-

MicroStrategy adds 122 BTC to its holdings, now totaling 214,400 Bitcoins.

Despite negative broader Bitcoin metrics, there is a possible uptick on the horizon.

As a seasoned crypto investor who has witnessed the ups and downs of Bitcoin’s market over the past few years, I find MicroStrategy’s latest move to add 122 more Bitcoins to its already impressive holdings an encouraging sign. Despite the recent negative metrics and downtrend in the broader Bitcoin market, this strategic accumulation by a major player reinforces my belief in the long-term potential of Bitcoin.

MicroStrategy, the software company now known for its advocacy of Bitcoin [BTC], has recently increased the size of its cryptocurrency holdings.

On April 30th, Michael Saylor’s company announced the purchase of 122 more Bitcoins, costing around $7.8 million.

This latest transaction elevates MicroStrategy’s total Bitcoin holdings to roughly 214,400 units.

MicroStrategy consistently reinforces its dedication to Bitcoin through this transaction, a significant component of their business strategy over the past few years.

As an analyst, I’d rephrase that as follows: In Q1 2024, MicroStrategy disclosed its cryptocurrency holdings, which were valued at a robust $7.54 billion despite the market’s volatile and downtrending conditions.

This values their extensive Bitcoin inventory at an average price of $35,180 per unit.

The company has persistently shown optimism towards Bitcoin, purchasing a total of 25,250 coins since the final quarter of 2023, with an average cost of $65,232 per coin.

Bitcoin’s bumpy road

As an analyst, I’ve noticed that MicroStrategy has been making positive strides in its accumulation efforts. However, the larger market landscape remains fraught with difficulties.

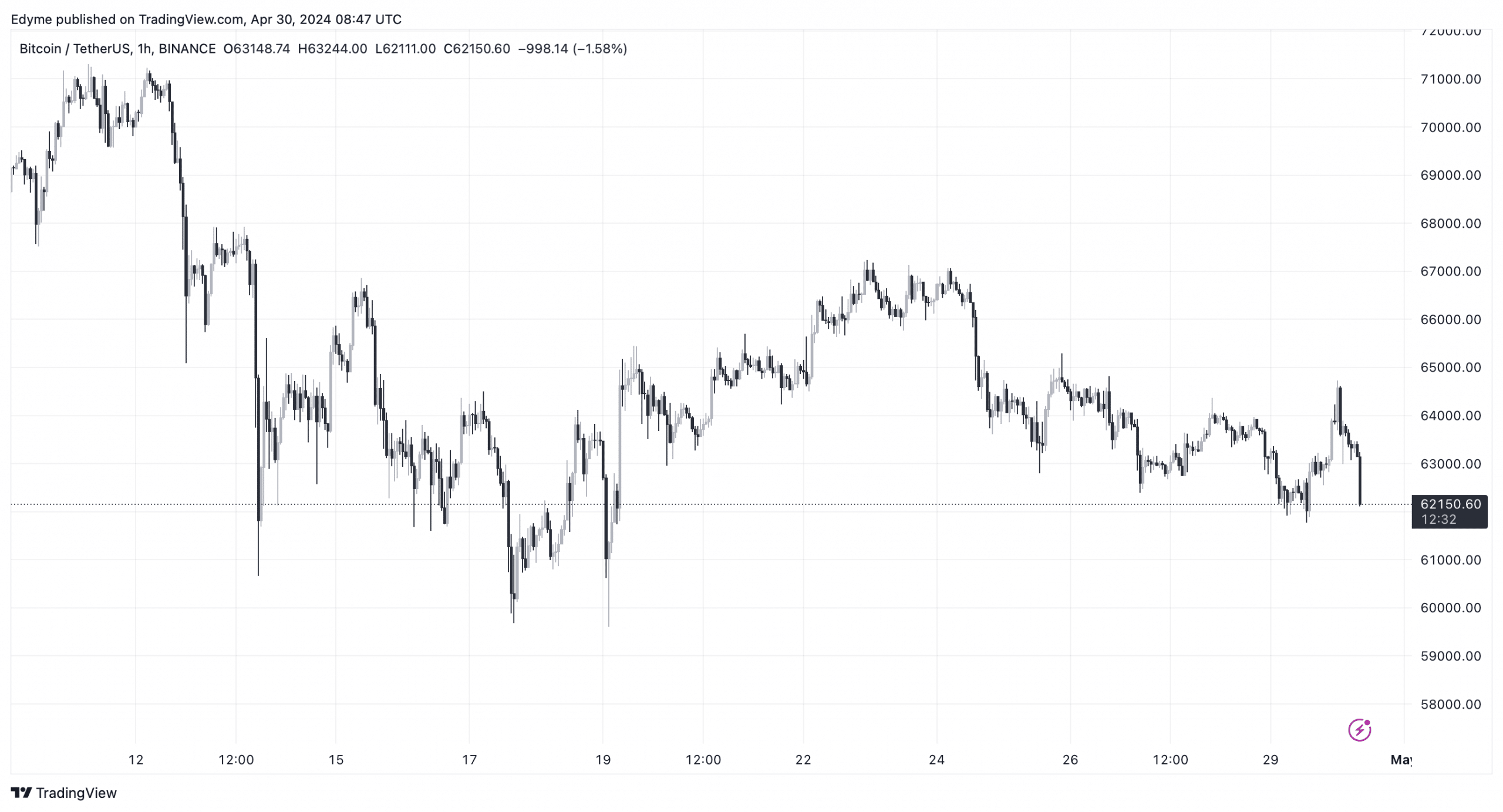

The value of Bitcoin has been trending downwards, experiencing a notable decrease of approximately 4.5% within the last seven days.

As a researcher, I’ve uncovered some intriguing data from CoinGecko that reveals Bitcoin reached a 24-hour low of $61,890. However, there was a slight recovery, amounting to 1.5%, which boosted the price up to $63,226 at the moment I’m documenting this information.

From a comprehensive viewpoint, the hurdles Bitcoin faces aren’t just about short-term price swings. A closer examination unveils substantial drops in some fundamental Bitcoin indicators, including hash rate, which noticeably worsened post-April 20th, marking the fourth halving event for the cryptocurrency.

Significantly, Bitcoin’s price drop aligns with a reduction in its hash rate, reaching new record lows.

For the first time in history, the price dropped below $50 per hash rate per day, posing a challenging time for miners as their profits are significantly reduced.

The drop in profits from mining operations has raised doubts about their sustainability in the future, causing unease among investors and leading to a pessimistic market outlook.

Despite the widespread pessimism regarding Bitcoin’s outlook, certain analysts maintain a positive perspective on its future possibilities.

According to AMBCrypto’s analysis, Bitcoin might encounter resistance around the $61,000 mark in the short term. However, if Bitcoin manages to bounce back from this level, it could set off a fresh wave of bullish sentiment and price growth.

A strong rally could have the potential to drive prices back up to $66,000, and potentially reach as high as $71,000 before hitting new peak records.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Sacha Baron Cohen and Isla Fisher’s Love Story: From Engagement to Divorce

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

2024-04-30 15:36