- Bitcoin reached a new all-time high of $106,554, fueling market excitement and adoption.

- MicroStrategy nears $50B Bitcoin portfolio as Saylor signals more BTC purchases above $100K.

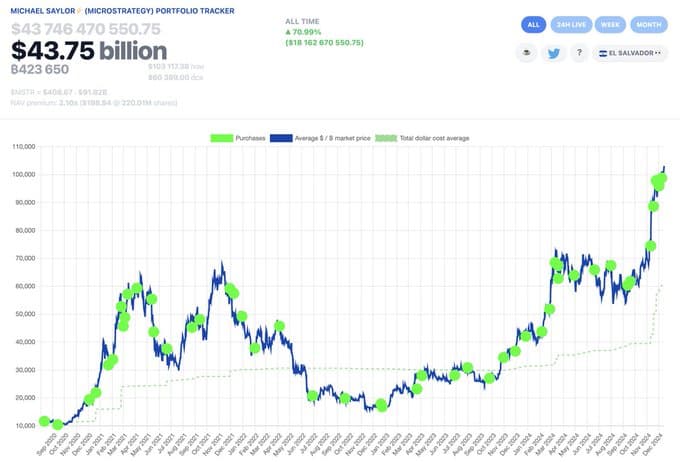

As a seasoned analyst with over two decades of experience in the financial markets, I find myself intrigued by the recent developments in the Bitcoin space. Michael Saylor, the executive chairman of MicroStrategy, has dropped yet another hint about a potential Bitcoin purchase, possibly at an average price above $100,000 per coin. This move, if confirmed, would mark a significant milestone for the company as it edges closer to a $50 billion Bitcoin portfolio.

Michael Saylor, the executive chairman of MicroStrategy, seems to indicate that the company may soon buy more Bitcoins, potentially marking their first acquisition when the average cost per coin surpasses $100,000.

This recent advancement coincides with Bitcoin hitting a fresh record peak, showcasing robust energy within the digital currency sector.

Saylor hints at another Bitcoin purchase

As a researcher, I recently came across a post by Michael Saylor on platform X, questioning whether the SaylorTracker – a tool designed to track MicroStrategy’s Bitcoin holdings – might have overlooked an update or addition, hinting at the potential presence of a “green dot” (possibly symbolizing increased holdings).

This statement has sparked speculation that MicroStrategy purchased more Bitcoin over the weekend.

For the past five Sundays commencing from the 10th of November, Saylor consistently posted content with comparable themes. Notably, every day after these posts, MicroStrategy made a verified Bitcoin acquisition.

On three successive Mondays between November 25 and December 9, as indicated by SaylorTracker data, the company purchased Bitcoin at an average price of roughly $97,862 on one Monday, $95,976 on another, and approximately $98,783 on the third.

Bitcoin reaches new ATH

Discussion about MicroStrategy’s acquisition arises following Bitcoin reaching an unprecedented high of $106,554.

At the moment I’m analyzing, Bitcoin is currently being exchanged for roughly $104,958. Over the last day, this has increased by 3.14%. On a weekly basis, it has climbed an impressive 6.05%.

Currently, the number of Bitcoins in circulation is approximately 20 million units, which gives the cryptocurrency a total market value exceeding 2 trillion U.S. dollars.

Enhanced trading activities and growing curiosity among investors have fueled the positive trend, or upward push, in the value of the cryptocurrency.

According to Santiment’s data, we’ve seen an increase of approximately 10% since October 10th, with the number of wallets containing at least 100 BTC growing by around 1,582.

MicroStrategy nears $50 billion portfolio

At the moment, MicroStrategy owns approximately 423,650 Bitcoins, which have a total value exceeding $43.6 billion as of December 15th. If the company manages to acquire Bitcoin at or above $100,000 per coin, it would represent a significant milestone for them.

Saylor has consistently maintained that MicroStrategy will continue accumulating Bitcoin, regardless of price levels.

Previously, he expressed confidence that the company would buy Bitcoin, even if each coin cost a million dollars.

This year, the innovative Bitcoin investment approach adopted by the company has significantly boosted MicroStrategy’s stock (MSTR) performance.

Based on Google Finance statistics, Microsoft (MSTR) shares have significantly increased by approximately 496.4% this year, making it one of the top-tier stocks with exceptional performance on the NASDAQ exchange in the year 2024.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-16 20:07