- MicroStrategy to release Q2 earnings report.

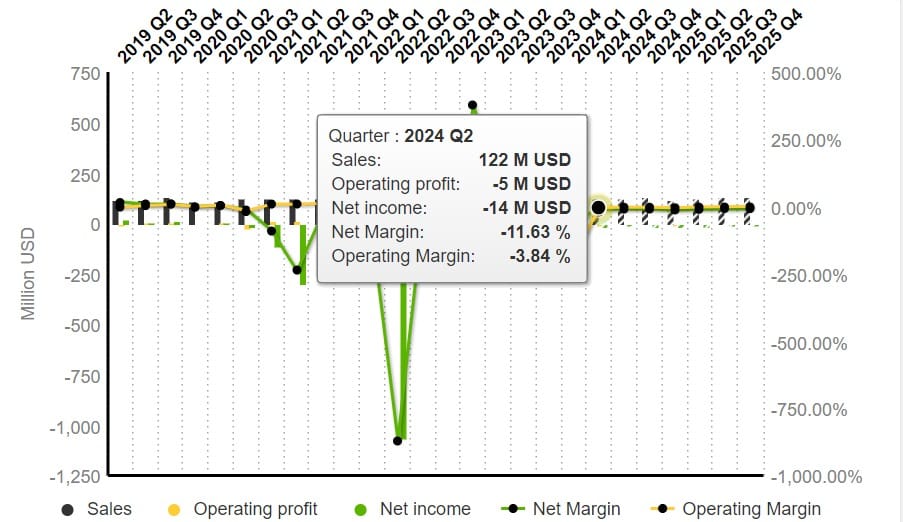

- Preview shows uncertainty and decline in net profit.

As a seasoned crypto investor with a keen eye for spotting trends and a knack for navigating through market volatility, I find myself in a state of cautious optimism regarding MicroStrategy’s upcoming Q2 earnings report. Over the past four years, I’ve watched Michael Saylor and his team at MSTR aggressively accumulate Bitcoin, transforming them into the world’s largest corporate BTC holder.

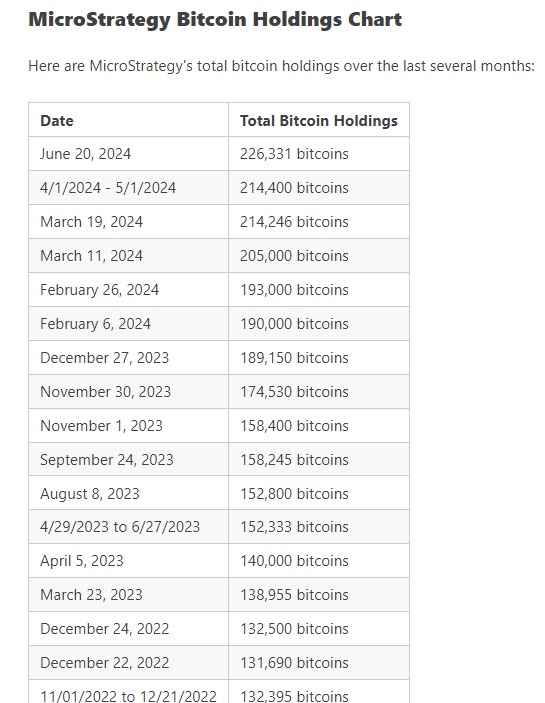

For the last four years, MicroStrategy has consistently purchased more assets with the aim of boosting its holdings and ultimately raising the worth of its stocks.

For a while now, MicroStrategy has bought Bitcoin almost every month, with exceptions in July 2024 and September 2020. As a result of this consistent investment, it now holds the most significant amount of Bitcoin among all global corporations.

Following a turbulent period of high volatility in Bitcoin, MicroStrategy is set to disclose its Q2 earnings on August 1st, 2024. This anticipated Q2 financial report has sparked significant curiosity about MicroStrategy’s current financial situation and future prospects.

MicroStrategy is all about Macrostrategy

The significant number of Bitcoin tokens (226,331) that MSTR has amassed over the last four years, makes this company a noteworthy and enticing investment option for many, due to its value. In all its business endeavors, MSTR possesses these Bitcoin assets.

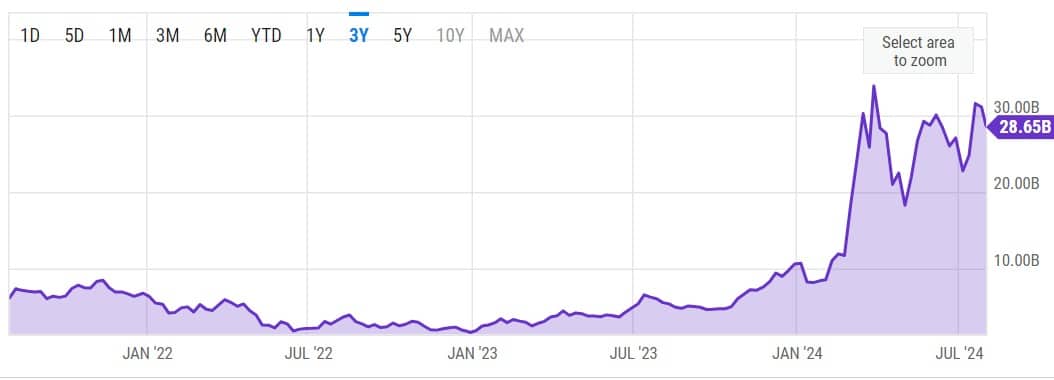

Owning Bitcoin significantly strengthens MicroStrategy’s argument for increasing its market capitalization to approximately $28.65 billion, marking a substantial jump compared to the $9 billion it held a year ago.

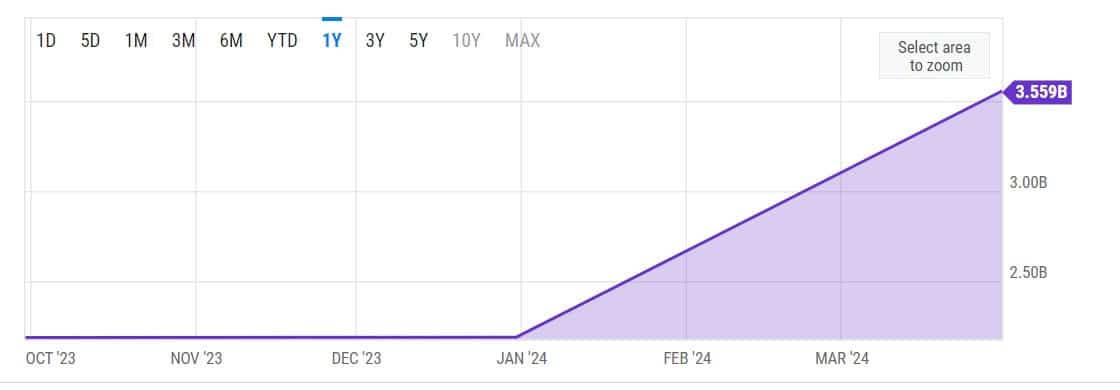

Instead of accumulating its holdings via long-term, low interest, and share insurance, MicroStrategy acquires these assets using long-term loans at low rates and insurance for shares. As per the Q1 2024 earnings report, the company carries liabilities of approximately $3.5 billion over the long term.

As a seasoned investor with years of experience in the financial market, I have seen both the rise and fall of various assets. From my personal perspective, I find it intriguing to observe the evolution of Bitcoin (BTC) and its impact on traditional fiat currencies. One aspect that has caught my attention is the idea of liabilities as a bet on BTC, which appreciates in value against depreciating fiat money over time.

As a result, MicroStrategy acquires Bitcoin and primarily transfers its holdings to MacroStrategy. Previous records show that MacroStrategy owns a significantly larger amount of Bitcoin, with approximately 175,721 tokens, compared to MicroStrategy’s 38,679 Bitcoin tokens.

Using this method, investors may get the misconception that MicroStrategy owns a large majority of Bitcoin, but this isn’t necessarily true. This deceptive situation poses significant risk to creditors, particularly in the event of bankruptcy for MicroStrategy. The reason being, if MicroStrategy’s parent company goes bankrupt, Macrostrategy might be protected from liability, which could exacerbate financial difficulties for the creditors.

As someone who has navigated through several financial crises and bankruptcies, I can tell you that the distinction between equity holders’ assets and those of a parent company is crucial to understand. In my experience, it often determines who gets paid back first in times of financial distress. In this case, it seems that MacroStrategy’s creditors cannot claim Bitcoin held by the firm, even though most of MicroStrategy’s BTC holdings are with MacroStrategy. This could potentially offer some level of protection for both entities during potential future bankruptcy proceedings, given that the BTC is not considered part of MicroStrategy’s assets. However, it’s essential to remember that this is just one aspect of a complex financial situation and should not be taken as definitive advice without consulting a financial expert.

As a seasoned investor with years of experience under my belt, I can’t help but be alarmed by the significant amount of Bitcoin (BTC) held by MicroStrategy. The sheer volume of this cryptocurrency in their possession is staggering, and if liquidation were to occur, creditors would undoubtedly face catastrophic losses. Having witnessed firsthand the volatility of the cryptocurrency market, I can only imagine the chaos that would ensue. It’s a risky move, and one that leaves me questioning their long-term strategy and financial stability.

Q2 earnings: What to expect

Currently, a single Bitcoin (BTC) is being traded for approximately $64,462, representing a decrease of 2.8% over the last 24 hours. According to information from bitcoin treasuries, the MicroStrategy (MSR) company holds about 226,331 Bitcoins, which equates to an investment worth around $8.37 billion when averaged at $36,990 per Bitcoin.

Consequently, given the existing returns, the MSR investment has yielded approximately $6 billion, with around 70% of that being profit.

Based on my professional background and years of working in finance, I can confidently say that these projected gains suggest a significant improvement for the company this fiscal year. As someone who has seen many financial reports over the years, it’s clear that a $122 million revenue against $115 million from the previous year is a positive sign of growth and success. This kind of increase not only demonstrates the effectiveness of their business strategies but also indicates a promising future for the company. I’m excited to see how they will continue to flourish and what new heights they will reach in the coming years.

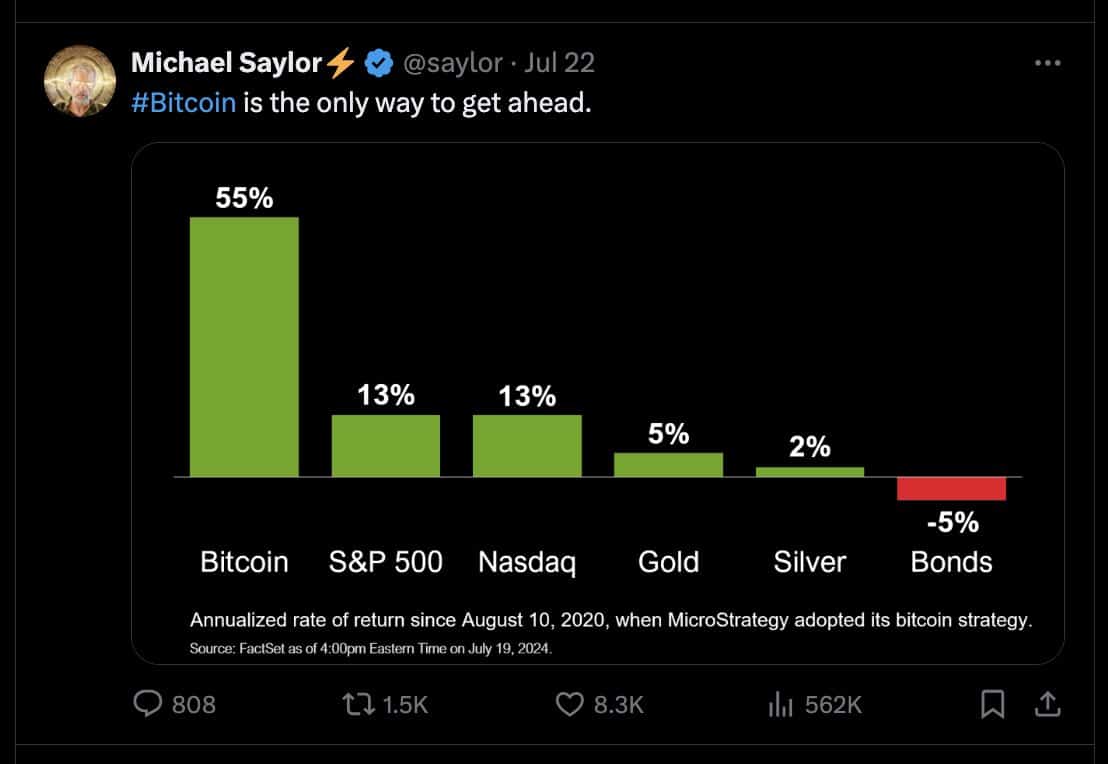

MicroStrategy’s case for BTC

In spite of ongoing apprehensions, MicroStrategy holds a positive outlook towards Bitcoin. According to its Chairman, Michael Saylor, Bitcoin is expected to reach an astounding $13 million by the year 2045.

Based on the company’s forecast, the total value of Bitcoin (BTC) could skyrocket to an astonishing $273 trillion, outpacing the worth of gold and all leading corporations. In this hypothetical situation, Microstrategy’s investment portfolio would soar from its initial $8 billion to a staggering $3 trillion.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-08-01 15:04