- MicroStrategy plans to buy $42B BTC in the next 3 years.

- An analyst projected that MSTR will become more like a US spot BTC ETF.

As a seasoned investor with over two decades of experience in the financial markets, I find MicroStrategy’s ambitious Bitcoin acquisition plan to be nothing short of audacious. Michael Saylor’s unwavering bullishness on BTC is noteworthy, and his prediction of reaching $3 million to $49 million within the next 20 years seems far-fetched but intriguing.

Michael Saylor’s company, MicroStrategy, has unveiled intentions to purchase approximately $42 billion worth of Bitcoin over the subsequent three years, coinciding with the approaching 2028 Bitcoin halving event.

Today, we’re disclosing an ambitious plan called the “21/21 Plan” which aims to collect a total of $42 billion in capital over the next 3 years. This will be broken down into $21 billion from equity investments and another $21 billion from fixed income securities.

As a researcher, my conviction in Bitcoin’s potential growth remains incredibly strong. I anticipate that its value could soar to anywhere between $3 million and $49 million within the next two decades. Furthermore, I align with President Trump’s forward-thinking stance on cryptocurrencies. Most recently, I advocate for the elimination of capital gains tax on Bitcoin, a move that could significantly boost its adoption and value.

Is MSTR changing to BTC ETF?

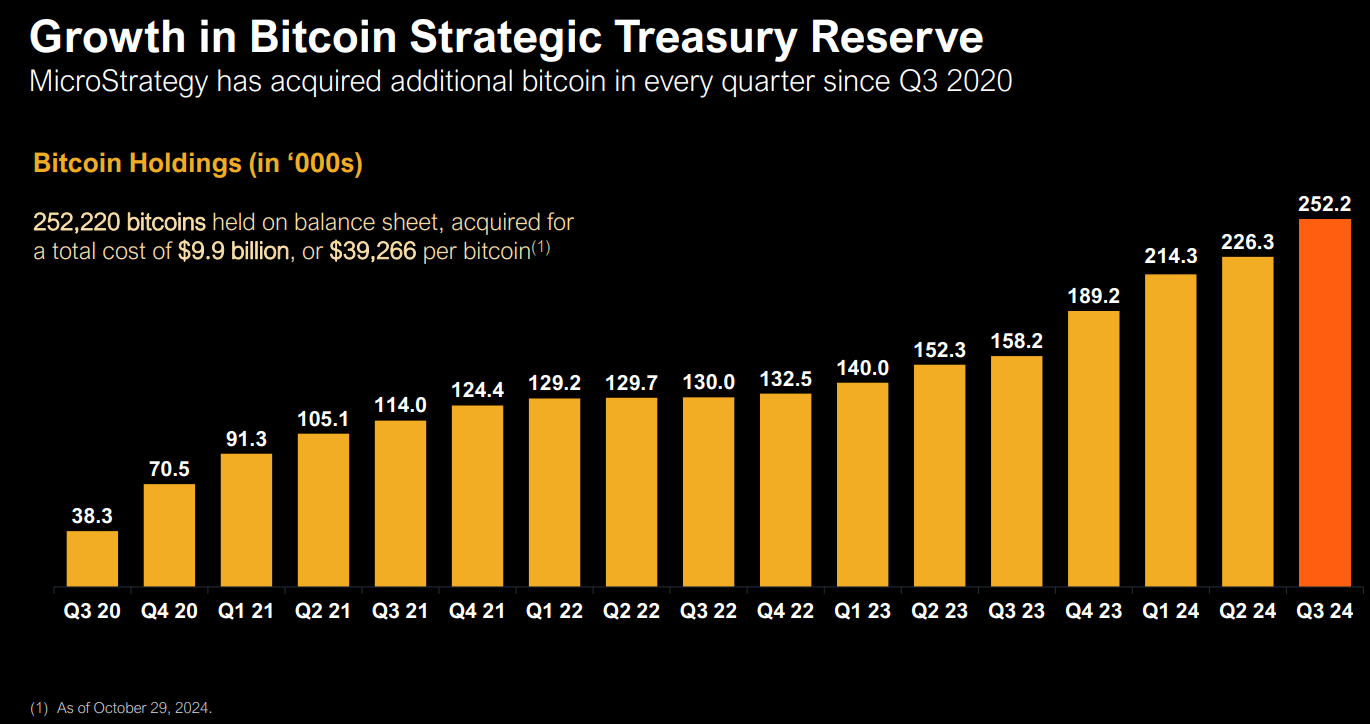

By October 2024, MicroStrategy owned approximately 252,220 Bitcoins, which they purchased for around $9.9 billion. With today’s prices, the value of their Bitcoin holdings has surged to over $18.15 billion, representing an estimated $8 billion in potential profits that have not yet been realized.

Instead of purchasing all $42 billion worth of Bitcoin directly, the company plans to execute part of this acquisition using a $21 billion ATM (at-the-market) stock issuance program. Some financial experts speculate that this move could make the company’s stock resemble a Bitcoin Exchange-Traded Fund (ETF), known as MSTR in this context.

As a crypto investor, I recently took note of insights shared by Quinn Thompson, the visionary behind the macro-centric crypto hedge fund, Lekker Capital. He made some intriguing statements that caught my attention.

By making such a large announcement about their ATM shares all at once, they’re essentially transforming $MSTR into an unofficial Exchange Traded Fund (ETF).

This arrangement enables the company to sell shares in the open market whenever needed for funding Bitcoin purchases, much like U.S. spot Bitcoin Exchange-Traded Funds (ETFs) function. As per Thompson’s analysis, this could further enhance Mastercard Stock’s performance.

The company’s equity program, combined with plans to acquire Bitcoin using convertible debt instruments (convertible notes), represents their long-term ambition to transform into a ‘Bitcoin financial institution.’ This intention was disclosed around the middle of October.

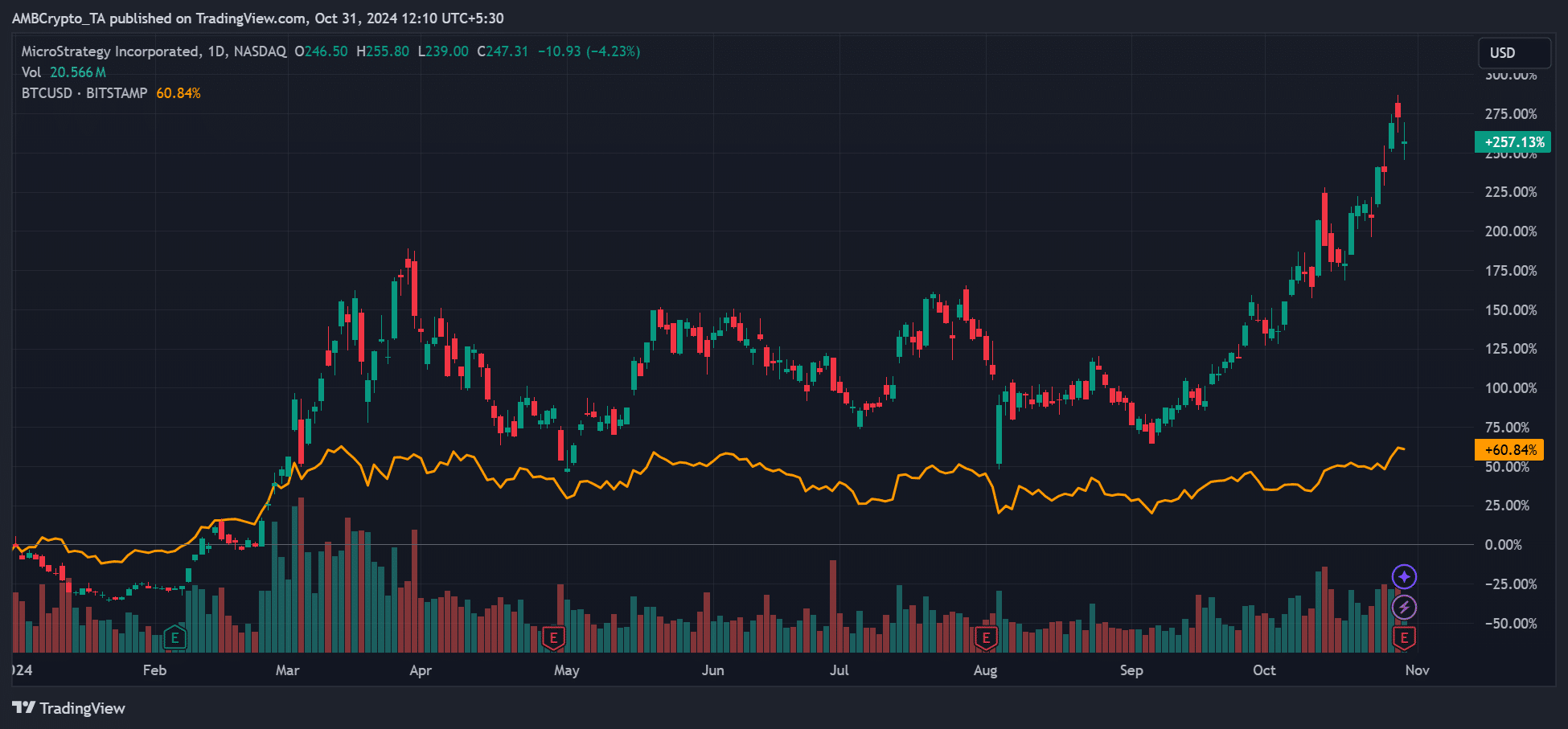

In other words, it appears that holders of MSTR have reaped the greatest rewards from the recent update. Since implementing its Bitcoin strategy in 2020, MSTR has been the top-performing stock on the S&P index. This outstanding performance has enabled MSTR to outshine its competitors and possibly overshadow the company’s Q3 loss of $19.4 million.

So far this year, Mastercard’s (MSTR) performance has significantly outperformed Bitcoin’s (BTC), as Mastercard climbed approximately 250%, which is over four times more than Bitcoin’s 60% increase. In the third quarter alone, Mastercard saw a surge of around 20%, while Bitcoin ended the quarter with minimal growth of less than 1%.

In short, from an investor returns perspective, it was better to hold MSTR than BTC.

Notably, it was anticipated that the stock would experience a 7% surge following the recent financial report, as mentioned by Jeff Park, who heads the alpha strategies at Bitwise. He based this prediction on the data from the MSTR options market.

“As we enter $MSTR earnings, an explosive set up: Nov 1 Vol is ~115%, implying a 7.2% move.”

Currently, Mastercard (MSTR) is worth approximately $247. It’s yet unclear if it will reach a new annual peak as predicted by Park, given Bitcoin (BTC) is tightly consolidating above the $72,000 mark.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Rick and Morty Season 8: Release Date SHOCK!

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-10-31 14:16