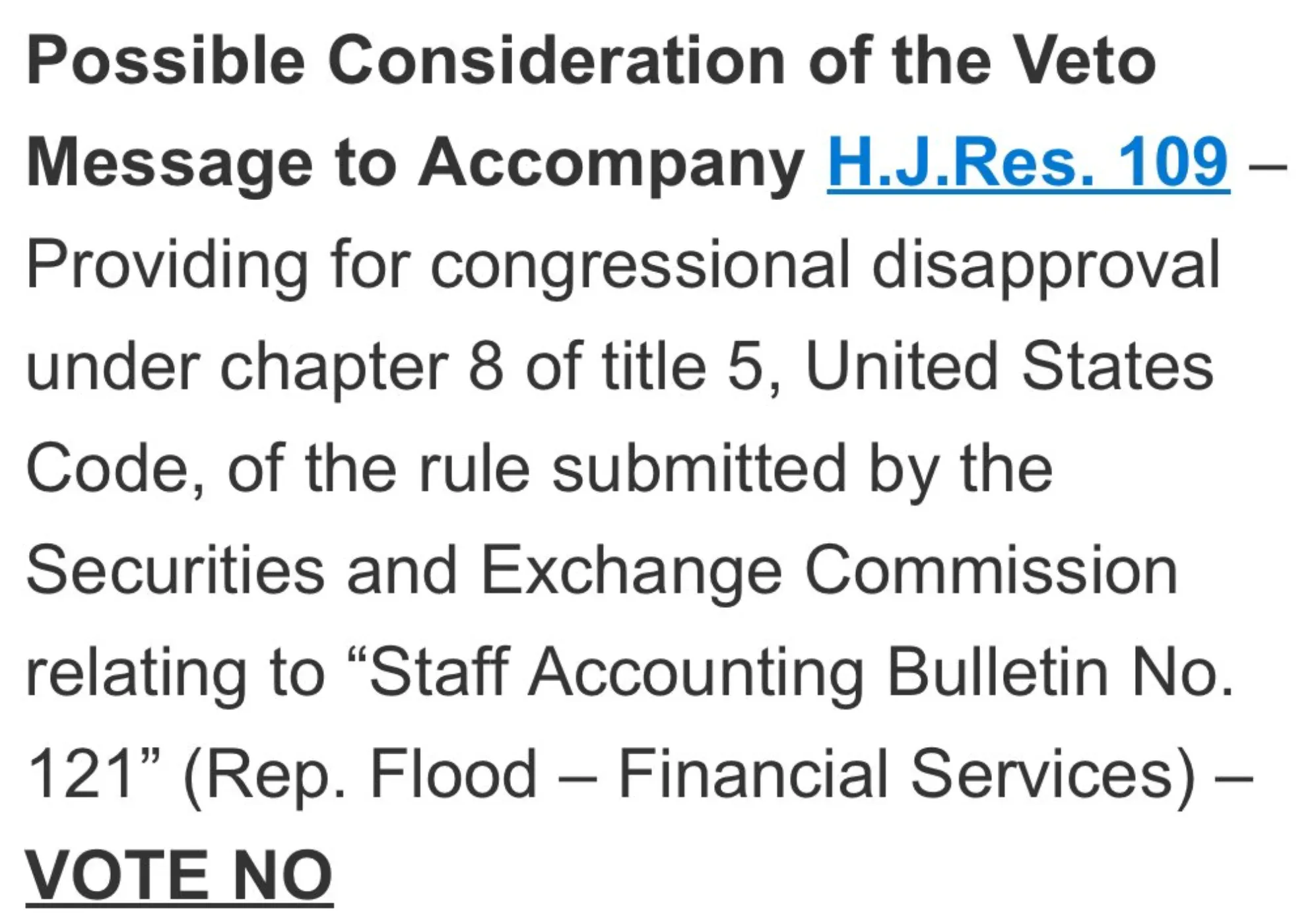

- Biden nears crypto crackdown victory by keeping SEC’s SAB 121 rule intact.

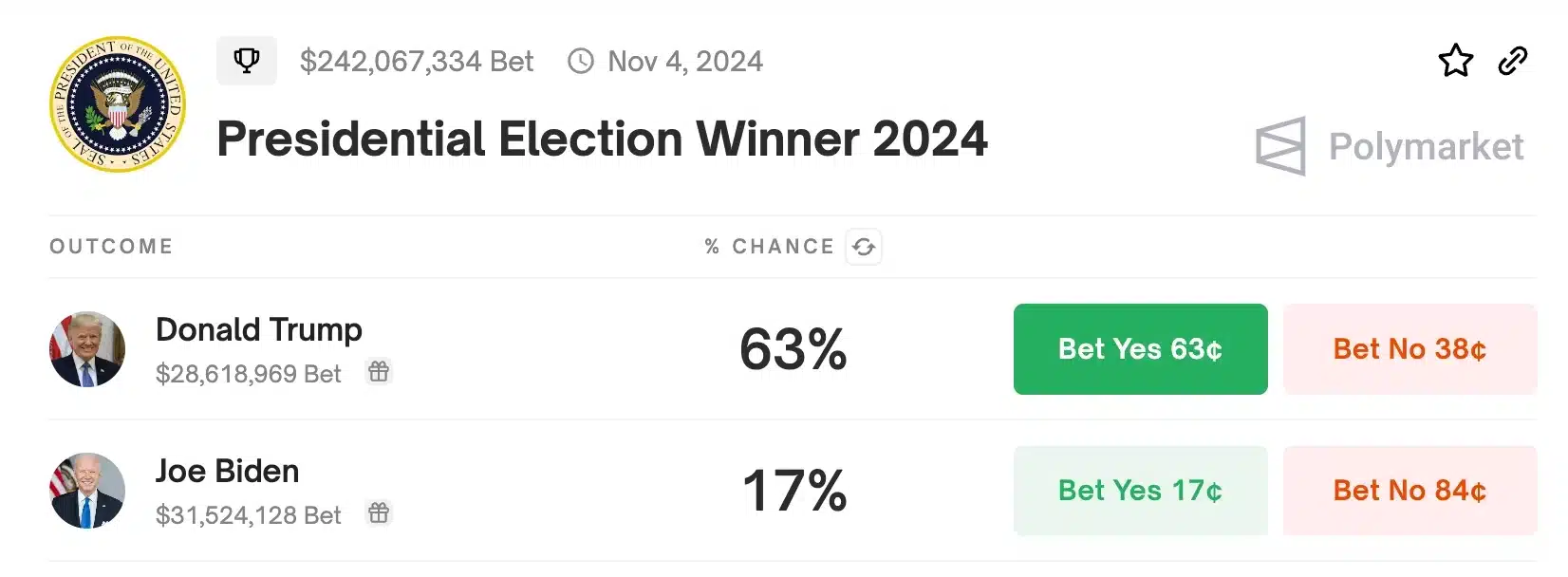

- Trump’s pro-crypto stance lifts his Polymarket odds, now at 63% against Biden’s 17%.

As a seasoned crypto investor, I’ve seen my fair share of regulatory developments and their impact on the market. The recent news about President Biden’s intent to preserve SAB 121 is yet another blow for the crypto community, especially given his previous anti-crypto measures.

A few weeks ago, President Joe Biden of the United States blocked the effort to revoke Staff Accounting Bulletin 121 (SAB 121). However, the controversy surrounding this issue appears to persist.

As a crypto investor, I’ve been closely following the developments regarding the legislative bills related to digital assets in Washington. Now, these bills have made their way back to Capitol Hill, and the lawmakers are determined to gather sufficient votes to bypass any potential vetoes this time around.

The SEC’s SAB 121 includes accounting directives that are contentious and perceived as disadvantageous towards cryptocurrencies.

What’s the matter?

During a House Financial Services Committee hearing on July 9th, Democratic Representative Wiley Nickel from North Carolina highlighted the issue when questioning Treasury Secretary Janet Yellen.

He highlighted concerns surrounding the controversial topic, saying,

As a researcher examining the crypto market, I share Congressman Flood’s apprehensions regarding the potential risks associated with the high concentration in the market for crypto custody. The SEC’s SAB 121, in my opinion, inadvertently contributes to making cryptocurrencies less secure for consumers by potentially limiting choices and increasing reliance on a few dominant players.

He further added,

“Our world-class banks should be capable of handling the custodial banking aspect.”

The unexpected twist

An update recently proposed a substantial change right before the scheduled voting day on the 10th of July.

According to recent news, the Biden administration is on the verge of achieving a significant win in its efforts to regulate cryptocurrencies by keeping in place the Securities and Exchange Commission (SEC) accounting rule, SAB 121. This rule effectively prevents banks from maintaining digital assets on their balance sheets.

Expressing an opinion on the matter, an X user, @publiusbtc, said,

“Don’t listen to Elizabeth Warren. Save your careers and vote yes.”

Echoing similar sentiments was @yugacohler, who said,

As an analyst, I would put it this way: “Failing to overturn the President’s veto on SAB121 means House Democrats forgo the opportunity to win votes from crypto supporters in an election year that is already tough.”

Crypto community to favor Trump?

The crypto community’s increasing dissatisfaction with President Biden’s standpoint on digital assets is highlighted by this circumstance. His repeated actions against cryptocurrencies could potentially harm his prospects in the upcoming election.

Instead of this: “In contrast, former President Donald Trump is increasingly embracing cryptocurrency, as evidenced by his recent adoption of a draft platform supporting digital asset innovation.”

The statement released by Trump’s camp clearly conveyed his sentiment, and stated,

“Republicans aim to halt Democrats’ illegal and un-American efforts to regulate cryptocurrencies and prevent the establishment of a Central Bank Digital Currency.”

The recent advancement has substantially influenced the Polymarket forecasting platform. A mere 24 hours ago, Trump held a 62% probability while Biden trailed behind with a 21% chance.

Based on the recent announcement of SAB 121, my analysis reveals that Biden’s probability has decreased to approximately 17%, whereas Trump’s chances have surged to a significant 63%.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-07-11 01:11