- MicroStrategy sees $22m in volume on launch day as Bitcoin’s historical pattern is set for repetition.

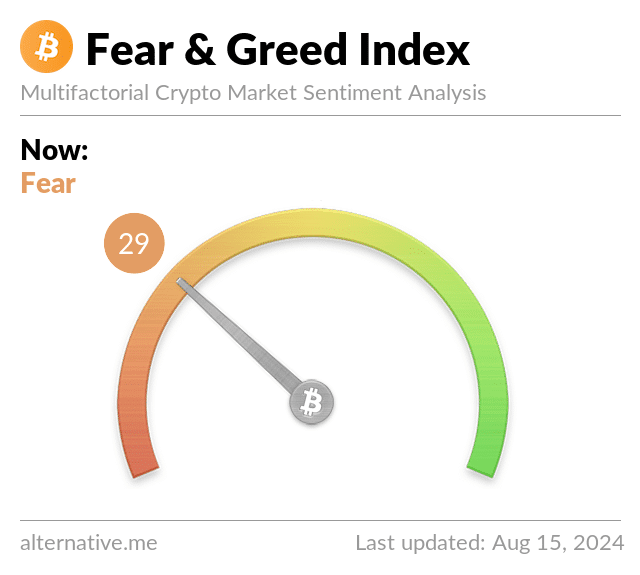

- Bitcoin ETFs net flow turned positive again after one day of outflows despite market sentiment being fearful.

As a seasoned researcher with a decade of experience in the volatile world of cryptocurrencies, I’ve seen my fair share of market swings and surprises. The recent launch of MicroStrategy’s ETF has certainly caught my attention, with its record-breaking trading volume that could potentially reshape the ETF landscape.

On its initial day, MicroStrategy, a significant Bitcoin [BTC] investor, reportedly transacted $22 million in volume, potentially breaking the record for leveraged ETFs. This information was initially shared by Bloomberg’s ETF Analyst Eric Balchunas on platform X (previously known as Twitter).

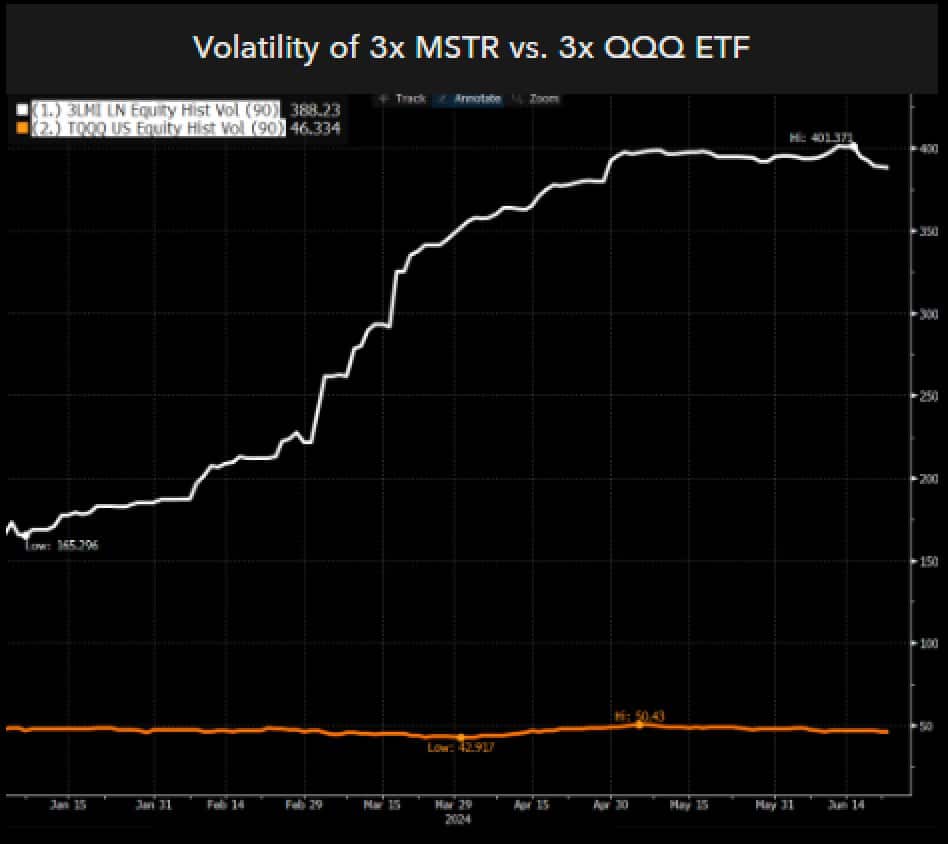

Based on my years of experience analyzing exchange-traded funds (ETFs), I believe that this particular ETF stands out as one of the more volatile options among U.S.-based ETFs, according to a 90-day volatility indicator. However, it’s important to note that its volatility could potentially escalate even further, as issuers are aggressively pushing boundaries to attract investors, leveraging various strategies and tactics. As someone who has seen the market ebb and flow, I would advise prospective investors to carefully consider their risk tolerance before diving into this high-volatility ETF.

Although MSTX exhibits significant volatility in the U.S., its fluctuations will likely be less intense than those of Europe‘s 3LMI LN, which has a 90-day volatility exceeding 350%.

Based on its fluctuation and trade activity, the exchange-traded fund (ETF) represented by $MSTX might emerge as a significant force within the ETF sector. Consequently, this development could potentially influence the value of Bitcoin in the future.

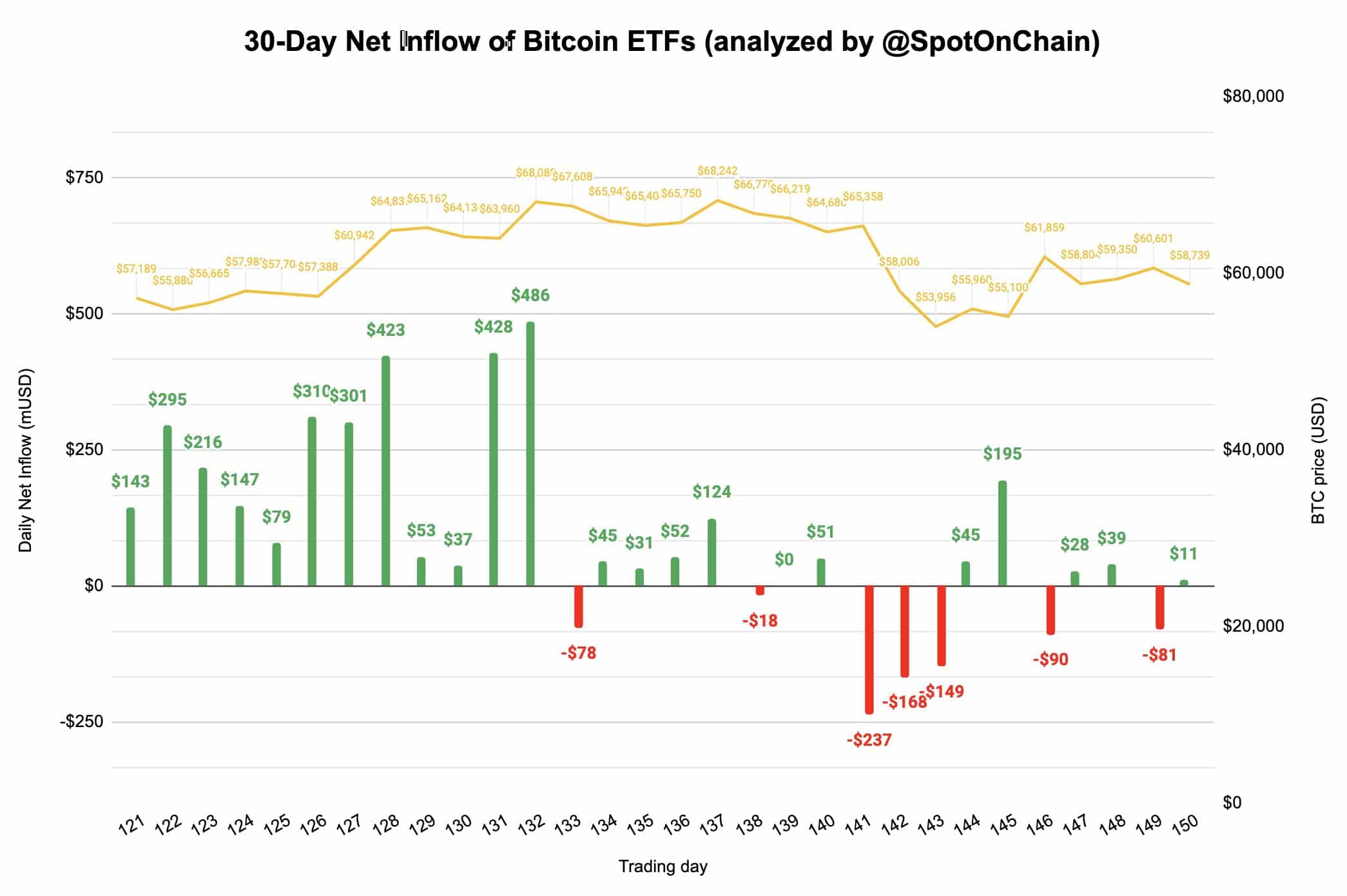

It appears that this development might have sparked a change for the better in Bitcoin ETFs, resulting in a $11 million deposit, which marks a turnaround from a temporary withdrawal. This information was recently disclosed by Spot On Chain via X.

In contrast to other leading U.S. Bitcoin ETFs such as those offered by Fidelity, Grayscale, and Bitwise, BlackRock’s IBIT did not witness substantial growth in net investment during this period. On the flip side, Fidelity, Grayscale, and Bitwise experienced a noticeable surge in inflows.

The ETF market is poised for continued growth, bolstered by the MicroStrategy ETF’s record trading volume.

Due to MicroStrategy’s significant amount of Bitcoins, it seems plausible that the price of Bitcoin could potentially increase, given its impact on the market.

BTC current cycle mirrors ‘Blue Years’

As a crypto enthusiast, I’ve noticed that the current trajectory of Bitcoin seems strikingly similar to its previous “Blue Years.” These cycles typically exhibit recurring trends characterized by two significant peaks and two stretches where the price tends to move sideways.

Over the past few months, there’s been a strong surge in performance from January until March, which was then followed by an extended period of adjustment or pullback. Unlike other cycles, this particular one hasn’t yet surpassed its previous record highs, meaning the correction or pullback is still ongoing.

Historically, we’ve seen that the market often experiences a downturn around August which precedes reaching new highs in the subsequent year. This pattern, as indicated by the light blue circles, resembles previous occurrences. So, it seems the recent drop could be part of this typical cycle.

Despite some differences, the Halving Cycles Theory indicates that a top in late 2025 remains on track. New highs appear likely as the cycle progresses.

Moreover, significant global banks and prominent financial entities are growing their Bitcoin reserves, even amidst a market climate characterized by apprehension.

It’s smart to imitate the actions of these significant investors, as they are actively purchasing and their actions align with positive trends in the Bitcoin market. This could signal a possible increase in Bitcoin’s price for traders and investors to consider.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- PI PREDICTION. PI cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Dragon Ball Z: Kakarot DLC ‘DAIMA: Adventure Through the Demon Realm – Part 1’ launches between July and September 2025, ‘Part 2’ between January and March 2026

2024-08-16 21:06