- MicroStrategy’s Bitcoin acquisition fueled a stock surge, highlighting its role as a major BTC holder.

- The company’s Nasdaq 100 inclusion boosted visibility, but risks linked to Bitcoin remained.

As a seasoned crypto investor with over two decades of market experience under my belt, I find MicroStrategy’s Bitcoin strategy both intriguing and risky. The company’s aggressive accumulation of BTC has undeniably solidified its position as a major player in the crypto space. However, I can’t help but see parallels between MicroStrategy and the infamous story of King Midas, where everything he touched turned to gold – but also to dust when the market took a downturn.

On Monday, MicroStrategy’s shares experienced an approximately 5% increase, buoyed by the company’s revelation of a substantial Bitcoin purchase as well as its addition to the Nasdaq 100 index.

As an analyst, I’m reporting that a former software company has recently purchased an extra 15,350 Bitcoins for approximately $1.5 billion, thereby increasing its Bitcoin holdings to roughly 440,000 coins.

This action fueled investor enthusiasm, underscoring MicroStrategy’s dedication to Bitcoin and its potential effects on the company’s shares and the overall financial sector.

MicroStrategy’s Bitcoin strategy

MicroStrategy’s persistent, heavy investment in Bitcoin is further establishing it as the leading corporate Bitcoin owner. The recent acquisition has significantly grown their Bitcoin holdings over the past 40 days.

According to analysts at Bernstein, approximately 40% of the current total was bought during this specific timeframe, indicating a surge in buying activity that aligns with increased optimism towards Bitcoin.

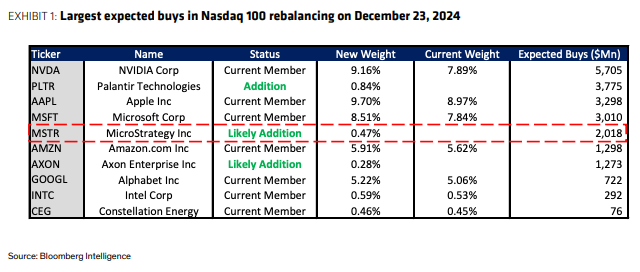

Notably, MicroStrategy has also been allocated a 0.47% weight in the Nasdaq 100 index.

The current surge in purchases is fueled by optimism about Donald Trump’s crypto-friendly policies, such as the appointment of Paul Atkins at the SEC.

After incorporating Bitcoin into its holdings in 2020, MicroStrategy has utilized various funding methods such as debt, stock sales, and cash reserves to finance acquisitions. This demonstrates their unwavering dedication to Bitcoin, even amidst its volatile nature.

Nasdaq 100 inclusion and implications

The fact that MicroStrategy was included in the Nasdaq 100, starting from the 23rd of December, along with Palantir and Axon, demonstrates a growing trust in their approach towards Bitcoin investments.

Initially, the announcement caused a 5% surge in share prices prior to ending at an even level. To date, the returns have surpassed 580%. This addition has significantly improved the stock’s exposure, potentially drawing in institutional investments, which may enhance both liquidity and overall performance.

Additionally, this further solidified MicroStrategy’s function as a proxy for Bitcoin, making the performance of its stock closely related to the fluctuations in Bitcoin prices.

As Bitcoin surpasses $106,000 due to President Trump’s pro-crypto stance, optimism persists, yet the market’s volatility continues to worry conventional investors.

MicroStrategy stock: Criticism and skeptics

As an analyst, I acknowledge the impressive rise in MicroStrategy’s performance due to its strategic investment in Bitcoin. However, it’s important to note that some critics caution against this approach, suggesting it could potentially expose the company to significant risks. In fact, short seller Citron Research recently expressed a bearish stance, asserting that the stock may carry an elevated level of risk.

“Completely detached from BTC fundamentals.”

This skepticism arises due to MicroStrategy’s significant use of debt and the speculative character of its Bitcoin investments, making it more susceptible to potential losses when there are drops in the Bitcoin market.

Currently, investing in Bitcoin has become more accessible than before, thanks to ETFs like $COIN and platforms such as $HOOD. However, the trading volume of $MSTR seems to have strayed far from the fundamental values of Bitcoin. Despite our bullish stance on Bitcoin, we’ve decided to take a short position in $MSTR as a precaution. I hold great respect for @saylor, but it’s hard to ignore the fact that $MSTR appears overheated.

Critics emphasize potential hazards associated with high concentration: although Bitcoin’s surge benefits the stock, it continues to be heavily dependent on Bitcoin’s volatile price movements.

With MicroStrategy continuing to invest heavily in Bitcoin, there are lingering concerns about how sustainable such a high-risk approach might be during unpredictable times.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-17 21:12