- Analysts reveal divergent views on the current miner profitability crisis.

- One camp deems the crisis as a ‘market top’ while others time it as a ‘buy signal’

As a researcher with a background in cryptocurrencies and market analysis, I find the ongoing miner profitability crisis an intriguing development that warrants close attention. The divergent views on this issue among analysts add complexity to the situation.

Following the Fed’s decision last week, Bitcoin (BTC) appears to encounter another potential challenge impacting its value—the actions of miners.

As a financial analyst, I’ve observed that the largest digital asset experienced a significant dip below $70,000 following the Federal Reserve’s decision not to reduce interest rates in June. Contrary to earlier market predictions, the anticipated rate cut did not materialize, leading to this decline in the asset’s value.

Move on to the upcoming week. At present, Bitcoin has been having a tough time maintaining its position above $65,000, with some market experts attributing this to potential resistance from Bitcoin miners.

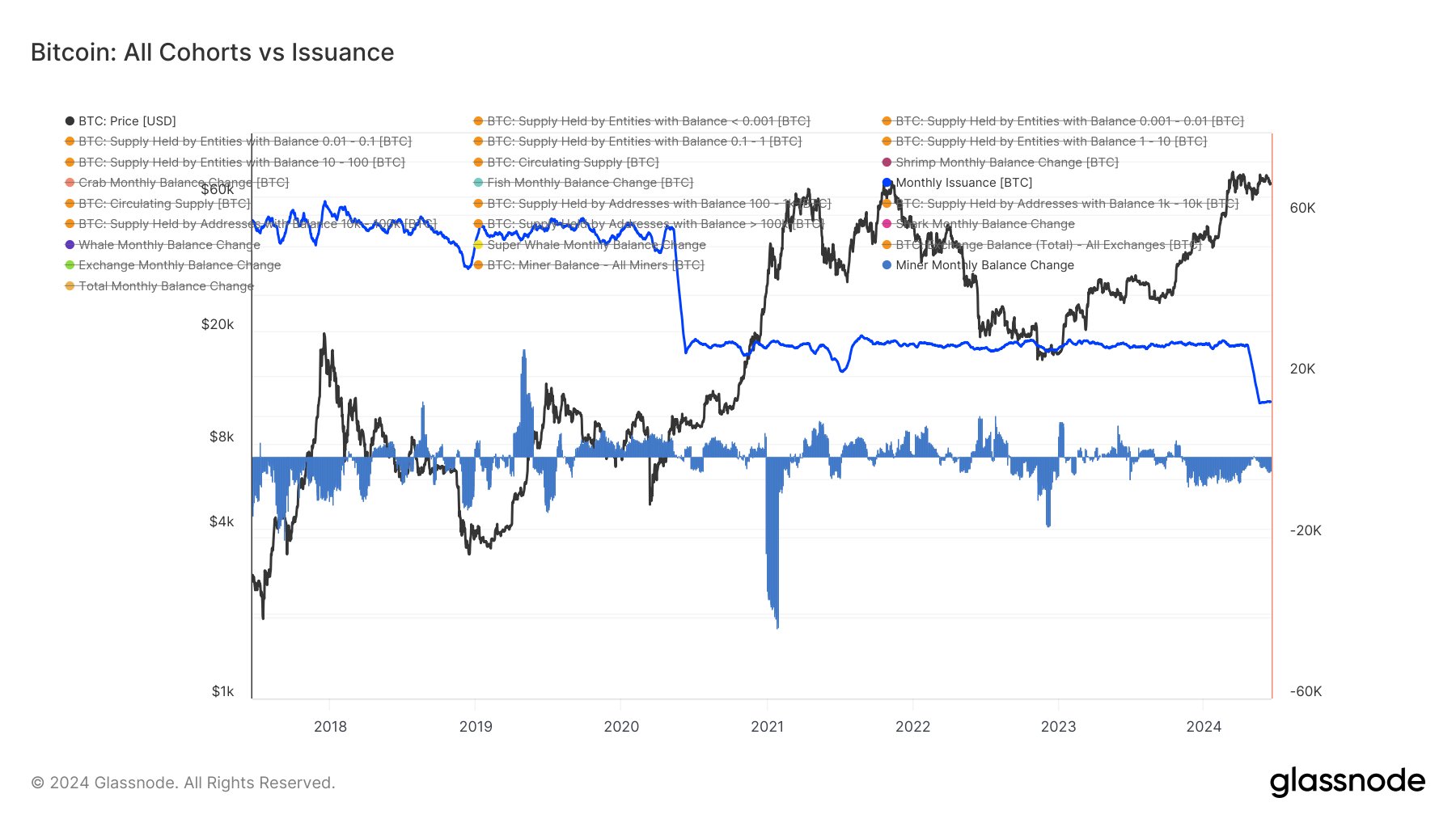

Based on the analysis of James Van Straten, a well-known figure in the on-chain community, approximately 30,000 Bitcoins from the stash of miners have been sold since last October.

As a Bitcoin analyst, I’ve noticed that collectively, miner holdings amount to approximately 700,000 BTC. However, there has been a decrease of around 30,000 BTC in their balances since October. This prolonged distribution phase is the longest we’ve seen since 2017, contributing to current market challenges.

Ineffective miners post-April halving have been offloading their Bitcoins to meet operational costs and potentially leave the mining industry as it becomes less profitable for them.

Should you sell or buy BTC?

As a researcher studying the cryptocurrency market, I’ve noticed that the miner profitability crisis, or miner capitulation, has persisted for the past 33 days. Consequently, the selling pressure from miners could be contributing to the current downward trend in Bitcoin’s price.

After the Bitcoin mining reward was reduced in April, some miners adapted by expanding into artificial intelligence computing to ensure profitability.

As a researcher studying the current state of the cryptocurrency market, I’ve come across an intriguing perspective from Quinn Thompson, CIO of Lekker Capital. He considers the ongoing miner crisis as a significant red flag for crypto and even more severe than the miner crisis during the 2022 crypto winter.

“Which metric among all is more effective than the price surge of Bitcoin due to the collective impact of AI and NVIDIA on the crypto market?”

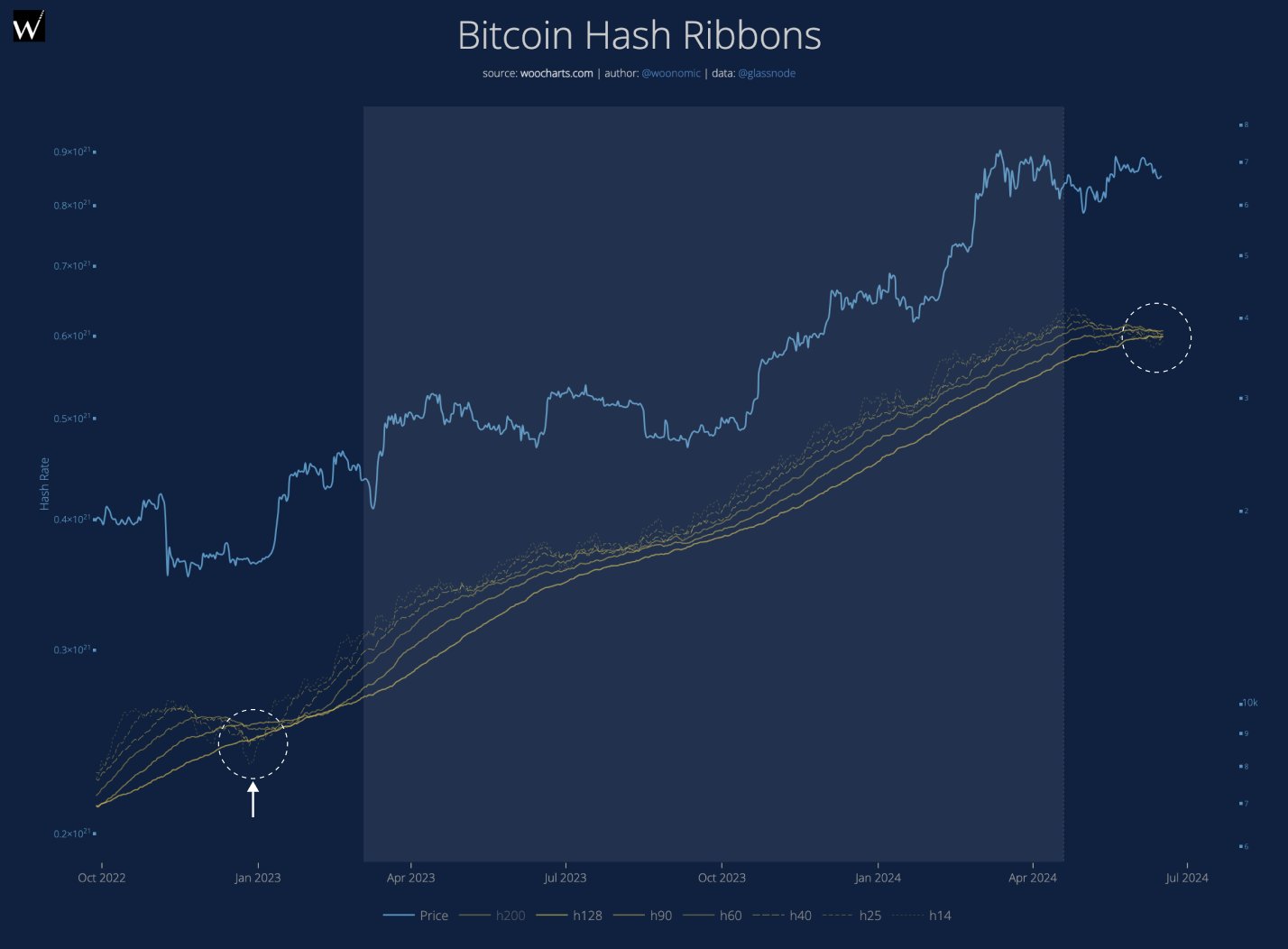

As a crypto investor, I’ve come across Willy Woo’s analysis suggesting that the Bitcoin price may face some downward pressure until the mining hashrate shows signs of improvement.

The price of Bitcoin may face further penalties until the hashing market gains more activity. This explanation was once a common analogy among bankers, likening Bitcoin to ill-gotten funds.

According to Blockchain data, the hashrate – the computational power required to mine Bitcoin – experienced a significant decrease following the Bitcoin halving events in April and May.

As a crypto investor, I’ve been closely following the analysis of Cole Garner, who is similar to Woo in his insights. According to him, a Buy signal for Bitcoin could be on the horizon if we see a recovery in the hashrate.

As a researcher studying Bitcoin’s market trends, I can tell you that when the hashrate, or the total computing power being used to mine Bitcoin, experiences a reversal, Hash Ribbons will generate one of the most historically significant buy signals. We are currently approaching this signal.

Hash Ribbons are moving averages that track hashrate downtrends and typically signal buy signals.

While Thompson considered the miner crisis to be a warning sign of a market peak, some investors viewed it as an opportunity for purchasing.

As a researcher studying Bitcoin (BTC), I’ve observed that its value tends to hover around the average cost of mining it. This cost reached an all-time high of $86,000. Given this trend, I believe BTC could potentially reach this price level soon.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-19 10:16