-

Saylor remains bullish on Bitcoin, citing its volatility as a valuable feature.

MicroStrategy holds 226,500 BTC, reflecting strong corporate commitment despite market skepticism.

As a seasoned crypto investor with over a decade of experience under my belt, I’ve learned to embrace volatility as a sign of life in the market, much like a heartbeat for an organism. Michael Saylor’s stance on Bitcoin’s volatility resonates deeply with me – it’s not a bug, it’s a feature!

Following a dip into oversold conditions in early August, Bitcoin (BTC) has staged a robust recovery and is now approaching the notable level of $60,000.

Based on the most recent information from CoinMarketCap, the top cryptocurrency is currently being traded at approximately $59,280, marking a 1.35% rise in value compared to the previous 24-hour period.

Saylor on Bitcoin

Long-term Bitcoin supporters, such as MicroStrategy’s Co-founder and Chair, Michael Saylor, have warmly received the recent surge in optimism about Bitcoin. On platform X, he expressed his thoughts explicitly.

“Unlock your future. #Bitcoin.”

Saylor’s comments found approval, particularly from Joel Valenzuela, the Marketing and Business Development Director at Dash. He shared similar thoughts and stated that he agreed with what was said.

“The future of custodial money.”

Saylor appreciated Bitcoin’s volatility

In other words, Saylor has highlighted that the volatility in Bitcoin (BTC) isn’t something to criticize, but instead, it’s a characteristic that’s built into digital currencies.

He emphasized that this instability, being an inherent aspect, contributes significantly to what sets Bitcoin apart and gives it enduring value over time.

“Bitcoin’s volatility is a feature, not a bug.”

Moreover, during a recent conversation with Bloomberg, Saylor revealed that he owns 17,732 Bitcoin and emphasized that he has not sold any of his cryptocurrency holdings.

“I’m consistently accumulating more, and I believe it serves as an excellent opportunity for personal, familial, corporate, or national capital investments. I find no other suitable location for my funds.”

Microstrategy’s BTC holdings revealed

Besides Saylor’s own Bitcoin investments, the business he heads, MicroStrategy, has left a substantial imprint on the cryptocurrency market as well.

By the close of July, MicroStrategy now holds a substantial 226,500 Bitcoins, positioning itself as the largest publicly-traded corporation with Bitcoin holdings.

Given the present market scenario, this substantial reserve is estimated to be worth around $12.7 billion, emphasizing the company’s significant dedication towards digital assets.

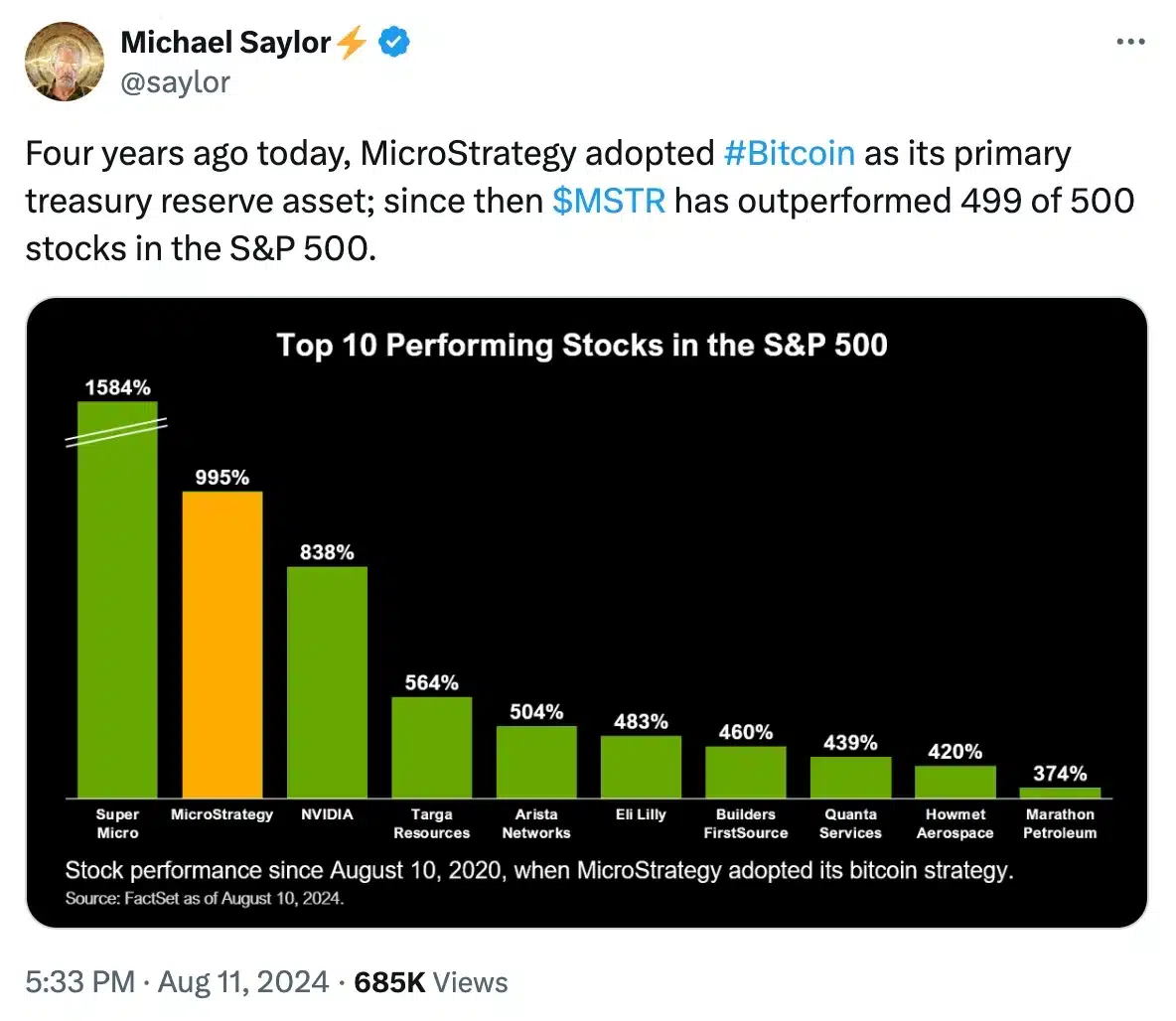

Expanding on the same, Saylor in his 11th August X post noted,

Peter Schiff disregards Bitcoin’s worth

On the other hand, not all individuals hold the same fervor for BTC as Saylor does. Financial expert Peter Schiff maintains a degree of doubt regarding Bitcoin’s worth.

In a recent conversation on YouTube, Schiff expressed doubt about the intrinsic value of Bitcoin, stating that he believes it may not have significant worth.

“I’m open-minded but I’m also smart and honest.”

He underscored that although Bitcoin supporters have made many attempts, he hasn’t come across a convincing reason, as of now, that persuades him to adopt the digital currency.

What’s ahead for BTC?

Additionally, since the Relative Strength Index (RSI) remains below the neutral point, it’s unclear if Bitcoin (BTC) will manage to surpass the $60K barrier or encounter more resistance before possibly initiating another bullish trend.

On the other hand, the expanding Bollinger Bands might indicate growing market volatility, potentially pointing towards an upcoming bullish trend.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-08-13 15:04