- MicroStrategy outperformed top S&P 500 stocks, showcasing significant growth.

- The company continues its “buy the dip” approach, attracting interest from other firms.

As a seasoned researcher with years of market analysis under my belt, I must admit that MicroStrategy’s recent performance has caught my attention like never before. The company’s impressive outperformance of top S&P 500 stocks is a testament to their innovative strategy, especially in the volatile world of Bitcoin.

Following Bitcoin‘s [BTC] recent price fluctuations, MicroStrategy, recognized for its significant Bitcoin investments, has gained notice due to allegedly outperforming top-tier S&P 500 stocks.

MicroStrategy’s stellar performance

In a recent update on House of Chimera’s blog posted on the 24th of September, the company has gained significant attention for its impressive performance in the market, surpassing notable tech companies like Apple Inc., Microsoft Corp., NVIDIA Corp., and Amazon.com Inc.

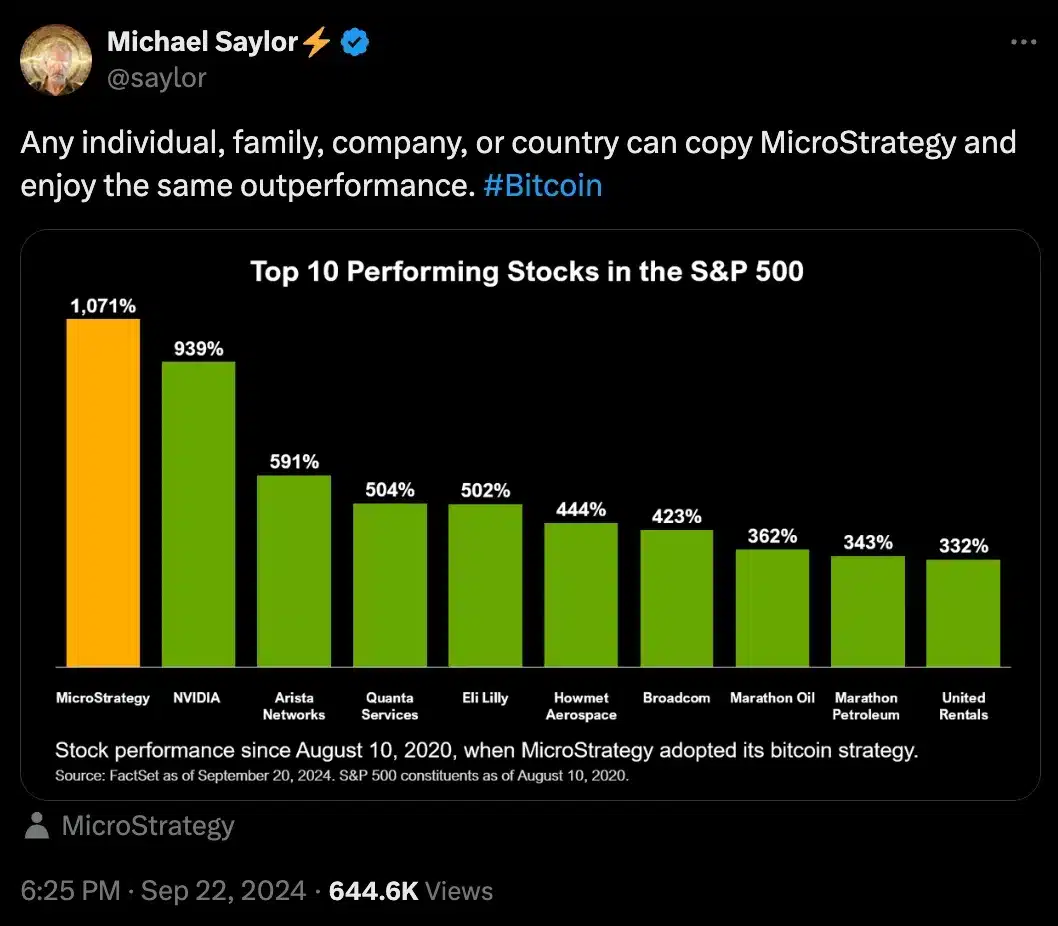

As a researcher, I’m struck by the remarkable growth trajectory of MicroStrategy, which has soared an astounding 1,071%. This phenomenal increase outpaces notable S&P 500 heavyweights like Nvidia and Arista Networks. To be specific, Nvidia experienced a significant 939% rise, while Arista Networks saw a more moderate growth of 591%.

The post further added,

This demonstrates that investing in Bitcoin can potentially yield significantly higher returns compared to conventional methods of growing your portfolio through stock investments.

Not the first time!

On previous occasions, the shares of MicroStrategy have created a stir in the financial market. In fact, as far back as July, they showed exceptional performance compared to well-known tech giants such as Nvidia, Tesla, and Microsoft.

As an analyst, I’ve noticed an interesting contrast between MicroStrategy and Bitcoin over the past month. While MicroStrategy has shown resilience with a 2.09% growth, Bitcoin has experienced a minor dip of 0.65%.

The striking difference in performance underscores MicroStrategy’s ability to withstand challenges and its increasing relevance as a choice for investment, particularly during times when Bitcoin experiences high volatility.

Remarking on the same, an X user – Mitchell Weijerman said,

MicroStrategy’s approach to Bitcoin is demonstrating that the potential growth of traditional equities may not be as great as that of cryptocurrencies.

Michael Saylor weighs in

Michael Saylor, MicroStrategy’s founder and chairperson, recently expressed delight over the company’s exceptional progress, pointing out its knack for surpassing leading contenders within the technology industry.

He emphasized that this pattern underscores both MicroStrategy’s strategic stance within the market and its ability to withstand the volatile nature of the cryptocurrency environment.

What’s the firm’s Bitcoin strategy?

After taking a more detailed look, it seems that MicroStrategy has mostly been resilient amidst Bitcoin’s recent price ups and downs, choosing instead to employ a “buying at lower prices” approach.

With Bitcoin finding it tough to surpass the $60,000 mark, a publicly traded firm revealed intentions to issue $700 million worth of convertible senior notes maturing in 2028.

In my analysis, I’d like to highlight a significant development: MicroStrategy has disclosed owning approximately 226,500 Bitcoins according to their second-quarter report. This substantial Bitcoin holding is part of their ongoing strategy.

As MicroStrategy continues to purchase Bitcoin aggressively, other firms are adopting a similar tactic.

To illustrate, Metaplanet – a Japanese company specializing in investment and consulting that is publicly listed – has just purchased an extra 38.46 Bitcoins for approximately $2.1 million. With this new acquisition, their Bitcoin holdings now total close to 400 BTC, equating to around $23 million in value.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-25 12:08