- MSTR extended its weekly losses to about 20%.

- Bitcoin’s halving and ‘over-valuation’ concerns could offer sellers more edge

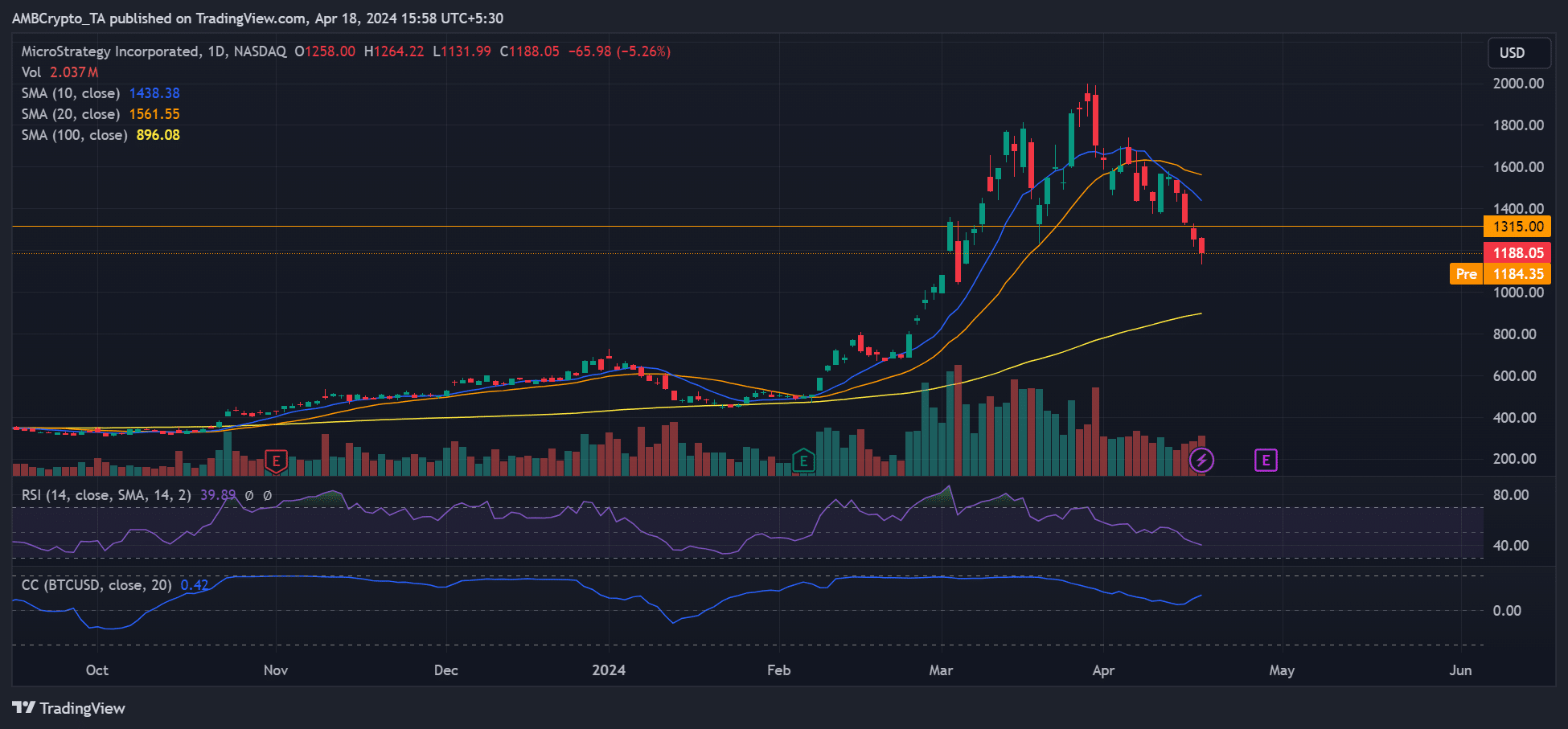

MicroStrategy’s (MSTR) stock suffered significant losses, totaling over 19% in just one week. This downturn occurred right before Bitcoin’s (BTC) fourth halving event. Reaching an all-time high of $1999.99 on March 27th, the stock experienced a correction and gave back some of its monthly advancements. Over the past three weeks, MSTR’s stock price displayed a prolonged decline as shown in the charts.

Every three months, the stock decreased by 30% during the second quarter. However, its Year-to-Date growth rate was a positive 73.4% as of the current moment.

On the 17th of April, MSTR’s closing price was $1188.05. This was a significant reduction from its previous price for those who hadn’t yet invested. However, based on current market trends and chart analysis, there could be even greater discounts available to investors willing to join now.

Will MSTR extend losses amidst Bitcoin halving?

MSTR’s stock shares similar trends with Bitcoin since February, as the corporation is among those implementing a Bitcoin strategy. This connection was made clear through a positive correlation between their price movements.

What this means is that BTC’s extended price dump has been dragging MSTR stock too.

From March 27 to April 18, the price of BTC on Bitstamp fell by 13%, decreasing from $71,700 to $62,400. During the same time frame, MSTR experienced a significantly larger decrease of 40%. This represents a drop more than three times greater than that of BTC.

Currently, bears hold greater power as MSTR has fallen beneath both its 10-day and 20-day moving averages, which are represented by the blue and orange lines respectively.

If bears continue their push, the 100-day simple moving average (SMA) at $896 will be their next objective. Reaching this level could result in further decreases for MicroStrategy’s (MSTR) value, potentially dipping below $1000. For investors who have missed earlier buying opportunities, this potential price drop might present an attractive discount.

A lower-than-normal RSI reading suggests increased selling activity, potentially indicating further price decreases.

Bitcoin halving and MSTR being “overvalued”

Furthermore, if there’s a surge in Bitcoin selling pressure close to the halving event, it may encourage bearish sentiment among MSTR investors.

MicroStrategy currently owns approximately 214,246 Bitcoins, which is valued at more than $13 billion according to present market values. The majority of these coins were obtained using the company’s convertible notes.

Yet, some market observers echo this viewpoint, arguing that Microstrategy’s (MSTR) stock is currently overpriced in light of the continuous share buybacks. A month ago, Kerrisdale Capital voiced a similar perspective.

“We hold Bitcoins and have sold MicroStrategy shares, as the price of the latter does not accurately reflect the value of the Bitcoin it represents.”

Kerrisdale Capital pointed out that with the introduction of new Bitcoin Spot ETFs, investors now have multiple options to invest in Bitcoin without relying on MicroStrategy for access. This means MicroStrategy no longer holds a monopoly and cannot justify the higher fees they charge.

From a different point of view, certain investors used to opt for purchasing MicroStrategy (MSTR) stocks instead of directly investing in Bitcoin (BTC).

In simpler terms, the private investment manager believes that Microsoft Corporation (MSTR) is worth between $700 and $800 according to their assessment. The higher end of this range is nearer to the more pessimistic view represented by the 100-day moving average (indicated by the yellow line).

But, the forecast could be disrupted if Bitcoin experiences a significant surge in value around its halving, which is an uncommon occurrence.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Top 10 Stocks and Crypto Robinhood Alternatives & Competitors

- ‘China’s going to have it’ – Donald Trump crypto stance, finally explained

2024-04-19 01:11