- MicroStrategy boosted its Bitcoin holdings to 331,200 BTC, worth $30 billion, leading to a stock surge.

- This coincided with MicroStrategy’s acquisitions under its ambitious “21/21 plan” and Bitcoin hitting $90K.

As a seasoned researcher who has witnessed the rise and fall of numerous market trends, I must admit that MicroStrategy’s Bitcoin strategy is nothing short of intriguing. Having closely observed the crypto market since its inception, I can say with confidence that this is one of the most audacious moves I’ve seen from a publicly-traded company.

MicroStrategy Incorporated is back in the news, this time for its bold Bitcoin (BTC) buying approach. They recently acquired a massive $4.6 billion worth of Bitcoin.

As part of its dedication to increasing its Bitcoin portfolio, a leading enterprise software company purchased around 51,780 Bitcoins from November 11th through 17th, as stated in a recent Securities and Exchange Commission (SEC) document.

With this most recent buy, the company has now amassed a substantial $30 billion worth of Bitcoin, adding to its previous acquisitions made in October and September.

Michael Saylor, the founder of MicroStrategy, expressed his opinions regarding X (previously known as Twitter).

On November 18th, the value of MicroStrategy’s stock (MSTR) significantly increased by around 13%, reaching a new peak at the end of trading.

Impact on MicroStrategy’s stock price

This remarkable performance highlights the company’s 2024 success, with MSTR shares up over 500% year-to-date. This significantly outpaces Microsoft’s 11% growth during the same period, according to Yahoo Finance.

At present, Google Finance shows MicroStrategy’s stock price at $384.79, and their bold approach towards Bitcoin appears to be generating significant profits. This profitability stems from increases in their stock value as well as the growing worth of their bitcoin holdings.

Furthermore, the company intends to gather approximately $1.75 billion by issuing zero-percent interest convertible senior notes in a private sale. This debt matures in December 2029, demonstrating their dedication towards growing their Bitcoin holdings.

Community reaction

Observing the firm’s significant strides, an X user remarked,

“Big moves! MicroStrategy’s playing chess while others are stuck on checkers.”

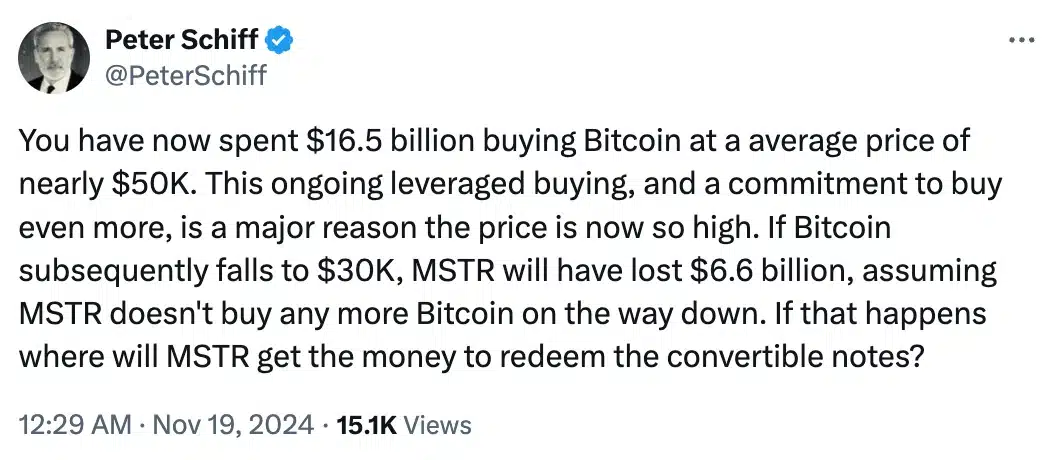

However, critics like Peter Schiff seized the opportunity to weigh in, stating,

As an analyst, I find myself in a position where I can acknowledge the criticism MicroStrategy has received from individuals such as Schiff. However, it’s undeniable that MicroStrategy has solidified its stature as the biggest institutional Bitcoin holder, having amassed an impressive 331,200 BTC at a total cost of $16.5 billion. This investment, made below the current market value, underscores the strategic foresight and boldness of MicroStrategy’s approach.

This significant event occurs when Bitcoin reaches unparalleled peaks, breaking through $90,000 after the U.S. elections.

Just checked, my Bitcoin (BTC) was valued at approximately $91,767.56 in the most recent update. Over the last day, it experienced a slight drop of 0.03%. However, it’s been on an impressive run with weekly and monthly gains standing at 2.72% and 34.19%, respectively, according to CoinMarketCap.

MicroStrategy’s roadmap ahead

MicroStrategy recently financed its latest Bitcoin purchase by offloading around 13.6 million of its own shares. This action mirrors the strategic objectives outlined in its aggressive “21/21 plan.

The plan is designed to gather approximately $42 billion via stock sales and bond issues within a three-year period, demonstrating the company’s dedication towards increasing its Bitcoin reserves.

After incorporating Bitcoin into its primary reserves back in August 2020, MicroStrategy has been employing it as a means to protect against inflation and expand the variety within its treasury holdings.

Other publicly traded firms, like Marathon Digital Holdings and Semler Scientific, have been influenced by an open-source Bitcoin reserve strategy used by some companies, suggesting a rising pattern of corporations investing in Bitcoin.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Lilo & Stitch & Mission: Impossible 8 Set to Break Major Box Office Record

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- We Ranked All of Gilmore Girls Couples: From Worst to Best

2024-11-19 15:04