In a world where the absurd meets the audacious, Michael Saylor, the intrepid captain of Strategy (formerly known as MicroStrategy), has boldly declared the acquisition of a staggering $584 million in Bitcoin. This audacious move catapults their total hoard to over 500,000 BTC, as if they were collecting rare stamps rather than digital currency. And lo! Bitcoin’s value has risen this morning, a mere coincidence, or perhaps a divine nod to the market’s confidence?

Yet, dear reader, let us not be deceived by the glittering facade. This firm, like a juggler with too many flaming torches, can only sustain its acquisitions through a labyrinth of debt obligations. The notion that Strategy could ever part with these assets without sending the market into a tailspin is as fanciful as a cat dreaming of flying.

Strategy’s Bitcoin Buys Grow Again

Ah, the saga of Strategy! In recent weeks, it has danced a wild waltz, oscillating between the heights of Bitcoin ownership and the depths of uncertainty. One moment a titan, the next a trembling leaf in the wind.

Today, however, Saylor has unveiled yet another monumental purchase:

“Strategy has acquired 6,911 BTC for approximately $584.1 million at a price of ~$84,529 per bitcoin, achieving a BTC Yield of 7.7% YTD 2025. As of 3/23/2025, Strategy holds 506,137 BTC, amassed for a princely sum of ~$33.7 billion at ~$66,608 per bitcoin,” Saylor proclaimed, as if announcing a new era of prosperity via social media.

But alas, the price of Bitcoin is as fickle as a cat on a hot tin roof, leaving Strategy in a precarious position. Just last month, the firm introduced STRK, a new perpetual security, as if to fund its insatiable appetite for BTC acquisitions.

In a prelude to today’s grand announcement, Saylor had the audacity to upsize his latest stock offering by over $200 million. A bold move, indeed! But it has reinvigorated the firm’s purchasing strategy while simultaneously sowing seeds of other serious dilemmas. In essence, Strategy is trapped in a gilded cage, unable to sell its Bitcoin without unleashing chaos upon the market.

With massive debt obligations weighing heavily upon its shoulders, the company finds itself in a quagmire of negative cash inflows. Saylor’s relentless acquisitions may keep the market’s spirits buoyant, but the community watches with bated breath, ever vigilant for signs of faltering activity.

Imagine the horror if Strategy’s unsecured debt were to plummet alongside Bitcoin’s price! The community would interpret a forced liquidation as a harbinger of doom, a bearish omen that would send shivers down the spine of even the most hardened investor.

And let us not forget the specter of tax obligations looming ominously on the horizon. For now, however, the price of Bitcoin appears to be on the mend, like a patient recovering from a particularly nasty bout of the flu.

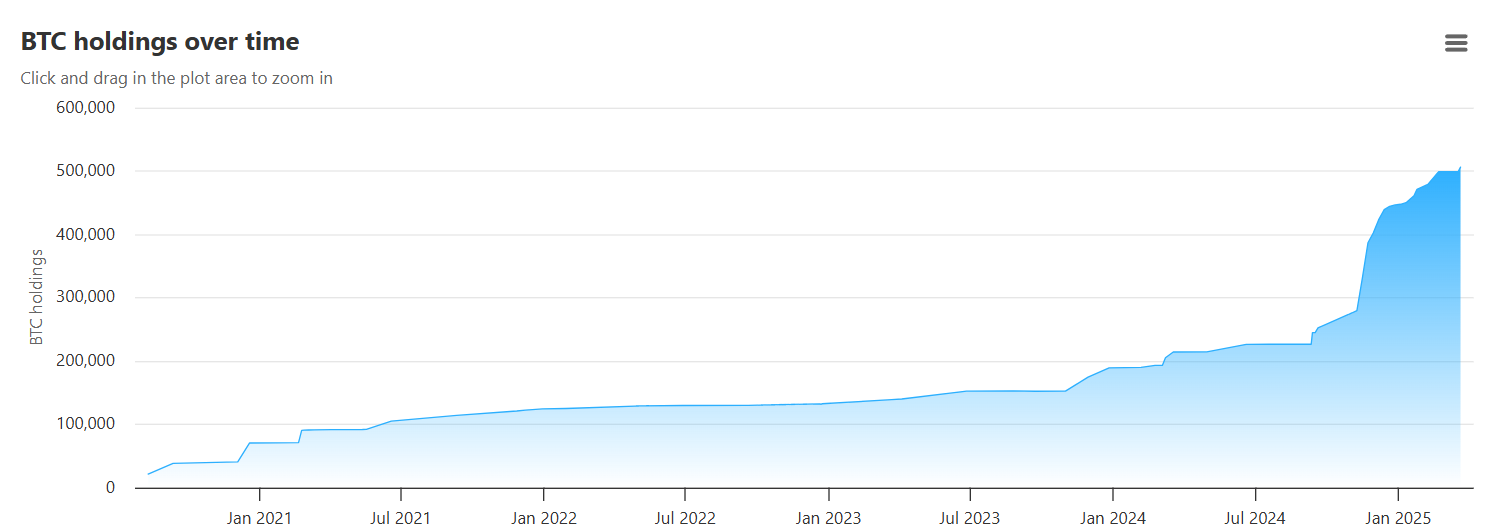

With this latest acquisition, MicroStrategy now holds more than 500,000 Bitcoins. The accompanying chart reveals a dramatic surge in the company’s BTC purchase activity since late 2024, even as the asset’s price reached dizzying heights during that period. A curious paradox, indeed!

It is clear that Saylor has become an unwitting guarantor of Bitcoin’s confidence. Yet, should the winds of market conditions shift violently, Strategy’s colossal debt could unleash a tempest of trouble, leaving us all to ponder the folly of our financial pursuits.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- PGA Tour 2K25 – Everything You Need to Know

- MrBeast Slams Kotaku for Misquote, No Apology in Sight!

2025-03-24 19:46