- Canada-based Sol Strategies has raised more capital for its SOL investments.

- A crypto VC projected a bullish outcome for SOL if ETF is approved.

Sol Strategies, comparable to MicroStrategy with Solana’s native token [SOL], has secured a CAD $25 million (approximately USD $17.4 million) credit line for purchasing SOL tokens and upgrading its staking infrastructure. The Canada-based firm declared in part that…

Our organization intends to distribute these tokens throughout our key sectors within the Solana network, such as decentralized finance platforms, validator management, and providing liquidity for upcoming Solana projects.

SOL ETF expectations

anticipation for increased involvement by institutions in the layer-1 platform may grow significantly over the next few months, fueled by expectations of a U.S. spot SOL Exchange Traded Fund (ETF) launch.

Based on the views of Andrew Kang from crypto venture capital firm Mechanism Capital, Solana (SOL) appeared to be underpriced compared to the expansion of its network prior to the anticipated approval of an ETF in the first quarter.

Furthermore, Kang pointed out the absence of a supply surplus similar to Grayscale’s as crucial drivers for the appreciation of SOL’s worth. In his words, this scarcity served as significant catalysts.

As a crypto investor, I’m excited about the strong possibility that a Solana ETF could be approved this year, possibly even by Q1, given the approval timelines in January to March have been set. Unlike with Ethereum, there won’t be the gray area of an Overhang like Grayscale has had.

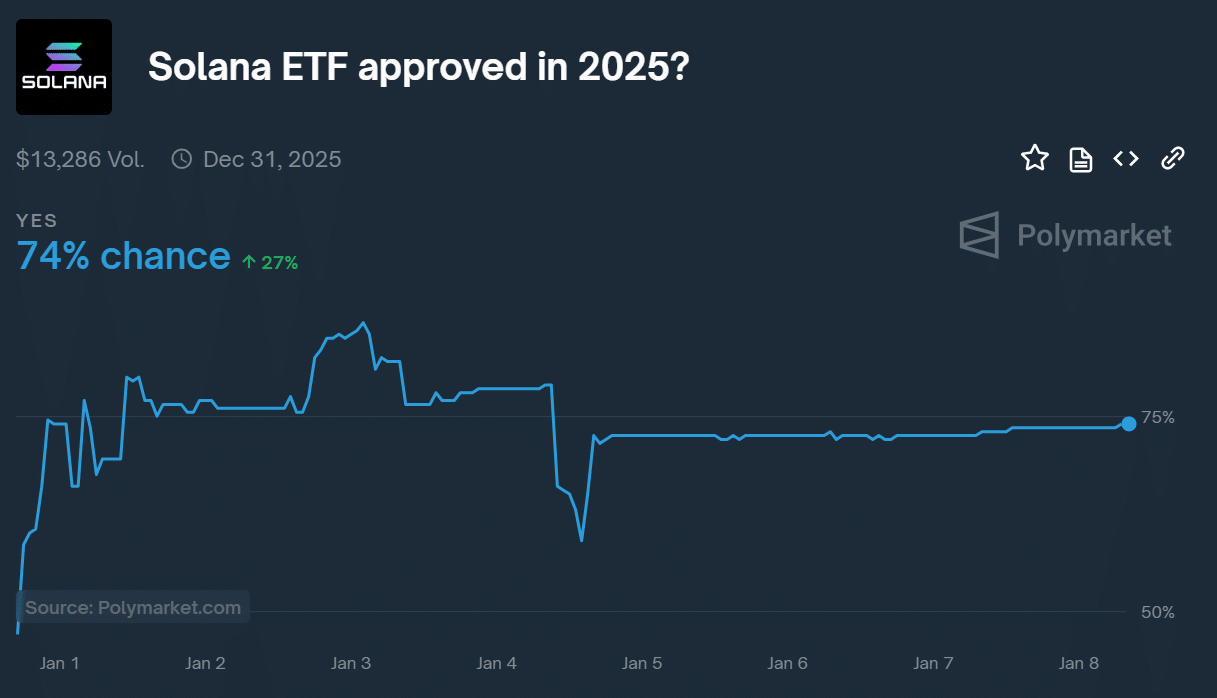

Currently, according to forecasts on the prediction platform Polymarket, there’s approximately a 3 out of 4 likelihood that the SOL ETF will be approved by 2025.

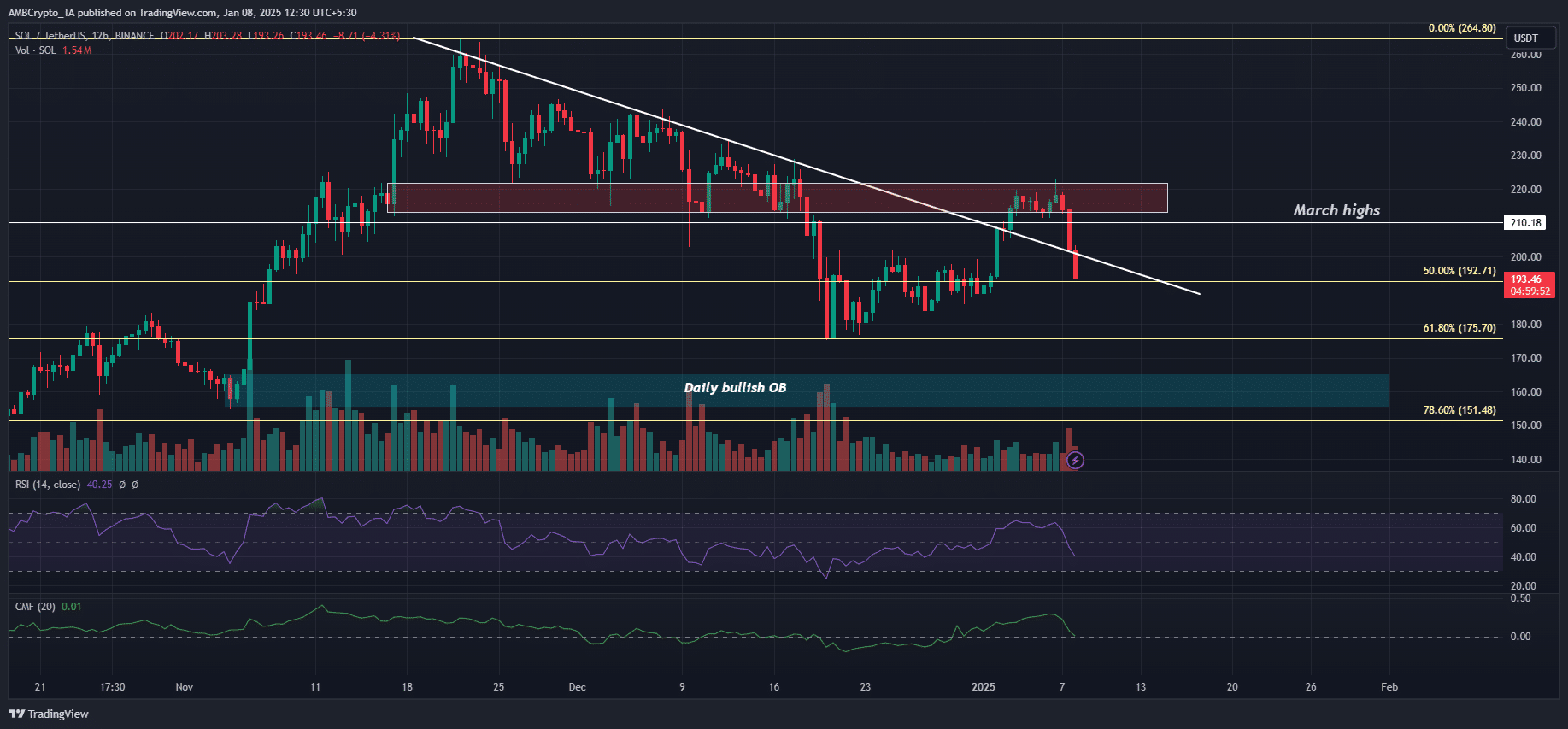

Nevertheless, SOL encountered temporary challenges due to unfavorable conditions in the broader economy. Latest U.S. economic statistics suggest persistent inflation, which might impede the planned Federal Reserve interest rate reduction in 2025 and potentially impact aggressive investments.

After the release of the macro update, markets experienced a significant decline, however, cryptocurrencies suffered the most severe drop. Solana’s (SOL) latest advancements were reversed, wiping out all the progress it had made since the beginning of January.

At the moment, it has dropped by 13% and fallen beneath $200. Important potential support levels can be found at $190 and $175.

Or:

In this current state, it’s down by 13% and now below $200. The critical levels of possible support are at $190 and $175.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2025-01-08 14:15