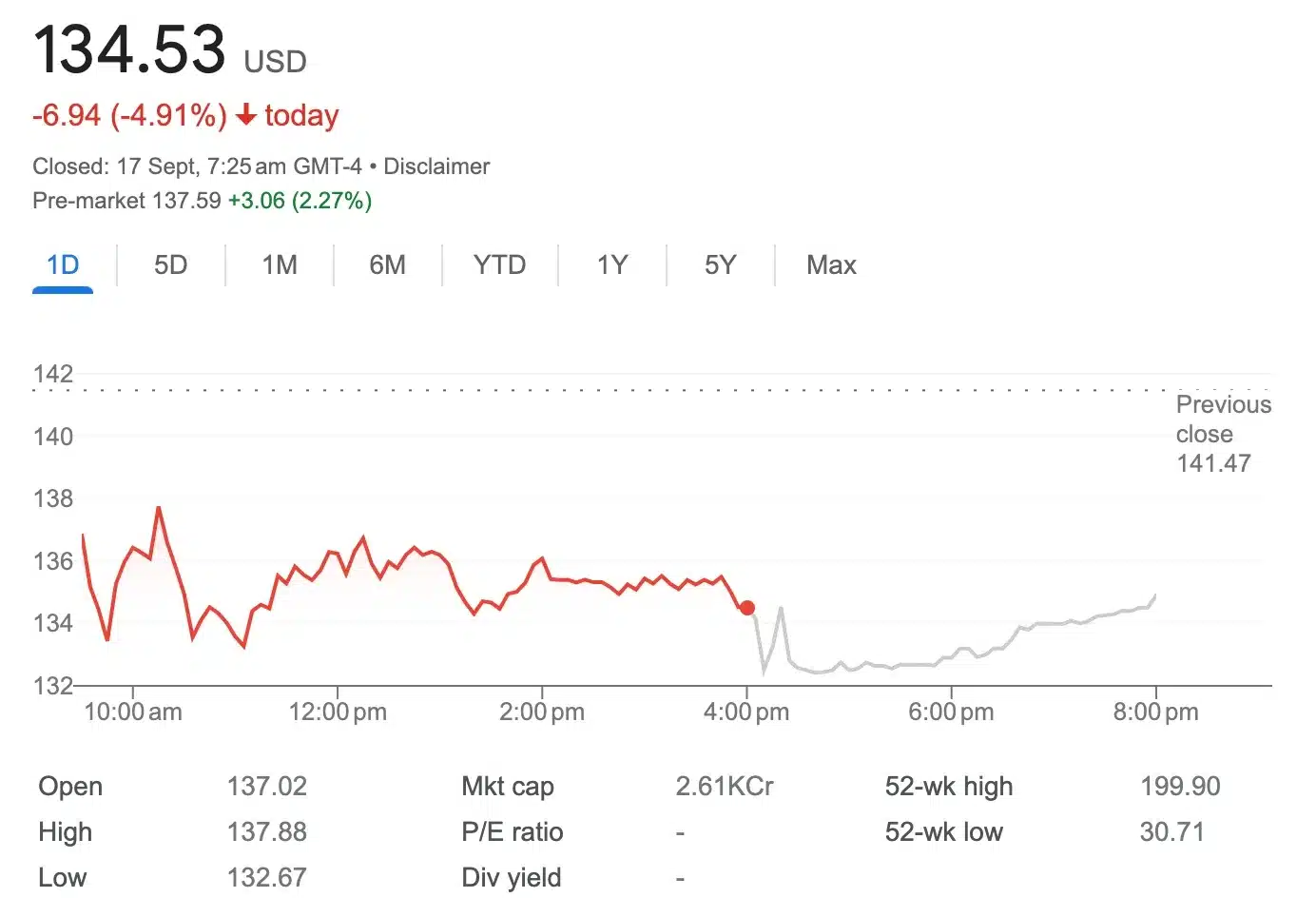

On the flip side, MicroStrategy’s shares experienced a 4.91% decrease on September 17th. However, it’s important to note that over the past year, these same shares have skyrocketed by an impressive 294.98%, according to Google Finance.

Indeed, my ongoing acquisition of Bitcoins by MicroStrategy underscores our enduring dedication to this digital currency. This strategic move strengthens our position as a significant institutional actor within the dynamic realm of cryptocurrencies.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-09-17 22:16